GST Registration is one of the most crucial registration and a business entity is not allowed to operate without GST registration, wherever applicable. Goods and Service Tax Act provide for registration under GST in various capacities such as Regular Taxpayer, Casual Taxable person, Non-resident India, TDS Deductor etc.

One of the most common form GST registration is register as Compsite taxpayer, i.e., dealer opting for composition scheme.

This Article discuss various aspect of GST registration of composition taxpayer such as Who is eligible to opt for composition scheme, GST Rate under composition scheme, Input Tax Credit under Composition scheme, Process of GST registration, shifting from regular taxpayer to composite taxpayer etc.

1. What is the GST Composition Scheme ?

The Composition Scheme is a simple and easy scheme option for small taxpayers to carry out hassle free tax compliance. Composite taxpayers are permitted to pay GST at a nominal rate without any hassle of obtaining Input tax Credit.

Composition scheme is meant for small businesses with low turnover and it comes with lower tax rates, no Input Tax credit and Lower compliances. Therefore, Compared to regular filing, the Composition scheme reduces paperwork and compliance. Normal taxpayers file multiple returns such as GSTR-1, GSTR-3B, Input Tax Credit reconciliation, Return for TDS and TCS. On the contrary, the Composition scheme requires filing of quarterly return (GSTR-4) and one annual return (GSTR-9A).

2. What is the threshold limit for Opting for Composition Scheme?

As per Section 10(1) of Central Goods and Service Tax Act, 2017 (CGST Act), a registered person whose following aggregate turnover is allowed to opt for composition scheme:

-

Supplier of Goods

A taxpayer, involved in supply of goods, with aggregate turnover upto INR 1.50 Crores (INR 75 Lacs in case of North-eastern states), is allowed to opt for composition scheme.

A Supplier of goods, who opted for composition scheme, may carry out supply of services, of the higher of the following amounts:

- 10% of the turnover in the state or Union Territory during preceding Financial year;

- INR 5,00,000

-

Supply of Services

a registered person engaged in supply of services, whose aggregate turnover does not exceed INR 50 Lacs during preceding Financial year, may opt to pay GST under Composition scheme.

Where a registered person is having more than one GST registration, whether in same state or different states, then the Composition scheme is required to be opted for all GST registrations.

Further, if a dealer opt for Composition scheme and his aggregate turnover exceeds the threshold limit specified above during the year then from the date aggregate turnover exceeds the threshold limit then the composition scheme opted shall lapse automatically and the supplier will be required to pay GST under normal scheme.

3. What is the tax rate for the Composition Scheme ?

As per Section 10 of CGST Act, dealer opting for composition scheme is liable to payment GST at following lower rates:

| Category | GST Rate |

| Manufacturers, other than manufacturers of such goods notified by the Government, i.e., Ice cream, Pan masala and tobacco products | 1 % (0.5% CGST and 0.5% SGST) |

| Restaurant not serving alcohol | 5 % (2.5% CGST and 2.5% SGST) |

| Service Providers | 6 % (3% CGST and 3% SGST) |

4. Who is not entitled to opt for a composition scheme?

As per Section 10(2) of CGST Act, 2017, Following registered persons are not entitled to opt for composition scheme:

- Who is engaged in making supply of goods or services which are not leviable to tax under this Act;

- Who in making inter-state supply of goods or services;

- Who is making supply of goods or services through e-commerce platform which is required to collect TCS;

- Who is either a casual taxable person or non-resident taxable person;

- Registered person who is a manufacturer of following goods:

- Ice cream and other edible ice, whether or not containing cocoa.

- Pan Masala

- All goods, i.e. Tobacco and manufactured tobacco substitutes

5. Condition for availing the composition scheme

A registered person opting for composition scheme is required fulfill following conditions:

- Shall not collect any tax from the recipient on supplies made by dealer opted for composition scheme;

- Not entitled to take any Input Tax Credit.

