GST Tax Invoice Format in Excel and Word - Download Excel.

Financial transparency and compliance are clearly defined by the GST Tax Invoice. Streamline your financial processes, improve operational efficiency, and set a new standard for excellence in billing with our innovative solution. An actual expression in ink and numbers is the Goods and Services Tax Bill, which is more than just a piece of paper. With our simple interface, you can effortlessly generate and oversee your tax bills, leaving you to focus on expanding your company. Adapting our GST Bill to the needs of contemporary businesses allows for a smooth transition in invoicing. Our services include answering compliance questions in real-time and providing in-depth explanations of the tax system. More than simply an invoice, it’s the tool you need for efficient, legal, and problem-free money management.

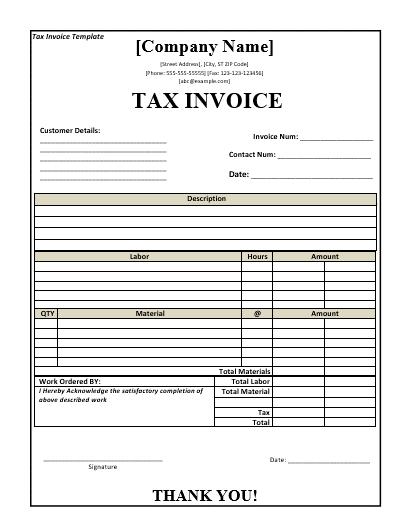

Invoice Tax Format in Word

Our Tax Invoice Format effortlessly combines compliance and some level of sophistication to ensure that your transactions go beyond merely fulfilling the legal requirements but also reflect the degree of professionalism you require. It is driven by the exactness of Excel for accurate calculations and efficient operations. That is a manifestation of our concern for your own special experience with personalized branding elements. The invoice with a friendly design will facilitate your records keeping and adapt to various changing tax environments. Make a bold move. Enjoy the way of billing in the future! Transparent, compliance-friendly, tailored for your business! Make your business transactions more sophisticated using our modern tax invoice layout.

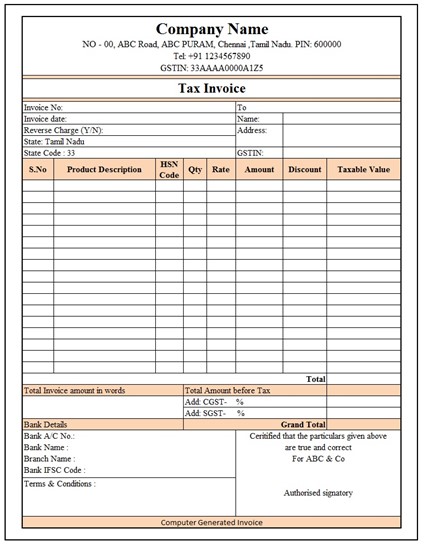

GST Tax Invoice

The business sector depends upon tax invoices as an important form of documentation. Indicating the kind of taxes that are applicable, it is a legal document that proves the supply of goods or services. The Goods and Services Tax system transforms a tax invoice into a GST bill that contains its concepts. The Goods and Services Tax (GST) bill is a legal document that details a tax agreement that provides clarity and compliance. Included among the important features are the names and addresses of the buyers and sellers, a unique invoice number, the date of issue, a detailed description of the products or services delivered together with their quantities, the total amount payable, and any relevant taxes. Several characteristics give the GST bill its distinctive character. The laws in this sector make it very apparent which taxes — CGST, SGSC, or IGST—apply to each transaction, and the structure of the system is based on the GST framework.

