The introduction of GST streamlined the taxation system in India. The government is working on policies to create a hassle-free system for taxpayers. While attempting to collect all unpaid taxes, the policymakers must also ensure that the taxpayers are not burdened. The system must be rigid enough to prevent tax evasion and fraud.

The launch of the GST network to increase accountability and transparency is welcomed by business owners. However, there are several navigation complexities that you must understand to ensure GST compliance throughout.

Generating GST invoices is now mandatory for all registered taxpayers supplying goods and services. With effect from August 2023, every GST-registered business with an annual turnover of more than 5 crore must generate e-invoices.

In this blog, you will learn the tax invoice cancellation process to stay compliant without tax liabilities.

Tax Invoice Importance

The GST tax invoice is vital for suppliers who can collect GST tax from the buyer. When you supply taxable goods or services, you must generate and issue a tax invoice. This invoice contains the price of the item along with the GST tax that must be collected for the item. You are liable to pay the GST tax to the government.

Every tax invoice submitted while filing GST returns updates your tax liabilities. Also, when you purchase something, you have to pay GST along with the price of the goods. To enable smoother B2B operations, the GST Act allows you to claim Input Tax Credit (ITC) for paying GST with purchases. You can use the ITC to offset the GST collected from sales to reduce your tax liabilities.

This simple offset process allows you to pay lower taxes to the government instead of claiming a refund for purchase orders. The process is hassle-free unless you make mistakes with invoice generation.

Reasons for Cancelling a Tax Invoice

The tax invoice is just a document to notify the price of the goods along with GST tax to the buyer. It is a crucial GST document that forms the basis of your GST returns. You must submit GSTR 1 every month detailing the tax invoices, purchase orders, and other financial transactions that can impact the GST liabilities.

As per the new updates in the GST law, you may also have to generate e-invoices. You must use the IRP system to generate IRNs for each tax invoice. The IRP system will automatically share the invoice details with the GST network, eliminating the need for submitting the same invoice twice.

Business disruptions are highly common in all sectors. Even though you may have issued a tax invoice and even collected an advance payment, the supply transaction may not be done. The supplier can cancel the invoice, or the buyer may not be happy to purchase from the supplier.

In that case, the generated e-invoice and tax invoice must be cancelled. Otherwise, the supplier will be liable to pay GST tax on goods or services they didn’t supply. Also, the invoice must be cancelled to ensure the recipient doesn’t claim the ITC they are not entitled to. Some of the valid reasons to initiate the tax invoice cancellation process are:

- Order cancelled by the buyer

- Wrong details mentioned in the invoice

- Mistakes in the invoice

- Duplicate tax invoice

Suppliers may also have any reason apart from those listed above for cancelling an invoice. In any case, you must know how to cancel a tax invoice so that the cancellation is reflected properly in the GST returns. When you cancel an invoice, the notification will be sent to the buyer automatically, and their ITC eligibility will also change.

Tax Invoice Cancellation Process Online

The government facilitated the generation of e-invoices based on the GST tax invoice. Similarly, the cancellation process can also be completed online. Whether you want to cancel the invoice through the e-invoicing IRP portal or GST portal, it can be done online.

In some cases, you may not have continuous internet connectivity. You can also cancel tax invoices offline. You must first download the invoice JSON file from the GST portal. An offline GST tool is helpful to cancel the invoice and generate a new JSON file that you can upload to the GST portal.

However, using a GST billing tool to generate and cancel an invoice is much easier and straightforward to manage all your billing transactions from one place.

GST Tax Invoice Cancellation Procedure

Under the GST Act, tax invoices, e-invoices, etc., must be accurately created with all the fields mentioned in the tax invoice format. Strictly adhering to this format is essential to easily auto-populate the master database. The GSTN network auto-populates details from invoices to generate GST forms. So, businesses must always generate GST-compliant invoices as per the format.

When you must cancel the tax invoice, you must know the right way to do it. If your business has a turnover of more than 5 crores, you must generate an e-invoice, which can be cancelled in two different ways. The method you choose depends on how long ago you generated the invoice.

Using the IRP portal, you must generate an e-invoice with a validated IRN and QR code. If you identified mistakes in the invoice and want to cancel it within 24 hours of generating the e-invoice, you can do so directly from the IRP portal. However, if you wish to cancel the invoice after 24 hours, you must go through the GST portal. The IRP system doesn’t store invoices, and it will only be available for the first 24 hours after generation.

However, using the GST portal, you can always delete or amend invoices as many times as you want before the cut-off date for GST return submission. Once you submit a GST return for the financial period, you cannot delete invoices included in the returns directly.

You cannot reissue a cancelled tax invoice. When you generate an IRN through the e-invoicing portal, it corresponds to one invoice only. However, you can generate another new invoice with a new invoice number. You must also generate the right e-invoice using the IRP portal based on the new invoice.

Tax Invoice Cancellation Process Step By Step Using an E-Invoicing Portal

If the time lapsed after generating the e-invoice is within 24 hours, you can cancel the tax invoice using the following steps:

Step 1: Log in to e-invoicing portal IRP system.

Step 2: Select the e-Invoice main menu.

Step 3: Select Cancel in the e-invoice menu.

