GST registration is a crucial step for businesses operating in countries that implement the Goods and Services Tax (GST) system. It is a legal requirement for businesses to register under the GST regime if they meet certain eligibility criteria. This article aims to provide a comprehensive guide on how to obtain GST registration, covering essential aspects such as eligibility criteria, required documents, the step-by-step process, common challenges, benefits, obligations, and frequently asked questions. Whether you are a small business owner or a budding entrepreneur, understanding the process of GST registration is essential to ensure compliance and smoothly navigate the tax system.

What is GST Registration?

GST Registration is like getting a golden ticket to the world of taxes – it’s your official entry pass into the Goods and Services Tax (GST) system. In simpler terms, it’s the process of obtaining a unique identification number from the government that enables you to collect and remit GST on your goods or services.

Importance of GST Registration

Why bother with GST registration, you may wonder? Well, there are a few good reasons. First and foremost, it’s the law! If your business meets certain criteria, you are legally obligated to get registered. But beyond that, it also helps you streamline your tax compliance, enhances your business credibility, and opens up opportunities for interstate and international trade. Plus, it’s a great conversation starter at parties – nothing says “fun” like chatting about tax registrations over a plate of hors d’oeuvres.

Eligibility Criteria for GST Registration

To ensure compliance with India’s Goods and Services Tax (GST) regime, businesses must meet specific criteria to obtain a GSTIN.

| Eligibility Criteria | Description |

| Turnover Threshold: | – Businesses with an aggregate turnover exceeding INR 40 lakhs (for goods) or INR 20 lakhs (for services) in a financial year must register for GST. – However, certain states have a lower threshold of INR 10 lakhs for special category states. |

| Inter-State Supplies: | – Businesses making inter-state taxable supplies (even below the threshold) must register for GST. |

| Casual Taxable Persons: | – Individuals or entities making taxable supplies occasionally, even without a fixed place of business, must register as casual taxable persons. |

| Non-Resident Taxable Persons: | – Non-resident individuals or entities making taxable supplies in India must register for GST. |

| E-commerce Operators: | – E-commerce operators providing services through an electronic platform or acting as aggregators must register for GST. |

| Agents of Suppliers or Recipients: | – Individuals or entities acting as agents of suppliers or recipients under reverse charge must register for GST. |

| Input Service Distributors: | – Businesses distributing input tax credit to their members must register as input service distributors. |

| Voluntary Registration: | – Businesses with a turnover below the threshold can voluntarily register for GST to avail input tax credit benefits. |

Additional Considerations:

- Composition Scheme: Small businesses with a turnover below INR 1.5 crores can opt for a simplified composition scheme with lower tax rates.

- Multiple Businesses: Businesses operating multiple entities under a single PAN must register each entity separately, if they meet the eligibility criteria.

- State-Specific Rules: Certain states may have additional registration requirements or exemptions, so it’s essential to check with the relevant state authorities.

Threshold for GST Registration

Before you dive headfirst into the registration process, it’s good to know where you stand. The government has set a turnover threshold to determine who needs to get registered. If your annual turnover exceeds this threshold (which varies for different states), you’re in the GST club, my friend. It’s like being part of an exclusive club, but with less jazz hands and more paperwork.

Mandatory GST Registration

In some cases, GST registration is a non-negotiable requirement, regardless of your turnover. For example, if you engage in interstate supply, have an e-commerce business, or are involved in certain industries like pharmaceuticals, it’s mandatory to obtain GST registration. It’s like a secret handshake the government demands from specific businesses to keep a closer eye on them. Trust no one!

Voluntary GST Registration

Now, if you fall below the turnover threshold or don’t fit into any of the mandatory categories, you might still want to hop on the GST train voluntarily. Voluntary registration allows you to avail yourself of certain benefits like input tax credit and better business reputation. Plus, you get the satisfaction of being part of an exclusive club without the government forcing you to join. It’s like being the cool kid who chooses to sit at the nerdy table.

Documents and Information Required for GST Registration

Hold on to your paperwork, folks! To obtain GST registration, you’ll need a few documents and information handy. Get ready to dig into your business details, including your PAN card, proof of address, bank account statements, and a list of your goods or services. Think of it as a treasure hunt, but instead of finding gold, you’re searching for documents with fancy acronyms and lots of numbers.

