Businesses must ensure accurate maintenance of GST-compliant invoices. As per the GST Act, every registered taxpayer is responsible for reporting invoices, purchase orders, and other types of bills generated during the course of the business. To ensure tax compliance, you must submit GST returns monthly, quarterly, and annually. Errors and discrepancies must be corrected before filing GST returns for smooth operations. However, if there are errors and mistakes in invoices, they must be corrected and updated in the GST portal.

Wrong details on the invoice can result in audit triggers, which will disrupt the business and incur additional costs. However, not all invoices are settled correctly in real time. So, you must know about cancelling a tax invoice if needed.

Understanding Tax Invoice

A tax invoice is a crucial GST document for businesses. Whenever a supplier supplies a product, they must generate an invoice before or at the time of supply. If the supply involves transportation of goods to another location, a tax invoice must be generated at the time of loading the trucks. An appropriate e-way bill must also be generated for the transporter to submit to authorities.

The supplier can collect GST tax and supply a GST tax invoice for taxable goods and services. In that case, the recipient must pay the price of goods along with the GST tax. The supplier must pay the GST tax to the government. All these transactions are streamlined with a tax invoice.

An invoice from the supplier is necessary for the recipient, too. As the recipient has paid GST tax on their purchase, they are eligible for Input Tax Credit (ITC). The recipient can claim ITC to balance against the GST they collect from their sales. This will reduce the tax liabilities for a business.

The GST tax invoice is also a demand for payment for the supplier. The recipient must pay the invoice amount, including the tax, after receiving the goods. The recipient then issues a payment receipt, which will be reflected in the GST forms of both the supplier and recipient.

The above process applies to the supply of services, too. In the case of services, the supplier has a time limit of a maximum of 30 days to submit the invoice. Without the invoice, the recipient cannot claim ITC.

Link Between Tax Invoice and E-Invoice

As of August 1, 2023, any business with a turnover of more than Rs. 5 crore must issue e-invoices. The e-invoicing system enables automated reporting and filing of invoices. The taxpayer must use the Invoice Registration Portal (IRP) for e-invoicing. It generates an Invoice Registration Number (IRN) for the invoice.

The IRP portal integrates with the GST network (GSTN). So, every e-invoice generated is automatically updated in the GST portal. This eliminates the need to enter invoice details once again while submitting GST returns.

The tax invoice must be generated and issued to the supplier. To streamline GST return submissions, an e-invoice must also be generated through the IRP. As per recent amendments, businesses with over 100 crore turnover must generate e-invoices within 7 days of issuing an invoice. Previously, e-invoices can be generated at any time. So, many businesses consolidated their invoices and updated those in the IRP portal weekly or monthly. To comply with the latest GST requirements, it is better to generate e-invoices in real time.

Reasons for Cancelling a Tax Invoice

The supplier issues a tax invoice at the time of supply or removal of goods for delivery. Sometimes, the supplier may not be paid because the supply transaction didn’t go through. Some of the reasons why cancelling a tax invoice becomes necessary are:

- Order cancellation

- Incorrect entries

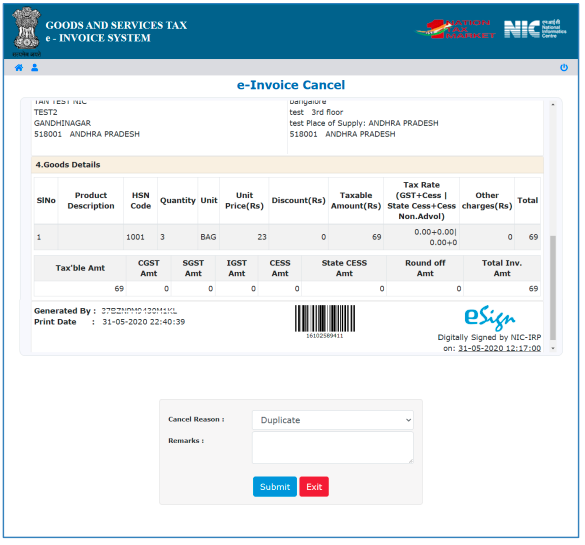

- Duplicate entries

When a tax invoice is issued before the time of supply, you need to cancel the tax invoice when the order is cancelled. If you have mentioned incorrect entries in the tax invoice, it will result in discrepancies when filing GST returns. In that case, cancelling the wrong tax invoice and issuing the right one is essential.

Sometimes, you may issue duplicate tax invoices due to human error. You must cancel duplicates to avoid discrepancies. You can cancel tax invoices at any time before GST return submission. However, the process for cancellation varies based on the timeline of cancellation.

GST Tax Invoice Cancellation Process for Small Businesses Before Filing GST Return

If you use GST billing software and create a tax invoice, you must check all the details before generating an invoice. Sometimes, you may notice errors only after generating a tax invoice. In that case, if you have not issued the tax invoice to the buyer, you can cancel it immediately using the software with a single click. At the time of filing the GST return, the cancelled tax invoice will be notified. This way, there will be no changes in your GST liabilities.

