Uploading a JSON file on the GST portal is an essential step in managing your GST compliance. This guide makes this important process straightforward, outlining each stage from getting your data ready in the GST JSON file format to the final steps of the upload on the portal. It’s designed to make your tax filing experience simpler and more efficient, ensuring you’re well-equipped to handle your tax filing process with ease.

Introduction to GST (Goods and Services Tax)

The Goods and Services Tax (GST) in India marks a pivotal shift in the country’s taxation system. This comprehensive tax reform, implemented on July 1, 2017, consolidates several central and state taxes into one unified tax structure. By doing so, GST simplifies and streamlines the tax administration process. It effectively addresses and reduces the cascading effect of taxes, making goods and services more cost-effective for consumers. This simplification not only enhances transparency and compliance but also plays an important role in boosting the overall economic growth of India.

Understanding JSON Files

JSON (JavaScript Object Notation) files are a popular data interchange format known for their simplicity and ease of use. Here are some key points highlighting why they are widely used:

- Human-Readable Format: JSON’s structure is straightforward and readable, making it easy for humans to understand.

- Lightweight: JSON files are lightweight and compact, which aids in faster processing and transmission of data.

- Flexible Structure: They can represent various data types, including arrays and objects, allowing for versatile data modeling.

- Ease of Integration: JSON is language-independent, meaning it can be used with most programming languages seamlessly.

- Widely Supported: JSON is supported by many systems and technologies, making it a universal choice for data interchange.

- Efficient Data Parsing: The JSON format allows for efficient data parsing and serialization, crucial for web applications.

Role of JSON Files in GST Portal

In the GST portal, JSON files are integral for return preparation and filing. They serve as a medium for taxpayers to upload their tax data efficiently. The GST JSON file format ensures uniformity and accuracy in data submission, which is critical for GST compliance. Utilizing JSON files for GST returns simplifies the process of GST portal JSON upload, making it more streamlined and user-friendly. The method of how to upload JSON in GST portal involves specific steps for GST portal JSON upload, ensuring that the JSON file submission GST is seamless and accurate. This format’s adoption significantly reduces errors and enhances the speed of processing tax returns.

IV. Preparing Your Data for Upload

Preparing your data for JSON file conversion involves several important steps:

- Data Compilation: Gather all relevant transaction data, including invoices, receipts, and other financial documents. Ensure that all necessary information is collected and organized systematically.

- Data Verification: Check the accuracy and completeness of the gathered data. Review each entry for errors or discrepancies to maintain data integrity.

- Conversion to JSON: Use GST-compliant software to convert the data into the GST JSON file format. This software will format your data as per the GST norms, suitable for JSON file submission GST.

- File Review: Thoroughly inspect the converted JSON file for any errors or missing information. This step is of utmost importance for preventing any type of submission error during the GST portal JSON upload.

- Final Upload: Follow the prescribed steps for GST portal JSON upload. Navigate the GST portal carefully, ensuring that the correct file is uploaded in the appropriate section.

