ITR Filing 2025: Complete Guide to All 7 Forms & Important Updates for Taxpayers

Introduction The Income Tax Department has released all seven Income Tax Return (ITR) forms for the Assessment Year (AY) 2025–26, corresponding to the Financial Year

Introduction The Income Tax Department has released all seven Income Tax Return (ITR) forms for the Assessment Year (AY) 2025–26, corresponding to the Financial Year

Input tax credit is an essential component of GST, which eliminates the cascading effect of taxes and brings transparency and efficiency to the indirect tax

Introduction Second-hand products, from cars to furniture, from electronics to clothing, have a significant position in today’s busy marketplace. The appeal of affordability and the

India’s Goods and Services Tax (GST) regime has been instrumental in streamlining indirect taxation, fostering a unified market, and promoting economic growth. However, new challenges

E-billing, or electronic invoicing, has changed India’s GST system, making it more open and easier for people to avoid paying taxes. It has become necessary

The Kerala High Court’s recent ruling on Section 16 (4) of the Goods and Services Tax (GST) Act has stirred discussions within the taxation community.

Input tax credit (ITC) plays a crucial role in the Goods and Services Tax (GST) regime, particularly in the context of the food and beverage

Introduction The Kerala High Court has delivered a significant ruling on the eligibility of input tax credit (ITC) concerning transportation services. The court held that

Big win for taxpayers. In this landmark judgment, the Bombay High Court has upheld the rights of taxpayers. The case was about Input Tax Credit

Introduction Where there is income, there is tax. This is an often-repeated phrase. It is the duty of all resident Indian citizens with taxable income

GST Annual return is an annual return filed in form GSTR-9 wherein aggregate information for complete year is required to be furnished about Output Tax

वस्तु एवं सेवा कर (GST) एक अप्रत्यक्ष कर है जो भारत में वस्तु और सेवाओं की आपूर्ति पर लगाया जाता है। यह एक एकल कर

एक ऐसा स्टोर चलाने की कल्पना करें जहाँ आप बढ़िया गैजेट बेचते हैं। अब, जब भी आप अपनी शेल्फ में सामान भरने के लिए नवीनतम

मुंबई की हलचल भरी सड़कों पर एक छोटी सी दुकान के मालिक रमेश भी कई अन्य लोगों की तरह बैंकिंग लेनदेन पर इनपुट टैक्स क्रेडिट

We now approach the area of the GST Input Tax Credit (ITC). Imagine you are the owner of a clothing store, and if you add

TCS ensures sellers collect tax from buyers at the point of sale, remitting it to government authorities, thereby preventing tax evasion and ensuring a steady

The Goods and Services Tax (GST) has revolutionized the taxation system in many countries, including India. With the implementation of GST, businesses are required to

Input tax credit refers to payment of tax which can be reduced if you have already paid tax on inputs. Input tax credit is vital

Introduction to TCS (Tax Collected at Source) Tax Collected at Source (TCS) is a provision under the Income Tax Act where the seller of specified

Introduction GST, or Goods and Services Tax, serves as a streamlined tax system for the purchase of goods or services, simplifying the prior complex tax

As the Indian financial year draws to a close on March 31, businesses nationwide get ready for the meticulous exercise of tax compliance. For those

Coming toward the end of the year, it is a must for small and bigger businesses in India to look back and see to it

Introduction to taxation systems Tax is any category of collecting money in the name of revenue which a government collects. This amount is collected to

If you’re a business owner or professional dealing with goods and services, you’re likely familiar with GST or Goods and Services Tax. GST is an