In case of cancelled orders, you might have issued the tax invoice before the supply. However, if you don’t make the supply, you cannot pay the GST tax as you have not collected. The tax invoice is already created in the system, and it must be cancelled. If the GST return has not been filed yet, you must use your billing software to cancel the tax invoice. The cancellation of the tax invoice will be recorded in the software.

You can cancel the e-invoice directly on the IRP portal if you cancel the invoice within 24 hours. The IRP portal doesn’t store invoices, so you need to cancel them within 24 hours. The IRP is automatically integrated with GSTN. So, if you have crossed the 24-hour mark, you can cancel the e-invoice using the GST portal.

Generated tax invoices uploaded to the GST portal during GSTR 1 submission must be cancelled through the GST portal only. You can log in to the GST portal, select the invoice you want to cancel, and click on cancel to cancel the invoice in the GSTR 1 column. The GST report will be automatically updated.

In the GST portal, you can delete a tax invoice one by one. You can delete as many files as you want. You can also delete invoices in bulk by preparing a JSON file. You are allowed to delete invoices as many times as you want before the submission of GSTR 1 for that tax period.

To cancel invoices offline, you can download the invoices from the GST portal, make changes to the invoices offline, and upload the changes in the GST portal once the connection is restored. You can generate JSON files and make changes to invoices offline.

GST Tax Invoice Cancellation Process for Small Businesses after Filing GST Return

Cancelling a tax invoice becomes complex if you have filed the GST return with the generated tax invoice. In that case, you must pay the GST tax as per the invoice. However, when you don’t make the supply and the order is cancelled, you are not liable to pay GST.

In this case, the best way to cancel the tax invoice is to issue a credit note. You can add a credit note to cancel out the invoice amount. It can be regarded as a return of supply. Your recipient must issue a debit note accordingly to balance the GST invoices.

Tax Invoice Cancellation Rules

Knowing the right way to go about cancelling a tax invoice is vital so that you don’t make any mistakes. When you wish to cancel GST invoices, there are some rules that you must remember:

- Partial cancellation of the invoice is not possible

- Always cancel the entire invoice

- The invoice number used for the cancelled invoice cannot be reused again

- If an e-way bill is issued for the invoice, it cannot be cancelled

- Ensure you refund the ITC claimed against the associated invoice

Tax Invoice Cancellation Process for Exporters

A tax invoice is generated for supplying taxable goods and services. If you don’t cancel the tax invoice for goods that you didn’t supply, you must pay the GST tax unnecessarily. Not cancelling tax invoices when there is no supply will result in GST liabilities.

The tax invoice for export transactions is similar to the GST tax invoice, but it must be endorsed as an export tax invoice. Depending on the goods exported, you have to pay IGST. For exports to SEZ units or SEZ developers for authorised operations under bond or letter of undertaking, there is no need to pay IGST. You can accept advance payments for exports and include them in your GST form as a payment receipt. Similar to regular tax invoices, you can also cancel and delete export invoices before filing a GST return.

Conclusion

Generating and issuing the correct tax invoice is essential for businesses to stay compliant with the GST rules. Providing correct details at the time of invoice creation will reduce errors. Using an automated tool will help you to avoid mistakes at the time of submitting GST reports. If you have made a mistake with the invoice and realise it after submitting GSTR 1, you can delete and cancel it through the GST portal. After submitting a GST return, the best way to nullify the GST pay is by issuing a credit note.

Automating GST billing and return submission saves a lot of hassle for businesses. CaptainBiz is a prominent GST billing software in India that empowers SMEs to always generate GST-compliant invoices. You can manage your financial transactions and inventory using a simple and unified interface. Generate GST reports automatically and never miss tax liabilities with CaptainBiz.

FAQs

-

Is a tax invoice needed for all supplies of goods and services?

Yes, any supplier that supplies taxable goods and services must generate a tax invoice for each outward supply. Regardless of the value and weight of goods supplied, you must issue a tax invoice.

-

Is the tax invoice the same as the e-way bill?

No, tax invoice and e-way bill are two different documents. If the supply of goods and services involves the transportation of goods with the help of a carrier, a bill must be generated. The supplier must generate the tax invoice at the time of supply. They must also generate an e-way bill for the transporter.

-

What happens when no tax invoice is issued?

The supplier must submit all the details about the goods or services. When no tax invoice is issued, but a supply is made, it is considered a fraud. Supplying goods without a tax invoice is an offence under GST. It can result in penalties and even jail time.

-

Can I cancel a tax invoice immediately after it is issued?

Yes, as long as the cancellation is made due to accepted and valid reasons, you can cancel the tax invoice at any time. If you created a tax invoice by mistake or created a tax invoice with mistakes, you can cancel it directly using your billing software.

-

Can I cancel the tax invoice using my billing software?

Some billing tools automatically integrate with the GST portal to update GST details in real time. In that case, changes made in the software will be uploaded to the GST portal. Finding a billing software compatible with GST requirements is essential for compliance.