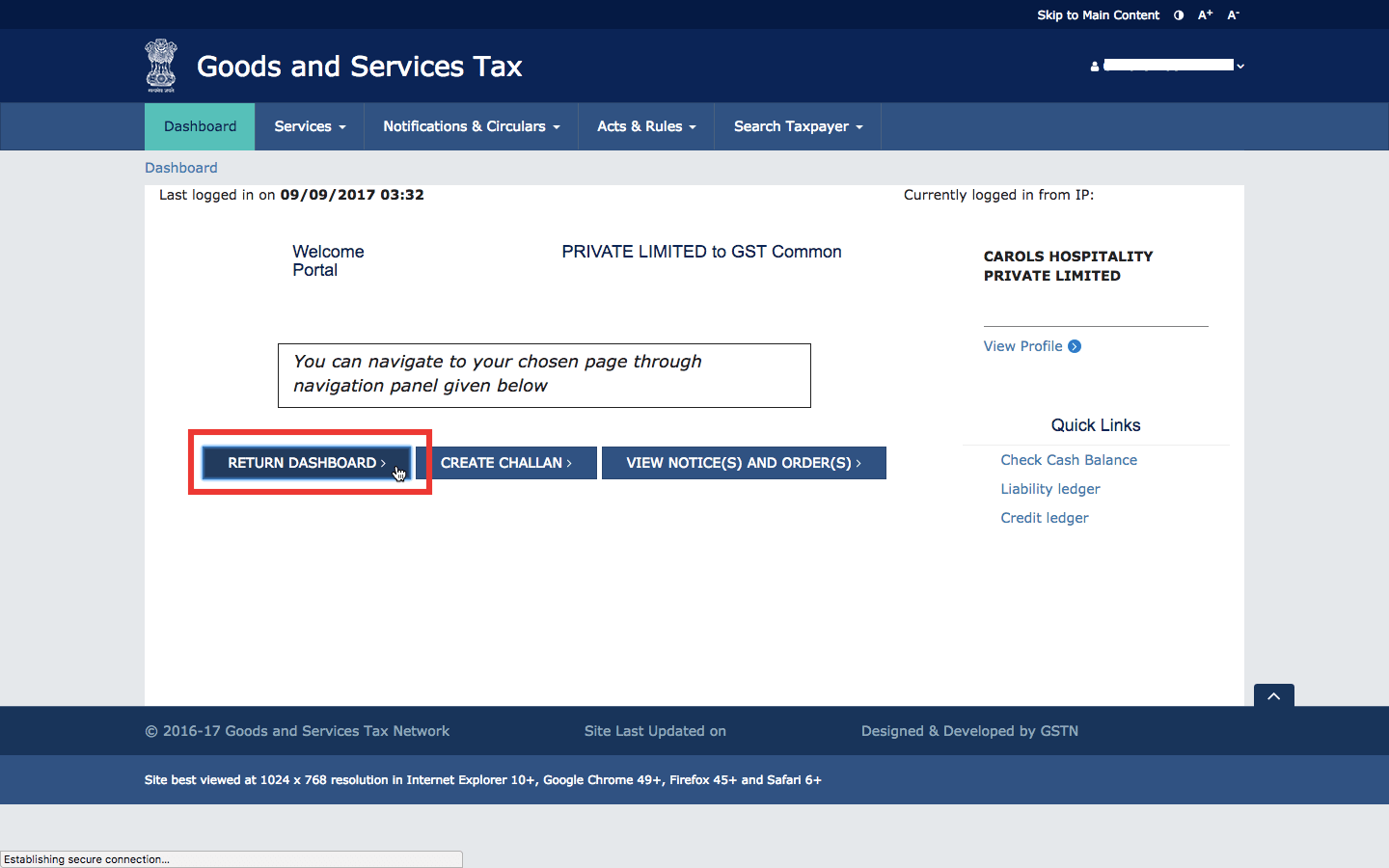

Accessing the GST Portal

To access the GST Portal for JSON file submission:

- Visit the GST Portal: Navigate to the official GST website.

- Login: Enter your GSTIN/Username and password. If you’re a new user, register to create an account.

- Dashboard Navigation: Once logged in, explore the dashboard. This is your hub area for all GST-related activities.

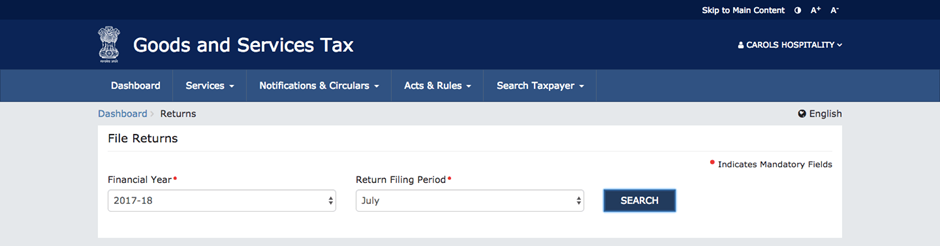

- Locate Return Section: In the dashboard, find and click on the ‘Returns’ section.

- Choose Return Period: Select the relevant tax period for your return.

- Prepare Offline Option: For JSON file submission GST, select the ‘Prepare Offline’ option.

