TCS ensures sellers collect tax from buyers at the point of sale, remitting it to government authorities, thereby preventing tax evasion and ensuring a steady revenue stream. Compliance with TCS regulations is crucial for e-commerce and marketplace sellers, involving specific procedures outlined by tax authorities. This typically includes providing business details, obtaining a Taxpayer Identification Number (TIN), and fulfilling compliance obligations. TCS differs from Tax Deducted at Source (TDS), focusing specifically on transactions within the e-commerce and marketplace domain. Understanding the impact of TCS registration is essential for sellers, influencing their financial obligations, operational processes, and compliance responsibilities in the digital marketplace.

TCS registration for non-resident taxpayers

Assess Applicability: Determine whether TCS registration is required based on the nature of your business activities, revenue thresholds, and any other relevant criteria established by the tax authorities.

- Obtain Taxpayer Identification Number (TIN): Non-resident taxpayers may need to obtain a Taxpayer Identification Number (TIN) or its equivalent from the tax authorities in the jurisdiction where they are liable to pay taxes.

- Gather Required Documents: Collect all necessary documents and information required for the registration process. This may include identification documents, proof of address, business incorporation documents, and any other relevant paperwork.

- Complete Registration Form: Fill out the TCS registration form provided by the tax authorities. This form typically requires detailed information about the taxpayer, their business activities, financial details, and other relevant information.

- Verification: Once you submit the application, it will undergo verification by the tax authorities. They may review the information provided and verify the authenticity of the documents submitted.

- Communication: During the verification process, the tax authorities may communicate with you for any additional information or clarification required.

- Issuance of Registration Certificate: Upon successful verification and processing of the application, the tax authorities will issue a TCS registration certificate or acknowledgment. This certificate confirms the taxpayer’s registration for TCS purposes.

- Compliance Training (if required): In some cases, tax authorities may require non-resident taxpayers to undergo compliance training or orientation sessions to understand their obligations under TCS regulations.

- Maintain Compliance: After obtaining TCS registration, ensure ongoing compliance with the relevant regulations, including timely collection of TCS from buyers, filing of TCS returns, payment of taxes, and adherence to other compliance obligations.

- Renewal and Updates: Periodically review and renew TCS registration as required by the tax authorities. Additionally, update registration details in case of any changes to business activities, contact information, or other relevant details.

Impact of TCS on e-commerce and marketplace sellers

The implementation of Tax Collected at Source (TCS) can have several impacts on e-commerce and marketplace sellers. Here are some of the key impacts:

- Financial Impact: TCS affects e-commerce sellers’ cash flows, increasing working capital needs.

- Compliance Burden: Sellers face complex registration, collection, and reporting requirements, requiring resource allocation.

- Price Adjustments: Sellers may alter prices to accommodate TCS, affecting competitiveness and sales.

- Operational Changes: Sellers must adapt systems and train staff for TCS compliance.

- Customer Experience: Clear communication of TCS charges is vital to maintain customer satisfaction.

- Impact on Marketplace Dynamics: TCS influences seller behavior, pricing, and market segment choices.

- Cross-Border Transactions: TCS adds complexity to cross-border transactions, necessitating compliance with diverse tax regimes.

- Tax Planning and Optimization: Sellers may employ strategies to minimize TCS obligations and optimize tax liabilities.

TCS registration and compliance obligations for non-resident sellers

The TCS (Tax Collected at Source) registration and compliance obligations for non-resident sellers typically vary depending on the specific regulations of the jurisdiction in which they operate. However, here are some common registration and compliance obligations that non-resident sellers may encounter:

- Registration Requirement: Non-resident sellers must register for TCS, providing business details to relevant tax authorities.

- Obtaining Taxpayer Identification Number (TIN): Non-resident sellers need a TIN for TCS registration and compliance.

- Understanding Thresholds and Exemptions: Non-resident sellers should know applicable thresholds and exemptions for TCS obligations.

- Collection of TCS: Sellers must collect TCS from buyers according to set rates and rules.

- Remittance and Payment of TCS: Sellers must remit collected TCS to tax authorities within specified timelines.

- Record-Keeping and Documentation: Sellers must maintain accurate records of TCS transactions for audit purposes.

- Filing of TCS Returns: Sellers must file TCS returns with tax authorities as per schedules.

- Compliance with Reporting Requirements: Sellers must report TCS transactions and business activities as required.

- Compliance Training and Awareness: Sellers should stay informed about TCS regulations for ongoing compliance.

- Renewal and Updates: Sellers must periodically review and renew TCS registration, updating details as needed.

