Indirect taxes have historically stood as a fundamental revenue source for governments. However, the preceding tax system faced challenges, such as the cascading effect and the burden of multiple taxes.

A significant shift occurred in 2017 with the introduction of the Goods and Services Tax (GST). This tax reform aimed to address the shortcomings of its predecessors, offering numerous benefits and causing substantial impacts across various industries.

Despite its transformative nature, public sentiment towards GST remains a subject of debate, with differing opinions on its effectiveness. This article offers a straightforward summary of GST rules, aiming to clear up common misconceptions and contribute to discussions on the pros and cons of the GST system.

What is GST?

Goods and Services Tax (GST) is a comprehensive, destination-based tax on the supply of certain goods and services. It serves as a replacement for various indirect taxes, such as VAT, excise, and import and export duties, with the aim of simplifying the taxation process.

Unlike the previous tax system, which focused on the point of origin, GST is calculated based on the point of consumption. The introduction of GST has streamlined the taxation process, making it easier to track calculations and reduce evasion.

What are the Types of GST?

GST in India is categorised into four main types:

1. Integrated Goods and Services Tax (IGST)

This tax is applied on interstate (between 2 states) supply of goods and/or services, as well as on imports and exports. It is governed by the IGST Act, and the Central Government is responsible for collecting the taxes, which are then divided among the respective states.

2. State Goods and Services Tax (SGST)

SGST is applicable on intrastate (within the same state) transactions. It is levied by the state government on goods and/or services purchased or sold within the state. The revenue earned through SGST is claimed solely by the respective state government.

3. Central Goods and Services Tax (CGST)

Similar to SGST, CGST is applicable to intrastate transactions and is governed by the CGST Act. The revenue earned from CGST is collected by the Central Government.

4. Union Territory Goods and Services Tax (UTGST)

UTGST is the counterpart of SGST and is levied on the supply of goods and/or services in the Union Territories of India. It is applicable in Union Territories like Andaman and Nicobar Islands, Chandigarh, Daman Diu, Dadra and Nagar Haveli, and Lakshadweep. The revenue earned from UTGST is collected by the Union Territory government.

What are the Various GST Tax Rates?

Here’s a detailed explanation of the various GST tax rates in India, including the major slabs and what is covered across those slabs:

| GST Slab | Tax Rates Description |

| Nil (0%) | Goods and services that fall under this category are exempt from GST. Examples include fresh fruits and vegetables, milk, educational services, etc. |

| 5% | Essential items such as household necessities, some food items, and transportation services fall under this slab. |

| 12% | Items like processed foods, mobile phones, and medicines are taxed at 12%. |

| 18% | Most of the goods and services fall under this slab, including electronics, restaurant services, and clothing. |

| 28% | Luxury items and services are taxed at 28%, including high-end electronics, automobiles, and five-star hotel services. |

| 0.25% | This rate is less common and may apply to rough, precious and semi-precious stones. |

What are the Salient Features Of the GST Regime?

Here are some of the salient features of the GST regime in India:

1. Dual Structure

GST operates under a dual structure, comprising the Central GST (CGST) levied by the Central Government and the State GST (SGST) levied by the State Governments. Additionally, an Integrated GST (IGST), which combines both CGST and SGST, is levied on interstate transactions.

2. Destination-Based Tax

GST is a destination-based tax levied at each stage of the supply chain, from the manufacturer to the consumer. This means the tax is collected at the point of consumption, not at the point of origin. This simplifies tax administration and reduces the scope for tax evasion.

3. Input Tax Credit (ITC)

Businesses can claim credit for the GST they paid on raw materials or services used in making their final product. This credit offsets the GST they owe on their final sale, reducing their overall tax burden and boosting the manufacturing and service sectors.

4. Simplified Tax Compliance

GST compliance is largely online, with registration, return filing, and even refunds happening through the GST portal. This has made the process more transparent, efficient, and convenient for taxpayers.

5. Composition Scheme

A composition scheme is available for small businesses with an annual turnover of up to ₹1.5 crore. Under this scheme, businesses can pay GST at a fixed rate, typically lower than the normal rates, on their total turnover. This simplifies compliance for small businesses.