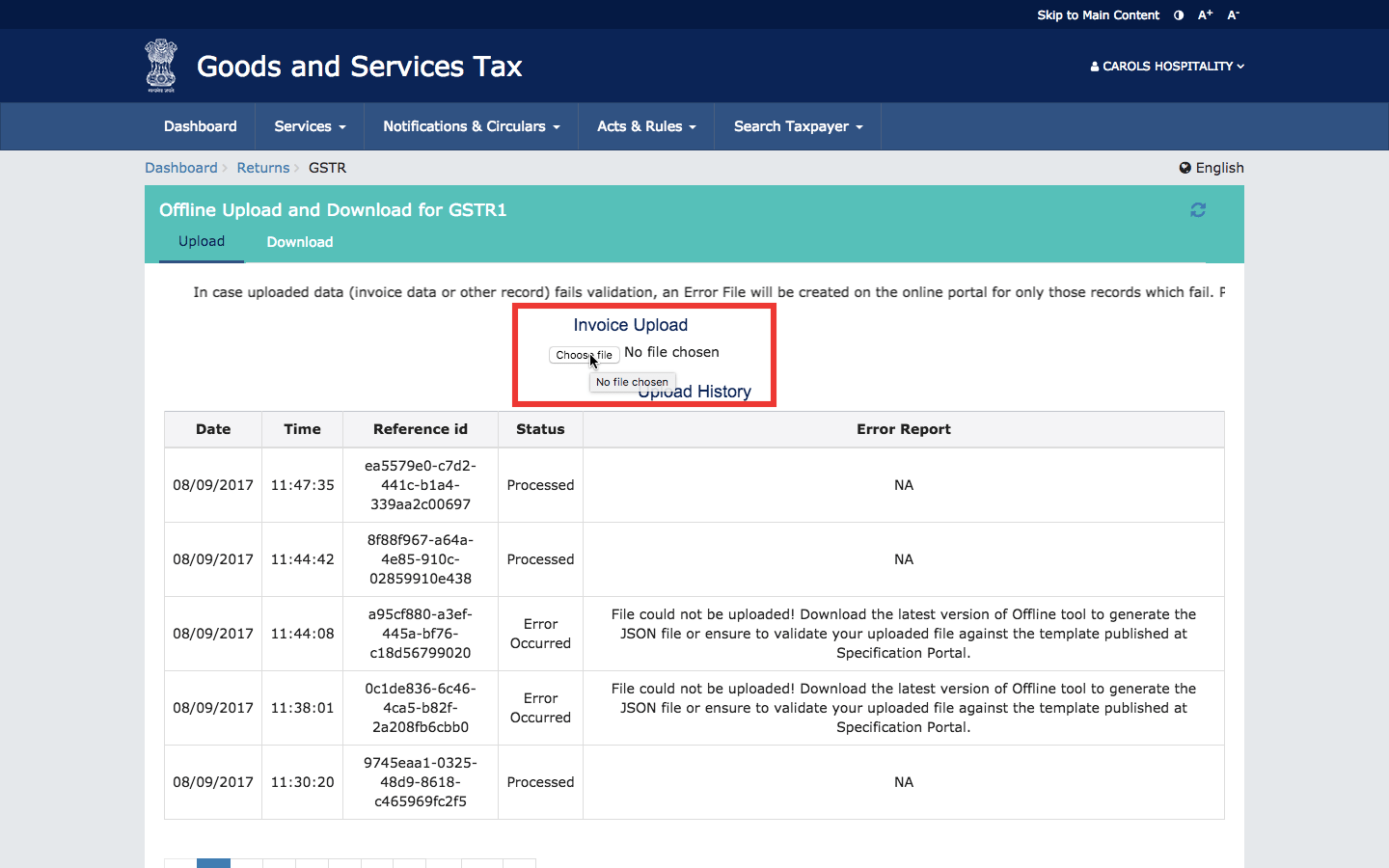

VI. Uploading a JSON File

- Upload Section: You’ll be directed to a page where you can upload your JSON file. Choose the ‘Upload’ option.

- Locate and Upload JSON File: Click on ‘Choose File’, navigate to where your JSON file is stored (in the GST JSON file format), and select it for upload.

- Completion of Upload: Once selected, the file will automatically begin uploading. A success message will appear once the upload is complete.