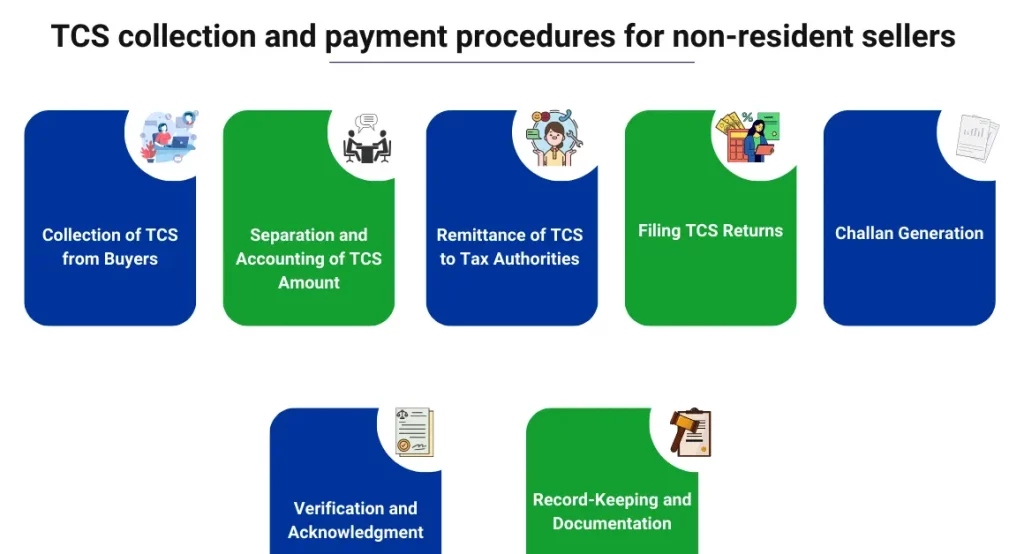

TCS collection and payment procedures for non-resident sellers

The TCS (Tax Collected at Source) collection and payment procedures for non-resident sellers typically involve several steps to ensure compliance with tax regulations. Here’s a general overview of the procedures:

-

Collection of TCS from Buyers:

- Non-resident sellers must collect TCS from buyers at the time of sale or transaction, as per the prescribed rates and rules determined by the tax authorities.

- The TCS amount is usually calculated as a percentage of the sale price or transaction value, and it is added to the total invoice amount payable by the buyer.

-

Separation and Accounting of TCS Amount:

- Upon collection, non-resident sellers must separate and account for the TCS amount separately from other transactional amounts.

- They should maintain accurate records of TCS collected from each buyer and ensure proper documentation for future reporting and remittance to the tax authorities.

-

Remittance of TCS to Tax Authorities:

- Non-resident sellers are required to remit the TCS collected from buyers to the designated tax authorities within the specified timelines.

- This typically involves filing TCS returns and making TCS payments electronically through approved payment channels or online portals provided by the tax authorities.

-

Filing TCS Returns:

- Non-resident sellers must file TCS returns with the tax authorities as per the prescribed schedules.

- TCS returns typically include details of TCS collected from buyers, TCS remitted to the tax authorities, and other relevant information for compliance purposes.

-

Challan Generation:

- Non-resident sellers may need to generate challans or payment vouchers to facilitate the remittance of TCS to the tax authorities.

- Challans typically include details such as the TCS amount, taxpayer information, payment mode, and other relevant particulars required for processing TCS payments.

-

Verification and Acknowledgment:

- Once TCS payments are made, non-resident sellers should verify that the payments have been successfully processed and acknowledged by the tax authorities.

- They should retain copies of payment acknowledgments or receipts as evidence of compliance with TCS payment obligations.

-

Record-Keeping and Documentation:

- Non-resident sellers must maintain accurate records and documentation related to TCS collection and payment activities.

- This includes invoices, receipts, TCS certificates, payment records, and other relevant documents required for audit or review by tax authorities.

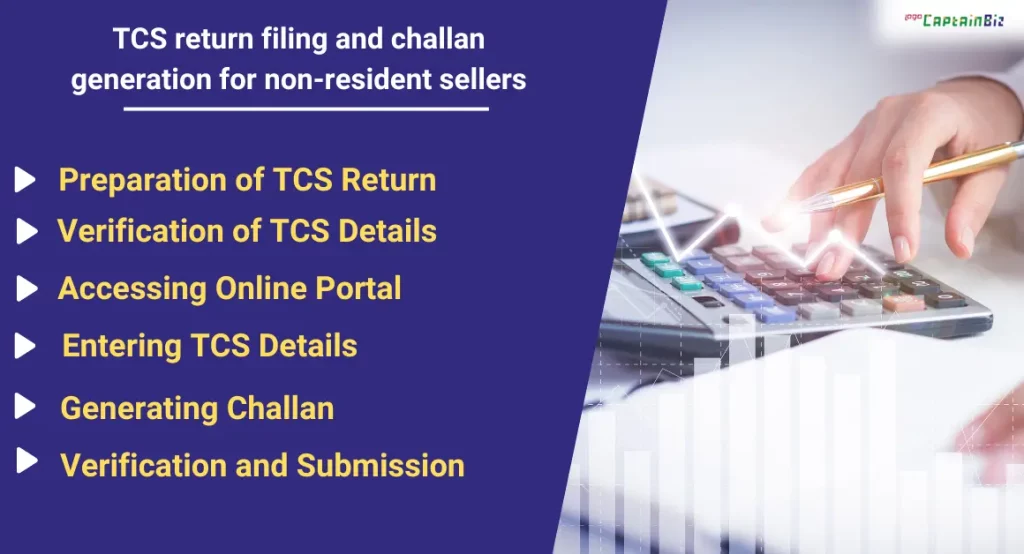

TCS return filing and challan generation for non-resident sellers

The TCS (Tax Collected at Source) return filing and challan generation process for non-resident sellers typically involves several steps to comply with tax regulations. Here’s a general overview:

- Preparation of TCS Return: Non-resident sellers compile TCS details including collections, remittances, and relevant data for return filing.