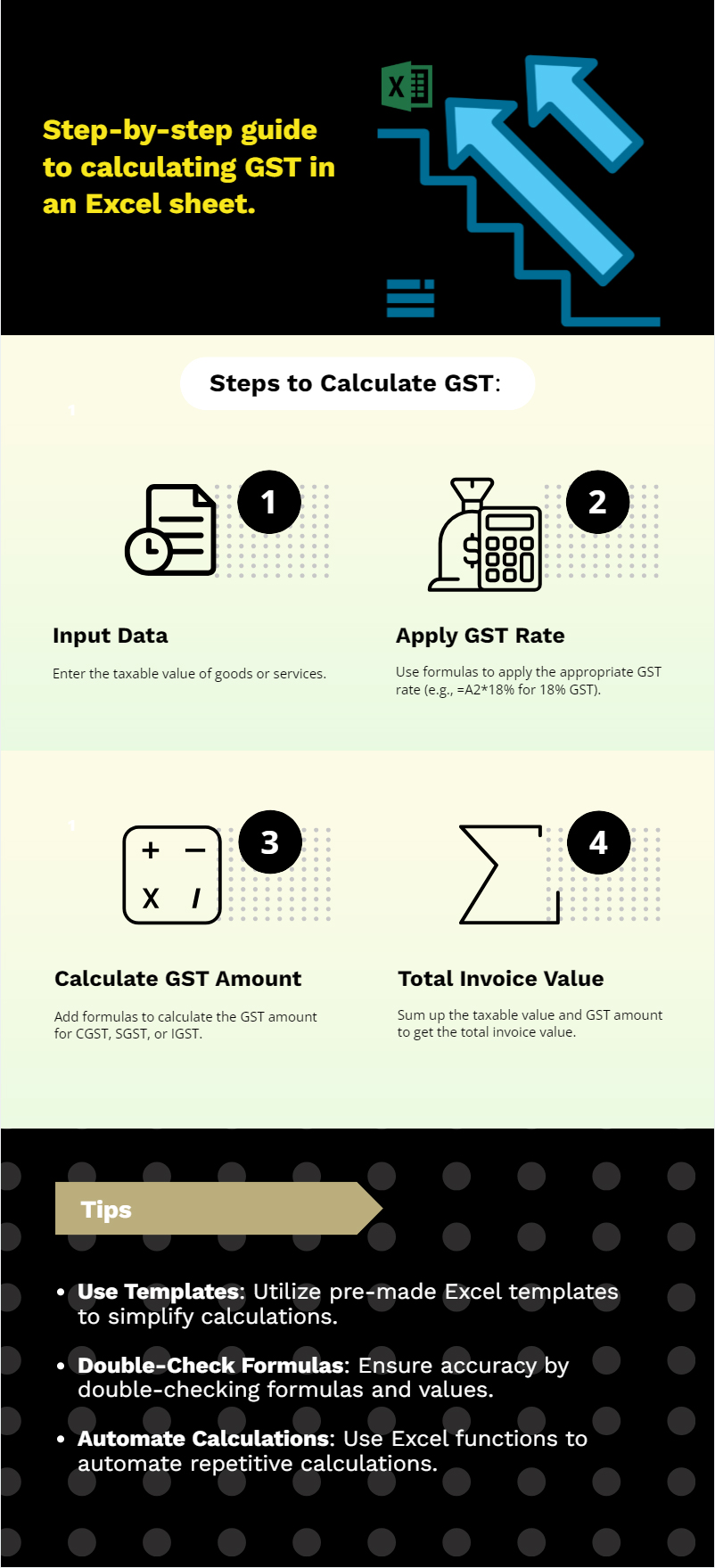

Suppose you wish to expand your trading to excel in navigating the compliance complexities and maximize the efficiency of the overall process, in that case,

Introduction To Input Tax Credits (ITC): Input Tax Credit (ITC) is the credit that firms can avail of for the tax paid on their purchases,

GST is a comprehensive indirect tax system that has brought uniformity and efficiency to the tax system in India. The GST process fundamentally comprises uploading

GST (Goods and Services Tax) is an indirect tax levied on the supply of goods and services in India. Understanding and complying with GST regulations

The Goods and Services Tax (GST) has revolutionized the tax landscape in many countries, and its impact on exporters has been significant. A GST number,

Goods and Services Tax (GST) is a comprehensive tax reform implemented in many countries, aimed at replacing multiple indirect taxes with a unified tax structure.

