GST Rate & HSN Code for Pharmaceutical products – Chapter 30

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

मुंबई की हलचल भरी सड़कों पर एक छोटी सी दुकान के मालिक रमेश भी कई अन्य लोगों की तरह बैंकिंग लेनदेन पर इनपुट टैक्स क्रेडिट

Introduction to GST on Construction Services The construction industry in India is valued at $639 billion. It is estimated to grow at a CAGR of

Business owners and service providers must accurately determine the HSN code or SAC code applicable to their products or services. These codes must be correctly

Navigating the world of taxes and codes can be daunting, especially when it comes to the Goods and Services Tax (GST) System. One of the

In the dynamic landscape of service-oriented businesses, the creation of accurate and legally compliant tax invoices is pivotal for ensuring seamless transactions and regulatory adherence.

Update from National Informatics Centre: Enhancements to E-Way Bill System – HSN Code Requirements (Date: 05-01-2023) – In alignment with Notification No. 78/2020-Central Tax from

Introduction Since GST (Goods and Service Tax) was introduced in India, both entrepreneurs and end customers have divided opinions regarding its benefits and losses. However,

HSN codes and product classification are extremely important for accurate E-waybill documentation while playing a crucial role in taxation and international trade. We explore here

Approximately 300 million individuals are attempting to initiate around 150 million businesses globally. Given a startup success rate of about one-third, it can be estimated

Embarking on the journey of classifying chemical products with the right Harmonized System of Nomenclature (HSN) code can feel like navigating through a dense forest

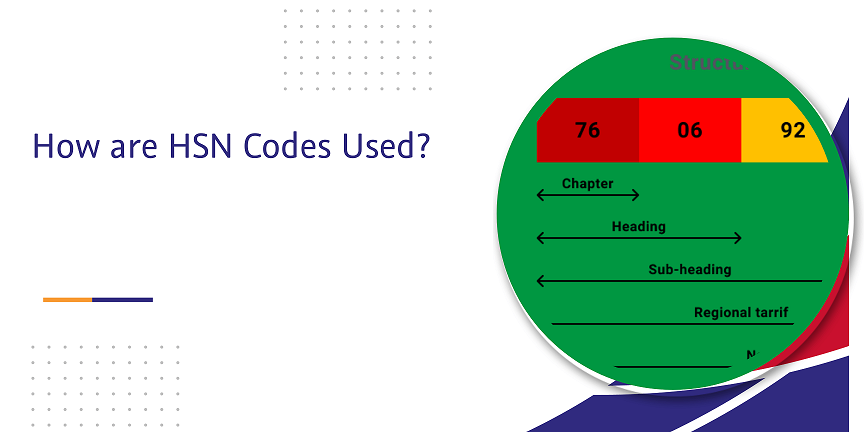

Harmonised System of Nomenclature, or HSN codes, are six-digit identification codes that categorize goods in international trade. It was in 1988 that the World Customs

The Harmonized System of Nomenclature (HSN) has simplified the process of classifying goods and services for taxation purposes. In India, the uniform code helps organize

The harmonization of state codes across different states is essential for the greater good of India. We will also be reading about the challenges and

All goods and services subject to taxation in India are classified using an international classification system. Harmonized System of Nomenclature or HSN is the system

For a more efficient international trade system, proper classification of goods is crucial. The classification not only helps in identification but can also come in

India has been a member of the World Customs Organization since 1971 and has used the 6-digit Harmonized System of Nomenclature codes to classify goods

The 42nd GST Council meeting was conducted virtually on October 5, 2020, with Smt. Nirmala Sitharaman, the Finance Minister, serving as chairperson. Along with senior

Harmonized System of Nomenclature (HSN) codes offer a uniform item classification system essential to global trade and business. Adopted by numerous nations globally, these codes

Stakeholders in international trade, governments, and enterprises can benefit from adopting and using Harmonised System of Nomenclature (HSN) codes. Products can be categorised systematically and

Introduction The HSN code or Harmonized System Nomenclature is a globally accepted six or 8-digit product classification method used for trading purposes. It is maintained

Introduction Accounting accuracy holds a key place in managing work contracts and projects. By understanding the pros and cons of financial management, one can steer

Introduction The Harmonized System of Nomenclature (HSN) designations serve as a standardized product classification system essential to international trade. The World Customs Organization (WCO) created

