Introduction

A business entity can’t get all the activities done in house because it may involve a lot of costing and may require expertise. Therefore, many parts of the production process or business process are outsourced to external entities. E.g. A car manufacturing company may get its sheet stamping done from outside as it requires specialization and requires expensive machinery.

However, what if goods sent for job work never come back to the premises of the manufacturer and are sold directly from the location of the job worker. Job work model may act as an escaping provision to prevent payment of tax on sales. Therefore, Job work activity is always monitored by the law, be it under Pre-GST regime or under GST regime.

A manufacturer is required to fill form GST ITC-04 for sending goods for job work. This article contains a detailed discussion about sending goods for job-work.

1. What is a job worker?

- Term Job work is defined under Section 2(68) of CGST Act as “job work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly.

- In common parlance, under job work goods are sent by the owner of the goods to the job-worker for carrying out specific activity and such goods are returned to the owner after completion of process. Ownership of the goods remains with the manufacturer only and the job worker gets the consideration for his job work activity.

- E.g. Maruti Suzuki sent 100 sheets for stamping to the job worker. Job-worker returns such sheets after stamping and charges consideration for his stamping services. Ownership of the goods lie with the Maruti Suzuki throughout the process.

- Goods are sent to the job-worker under Delivery challan and returned back under delivery challan. Tax Invoice is raised only for job work services, if the job worker is registered under GST.

2. What is GST ITC-04?

- As per Section 143 of CGST Act, a registered person is required to follow detailed procedure for sending goods for job-work.

- Inputs or capital goods both can be sent under job work. However, the same are required to be returned within the time period prescribed under Section 143 of CGST Act. E.g. Inputs are required to be returned to the registered person within 1 year and capital goods are required to be returned within 3 years.

- If goods are not returned within the above mentioned time period, the same are considered as supplied on the date such goods were sent to the job worker and the registered person is liable to pay GST on the same.

- GST ITC-04 is a detailed form filed by a registered person to furnish the information about goods sent for job work, goods returned from job workers and goods sold directly from the premises of the job worker on a half yearly basis.

3. Information to be furnished in GST ITC-04

Form GST ITC-04 is furnished in 4 parts wherein following information is required to be furnished in each part:

-

Table-4: Details of Input or capital goods send for job work

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Job worker’s Type, i.e., SEZ or non-SEZ

- Challan number through which goods are sent for job work

- Challan date

- Type of goods sent for job work, i.e., Input or capital goods

- Description of goods

- Unique Quantity code (UQC), It is required to be selected from drop down list available;

- Quantity

- Taxable value

- Applicable taxes, IGST, CGST & SGST

-

Table-5A: Details of Input or capital goods received back from the job worker to whom such goods were sent for job work and losses and wastage

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Original Challan number issued by principal

- Original Challan date

- Challan Number issued by the Job worker

- Challan date issued by the job worker

- Nature of job work done

- Description of goods

- Unique Quantity code (UQC), It is required to be selected from drop down list available;

- Quantity of goods returned to the principal

- Quantity of Losses and wastage

-

Table-5B: Details of Input/ Capital Goods received back from the Job worker other than job worker to whom such goods were originally sent for job work; and losses and wastage

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Original Challan number issued by principal

- Original Challan date

- Challan Number issued by the Job worker

- Challan date issued by the job worker

- Nature of job work done

- Description of goods

- Unique Quantity code (UQC), It is required to be selected from drop down list available;

- Quantity of goods returned to the principal

- Quantity of Losses and wastage

This table is applicable when goods are sent from the location of one job worker to another job worker for further processing.

-

Table-5D: Details of Input/ Capital Goods sent to job worker and subsequently supplied from the premises of Job worker; losses and wastage

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Original Challan number issued by principal

- Original Challan date

- Invoice number issued by Principal

- Invoice date issued by the Principal

- Nature of job work done

- Description of goods

- Unique Quantity code (UQC), It is required to be selected from drop down list available;

- Quantity of goods returned to the principal

- Quantity of Losses and wastage

This table is applicable when goods are supplied directly from the location of job work on payment of taxes and not brought back to the location of the principal.

4. What is the frequency and Due date of filing of ITC-04?

Till 30th September, 2021, ITC-04 was required to be filed on quarterly basis. However, with effect from 1st October, 2021, ITC-04 is required to be filed at following frequency and corresponding due date:

| Aggregate Annual Turnover | Frequency of filing of GST ITC-04 | Due date of filing of GST ITC-04 |

| More than 5 Crores | Half Yearly basis | 25th of the month following the end of half year.

