Invoice management is simple initially but if not done correctly it may become quite difficult. Small business owners must keep track of invoices and make timely bill payments.

It helps them for the smooth operation of a company. They can use efficient invoicing for small businesses for simplifying their transaction processes.

This article will examine the fundamentals of invoice management for small businesses. It also covers how to implement efficient invoicing for small businesses, the benefits of invoice automation, and its key features for optimal financial operations.

Introduction to Invoice Management

A business function that helps with the procurement process is invoice management. It involves handling supplier invoice processing. Invoice management helps companies to verify the authenticity of an invoice and enable timely payments.

The following are the steps in invoice management:

|

|

|

|

|

Most businesses use invoice management systems as a faster, precise, and more economical solution. You can automate the majority of the invoice management process using invoice management systems.

Challenges Faced in Invoice Management by Small Businesses

Effective invoice management for small Businesses is essential for a successful operation. However, managing invoicing for small businesses presents several difficulties.

You may improve client happiness, expedite the invoicing process, and improve cash flow by fixing these issues. The following are the major invoicing issues and offer insights on effective small business invoice solutions:

- Late Payments: You have to be precise about payment terms. Monitor overdue invoices closely and consider early payment incentives.

- Inaccurate Invoices: You must ensure your invoices are correct and error-free. Reduce errors by using invoicing software.

- Lack of Invoice Tracking: Use a spreadsheet or specialized software to implement a tracking system to maintain organization.

- Complicated Payment Processes: Streamline payment process by providing online payment options or regular billing and improving cash flow with invoice management.

- Inconsistent Invoicing: Establish standardized procedures, utilize templates consistently, and state the payment.

- Lack of Automated Invoicing Systems: Utilize automated systems to obtain important insights, reduce errors, and save time.

Advantages of Implementing Invoice Management for Small Businesses

Implementing an invoice management system is more efficient than manual invoicing. Here are some of the benefits of Invoice automation for small businesses:

- Accurate Data Processing: Automated online systems eliminate errors such as typos and duplicate payments in invoicing.

- Faster Operations: Manage invoices more quickly, save money, and make fewer mistakes, which will improve communication with suppliers.

- Speedy Approval: Inbuilt authorization logic guarantees prompt invoice approvals, so there’s no need to wait for permissions.

- Real-time insights: You may check your invoices in real time without searching through papers because of the dedicated dashboards.

- Secure Cloud Encryption: Industry-standard 256-bit SSL encryption protects your data while it’s stored online.

- Direct Integration: Easy online transfers, automatic reconciliation, and fraud protection are all made possible by a seamless integration with your bank or credit card.

Also Read: Exploring The Advantages of Free Invoice Software

Key Features and Components of Effective Invoice Management System

Numerous invoicing systems are available today, some of which are more beneficial than others. Because of this, we advise you to create a list of requirements before making an immediate decision.

When looking for an effective invoice management system, the following are some essential elements to consider:

|

|

|

|

|

|

|

|

|

|

|

|

|

Also Read: The Importance Of Including All Required Elements On a Tax Invoice

How to Choose the Right Invoice Management System for Your Business

Effective financial operations in your company depend on selecting the appropriate invoice management system. Here’s an outline to assist you in selecting the best option:

Step 1: Figure Out What You Need

Determine the features that your company needs in invoicing software. This makes it easier to locate software that meets your goals, is affordable, and saves time. Consider issues like your company model, preferred payment methods, email or mail-based invoicing, and software integration requirements.

Step 2: Check Software Features

After deciding what your company requires, have a look at the features of various invoicing software. The features that differ across applications include time monitoring, automated payment reminders, and customizable templates. Select software that is compatible with your unique business requirements.

Step 3: Ensure User-Friendly Interface

Verify that the UI of the invoicing software is easy to use. Effective utilization requires a straightforward and simple-to-use interface. To make managing bills, monitoring payments, and creating reports simple, look for invoice templates that can be customized, user-friendly instructions, and customer assistance.

Step 4: Compare Pricing Models

Recognize the many price schemes for invoicing software, such as usage-based, subscription-based, and freemium. Seek out a free trial, evaluate the features vs the pricing, and keep an eye out for any additional expenditures. Select software that can grow with your company and meet its demands.