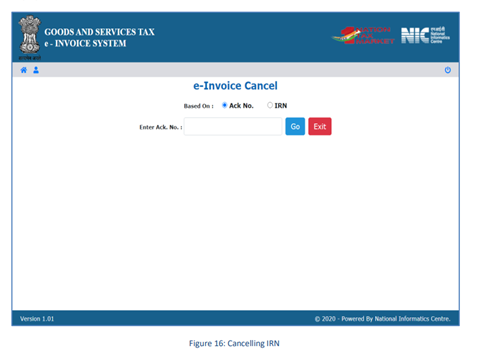

Step 4: In the text box, type the Ack.no or IRN of the invoice you wish to cancel.

Step 5: Click on Go.

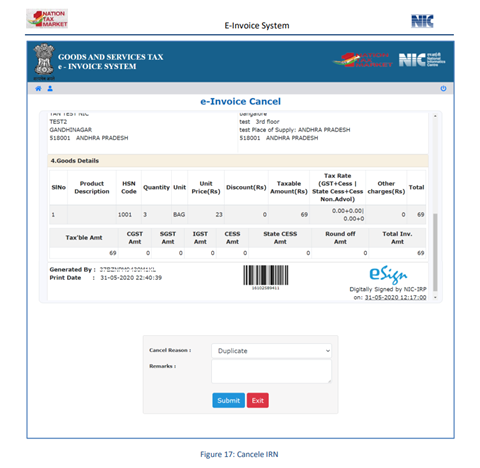

Step 6: The e-invoice that you are about to cancel will be displayed.

Step 7: Select the correct reason for cancellation. You can also mention the remarks for the invoice.

Step 8: Click on Submit.

Step 9: You will see a success message, and a ‘Cancelled’ watermark will appear over the cancelled invoice.

Step 10: You can continue to cancel another e-invoice that you have generated within the past 24 hours.

Tax Invoice Cancellation Process Step By Step Using the GST Portal

You can delete invoices before filing GSTR forms during the tax period directly on the GST portal. You can upload the invoices at your convenience and edit them online before the time of submission of GSTR 1 filing. The step-by-step process is as follows:

Step 1: Log in to the GST portal

Step 2: Go to the returns dashboard

Step 3: On the returns dashboard, choose the financial period and month of invoices to delete.

Step 4: Click on details of outward supplies of goods or services

Step 5: Navigate to Prepare online

Step 6: Click right tab based on the type of invoices you want to delete

Step 7: Open the list of invoices available. Click on the red delete button to delete the invoice

Step 8: Delete as many invoices as you want

Ensuring Compliance with Invoice Cancellation

While you can delete an invoice as long as the reason is valid, you must ensure compliance. When you delete an invoice directly on the GST portal, any changes made in the e-invoices will be marked as discrepancies. So, you must maintain accurate records of cancelled invoices, too.

Sometimes, you may be tempted to cancel a tax invoice because the buyer has not paid. You may not be willing to pay GST liabilities when the buyer has not paid the invoice. However, once the supply is made, cancelling a tax invoice for non-payment is not the right method. You are still liable to pay the GST tax as per the tax invoice if you have made the supply.

After filing GST returns, you cannot delete invoices. However, you don’t have to pay taxes for goods not supplied. You can inform the recipient and issue a credit note considering the order cancellation as a return of shipment. There is also an option to claim a refund of excess tax in some cases.

Once you have cancelled a GST invoice correctly, you must update your GST return to show reduced tax liabilities. For credit notes, update those in your GST forms as well. Accurately documenting all issued, modified, and cancelled invoices will help you file accurate GST return forms.

Conclusion

Maintaining accurate documentation is essential for GST compliance. All the invoices and purchase orders must match when you file GST returns. Any discrepancies will be marked, and based on the situation, an audit may be required. Manual processing of GST-compliant invoices is cumbersome and time-consuming. An automated billing tool will enable you to create GST-compliant invoices and manage them properly and easily. You can cancel invoices for mistakes, errors, or order cancellations to ensure accurate GST records.

CaptainBiz is a popular GST billing software that empowers you to manage your business finances effortlessly. You can quickly create GST-compliant invoices with a few clicks. You can also amend or delete invoices using the software before uploading them to the GST portal. The system automatically double-checks the invoices during GST report generation so that you always stay compliant with the GST Act.

FAQs

-

Why should I cancel a tax invoice under GST?

For every tax invoice generated, you are liable to pay GST. If the order is cancelled and you no longer supply to the recipient, there is no need to pay GST. The only way to reflect this change in your GST liabilities is to cancel a tax invoice.

-

What can I do if I accidentally create several duplicate invoices?

Using a GST billing automation tool like CaptainBiz will help you reduce errors while creating GST invoices. However, sometimes, you may create duplicate invoices in the tool or GST portal. You can always delete duplicate invoices directly on the GST portal or your billing software before GST return submission.

-

What is the process for cancelling tax invoices in GST?

Before filing GST return forms, you can cancel the e-invoice on the IRP portal if you have generated an e-invoice within the last 24 hours. Otherwise, you can delete the e-invoice on the GST portal. The online process for cancelling tax invoices in GST is easy and simple.

-

What is a credit note, and why is it important for invoice cancellation?

If you have already submitted GST returns and want to change or cancel invoice details, you can do so with a credit note. The credit note is a GST document that helps you to offset the original tax invoice so that you don’t pay excess tax. The recipient will also acknowledge errors in the invoice. A credit note is widely used under GST for correcting invoices.

-

Do I have to issue a credit note for all cancelled invoices?

No, the need for credit notes is based on specific transactions. If you delete the e-invoice directly on the e-invoicing portal, the invoice will be cancelled, and there is no need for a credit note. You can also cancel invoices on the GST portal before submitting GST return forms. Deleting GST invoices on the portal will also not require a credit note.