Navigating the world of taxes and codes can be daunting, especially when it comes to the Goods and Services Tax (GST) System. One of the crucial elements in this system is the GST SAC Code, which plays a pivotal role in classifying services under the GST regime.

If you’re a business owner or a service provider trying to figure out where you stand in this complex web of codes, this guide is here to simplify the process for you.

Introduction to GST SAC Code

GST SAC Code or GST Services and Accounting Code is a system of classification used by the Indian Government to classify and implement taxes on different services that businesses provide.

These codes are used to know the type of offered service and the GST rate applied for that service. SAC code functions are similar to that of Harmonized System Of Nomenclature (HSN) code used for Indian goods.

Allocating specific SAC codes to different services enables the Government to effectively evaluate GST revenues obtained from various service categories.

The SAC code in GST has several benefits for businesses:

| Uniformity: SAC codes help in creating uniformity in the tax system, making sure that businesses are taxed consistently across the country. |

| Identification of services: The SAC codes make it convenient to identify the different types of services offered and the applied tax rates for each service. |

| Compliance: Using SAC codes simplifies the process of tax calculation and filing of GST returns, decreasing the burden of compliance for businesses. |

| Monitoring and tracking: The government uses SAC codes to control and track the services offered and collect taxes more efficiently. |

Understanding the Components of a GST SAC Code

A Service Accounting Code, or SAC under GST, is a unique 6-digit number used to classify services for the purpose of taxation. The SAC code always begins with the number 99. The next four digits help you know the specific type of service.

Let’s consider the SAC code for general construction services showing single-family homes and multi-storey residential buildings, which is 995411.

Now, the first “99” in all SAC codes indicates the category referring to services. The following “54” means the primary service category, which here is “construction services.” Finally, the unique nature of the primary service, such as “general construction services of buildings,” is shown by the “service code” of 11.

Also Read: GST Rates and SAC Code on Construction Services

Why Finding the Correct GST SAC Code Matters?

Finding the correct GST SAC Code is challenging yet important. The CBIC has thus provided a comprehensive list of SAC codes, with detailed descriptions of the services that are associated with each code. Service providers can always refer to this list to check the correct SAC code for their service.

Alternatively, service providers can also find the help of a tax consultant or accountant to determine the correct SAC code for their service. Detecting SAC codes is crucial for various reasons:

- They provide a standardized system of classification for services, which helps in consistency in the application of tax rates across India. It is convenient for service providers to comply with GST regulations and for tax authorities to execute them.

- SAC codes also help to decrease the risk of misinterpretation and miscommunication between service providers and tax authorities. By using a standardized system of classification, service providers can make sure that they are correctly identifying and classifying the services they provide for tax purposes.

- SAC codes aid in simplifying the process of filing GST returns. By using the correct SAC code for each service provided, service providers can make sure that their tax liability is calculated accurately, which can decrease the risk of errors and penalties.

Exploring Different Categories and Segments under GST SAC Codes

Given below are the major categories and segments under GST SAC codes:

| 00440003 | Telegraph Authority- Telephone Connection Service |

| 00440005 | General Insurance Service |

| 00440008 | Stock Broker Services |

| 00440013 | Advertising Agency Services |

| 00440014 | Courier Services |

| 00440015 | Radio Paging Services |

| 00440026 | Customs House Agents Services |

| 00440029 | Steamer Agent Services |

| 00440032 | Air Travel Agent Services |

| 00440035 | Mandap Keeper Services |

| 00440045 | Clearing and Forwarding Agent Services |

| 00440262 | Transport of Goods by Road/ Goods Transport Agency |

| 00440092 | Chartered Accountant Services |

| 00440104 | Real Estate Agent |

| 00440165 | Broadcasting Services |

| 00440173 | Banking and other Financial Services |

| 00440189 | Cargo Handling Services |

| 00440258 | Airport Services by Airport Authority |

| 00440302 | Transport of Goods through the pipeline or conduct. |

| 00440326 | Packaging Services |

Methods to Find the Correct GST SAC Code

It is compulsory for every business to mention SAC codes in their invoices. So it is crucial to know how to pick up the right SAC code. Let’s learn all the possible ways to find one:

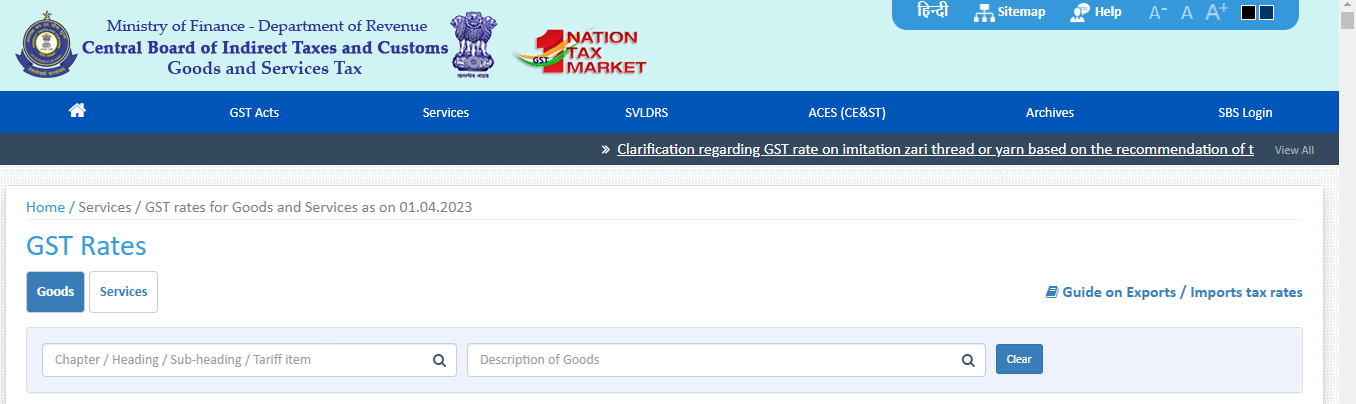

- Using the GST portal: The most effective way is to search in the GST portal, maintained by the Government of India. The portal comprises the complete SAC code list for all the different services. You can search for the code by typing in keywords that are related to your service.