The Goods and Services Tax (GST) has revolutionized the taxation system in many countries, including India. One of the key aspects of GST is the

GST, or Goods and Services Tax, is a consumption-based tax system implemented in many countries around the world. Under GST, various taxpayers are required to

The implementation of Goods and Services Tax (GST) revolutionized the indirect tax structure in India, aiming to streamline and simplify tax compliance. However, for regular

As businesses navigate the intricacies of the Goods and Services Tax (GST) system, attaining and maintaining regular taxpayer status emerges as a pivotal advantage. This

To maintain compliance and financial integrity, navigating the complex world of Input Tax Credit (ITC) in banking transactions requires a careful approach. Errors in claiming

Organizations must be able to adjust to changing regulatory frameworks to succeed in the ever-changing commercial and technological world. The Tax Collected at Source (TCS)

Introduction Modern tax systems cannot function without the Input Tax Credit (ITC). It enables businesses to deduct the tax on inputs from the tax owed

Introduction An input tax credit is an incredibly powerful tool in businesses. The input tax credit means the Goods and Services Tax paid by a

इनपुट टैक्स क्रेडिट (ITC) वस्तु एवं सेवा कर (GST) लेखांकन का एक महत्वपूर्ण पहलू है, जो व्यवसायों को आउटपुट आपूर्ति पर कर देयता के खिलाफ

Rule 37 is an important provision under the Goods and Services Tax (GST) framework in India. It deals with Input Tax Credit (ITC) under GST,

सरकार को इनपुट टैक्स क्रेडिट (ITC) की सूचना देना वस्तु एवं सेवा कर (जी. एस. टी.) प्रणाली के अनुपालन का एक महत्वपूर्ण पहलू है। ITC

The State Goods and Service Tax (SGST) is a significant component of India’s Goods and Services Tax (GST) system. It is an indirect tax levied

जब हम इनपुट टैक्स क्रेडिट (ITC) के बारे में बात करते हैं, तो हमें यह सुनिश्चित करने की ज़रूरत है कि हम सटीक और गलती

इनपुट टैक्स क्रेडिट (ITC) सभी व्यवसायों के लिए एक प्रमुख भूमिका निभाता है। यह विशेष रूप से वस्तु एवं सेवा कर के मामले में महत्वपूर्ण

व्यवसायों को इनपुट टैक्स क्रेडिट (ITC) का हिसाब देने के लिए, उन्हें रिकॉर्डिंग और प्रबंधन में मेहनती होने की आवश्यकता है। इसका मतलब यह है

To maintain compliance and financial integrity, navigating the complex world of Input Tax Credit (ITC) in banking transactions requires a careful approach. Errors in claiming

The Goods and Services Tax (GST) system is devised in such a way that it presents businesses with a useful mechanism known as Input Tax

व्यवसाय मे करों का अपना हि एक खेल है। एक व्यवसायी के लिए इसको समझना बहुत मुश्किल हो सक्ता है। लेकिन इस मुश्किल से निकलने

ITC matching plays a crucial role in maintaining integrity within the GST system. Introduction The indirect tax system in many countries has seen a lot

It is essential to accurately classify and value imported goods. Introduction The import of products and services is a crucial component of global trade and

Introduction Customers are the king, and companies take care of their customers. They keep on employing various strategies to impress customers and build better relationships.

Introduction Ever thought about why you pay Rs.5 for a chips packet while its manufacturing and transportation cost is less than Rs.2.5 or you pay

The input tax credit is the goods and services tax a taxable person pays to buy any services or goods. You must note that businesses

In the intricate realm of taxation, the proper claiming and reporting of Input Tax Credit (ITC) stand as pillars of compliance for businesses operating

Navigating the intricate web of Goods and Services Tax (GST) requires businesses to not only comprehend the broader tax framework but also master the

Introduction Goods and Services Tax (GST) is a complex world, and the process of claiming Input Tax Credit (ITC) on capital goods stands as a

Input tax credit is an incredibly powerful tool in business, marketing, and promotions. The article will let you understand ITC, its benefits, how to claim

Introduction Transfer of business either through Demerger, Amalgamation, sale of business, transfer through succession etc. is a very common business transaction which takes place not

Introduction A business entity can’t get all the activities done in house because it may involve a lot of costing and may require expertise. Therefore,

If suppliers provide capital goods on which a person has taken credit, that person shall pay an amount equal to such credit reduced by percentage

Organisations must be able to adjust to changing regulatory frameworks to succeed in the ever-changing commercial and technological world. The Tax Collected at Source (TCS)