Verifying Uploaded Data

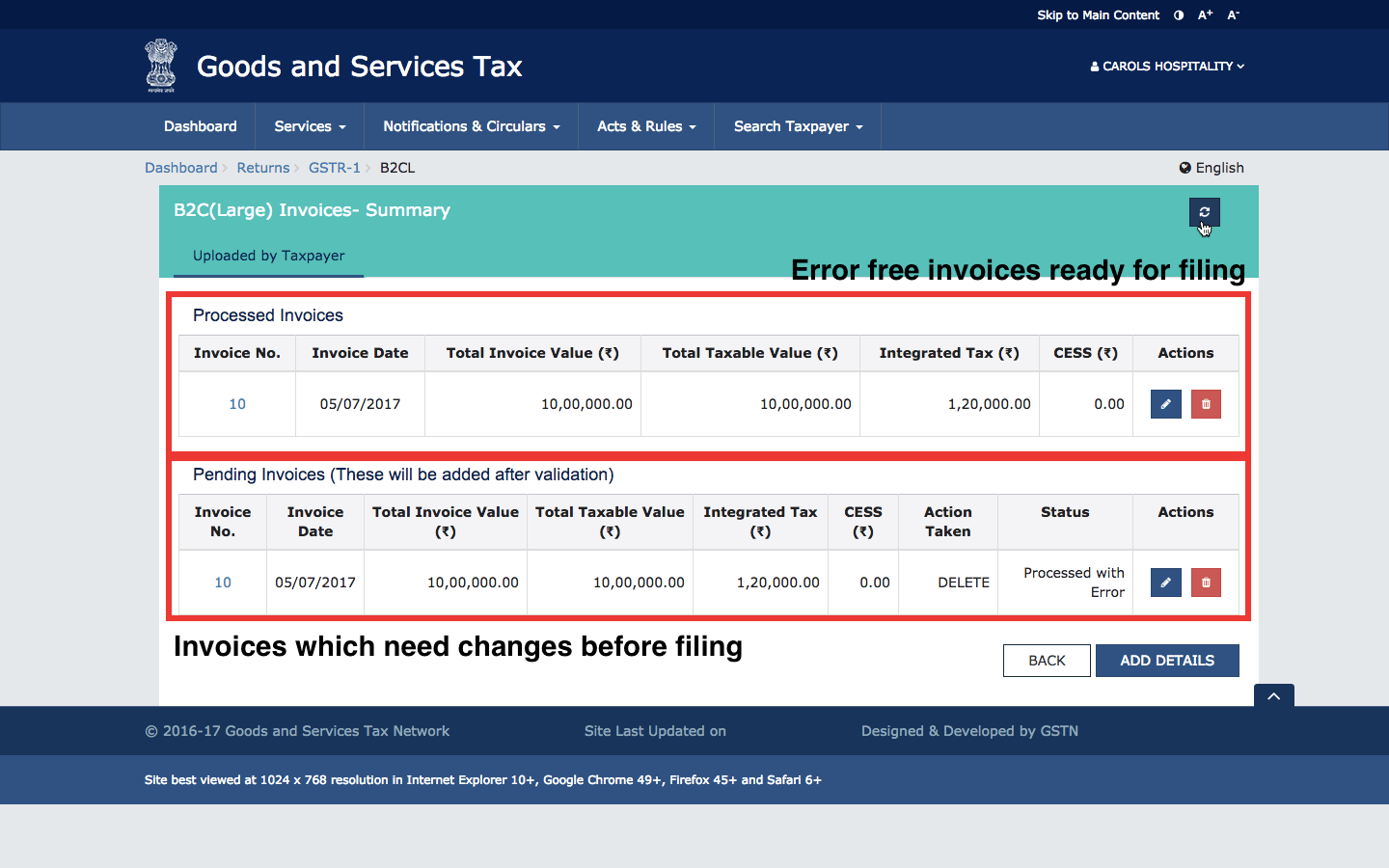

After uploading a JSON file on the GST portal, it’s essential to verify the uploaded data for accuracy:

- Wait for Processing: Uploaded data may take some time to reflect on the portal. Wait for about 15-30 minutes.

- Check the Dashboard: Return to the GST return dashboard to review the uploaded data.

- Data Validation: The portal automatically validates the uploaded data. Check for any error messages or discrepancies.

- Review Invoices and Details: Go through each section of your GST return to ensure all invoices and details are correctly uploaded and reflected.

- Rectify Errors if Any: If you find any errors or missing data, make the necessary corrections and re-upload the file.

Understanding Error Messages

| Error Type | Description | Resolution Steps |

| Invalid Format Error | File doesn’t match required GST JSON format | Recheck and align file with GST portal specifications |

| Data Mismatch Error | Discrepancy between uploaded data and GST records | Verify data accuracy and align with GST records |

| Incomplete Information Error | Missing details in the JSON file | Ensure all mandatory fields are filled |

| File Size Exceeds Limit | JSON file size larger than portal’s limit | Split data into smaller JSON files and upload separately |

When uploading a JSON file on the GST portal, encountering error messages is common. These errors usually relate to the format or content of the JSON file. Common errors include ‘Invalid Format,’ indicating issues with the GST JSON file format, or ‘Mismatch in Data,’ pointing to discrepancies in the details provided.