Also Read: All you need to know about the threshold limit for GST registration

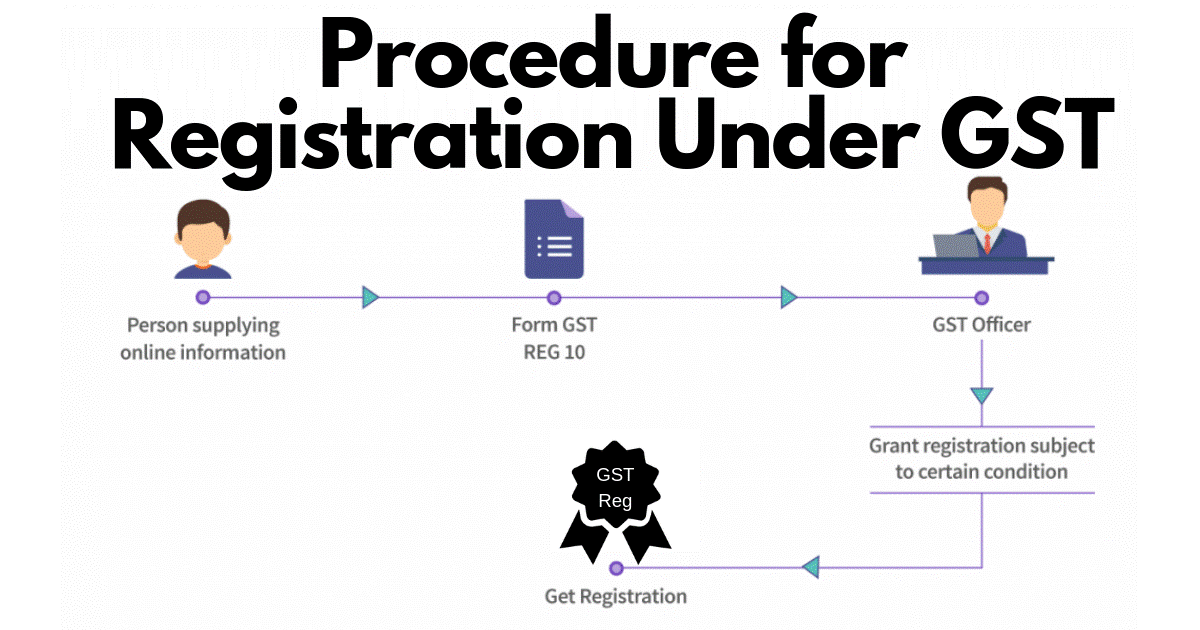

Step-by-Step Process of GST Registration

To navigate the Goods and Services Tax (GST) registration process in India and obtain a GSTIN, businesses must follow a specific set of steps.

Here’s a detailed guide, presented in a clear table format for easy reference:

| Steps | Description |

| 1. Digital Signature (DSC) | – Acquire a Class 2 or Class 3 DSC from an authorized agency. – This enables authorized individuals to electronically sign the application. |

| 2. GST Portal Access | – Visit the GST portal (www.gst.gov.in). – Register for an account using PAN and a valid email address. |

| 3. Begin Application | – Under the “Services” tab, select “New Registration.” |

| 4. Basic Information | – Enter basic business details: – Legal name – PAN – State of operations – Principal place of business – Business type (individual, partnership, company, etc.) |

| 5. Business Details | – Provide comprehensive information: – Principal place of business address – Additional place of business addresses (if applicable) – Bank account details – Nature of business activities – Expected annual turnover – Details of directors/partners/proprietor |

| 6. Document Upload | – Attach required documents (may vary): – PAN card – Proof of business address (electricity bill, rent agreement, etc.) – Bank account statement – Identity and address proof of proprietor/partners/directors – Proof of business constitution (for non-individuals) |

| 7. Verification and Signing | – Review the application thoroughly. – Ensure accuracy and completeness. – Use DSC to electronically sign. |

| 8. Submission and Payment | – Submit the application. – Pay applicable registration fees (currently INR 100 for most states). |

| 9. Authority Verification | – GST authorities will verify submitted information and documents. – If approved, a GSTIN will be generated, and a registration certificate will be issued (typically within 3-7 working days). |

| 10. Physical Verification (if applicable) | – In some cases, physical verification of business premises may be conducted. |

Additional Considerations:

- Professional Guidance: Seek assistance from a GST expert or tax professional for complex cases or guidance.

- Registration Timeline: Allow 3-7 working days for application processing and approval.

- Stay Updated: Track registration status on the GST portal and respond promptly to queries.

- Post-Registration Compliance: Adhere to GST compliance requirements, such as filing returns and paying taxes on time.

Preparing for GST Registration

Before you embark on the registration journey, it’s wise to gather all the necessary documents, double-check your eligibility, and mentally prepare yourself for a bureaucratic adventure. Take a deep breath, put on your favorite playlist, and let’s get ready to rumble with some government forms!

Online Application Process

Gather ’round, tech-savvy entrepreneurs! The GST registration process is now digital, eliminating the need for physical forms and long queues. Hallelujah! Get ready to navigate the government portal, fill in the required details, and upload your documents. Just remember to keep your cool when faced with frustrating error messages or slow internet connections. Patience is key, my friend.

Verification and Approval

Once you’ve completed the online application, it’s time to play the waiting game. The government will review your application, cross-check your documents, and perform their detective work to ensure you’re the real deal. If everything checks out, you’ll receive your GST registration certificate, making your business officially GST-approved. Cue the confetti cannons and celebration dances!