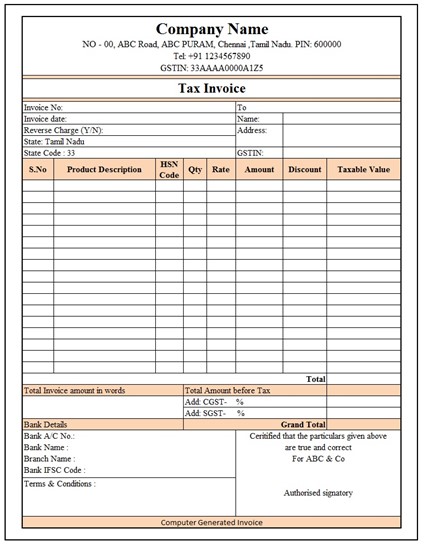

GST Tax Invoice

A tax invoice is an important piece of paperwork for the world of commercial transactions. It’s a legal record that shows that goods or services are provided and indicates in turn what kind of taxes apply. Under Goods and Services Tax, a tax invoice becomes a GST bill that expresses the concepts embodied in its system. The GST bill is an instrument that specifics a deal offering transparency and adherence to the taxation regime. The key points include the name and address of parties buying and selling, unique invoice number, date of issuance, complete description with quantities indicated for goods or services supplied including the total amount due; and applicable taxes to be included. The GST bill has several features that make it all the more unique. For one thing, its structure is directly based on the GST framework itself–the regulations in this area state clearly which taxes CGST and SGSC or IGST are depending upon how each transaction takes place.

Features of GST Invoice in Excel

User-Friendly Interface

We have an Excel GST invoice that is an ideal example of minimalism. Any user may easily navigate this UI. There is no longer any need for complicated software or jumbled spreadsheets!

Effortless Data Entry

Entering data is no longer needed! Filling out our GST Invoice template in Excel is a breeze since it streamlines the procedure. Put your worries aside and give your whole attention to the things that are really important.

Automatic GST Calculations

Complex tax calculations are not an issue. Luckily, our Excel template is here to save the day. The convenience of accurate and compliant GST computations is at your fingertips.

Customizable Design

Elevate the visibility of your bills! Several design possibilities are available in the accompanying Excel template, allowing you to modify it to your brand's image. Impress customers with your company style by using professionally created, individualized invoices.

CaptainBiz In Media

Customer Testimonial

Frequently Asked Questions about GST Tax Invoice Format for Your Business

The vendor issues a tax invoice to the purchaser detailing the services or commodities rendered as well as the relevant GST amount. In addition to serving as proof of input tax credit, it is an important record for taxpayers to have on file.

With Excel, companies can keep track of their GST tax invoice transactions and manage them more efficiently. With Excel, you can easily enter data in a structured way like,

- The invoice number

- Date

- Product details (including GST amount)

As a result, keeping records for tax purposes becomes much easier for businesses.

Important parts consist of:

- Date & Invoice Number

- Name and Address of Supplier

- The Name and Address of the Buyer

- The GSTIN.

- Item description.

- Amount, Quantity, and Unit Rate

- CGST/SGST/IGST Details

- Total Invoice

Excel does provide personalization. You may customize the invoice template to fit your company's needs while still including all the important GST details. Make use of Excel's calculating capabilities, formulas, and cell formatting to make your work seem professional.

When calculating GST, the Excel formula is easy to utilize.

GST Amount = (Original Amount × Rate of GST) × 100

Initial Amount = Total Invoice + GST

There is no need to fill out a specific form. But everything that's required should be there by GST regulations. There is some leeway for flexibility within the framework provided by the GST laws.

Read up on the most recent GST laws and regulations. Keep your eyes out for updates or announcements on a regular basis. Always use the most recent version of your Excel template.

A variety of websites provide GST invoice templates in Excel format. Before making any changes, make sure the template complies with your company's GST regulations.

Regular backups, secure passwords for sensitive information, and thorough calculations to avoid mistakes. The structure of your invoice might be affected by changes to GST rules. Therefore, you should be on the lookout for such changes. Actions so as not to make errors. You should watch for GST rule changes that could affect your invoice format.

Seeking expert assistance might be a wise decision if you are unsure of whether GST is applicable or if you are finding your template to be too challenging. For your company's specific requirements, experts may design a custom spreadsheet template.

Using our format in Excel for GST tax invoices, you'll be able to seek greater efficiency and accuracy in your business dealings. Our invoicing format is easy to use so that you can fill in the details you need without making a lot of effort. Completing this task, your financial record-keeping will be child's play! Our Excel format is simple but conforming. It lets you get on with the important business of growing your own. GST tax invoice format in Excel--Switch today to improve your current invoices. Quicken your financial procedures, reinforce accordance and master the GST environment that is changing by the second. Your company truly deserves the best, and our template will bring it to you in the form of that excellence with just a few clicks.