- Verification of TCS Details: Sellers ensure accuracy and completeness of TCS data before filing returns.

- Accessing Online Portal: Sellers utilize tax authority portals for electronic TCS return filing.

- Entering TCS Details: Sellers input TCS information accurately into the online portal.

- Generating Challan: Sellers create payment vouchers or challans for TCS remittance via the portal.

- Verification and Submission: Sellers verify TCS details, then electronically submit returns and generated challans.

- Acknowledgment and Confirmation: Sellers receive acknowledgment from tax authorities post-submission.

- Record-Keeping and Compliance: Sellers maintain TCS return copies and acknowledgments for compliance purposes.

Navigating TCS regulations and minimizing compliance risks

Navigating Tax Collected at Source (TCS) regulations and minimizing compliance risks requires careful planning, understanding of tax laws, and proactive measures. Here are some strategies to navigate TCS regulations effectively and mitigate compliance risks:

- Stay Informed: Regularly check for updates from tax authorities to stay informed about changes in TCS regulations.

- Understand Applicability: Determine if TCS rules apply to your business activities and revenue streams.

- Seek Professional Advice: Consult with experts for guidance on interpreting complex TCS laws.

- Implement Robust Systems: Set up systems capable of tracking and calculating TCS accurately.

- Train Staff: Educate your team on TCS regulations and their compliance responsibilities.

- Conduct Internal Audits: Regularly review TCS processes to identify and fix any errors.

- Monitor Transactions: Keep a close eye on TCS-related transactions for compliance.

- Maintain Documentation: Organize and store TCS-related documents for easy access.

- Review Contracts and Agreements: Ensure contracts align with TCS regulations.

- Engage with Tax Authorities: Communicate openly with tax authorities for guidance.

- Monitor Legislative Changes: Stay alert to legal changes affecting TCS compliance.

Also Read: The Crucial Role Of TCS Registration In Navigating Evolving Regulatory Landscapes

Conclusion:

In conclusion, Tax Collected at Source (TCS) registration affects e-commerce and marketplace sellers, particularly non-residents. It influences their operations, financial obligations, and compliance responsibilities. From registration to return filing and navigating regulations, understanding and managing TCS impact is crucial for sellers to minimize risks and ensure smooth business transactions. By staying informed, implementing robust systems, and maintaining compliance, sellers can navigate TCS regulations effectively and mitigate potential challenges. Overall, TCS registration significantly impacts e-commerce and marketplace sellers, shaping their strategies and practices in the digital marketplace landscape.

Also Read: Know Everything About GST Billing Software

FAQs

-

What is TCS registration, and who needs to register as a non-resident taxpayer?

TCS registration is required for non-resident taxpayers engaged in e-commerce or marketplace selling, involving the collection of tax from buyers.

-

How does TCS impact e-commerce and marketplace sellers?

TCS impacts sellers by affecting cash flows, pricing strategies, and operational processes due to tax collection obligations.

-

What are the registration and compliance obligations for non-resident sellers regarding TCS?

Non-resident sellers must register for TCS, obtain a TIN, collect TCS from buyers, file returns, and maintain records.

-

What are the procedures for TCS collection and payment for non-resident sellers?

Procedures for TCS collection and payment include collecting tax from buyers and remitting it to tax authorities within specified timelines.

-

How do non-resident sellers file TCS returns and generate challans?

Non-resident sellers file TCS returns electronically, providing details of TCS collected and remitted, and generate challans within designated portals.

-

What are the risks associated with TCS compliance, and how can sellers minimize them?

Risks of TCS non-compliance include penalties, financial losses, and reputational damage, mitigated by staying informed and implementing robust systems.

-

Are there any differences between TCS and TDS, and how do they relate to non-resident sellers?

TCS focuses on collecting tax from buyers at the source of the transaction, specifically in e-commerce and marketplace domains. TDS, on the other hand, involves deducting tax from income sources. Non-resident sellers need to understand and comply with both if applicable.

-

What steps can non-resident sellers take to navigate TCS regulations effectively?

Effective navigation of TCS regulations involves seeking professional advice, staying updated, maintaining records, and staff training.

-

What are the consequences of non-compliance with TCS regulations for non-resident sellers?

Non-compliance with TCS regulations may result in penalties, legal repercussions, and trust issues with customers and stakeholders.

-

How does TCS registration impact the overall business operations of non-resident sellers?

TCS registration affects cash flow, pricing, operations, and customer relationships, necessitating careful management for smooth business operations and compliance.