- Can’t involve in making Inter-state supply

- Can’t make supply through e-commerce platform

- Registered person is required to issue “Bill of Supply” instead of “Tax Invoice”.

- Taxpayers must mention ‘composition taxable person’ on every bill of supply.

Composition scheme opted by a registered person shall remain valid only as long as it satisfies all the conditions given for composition scheme.

6. When to opt for a composition scheme?

A registered person may opt for composition scheme at the following point of time:

- At the time of obtaining GST registration, i.e., applicant may opt for composition scheme while filing application for GST registration itself;

- After obtaining GST registration, by 31st March of the preceding financial year for which registered person wants to opt for composition scheme. For e.g., for FY 2023-24, dealer can for composition scheme by filing for GST CMP-02 by 31st March, 2023.

7. Compliances for Dealers opting for Composition scheme?

A dealer opting for composition scheme is not required to file GSTR-1 or GSTR-3B on monthly or quarterly basis. A composite dealer is required to file following forms:

| Form | Frequency | Nature | Due date |

| GST CMP-08 | Quarterly | Statement filed for Payment of taxes | 18th of the month following the relevant quarter, i.e., 18th October for the period of July to September |

| GSTR-4 | Annual return | Return of Inward and Outward supply | 30th April of the following Financial year. E.g. for FY 2022-23, GSTR-4 is required to be filed by 30th April, 2023 |

8. Process of GST Registration for Composition Dealers

As discussed above, a dealer for opt for composition scheme either at the time of filing application for GST registration or at the time of obtaining GST registration or at any time after obtaining GST registration.

Following is the process of opting for composition scheme:.

- Opt at the time of obtaining Registration

Process of filing an application for GST registration is the same for Composition dealer and regular dealer. A dealer opting for composition scheme shall file an application in Form GST REG-01.

Process of creating profile on Gst portal https://services.gst.gov.in/services/login is same for regular GST registration and composition dealer.

- Registered person is required to generate Temporary registration Number (TRN) on the GST by verifying PAN, email id and Phone Number.

- Post verification of mobile number and email id, system generated Temporary Reference Number (TRN) will be used till application for GST registration is filed. TRN will be communicated over e-mail address as well as your mobile number.

- In Part-B of GST REG-01, applicant is required to furnish following information in detail:

- Business details;

- Partner or promoters details

- Authorised Signatory

- Authorized Representative

- Principal Place of Business

- Additional Places of Business

- Goods and Services

- State Specific Information

- Aadhaar Authentication

- Verification

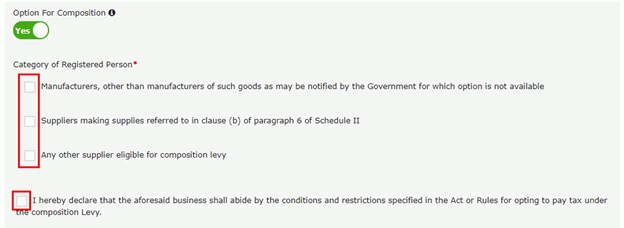

- A dealer opting for composition scheme is required to tick furnish following information under “Business” Tab:

- Select “yes” to the question “Opting for Composition Scheme”

- Select the checkbox for accepting the declaration for opting for Composition Levy.

- Transfer from Regular Scheme to Composition Scheme

-

- Any taxpayer who is registered as a normal taxpayer under GST may opt for composition scheme after obtaining GST registration by furnishing Form GST CMP-02

- An application to opt for composition scheme can be filed post login at GST portal at following path.”