GST Return and Filing Procedure

A GST return is an official document filed by registered taxpayers under the GST regime in India. The type and number of GST forms to be filed depend on your registration type. Here’s how to File GST Returns:

Online Filing Process

Here is the online filing process:

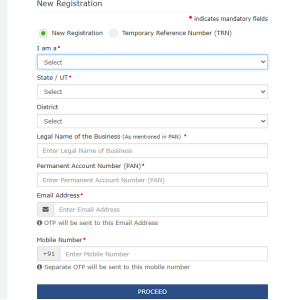

Step 1: Visit the GST portal.

Step 2: Obtain a 15-digit number based on your state code and PAN number.

Step 3: Upload each invoice, and a reference number will be issued against each invoice.

Step 4: File outward returns, inward returns, and cumulative monthly returns, rectifying any errors.

Step 5: File the outward supply returns (GSTR-1) using the information section at the GST Common Portal on or before the 10th of the month.

Step 6: Obtain outward supplies furnished by the supplier from GSTR-2A.

Step 7: Verify details of outward supplies and file details of credit or debit notes.

Step 8: Supply details of inward supplies of goods and services in the GSTR-2 form.

Step 9: The supplier can accept or reject the details provided by the inward supplies made apparent in the GSTR-1A.

Offline Process

While the primary method for filing GST returns is online through the GST portal, the GST Network provides offline tools for taxpayers to prepare and file their returns in areas with limited internet connectivity or technical difficulties.

1. Download Offline Utility

- Visit the GST portal.

- Navigate to the “Downloads” section and select “Offline Tools.”

- Choose the specific offline tool for the return you want to file (e.g., GSTR-1, GSTR-3B).

- Download the tool and extract its contents.

2. Prepare Return Data Offline

- Open the downloaded offline utility (usually an Excel-based tool).

- Enter the required details of your outward and inward supplies, tax liability, and other relevant information as per the form’s instructions.

- Ensure accuracy in data entry, as errors can lead to rejection or amendment requests.

- Save the file in the specified format (usually JSON).

3. Upload JSON File

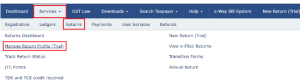

- Log in to the GST portal using your credentials.

- Go to the “Returns” section and select the relevant return.

- Click on the “Prepare Offline” option.

- Browse and upload the prepared JSON file.

4. Validation and Submission

- The portal will validate the uploaded file for errors or inconsistencies.

- If errors are found, rectify them in the offline tool and re-upload the file.

- Once the file is validated successfully, click on the “Submit” button to file the return.

5. Generate ARN

- Upon successful submission, an Acknowledgement Receipt Number (ARN) will be generated.

- Note down the ARN for future reference and tracking.

Also Read: GST Return Filing-Types Of Returns And Process Of Filing

What are the Benefits of GST Rules?

GST has multiple benefits. Some of the most notable ones are:

1. Reduced Number of Compliances

GST streamlines compliance by reducing the number of returns compared to the previous VAT and service tax system. With about 11 returns under GST, including basic returns like GSTR-1, GSTR-2A, GSTR-2B, and GSTR-3B, the filing process is more straightforward.

2. Special Treatment for E-commerce Operators

GST eliminates the confusion surrounding the treatment of e-commerce operators, providing common provisions applicable nationwide. This clarity reduces complications related to inter-state movement of goods and facilitates smoother operations for online platforms.

3. Improved Efficiency of Logistics

GST has eased restrictions on inter-state movement of goods, reducing the need for multiple warehouses. This has led to increased efficiency in logistics and prompted strategic locations for warehouses, optimising costs and increasing profits for businesses in the supply chain.

4. Regulation of Unorganised Sector

GST brings accountability and regulation to traditionally unregulated industries like construction and textiles. The implementation of online compliances and payments ensures transparency and accountability in these sectors.

What is the Impact of GST Rules on Different Sectors?