Step 5: Research Customer Support

Troubleshooting and seamless software functioning depend on customer help. Choose software with plenty of training materials, availability during business hours, and several support channels (email, phone, live chat). Examine testimonials or contact references to determine the standard of client service.

Step 6: Make Your Decision

Make your final choice after considering the features, cost, customer service, and your company’s demands. Examine your notes, weigh the benefits and drawbacks, and take notice of comments from other companies. Upon decision-making, seamlessly integrate the software by getting to know its functionalities, transferring data, educating personnel, and keeping an eye on the billing procedure.

Implementing Invoice Management: Best Practices for Small Businesses

The financial stability of small businesses depends on the implementation of efficient invoice management. Consider the following best practices for efficient invoice management:

- Simple Invoices

- Make simple invoice templates that include all the information required.

- To prevent confusion, provide a clear list of the goods and services, the conditions of payment, and the deadlines.

- Timely Invoicing

- After providing goods or services, send invoices as soon as possible.

- Assures steady financial flow. Improving cash flow with invoice management to avoid late or missed payments.

- Detailed Descriptions

- Offer thorough explanations to avoid misunderstandings.

- Indicate the amounts, quality, and any unique arrangements for transparency.

- Clear Payment Terms

- Mention acceptable payment options, deadlines, and late payment fines.

- Sets standards and motivates customers to make timely payments.

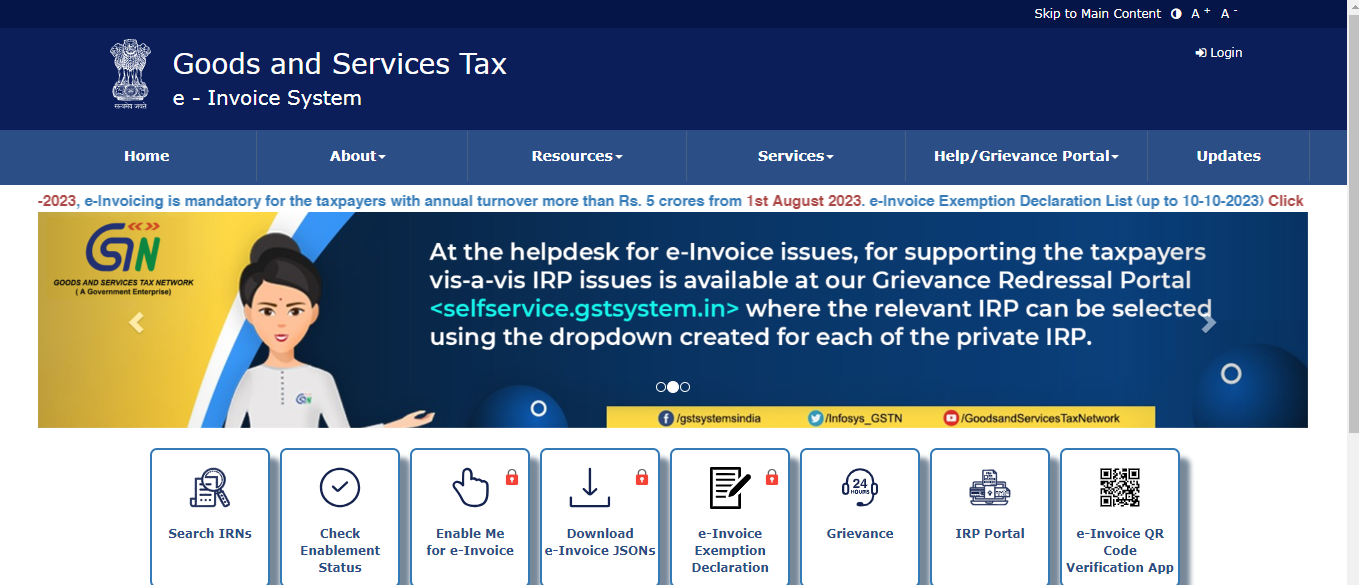

- E-Invoicing

- Adopt digital technologies for precise and automated billing.

- Simplifies the procedure, lowers mistake rates, and saves money and time.

E-invoice System Dashboard

- Organized Record-keeping

- Keep meticulous records of all invoices both printed and digital.

- Important for day-to-day operations, accounting documentation, assessments, and adherence to regulations.

- Regular Follow-up

- Investigate past-due payments by proactively following up with customers.

- Gentle but firm reminders help to guarantee a steady flow of funds.

- Reconciliation

- Check payments against issued invoices regularly to identify inconsistencies, preserve financial integrity, and facilitate timely resolution.

- Periodic Review

- Maintain compliance with changing tax laws and industry standards for long-term success.

- Review and modify invoicing procedures regularly to meet changing company demands.

- Tax Compliance

- Give adherence to tax regulations priority to guarantee correct billing.

- Prevents penalties and legal problems while encouraging prudent financial management for the long-term viability of the company.

Real-Life Success Stories: Small Businesses’ Experience with Invoice Management

The following is a selective compilation of actual success stories from companies that used online invoicing management software to transform their operations:

1. Zoho Invoice

Zoho Invoice is an online tool for creating invoices. It helps in collecting payments that assist small businesses. It is easy to use, safe, and completely free. It helps to generate professional invoices, send them effectively, and receive timely payment.

Challenges Faced

Cathleen Mahoney is the CEO of Bright Language. It is a digital platform that helps companies manage online language assessments. Cathleen faces difficulty in using spreadsheets for invoices. She found it time-consuming and impacting customer relationships.

Solutions

| Time Savings |

|

| Improved Cash Flow |

|

Outcomes and Changing Effects

| Improved customer relationship |

|

| Enhanced Recognition |

|

2. Fresh books

Freshbooks is an accounting software for accountants and business owners. It can integrate with more than 100 fantastic applications. It makes work easier for business owners and maintains communication between teams and clients. It helps to gain a deeper understanding of your company.

Challenges Faced

Rebecca is an accountant and an owner of the company “Ledger Sense” which provides virtual accounting for small businesses. She needs accounting software to facilitate working with clients who are small enterprises.

Solutions

| Time Tracking |

|

| Invoicing Efficiency |

|

Outcomes and Changing Effects with FreshBooks

With the help of the user-friendly FreshBooks technology, clients can effortlessly handle pre-accounting procedures, giving Rebecca more time to focus on strategic advising work.

Conclusion: The Significance of Invoice Management for Small Business Success

In summary, successful invoice handling is crucial for small business success. Small business invoice solutions are essential to preserve financial stability. It guarantees timely payments and cultivates a good relationship with clients.

Effective invoicing helps small businesses to manage spending, monitor cash flow, and make expansion plans. It helps to create accurate and timely bills. It builds confidence, professionalism, and customer trust.

Also Read: The Transformative Power Of Online Invoice Management Software

FAQs

Q1. What does small business invoice management involve?

Small business involves invoice management in the production, tracking, and processing of invoices. It helps to ensure prompt payments and well-organized financial records.

Q2. Why does a small company need effective invoicing management?

A small company needs effective invoice management to Improve cash flow and reduce late payments. It provides an open view of all financial activities.

Q3. When should a small company owner send invoices?

A small company owner should send invoices as soon as products or services are supplied.

Q4. How do businesses handle their invoices?

Businesses have two methods for handling their invoices. They are:

- Automatic

- Manual

Q5. What does invoice management reporting mean?

Invoice management reporting is the accounting procedure for invoice data. It is a mechanism to monitor the sending, receiving, and paying of invoices.

Q6. An invoice management system is needed by whom?

Organizations that wish to streamline their accounts payable and invoice processing process employ invoice management systems. An invoice management system can be helpful for the departments listed below:

- Internal auditors,

- The finance department,

- The accounts payable team.

Q7. Can I customize my invoices to reflect my brand?

Yes, you can customize invoicing tools. You can add your logo, colors, and personalized messages to reflect your brand.

Q8. Should I have to preserve paper copies?

Even while digital storage is effective, you have to maintain backups and hard copies for legal and auditing purposes, if needed.

Q9. How do I handle disputes over invoices with clients?

Open communication is key for handling disputes over invoices with clients. Address concerns promptly, provide detailed records, and negotiate a resolution that works for both parties.

Q10. What security measures should I take to protect invoice data?

Use secure and reputable invoicing software, regularly update passwords, and consider encryption to safeguard sensitive financial information.