I.e., April to September: 25th October October to March: 25th April |

| Less than 5 Crores | Yearly basis | 25th of April of the following year. |

5. What is the procedure of ITC-04 return filing ?

GST ITC-04 can be filed either through online method, i.e., furnishing information in GST ITC-04 directly on GST portal or through offline method, i.e., furnish information in offline utility downloaded from GST portal and upload the JSON file.

Let’s discuss both the methods in details:

-

Online Method

- Dealers are required to login at the GST portal with GST login credentials.

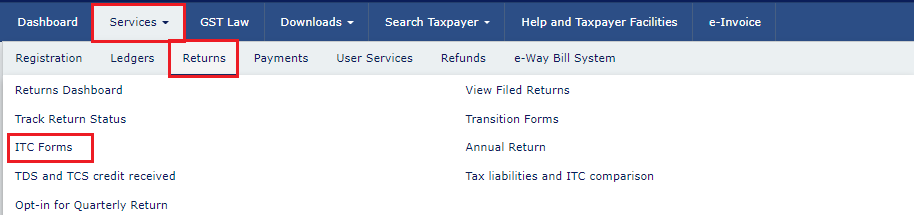

- Form GST ITC-04 is available at following path:

Services>ITC forms> GST ITC-04

- Post selection of Form, principal is required to select the financial year and period for which form is to be filed.