Now that you’re armed with the know-how of obtaining GST registration, go forth, conquer the registration process, and embrace the world of taxes with open arms (or at least a resigned shoulder shrug). Happy registering!5. Common Challenges and Tips for a Smooth GST Registration Process

Common Challenges Faced

Registering for GST may seem like a walk in the park, but let me tell you, it can have its fair share of hurdles. Here are some of the common challenges you might encounter during the GST registration process:

- Deciphering the jargon: GST comes with its own set of confusing terms and acronyms. From Input Tax Credit (ITC) to Goods and Services Tax Network (GSTN), trying to make sense of it all can leave you scratching your head.

- Document overload: Be prepared to swim through a sea of paperwork. From financial statements to business registrations, you’ll need to gather a ton of documents to prove your eligibility for GST registration.

- Technical glitches: Ah, technology, our best frenemy. The GST registration portal can sometimes develop a mind of its own and throw error messages at you just when you thought you were almost done. Patience and a cup of tea might be your best allies here.

Tips for a Smooth GST Registration Process

While the GST registration process may have its quirks, fear not! Here are some tips to help you navigate your way smoothly:

- Educate yourself: Take the time to understand the basics of GST. Familiarize yourself with the terminologies, registration requirements, and the overall process. The more you know, the easier it will be to tackle any challenges that come your way.

- Get your documents in order: Be organized and ensure you have all the required documents handy. This will save you from running around in search of that elusive tax invoice or PAN card when you’re knee-deep in the registration process.

- Seek professional help: Don’t be shy to reach out to professionals like accountants or tax consultants who specialize in GST. They can guide you through the process, answer your questions, and help you avoid any potential pitfalls.

Benefits and Obligations of GST Registration

Benefits of GST Registration

Congratulations! You’ve successfully jumped through the hoops and obtained your GST registration. But what’s in it for you? Here are some benefits you can enjoy:

- Input Tax Credit (ITC): One of the sweetest perks of GST registration is the ability to claim ITC. This means you can offset the tax you paid on purchases against the tax you collected from sales. Say goodbye to double taxation and hello to some tax savings!

- Enhanced credibility: Being registered under GST adds a level of credibility to your business. It shows potential customers and suppliers that you’re compliant with tax regulations, which can earn you trust and open doors to new business opportunities.

Also Read: Benefits of GST Registration

Obligations and Compliance Requirements

But let’s not forget the obligations that come with GST registration. Here are a few compliance requirements you need to keep in mind:

- Filing regular returns: As a registered GST taxpayer, you’ll need to file regular returns. The frequency of these returns depends on the nature of your business, so make sure you stay on top of your filing obligations.

- Maintaining proper records: Goodbye, shoebox of crumpled receipts! Under GST, you’re required to maintain proper records of your business transactions. This includes invoices, purchase registers, and other relevant documents.

Conclusion and Final Thoughts on Obtaining GST Registration

Obtaining GST registration may seem like a daunting task, but with a little bit of patience, organization, and perhaps a few deep breaths, you can sail through it smoothly. Remember to educate yourself, gather your documents, and seek professional assistance when needed. And once you’re registered, enjoy the benefits while fulfilling your obligations as a responsible GST taxpayer. Happy registering!8. Conclusion and Final Thoughts on Obtaining GST Registration.

Acquiring GST registration is a fundamental requirement for businesses operating in GST-regulated countries. It not only ensures compliance with tax laws but also offers various benefits and opportunities. By following the step-by-step process, submitting the necessary documents, and meeting the eligibility criteria, businesses can smoothly obtain GST registration. Though challenges may arise, staying informed and seeking professional guidance can help overcome them. With GST registration in place, businesses can enjoy the advantages it brings while fulfilling their obligations in the tax system. By understanding the importance of GST registration and taking the necessary steps, businesses can confidently navigate the GST landscape and contribute to their growth and success.

Also Read: All you Need to Know About GST Registration

Also Read: CaptainBiz launches unlimited e-Invoices and e-Way bills for MSMEs

Frequently Asked Questions about GST Registration

1. Who is required to obtain GST registration?

Businesses or individuals meeting the threshold specified by the tax authorities are mandated to obtain GST registration. This threshold may vary depending on the country and the nature of the business.

2. Can I voluntarily register for GST even if my turnover is below the threshold?

Yes, in some cases, businesses or individuals with turnover below the mandatory threshold can choose to voluntarily register for GST. Voluntary registration can provide advantages such as availing input tax credit and expanding business opportunities.

3. What documents are typically required for GST registration?

The documents required for GST registration may include proof of business incorporation, identification proof of the business owner/partners/directors, address proof of the business premises, bank account details, and additional supporting documents as per the country’s tax authority guidelines.

4. How long does it take to complete the GST registration process?

The time required to complete the GST registration process can vary depending on the country and the efficiency of the tax authority. Typically, it can take anywhere from a few days to a few weeks to complete the registration process, considering the verification and approval stages.