In the 2022 Budget, the Finance Minister introduced a significant change in the taxation of virtual digital assets. 30% income tax was imposed on gains

Introduction In 2017, India undertook a significant tax reform by replacing service tax, excise duty, and VAT (Value-added Tax) with the comprehensive Goods and Services

GST Registration is one of the most crucial registration and a business entity is not allowed to operate without GST registration, wherever applicable. Goods and

परिचय जब से भारत में जीएसटी (वस्तु एवं सेवा कर) लागू किया गया, उद्यमियों और अंतिम ग्राहकों दोनों ने इसके लाभ और हानि के बारे

Construction services play a crucial role in India’s economic framework, representing a substantial sector that makes an approximate 9% contribution to the nation’s GDP. GST,

The GST regime has brought about significant changes in the taxation of the IT sector, affecting its cost structure, pricing, cash flow, compliance, and competitiveness.

The Goods and Services Tax (GST) has completely reshaped the Indian tax scene. Think of GST as this broad-based, all-encompassing indirect tax system that got

GSTR 8 amendments is a monthly report that online marketplace operators need to submit. These are businesses that are required by GST law to collect

In the manufacturing world, where precision and organisation are paramount, managing your inventory effectively is a crucial component of success. This is where the “Item

Every regular taxpayer under Goods and Services Tax (GST) in India is required to file GSTR-9. This is particularly true for taxpayers whose annual turnover

Introduction The Goods and Services Tax (GST) rate slabs are determined by the GST Council, with regular reviews of rates for goods and services. These

Late fees and interest charges can become a concern for businesses that fail to file their GST returns on time. This article provides the latest

Certainly, an individual can obtain multiple GST registrations at the same address, provided they meet the conditions outlined in the GST Registration Rules. These rules,

In the world of gold, glittering changes are on the horizon. The Indian government is set to introduce some significant adjustments to the GST (Goods

In the world of business, knowledge of GST rates is essential, especially for industries like Recruitment and HR services. This article delves into the significance

GST: The Tax Revolution In April 2017, a significant transformation occurred in India’s financial landscape with the introduction of Goods and Services Tax (GST). It’s

GST represents a novel taxation system with innovative concepts such as determining the ‘place of supply’ and new tax structures. It is a consumption-based tax

GST applies to every supply of goods or services unless a specific exemption is provided by GST law. “Labour Services” is a very usual nature

GST on fruit, nuts and peels of citrus fruits and melons According to section 2 of chapter 8 of the GST Act, the GST tax

Plastic products are classified under different HSN codes based on their specific characteristics and composition. The most common HSN code for plastic products is 39.

With the implementation of GST system in India significant structural changes shaped businesses operate and pay taxes. One of the crucial aspects of GST is

Do you start your mornings with a potent dose of caffeine from a freshly brewed cup of Joe? Or do you prefer a slightly less

In the Evolving world of technology, computers and laptops have become an integral part of our daily lives. Whether for work, education, communication or entertainment,

India is known for its rich agricultural heritage, producing a wide variety of cereals, including rice, wheat, barley, and more, with the introduction of the

“Reading is an act of civilisation; it’s one of the greatest acts of civilisation because it takes the free raw material of the mind and

What is HSN Code HSN stands for ‘Harmonized System Nomenclature’. The WCO (World Customs Organization) developed It is a multipurpose international product nomenclature that first

In the dynamic landscape of tax compliance, keeping current is vital for business success. GST offers transparency updates on tax obligations and enhances the overall

Understanding HSN Code, It’s Full Form? HSN stands for “Harmonized System of Nomenclature”. The HSN code is a numerical classification system used to categorize goods

Works contract means a service contract involving supply, a mixture of service and transfer of goods. Examples of works contracts are the construction of a

What is HSN Code If you are a business owner in India, you are likely familiar with the Goods and Services Tax (GST). The GST

In the dynamic landscape of taxation, the Goods and Services Tax (GST) has been a game-changer in simplifying the indirect tax system in India. One

Understanding HSN Codes and Their Significance in GST HSN, or Harmonized System of Nomenclature, is a globally recognised classification system for products. It’s a standardised

[ez-toc]Implementation of mandatory mentioning of HSN codes in GSTR-1 In the intricate tapestry of the Goods and Services Tax (GST) framework, HSN codes are essential

© Copyright Logo Infosoft. All Rights Reserved