Introduction

The HSN code or Harmonized System Nomenclature is a globally accepted six or 8-digit product classification method used for trading purposes. It is maintained and developed by WCO, or World Customs Organization, and gets revised every 5-6 years. The primary goal is to promote uniform language for traders, customs authorities, and other associated people.

The HSN code is essential in cross-border trade and helps promote efficiency and consistency. If you are a new business owner seeking help understanding everything related to HSN codes, you have reached the right place. This article will help you learn about HSN codes and their significance for trade and taxation.

Definition of HSN Code

HSN code is also known as Harmonized System Nomenclature, which was introduced to systematically classify the goods globally. HSN was developed by WCO in 1988, and since then, more than 200 WCO members have been operating domestically and internationally using HSN codes. This code represents what kind of product is shipped across without needing a long, detailed description.

Understanding Harmonized System Nomenclature

HSN codes are usually applied globally to establish the national customs tariff and gather economic statistics data. There are around 5000 commodity groups identified by using a 6-digit code. This code is set up per logical and legal structure based on some fixed rules and regulations.

Over 98% of the goods in international trade are classified based on the HS policies and documented as per the HSN codes. The HS Committee, made up of members from the contracting parties to the HS convention, is responsible for ensuring the official interpretation of these codes, which guarantees its uniform global interpretation.

The HS committee also helps to lower the costs associated with international trade. They do it by assisting in harmonizing business and customs procedures and the interchange of non-documentary trade data concerning these procedures. Thus making it a global language for goods and a necessary tool in the international trade market.

The HSN Code comprises of:

| Sections | 21 |

| Chapter | 99 |

| Headings | 1244 |

| Subheadings | 5244 |

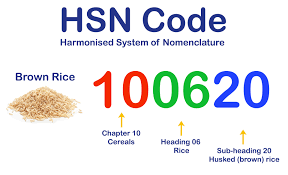

The first two digits of the code are the chapter number, the next two digits are the heading, and the following two are the sub-headings.

Role of HSN Code in Product Classification

HSN codes give commodities and items a distinct classification ID that lets customs officials know exactly what is being delivered. It is simpler to identify things and apply the proper taxes and fees in the country it is imported with the help of this widely accepted coding system. Moreover, these HSN codes also help improve efficiency and speed, especially regarding importing and exporting goods worldwide.

In India, these HSN codes were initially six-digit to classify products for central excise and customs duties. Later, the Central Excise Authorities added two more digits to make the codes more precise. Hence, you will see the codes as eight digits instead of 6 in India. The HSN code is used to classify almost all commodities in India, making it easier to use HSN numbers when calculating the Goods and Service Tax (GST). Currently, the number is used to classify products to calculate Value Added Tax (VAT).

Importance of HSN Code in Trade

HSN Code is significant in how trade and businesses happen within and outside India. The correct tax rate can impact the business profit margins; thus, it is essential to classify the products correctly under the relevant HSN code. Tax overpayment or underpayment due to incorrect classification may incur fines or other financial consequences.

Below are some other reasons why the HSN code is necessary in trade:

- HSN codes assist businesses in the classification of goods needed for taxation purposes.

- It is also required to comply with GST laws and regulations in India.

- Businesses can efficiently provide a uniform product classification system by using these codes. Thus avoiding errors and confusion in the entire process.

- Companies can quickly identify and track their products with HSN codes, which helps them manage their inventory more effectively.

- For businesses dealing in international trade, these HSN codes can help in smooth transactions as these codes are globally accepted.

- Companies can also use these codes to compile trade statistics. It can further help them in making informed business decisions.

- These codes also allow accurate transparency in business transactions, thus, better regulation and trade monitoring.

- It also assists in simplifying the entire taxation process by reducing unnecessary complexities.

HSN Code as a Product Identifier

A crucial question is using HSN code to find or identify a product. Or how to search for an HSN code to identify a particular product. You can use the HSN code finder online to search for your needed information. Let’s look at two different ways through which HSN code can be searched or the product information can be retrieved:

1. Search Using the Product Name

When you enter the name of your product, the code finder will show the most relevant recommendations of the four-digit HSN code. You can click on search more results if you feel the information is inaccurate. Furthermore, for export-import reasons, you can also click the four-digit code to obtain facts about the six- and eight-digit HS codes, along with the GST rates.

2. Search Using HSN Code

If you need to identify the product and have the HSN code, type the code’s first 2 or 4 digits. It will give all the desired information and recommendations, and you can click on the HSN code to get the complete product details.

Significance of HSN Code in Taxation

HSN codes are crucial and necessary for GST purposes in India. Hence, the primary purpose of these codes is to make GST globally accepted and systematic. When traders and taxpayers use these globally accepted HSN codes, there will no longer be a need to upload the entire description of what is being imported or exported.

Hence, it will eventually simplify GST filing and be efficient while saving time. The taxpayer must ensure that if they fall above the annual turnover bracket, they must write the HSN codes while submitting their GSTR-1 forms.

Final Thoughts

The HSN code is an essential instrument in global trade and business since it provides a uniform structure for the systematic categorization of various goods. This code is the foundation that supports efficiency, openness, and a common language between companies and customs agencies around the globe. When companies have to handle international supply chains and comply with regulations, the HSN code becomes a vital tool. It also facilitates faster trade operations by giving traders and customs officials worldwide a similar language. It also makes the classification of commodities easier. Thus, it is an essential element in global trade, contributing to uniformity.

Also Read:

Reporting HSN Codes In GSTR – 9: Procedure Requirements And Penalties

New GST Rates 2023 – List Of Latest Goods And Service Tax Rates Slabs

FAQs

1. How is the SAC code different from the HSN code?

While SAC codes are used for services, HSN codes are used to classify commodities.

2. What does HSN stand for?

The “Harmonized System of Nomenclature,” or HSN code, is a global system for classifying commodities.

3. Who needs to mention the HSN code in GST filing?

Any taxpayer with an annual aggregated turnover of over INR 5 crores must mention the HSN code in their GST filing.

4. Where does one need to mention HSN codes in the GST form?

HSN codes must appear in their GSTR-1 return form and on bills of supply or invoices.

5. How many digits does the HSN code have?

Generally, HSN codes consist of six digits. However, there are eight-digit HSN codes in India.

6. What is the meaning of four and six-digit HSN codes?

Six-digit HSN codes include the product category’s sub-heading, while four-digit HSN codes include the chapter number and heading.

7. Does the invoice have to include the HSN code?

When submitting GST returns, taxpayers classify their items using HSN codes. It is only required to reveal the HSN on a taxable invoice if the dealer or taxpayer has a turnover of more than five crores. In that case, the dealer or taxpayer must include the HSN code in the invoice.

8. Is the HSN code the same in every nation?

The World Customs Organization is responsible for developing the HSN codes. The commodities are categorized using HSN codes. Every nation under the WCO has comparable HS codes. While some countries use an 8-digit number to subclassify products, some utilize a 6-digit code for their goods.

9. What makes HSN codes distinct?

Each product has a unique HSN code based on categorization. For instance, there are 21 sections; within those, there are 99 chapters. Within these chapters are headings – 1244 and subheadings – 5244 to classify these products.

10. Is it possible to find the exact HSN code of any product?

Yes, you can find the exact HSN code of each product on the GST portal. You can use the HSN code finder and search it either by the product name or if you are aware of any digits of the HSN codes.