- SAC Code Lookup Tool: Businesses can use the SAC Code Lookup tool that the government offers on the official GST portal to find the correct SAC Code as per keywords or service specifications.

- Talk to a tax expert: If you are still not sure enough and have doubts about which code is right for your services. Then, it’s better to consult with tax experts or a chartered accountant. They will help you find the right code and make sure that you are following GST rules.

- Use the SAC code list: The Central Board of Indirect Taxes and Customs (CBIC) has put the SAC code list on the website. You can use this official list that groups services into different sections, headings, and subheadings. It will make your task easy to find any code.

Factors Influencing the Selection of a GST SAC Code

Below given is the curated list of the factors influencing the selection of a GST SAC Code:

- Invoicing: When creating service invoices, businesses have to remember to incorporate the relevant SAC Code along with other important information like the product or service’s description, pricing, and other details. Accurate billing with the relevant SAC Code is important for accurate tax calculation and GST compliance.

- Filing GST Returns: Businesses must deliver the details of the services they offer in standard GST returns, and exact service accounting in such returns depends on the SAC code. You must use the correct SAC code when reporting GST returns to comply with regulatory requirements, thereby ensuring accurate tax filing.

- Claiming Input Tax Credit: The provider needs to have a valid GSTIN. He/she must have correctly submitted returns to prove input tax credit under GST. To ensure that the supplier has paid taxes, the recipient needs tax invoices and the provider’s GST returns. Services used for commercial purposes are allowed to receive the credit, which decreases the recipient’s output tax obligation.

- Determining Tax Liability: GST uses SAC to categorize services to determine tax liability. Established on the SAC code and the location where the service is provided, the tax rate that is applicable to it is based. This makes sure for them to comply with tax laws and regulations correctly. GST charges and collections must be established based on the relevant SAC Code thereby guaranteeing compliance with the rules.

Conclusion

When it comes to dealing with SAC codes for commercial rent or any other services under GST, it is important to be assured of accuracy and compliance.

It’s important to use the right SAC code for services related to commercial rent. Any incorrect code usage can lead to discrepancies in tax calculations and may invite undue attention from tax authorities. Thus, whether you’re a business owner, landlord, or tenant, it is advised to double-check the codes applicable to your transactions.

Also, feel free to seek professional advice if you find the classification process beyond your understanding or have any doubts about which code to use.

Also Read: How to Calculate GST in an Excel Sheet: Step-by-Step Guide

FAQs

Q1. How are the SAC Code and HSN Code different from each other?

The HSN (Harmonised System of Nomenclature) Code is used for product classification whereas the SAC Code is used for services are two independent systems. The structure and organization of the SAC Code and HSN Code are not the same. The SAC Code is a 6-digit system, whereas the HSN Code is a 4-to-8-digit format.

Q2. What is the Use of SAC Code in GST?

SAC codes serve various purposes like :

- They have unique codes for different services, thus allowing easy distinction.

- They help GST taxpayers recognize the GST rate applied to the services delivered by them.

- GST taxpayers need to mention these SAC codes when they register on the GST portal, on their invoices, and in GST returns.

Q3. Is the SAC compulsory for the GST invoice?

Yes, it is compulsory for service providers to furnish the SAC code if their yearly average turnover exceeds Rs.5 crore. For businesses earning below Rs.5 crore, a 4-digit SAC code must be there for business-to-business transactions.

Q4. Why is the SAC code required?

SAC codes are allotted to various services, they help in the easy identification of services delivered and the applied tax rates under the GST regime. Also, these codes are mentioned on the GST invoice.

Q5. Can I use one SAC Code for all my services?

The SAC Code must be chosen following each service’s unique characteristics. Certain services may have multiple SAC codes entirely depending on how they are classified.

Q6. Which SAC Code is appropriate for my services?

To find the exact SAC Code for your services, you can use the SAC Code lookup tool on the official GST portal or refer to the SAC Code list issued by The Central Board of Indirect Taxes and Customs (CBIC). A tax professional can be consulted to ensure proper SAC Code classification.

Q7. Does the SAC code matter to small businesses?

Yes, the SAC Code covers small enterprises with medium and large enterprises. Small firms must also stick to SAC Code standards to avoid fines and have accurate tax calculations and reporting.

Q8. Can there be penalties for using the wrong SAC Code?

As per GST laws, incorrect or missing SAC codes in bills or GST returns can lead to compliance problems and fines. Using the relevant SAC Code for services is important to guarantee effective tax compliance.

Q9. Is the SAC Code only for service providers?

No, every business that provides a service or is related to a service offering in any way, comprising manufacturers, traders, and other service providers is subject to the SAC Code regulations.

Q10. Can I find the GST rate with the HSN code?

GST for goods and services is based on the HSN code or SAC code of a commodity. Under GST, all goods and services that are transacted in India are classified under the HSN code system or SAC Code system. Goods are classified under HSN Code and services are classified under SAC Code.