Services> Registration> Application to opt for Composition Scheme

-

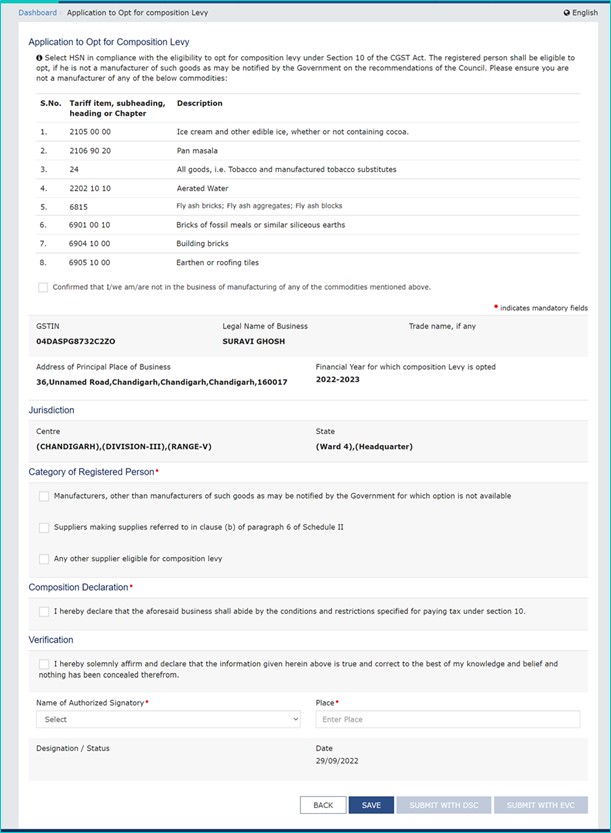

- Post clicking, system will show an autofiled application in Form GST CMP-02 alongwint HSN codes in following manner:

If HSN Code selected by taxpayer on GST portal are not eligible for Composition scheme then system will pop-up a waring notification. A taxpayer can’t proceed to file GST CMP-02 unless such HSNs are removed from the list of commodities.

If HSN Code selected by taxpayer on GST portal are not eligible for Composition scheme then system will pop-up a waring notification. A taxpayer can’t proceed to file GST CMP-02 unless such HSNs are removed from the list of commodities.

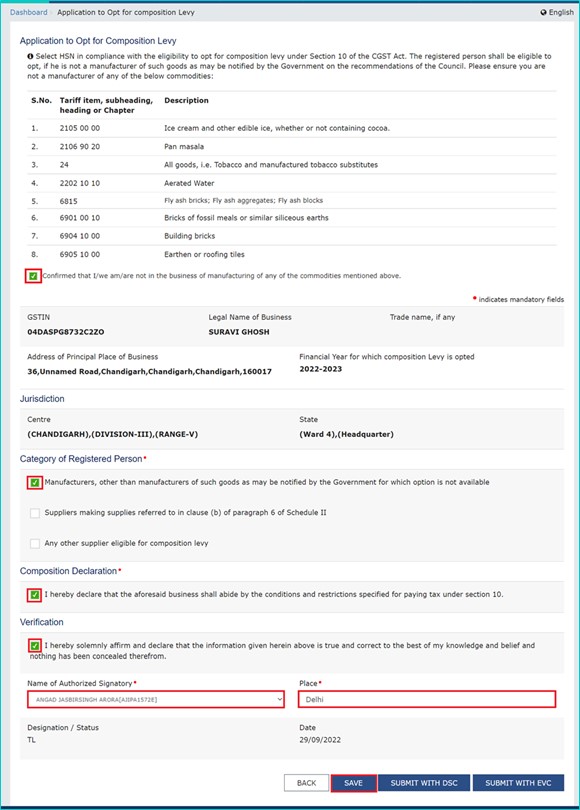

- The dealer is required to verify the detailed auto-populating in Form GST CMP02.

- Select the Authorized Signatory from the drop-down list and enter the Place from where the form is filled.

- Click SAVE.

- Application can be filed through EVC received on registered email id or phone number or through DSC verification.

- Post submitting the application, the system will display a success message and acknowledgement mail will be received on registered e-mail address and mobile phone number.

- Also Read: Composition Levy under GST: Everything You Need to Know

- Post clicking, system will show an autofiled application in Form GST CMP-02 alongwint HSN codes in following manner: