The Goods and Services Tax (GST) system is devised in such a way that it presents businesses with a useful mechanism known as Input Tax Credit (ITC). ITC is a way businesses become eligible to get credit on the GST they have paid on their purchases.

This credit can eventually be balanced out against the GST that the businesses receive from their sales transactions. Thus, ITC helps reduce the overall GST liability that the business incurs at the time of sales.

It also acts as a check so that businesses are not burdened with double taxation, since it allows them to regain the GST paid on inputs. Due to this, they only have to pay the net GST amount on transactions related to their final sales.

ITC Eligibility for Specific Marketing Expenses

Businesses should accustom themselves to the requirements mandated in the GST laws to find out whether they can meet the criteria for claiming ITC on their marketing expenses. Following the legal framework of the Goods and Services Tax (GST), businesses are permitted to claim ITC on specific marketing promotion expenses.

So, what do you have to keep in mind about marketing expenses before you claim ITC?

-

Commercial Use:

ITC can be claimed on marketing expenses or promotional schemes while keeping in mind that all of these transactions should be commercial since ITC is not allowed on GST paid on personal costs.

-

Nature of Marketing Expenses and ‘Inputs’:

Businesses need to understand that the eligibility for claiming ITC is entirely dependent on the nature of the marketing expense as well as the ‘inputs’ and its nexus with the promotional objectives of the business.

To know what can be constituted as ‘inputs’, the scope of Section 2 (59) of the CGST Act should be well understood. This provision terms all promotional products/materials as well as marketing items that are used by businesses to market their product or promote their brand as ‘inputs’.

-

Goods Specifically Used for Marketing and Promotional Schemes:

If businesses are giving away or distributing goods to dealers to either market their products or promote their brands, which includes promotional schemes and activities, then such goods will be eligible for ITC. It is even better if the distribution of goods to dealers takes place especially when they have achieved pre-specified sales targets.

-

Complying with the GST Laws:

Businesses need to comprehend the GST laws on marketing expenses to find out whether they meet the eligibility criteria concerning the specific regulations for the category of goods.

So, businesses can claim credit for the tax they paid on goods used for promotional schemes, such as distributing items to dealers after reaching sales targets or as part of combo offers. But, it is also important to know when can you not claim ITC on marketing expenses.

ITC cannot be claimed for goods which are distributed as complimentary gifts, even though they are used in the course of business since they fall under the category of non-taxable supplies. This renders them ineligible, which is why they do not attract an ITC.

- Businesses cannot avail ITC on costs incurred on food and beverages except when the food items are provided to the employees.

- All costs incurred while making political contributions, donations, employee welfare expenses, entertainment expenses or paying penalties and fines will not be considered eligible for claiming ITC.

Goods that have been obtained after the payment of GST but are being done away with in the form of gifts will not be eligible for ITC, even if it is done for the marketing or promotion of the business.

Hence, it is important to have prior knowledge about the eligibility criteria of ITC with regard to specific marketing expenses.

GST Credit on Advertising Costs Examples

Marketing is advertising or promoting one’s goods or services to increase the sales of the business. The GS, which applies to advertising costs, provides an opportunity for businesses to claim ITC on advertising-related expenses.

Businesses might be able to avail ITC on costs which can be related to advertising under specific situations. A few examples of marketing and advertising expenses on which businesses can claim GST credit are-

-

Advertising services

Businesses that provide advertising services can claim GST credit on all the goods that they own. Expenses which might be incurred for creating as well as developing marketing campaigns are also eligible to claim GST credit.

-

Print Advertising

For print media, the rate of GST is fixed at 5%. Businesses can claim GST credit for expenses related to digital advertising, like social media promotions and paid search campaigns.

-

Digital Advertising

The rate of GST on advertisements on digital media is 18%. Businesses can avail ITC of expenses related to creating advertisements in print media, which includes newspapers and magazines.

Advertising, in most of its forms, whether digital or print, is eligible for GST credit.

Claiming ITC on promotional events

Businesses should bear in mind that the distribution of promotional items has to be made in accordance with the specified contractual obligations. Here are a few examples of promotional items on which ITC can be claimed-

-

Promotional Events:

Businesses can avail ITC of all the expenses that have been incurred in organising any promotional event as well as on the costs of providing promotional as well as marketing materials.

-

Promotional Materials:

Promotional products that are distributed at promotional events or for the purpose of promotion are eligible for ITC. They can include branded items such as T-shirts or promotional gifts like bottles or keychains.

Many businesses use customised promotional products such as pens, calendars, and notepads to promote their brand. Businesses can reap the benefits of ITC on all of these products.

-

Combo offers:

Promotional items that are given away through combo offers are eligible for ITC. Tax on such goods is considered to be paid, being a part of the combo.

-

Sales Promotional schemes:

Goods that are normally not considered promotional items but are given away as part of sales promotional schemes in order to fulfil marketing and promotional goals, like gold coins, are eligible for ITC. This decision was taken by an Indian court. As per which these items are not categorized into gifts.

In addition to this, ITC can also be availed for free gifts and samples, and discounts and offers like buy-1-get-1 free

Documenting ITC for sponsored activities

Sponsorship activities include activities wherein one party supports another with money or other assistance in exchange for promotion. This support can be by way of funds, goods, or services. While the GST rate for sporting events is typically 18%, for cultural or artistic events, it may be lower at 12%.

For documenting ITC for sponsored activities, it is important to understand the legal framework that supports the claiming of ITC as well as the nexus between Sponsorship and GST.

-

GST and Sponsorship:

As per the GST Act, sponsorship is considered to be a taxable supply. This is why tax for sponsorship falls under the Reverse Charge Mechanism (RCM).

-

Effect on Service Receiver:

Under RCM, anyone who is paying for or receiving the sponsorship will have to pay an 18% GST on the sponsorship amount.

-

Effect on Service Provider:

According to rules 42 & 43 of CGST Rules, anyone who is providing the sponsorship services may have to reverse their ITC, which shall be proportional to Exempt supply.

-

ITC Reversal:

According to sections 2 (47) and 17 (3) of the CGST Rules, businesses that offer sponsorship services will have to reverse their ITC based on Exempt Supply.

-

CSR Activities and ITC:

In 2023, an amendment was made to the CGST Act which clearly stated that ITC shall not be claimed on all goods and services that are used in CSR activities.

It is necessary to have a proper understanding of the mechanism for claiming ITC on sponsored activities.