The impact of GST rules on different sectors in India has been varied, with some experiencing significant benefits and others facing certain challenges. Here’s a breakdown of the impact on some key sectors:

| Industry | Impact |

| Manufacturing | Removal of cascading taxes and efficient input tax credit mechanism lowered production costs, boosting competitiveness and exports. |

| Telecom | Reduced tax rates on services and simpler compliance boosted affordability and growth. |

| IT and Software | Increased demand for technology solutions to manage GST compliance benefited the sector. |

| Real Estate | Inverted duty structure (higher tax on inputs than output) led to accumulated credit and liquidity issues for some developers. |

| Logistics and Transportation | Abolishment of inter-state checkpoints streamlined the movement of goods, reducing logistics costs and transit times. |

| Agriculture | Complexities in applying GST to agricultural products and exemptions led to confusion and challenges for farmers and traders. |

Also Read: Impact Of GST: Invoice, Simplified Tax System And Reduce Compliance Burden

What are the Recent Amendments and Updates to GST Rules?

Some anticipated updates of 2024 are as follows:

1. GST Rate Increase From 8% to 9%

This is part of a two-stage increase announced in Budget 2022, with the final rise expected in January 2024.

2. GST Appellate Tribunal Establishment

The establishment of this tribunal is expected to simplify dispute resolution for GST matters.

3. Simplification of GST Compliance Procedures

The government is continuously working on simplifying compliance processes for businesses.

What are the Common Misconceptions About GST Rules?

Even though GST has been around for a few years, some misconceptions still persist about its rules and how it affects businesses and consumers. Here are some common ones:

1. GST has Increased the Prices of Everything

Fact: While some price increases did occur due to the removal of cascading taxes and higher rates on certain goods, overall, the prices of many essential items have remained stable or even decreased because of the streamlined tax system and improved logistics.

2. GST has Made Everything Complicated

Fact: While adapting to any new system can initially seem complex, GST has simplified compliance in many ways. Online return filing, standardised tax rates, and reduced paperwork eliminate the need to navigate multiple taxes and complex calculations.

3. GST Benefits Only the Government

Fact: GST has several benefits for businesses, such as reduced costs due to input tax credits, improved logistics, and a level playing field. Consumers also benefit from transparency in pricing and potentially lower prices in the long run.

Conclusion

Now, you have gained insights into the essential aspects of GST, its rules, and its impact on various sectors. This comprehensive overview has covered the types of GST, tax rates, benefits, filing procedures, and common misconceptions.

However, it’s important to note that GST is a vast topic that undergoes regular updates and amendments. To stay well-informed, continuous research and staying updated on the latest developments in GST rules are crucial.

Frequently Asked Questions

Q1. What is the GST law Summary?

GST serves as a unified domestic indirect tax law applicable across the entire nation.

Q2. What is the Main Objective of GST law?

GST simplifies the indirect tax system by replacing various taxes like excise duties, service tax, and VAT with a single tax.

Q3. Is GST Good or Bad?

GST is definitely good as it has made compliance simpler for taxpayers and reduced the chances of tax evasion.

Q4. Who is the Father and Ambassador of GST?

Atal Bihari Vajpayee is recognised as the driving force behind GST and is often referred to as the father of tax reform.

Q5. Who is the GST CEO of India?

The present Finance Minister, Nirmala Sitharaman, holds the position of the current chairperson of the GST Council.

Q6. Which Country has no GST?

Countries and territories that utilise a sales tax system instead of a VAT/GST system include Malaysia, the United States, and Puerto Rico.

Q7. When did GST Start?

The GST was officially launched on July 1, 2017, in a grand ceremony held in the Central Hall of Parliament.

Q8. What is the use of ARN in GST?

The GST ARN number serves as a tool to monitor the progress of a GST registration application until the Government issues the GST Certificate and assigns the GSTIN.

Q9. What is the Form 16?

Form 16 is a certificate issued under section 203 of the Income Tax Act, providing information about the Income Tax deducted at source (TDS) by the employer.

Q10. What is Form 12BB?

Form 12BB serves as a statement of claims made by an employee for the deduction of tax under section 192 of the Income-tax Act, 1961.