To resolve these, carefully review the error message, identify the section of the file with the issue, and make the necessary corrections. Ensuring data accuracy and compliance with the steps for GST portal JSON upload can prevent many of these errors. For complex issues, the portal’s help section or a GST expert may offer additional guidance.

Troubleshooting and Best Practices

For successful JSON file uploads to the GST portal, consider the following troubleshooting tips and best practices:

- Pre-Upload Validation: Before uploading, use GST software tools to validate the JSON file. This can preempt common formatting and data errors.

- File Size Check: Ensure the file size is within the GST portal’s limits. Large files may need to be broken down into smaller segments.

- Error Code Analysis: If the GST portal throws an error code after upload, refer to the GST portal’s guide to interpret and resolve specific issues.

- Internet Stability: Ensure a stable internet connection during upload to prevent incomplete submissions.

- Browser Compatibility: Use a compatible web browser for the GST portal, as certain browsers may have compatibility issues.

- Regular Data Backup: Regularly back up your GST data to avoid loss during the upload process.

- Software Updates: Keep your GST filing software updated to the latest version for seamless compatibility with the GST portal (if using applications other than cloud based GST filing solutions).

- Follow GST Portal Instructions: Adhere strictly to the steps and guidelines provided on the GST portal for JSON upload.

- Seek Expert Advice: In case of persistent issues, consult a GST expert or use the helpdesk support on the GST portal.

- Regular Practice: Regularly uploading files can help familiarize you with the process, making it more efficient over time.

These practices ensure a smoother, error-free experience when uploading JSON files to the GST portal.

Conclusion

In conclusion, the correct upload of JSON files to the GST portal is an essential step for business tax compliance. It demands accuracy and adherence to the specified format and procedures. This process, while technical, is vital for maintaining transparency and efficiency in GST filings. As the tax filing systems keep evolving digitally, staying informed and proficient with these procedures is essential for any business. It ensures compliance and streamlines financial operations, reinforcing the importance of adapting to the latest technological advancements in tax administration.

Also Read: Know Everything About GST Billing Software

Frequently Asked Questions (FAQs)

-

What is the purpose of a JSON file in GST?

JSON files in GST are formatted for uploading tax data to the GST portal. They ensure accurate data representation, following the GST JSON file format, crucial for proper GST filings.

-

How do I prepare my data for GST JSON file submission?

To prepare your data for GST portal JSON upload, start by organizing and compiling relevant tax data in your existing accounting setup. Following this, you can utilize a cloud-based GST application, which is designed to handle both accounting and GST compliance, to convert this data into the GST JSON file format. This integrated approach ensures your data is properly formatted and structured for the GST portal, streamlining the process and aligning with GST compliance standards.

-

What are the steps for uploading a JSON file on the GST portal?

The steps for GST portal JSON upload include logging into the GST portal, navigating to the ‘Returns’ section, selecting the relevant tax period, choosing ‘Prepare Offline,’ and then uploading the JSON file as per the GST JSON file format.

-

Is it necessary to use a specific file format for GST submissions?

Yes, for GST submissions, specifically JSON file submission GST, the GST JSON file format is required. This ensures compatibility with the GST portal’s filing system.

-

How do I ensure my JSON file meets GST compliance requirements?

To ensure compliance in GST filing, opt for cloud-based applications specifically designed for GST processes. These applications, inherently up-to-date, facilitate the creation of JSON files that adhere to the GST JSON file format. They eliminate the need for manual updates, providing a seamless experience in aligning with the latest GST regulations and requirements.

-

What should I do if I encounter an error during the JSON file upload process?

If an error occurs, check the error message details, correct any issues in your file that don’t comply with the GST JSON file format, and attempt to re-upload the file.

-

Are there size restrictions for JSON files on the GST portal?

Yes, the GST portal has size limitations for JSON files. Ensure your file size is within these limits to avoid upload issues.

-

Can I upload multiple JSON files for different tax periods together?

No, you should upload JSON files for each tax period separately to ensure accurate processing and compliance.

-

What steps should I take if I face technical issues during the JSON upload?

First, verify your internet connection and confirm your file is in the GST JSON file format. If problems persist, consult the GST portal’s helpdesk for assistance. Additionally, ensure your browser is up-to-date and clear your browser cache, as these can often resolve common technical issues.

-

How can I verify the success of my JSON file upload on the GST portal?

After uploading, check the portal for a confirmation message. If your file is correctly formatted and successfully uploaded, it will be reflected in your account’s return section. You can also check the ‘Status’ section within the portal to confirm if the file has been processed without errors.