Approved marketing expenses for ITC claims

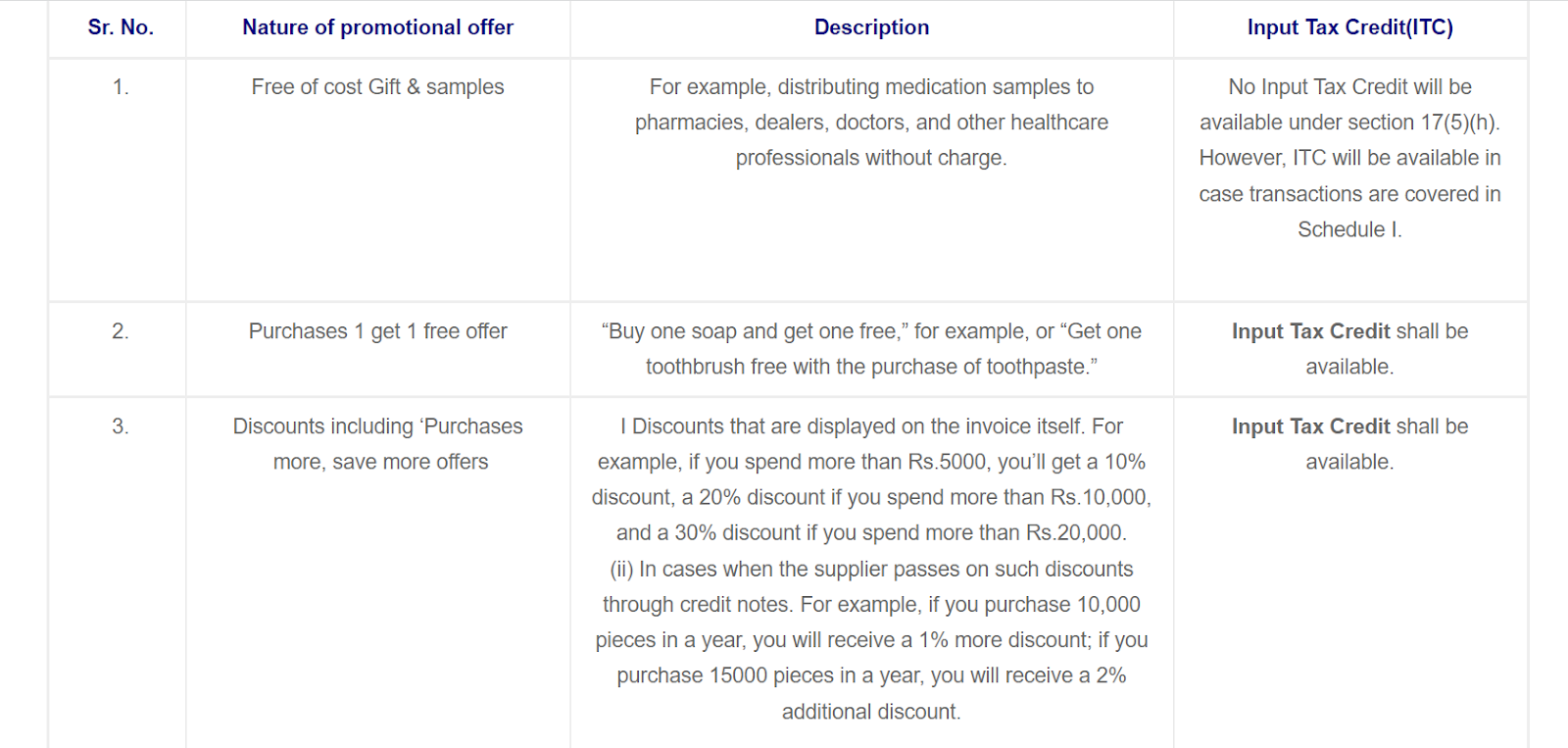

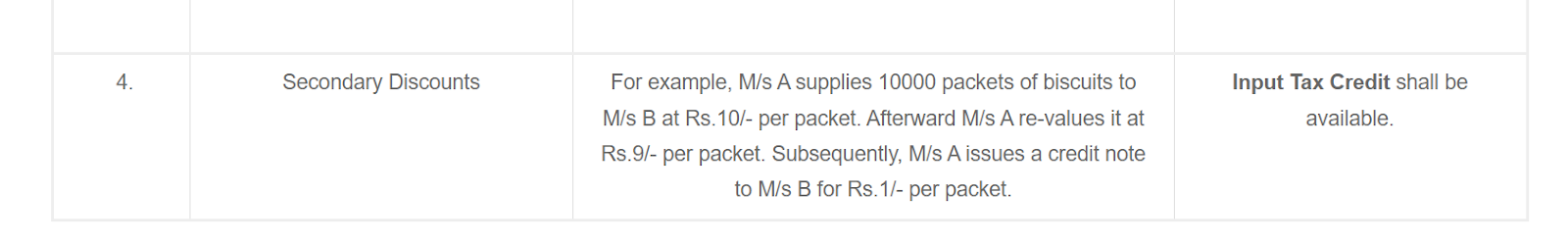

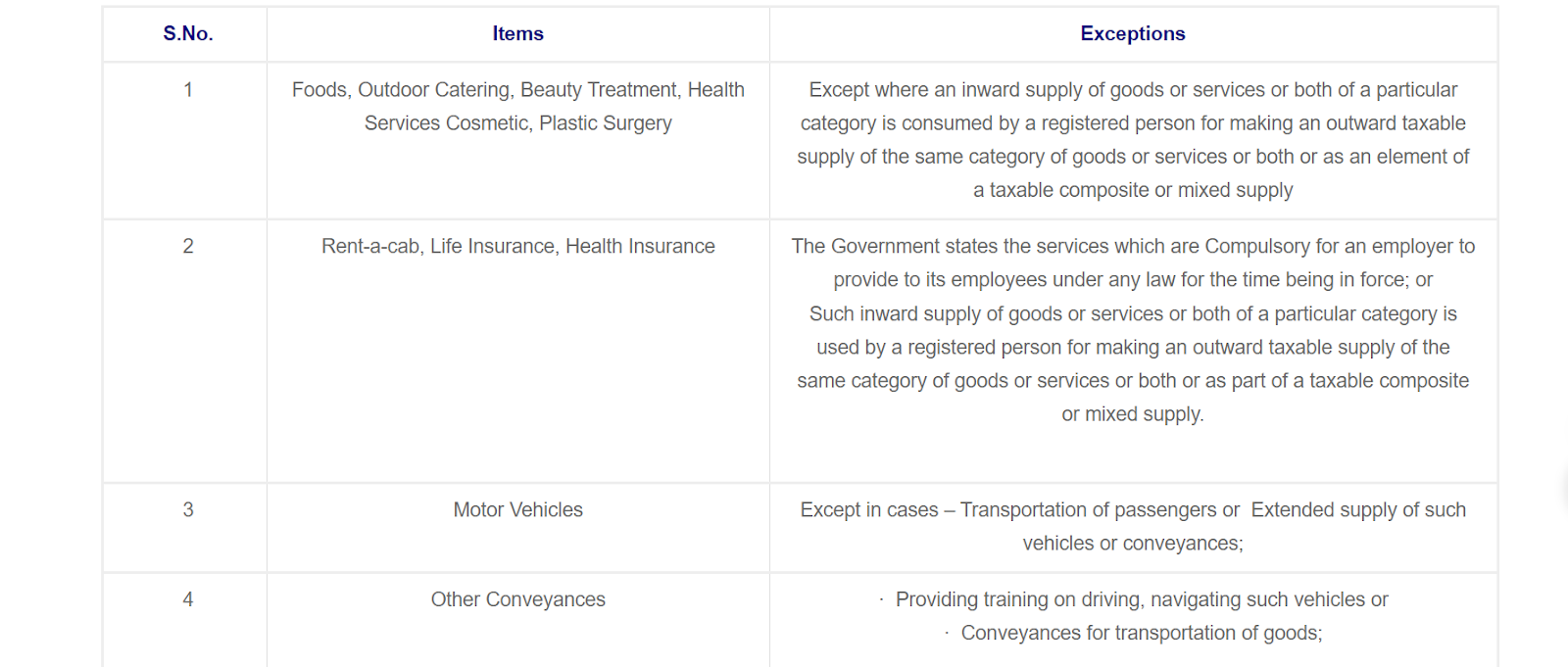

The following tables will help one get an idea of whether ITC can be claimed on a specific marketing expense.

Items on which ITC can be claimed:

Certain items on which ITC can not be claimed:

Source1: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Source 2: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Apart from the above-mentioned items, there are various other goods and services for which businesses can not claim for ITC. They are-

- Club memberships

- Health centre memberships

- Home travel concession benefits

- Written-off goods

- Vacation travel benefits provided to employees

- Stolen goods

- Goods given away as gifts

- Free samples

- Goods or services used for personal consumption

- Lost goods

- Destroyed goods

- Fitness centre memberships

Hence, businesses should be aware of the marketing expenses that they can claim ITC on.

Maximising GST benefits for promotional spending

In order to maximise GST benefits for promotional spending, businesses have not just to optimise ITC but also minimise their tax liabilities. Here are a few strategies that can help organisations maximise GST benefits-

-

Through Free Samples:

As per Section 7 of the CGST Act, 2017, providing complimentary samples to unrelated individuals without any value or consideration, falls outside the purview of ‘Supply.’ However, according to Section 17(5) (h) of the CGST Act 2017 ITC for goods distributed as free samples is ineligible.

-

Through Promotional Quantity Offers:

By providing additional units or quantities of the same product in promotional schemes like ‘Buy 1 shampoo, get 20% extra’ or ‘Buy 1 Get 1’, businesses incorporate the cost of the extra quantity of shampoo in the sale price of the unit for which the customer is making a payment.

-

Through Cashback Coupons and Promotional Gift Vouchers:

Using strategies such as cashback coupons or promotional gift vouchers valid for future purchases can encourage subsequent purchases.

-

Through Promotional Giveaways:

Since the costs incurred on promotional giveaways are eligible for ITC, businesses that distribute promotional items can claim for ITC, leading to maximized benefits.

By encouraging promotional spending in various ways, businesses can avail of maximum GST benefits.

Conclusion

Businesses should have a proper understanding of ITC eligibility for specific marketing expenses, including advertising costs and promotional events, to maximise GST benefits. By enhancing GST compliance as well as proper documentation of ITC for sponsored activities and approved marketing expenses, businesses will be able to make the most out of the Input Tax Credit.

Frequently Asked Questions (FAQ)

-

What is Input Tax Credit (ITC)?

ITC allows businesses to balance out the GST paid on purchases from the tax they collect on sales.

-

Can businesses claim ITC on GST paid on personal costs?

No, businesses cannot claim ITC on GST paid on personal costs.

-

Can ITC be claimed on goods distributed as complimentary gifts?

No, ITC cannot be claimed on goods distributed as complimentary gifts.

-

Is ITC allowed on advertising-related expenses?

Yes, ITC is allowed on advertising-related expenses.

-

What is the GST rate for print media and digital media?

While it is 5% for print media, the rate of GST for digital media is 18%.

-

On what promotional events can ITC be claimed?

ITC can be claimed on sales promotional schemes, combo offers, discounts etc.

-

What is Reverse Charge Mechanism (RCM)?

RCM is the mechanism where the onus of paying the tax is on the buyer, not the supplier.

-

Can ITC be claimed on CSR activities?

No, ITC cannot be claimed on CSR activities.

-

What is ITC Reversal?

When a business has to reverse previously claimed ITC on GST paid for not being eligible to avail, it is called ITC reversal.

-

Are goods distributed as free samples eligible for ITC?

No, goods distributed as free samples are not eligible for ITC. This is because in accordance with Section 17(5)(h) of the CGST Act, 2017, ITC will be blocked if the goods are lost, destroyed, stolen, written off, or disposed of by way of gift or free samples.