The 47th GST Council meeting was held on the 28th and 29th of June 2022 in Chandigarh. Union Finance Minister Smt. Nirmala Sitharaman led the

On 31st December 2021, the 46th GST Council meeting convened under the leadership of Union Finance Minister Nirmala Sitharaman. During this session at Vigyan Bhavan,

The method of filing the Input Tax Credit (ITC) is a key part of businesses’ tax compliance. It involves carefully recording, checking, and sending tax

In the intricate tapestry of modern business operations, where financial intricacies and regulatory landscapes converge, the significance of accurate Input Tax Credit (ITC) reporting cannot

In the intricate landscape of modern business finance, the meticulous handling of Input Tax Credits (ITC) stands as a linchpin for companies aiming to achieve

Input Tax Credits (ITC) are of utmost importance to businesses, especially in the complex modern world of finance. This helps businesses in multiple ways, which

The world of Goods and Services Tax (GST) is very complex. Businesses need to learn to work in this. When it comes to GST, financial

Businesses that desire to improve their financial standing choose to claim Input Tax Credit. Since the Goods and Services Tax (GST) system is complex, this

Businesses are a part of a dynamic realm. In this world, financial strategies play a key role in leading companies to the road to success.

Introduction One of the most crucial aspects of financial and accounting practices for businesses is tax invoice valuation. The accurate valuation of goods and services

E-invoicing in the GST system has seen significant updates recently, impacting the way businesses handle Input Tax Credit (ITC) claims. Understanding these changes is crucial

E-invoicing has introduced significant changes to GST processes, especially regarding Input Tax Credit (ITC) claims. With these changes come the risks of incorrect or fraudulent

E-invoicing has brought significant changes to GST, but it also comes with its own ITC Challenges. In this article, we’re going to take a close

When you run a business, effective cash flow management and tax benefits maximization are as crucial as steering a ship through a sea of numbers.

What is TCS under GST Tax Collected at Source (TCS) under GST means the tax collected by an e-commerce operator from the consideration received by

GSTR-10 is a crucial document for taxpayers who are required to cancel or surrender their GST registration. It is also called a final return and

E-invoicing is a crucial aspect of the modern tax regime, and the consequences of not claiming input tax credit for e-invoices under the Goods and

In the world of modern finance, where every transaction is meticulously documented and scrutinized, the ITC claims banking transactions often go underutilized. The introduction of

Circa 2017: The Goods and Services Tax (GST) introduced in July of 2017 faced many challenges. It took 17 long years for this to be

वस्तु और सेवा कर, एक व्यापक और अप्रत्यक्ष कर है जो कई देशों में वस्तुओं और सेवाओं की आपूर्ति पर लगाया जाता है. इसे कई

The reverse charge mechanism is a taxation concept that moves the liability to pay tax from the Supplier to the recipient. This mechanism is widely

The goods and services tax transformed the indirect tax system in India by replacing multiple taxes like VAT, excise duty, service tax, etc. with a

Technological advancements, improved connectivity, and internet access across the country have helped develop the e-commerce industry in India. The increased demand for online goods and

E-commerce has transformed the retail marketplace into a digital market, which is convenient and beneficial for sellers, e-commerce operators, consumers, and tax authorities. Along with

Businesses are generally eligible to claim Input Tax Credits for the goods and services they use in their day-to-day operations. However, there are certain circumstances

Bill-to/Ship-to transactions have become increasingly common in the business world, allowing for greater flexibility in the supply chain. However, businesses need to understand the implications

Are you familiar with the amendments and revisions in GSTR-6? The Goods and Services Tax Return-6 (GSTR-6) is an important document that must be filed

Unlocking the benefits of input tax credit (ITC) distribution and utilisation in GSTR-6 can be a game-changer for businesses. With the correct understanding and strategy,

GST brought uniformity in the tax structure in India, eliminating the cascading effect of taxes on consumers. The introduction of the online portal enhanced compliance

The Indian Taxation system has noticed much transformation with the introduction of Goods and Services Tax (GST). The aim of introducing GST was to simplify

© Copyright CaptainBiz. All Rights Reserved