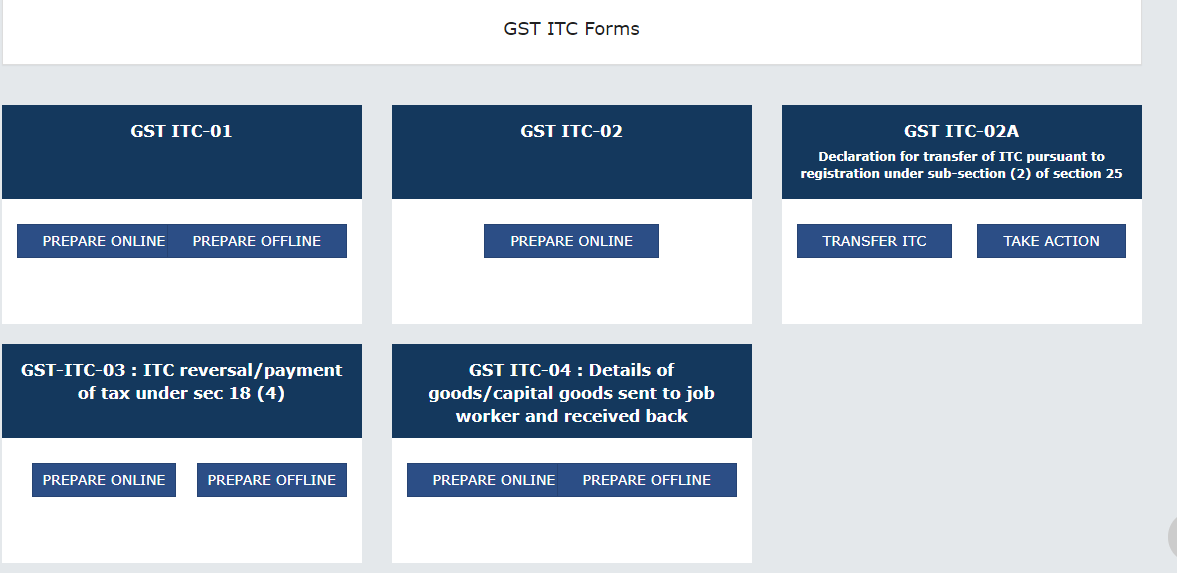

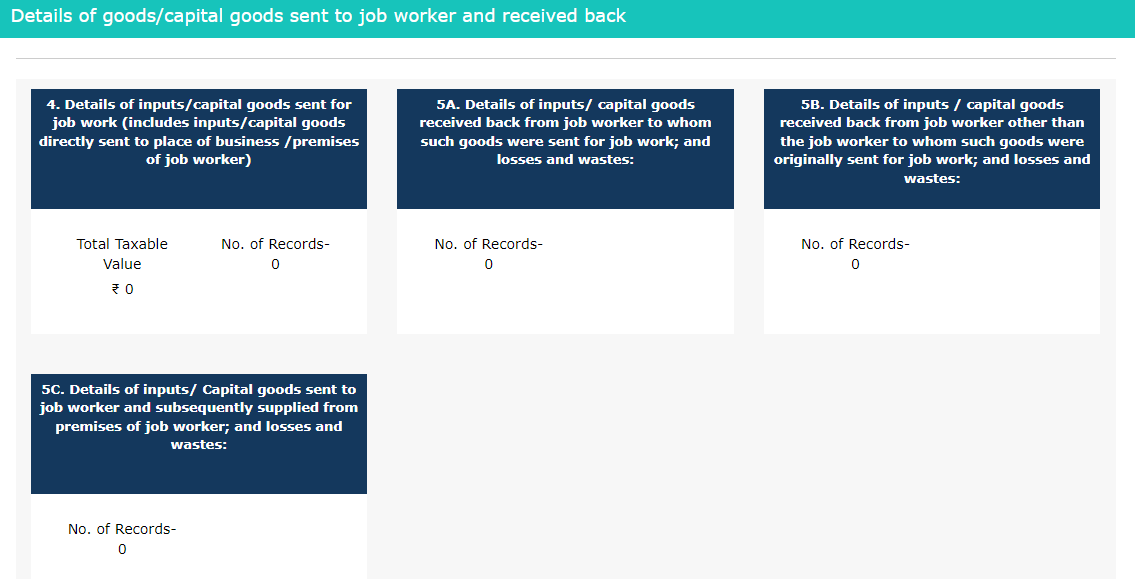

- Post this, system will display 4 tables in following manner:

- Details can be filed by clicking on the respective table.

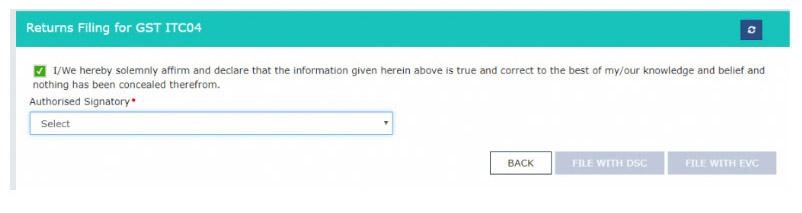

- Post furnishing of entire information, GST ITC-04 can be submitted with DSC or EVC.

-

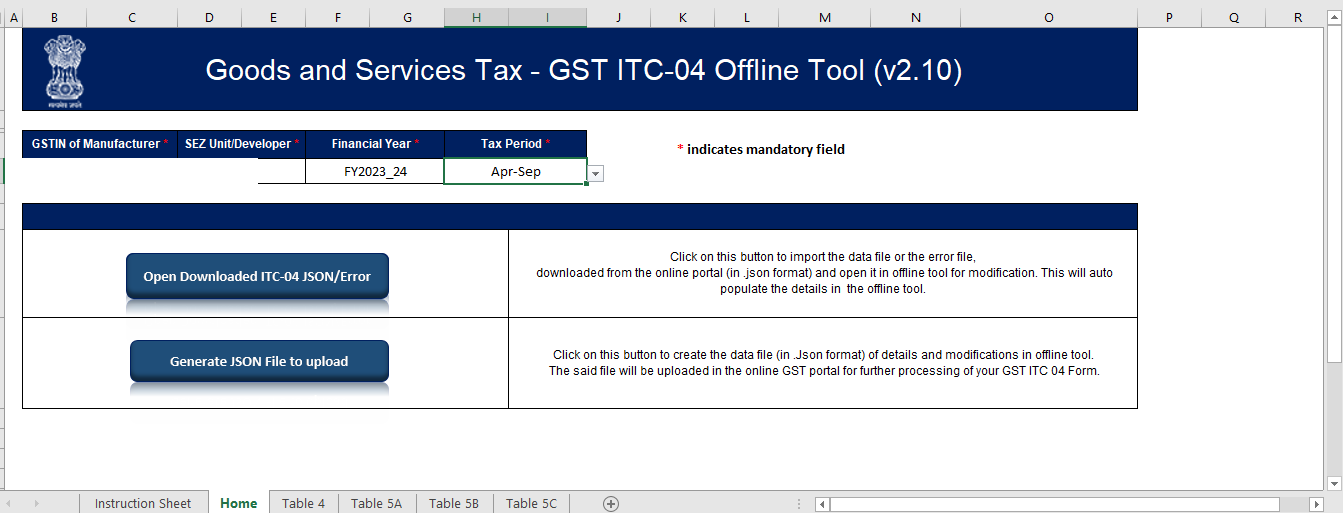

Offline Method

- For offline filing purpose, offline tool can be downloaded from GST portal at following path:

Downloads> Offline Tools> ITC04 Offline tool

- System will provide a zip file containing the excel utility of GST ITC-04.

- All tables are provided under different tabs in following manner:

- JSON file is required to be generated post validation of information entered in different tab and such JSON file can be uploaded on GST portal at following path:

Services>ITC forms> GST ITC-04> Prepare offline

- Uploaded GST ITC-04 can be filed with EVC or DSC Postal validation by GST portal.

Also Read: The Benefits Of Claiming ITC On Capital Goods