Do you find it difficult to understand invoices for projects? Normally, all you have to do is open an invoice template, add it to your email, and start typing. Nevertheless, prior to sending an invoice, there are other considerations to bear in mind.

As a beginner freelancer, you could be at a loss for what to do first. Maybe you’ve been in business for a long, but now is the moment to think about new methods to improve customer billing.

There may be a delay in processing the invoices for all parties involved with your organization. Consequently, it might be quite beneficial to have an all-inclusive solution for managing bills if you want to send out invoices quickly and get payments on time.

Moreover, it has the potential to lessen administrative hassles and the creation of duplicate papers. An organization may keep track of all invoices generated with the use of invoice management software, which handles and registers invoices from suppliers.

Some of the information below may be useful to you. It will go over the basics of invoicing as well as the best ways to invoice customers effectively so that cash continues to flow in!

What’s an invoice?

A time-stamped invoice is a business document that details and documents a purchase or sale between two parties. An invoice will often lay out the details of a credit transaction, including the conditions of the agreement and any applicable payment options.

Paper receipts, bills of sale, debit notes, sales invoices, and electronic records are all possible invoicing forms.

When is a tax invoice necessary?

Every country has its own set of rules regarding tax invoicing. There are so many facts about the importance of complete tax invoice. The following are examples of frequent scenarios in which a tax invoice may be helpful:

- To prove that your company is legally able to collect tax on sales

- To indicate which invoice items are liable to tax and which ones are not (if relevant)

- In order to determine a time frame for tax accounting, such as monthly, quarterly, or yearly

Importance of complete tax invoice

Tax invoices showing sales taxes help sellers authenticate their company tax returns. Some may save their lives with this tax return. Some may be paying taxes.

Tax invoices allow customers to verify they paid taxes on purchases and claim tax credits.

Tax invoices help the government avoid tax evasion.

What are the benefits of complete tax invoice?

You should get compensation for your work, and you should be able to decide how much and when you get it.

You should make these things very clear when you begin working with someone, but the invoice is where you formally request payment. There are a number of benefits of complete tax invoice.

- It requires payment. Customers are unlikely to pay you in advance unless you send them an invoice, even if doing so is optional. Payment for products or services rendered prior to the issuance of an invoice is unusual, and voluntary settlement of obligations without a prompt is much more uncommon.

- It is helpful to remind clients of the services or items delivered through invoices. Because it is a detailed invoice, clients can easily understand exactly what they are paying for.

- You may use them to keep track of things. When it comes to sales, income, and spending, companies are required by HMRC to keep records for a maximum of six years, but self-employed individuals only need to preserve them for five years. You run the risk of receiving a substantial charge from the Revenue if your records of invoices issued and received are not current and correct.

- In doing so, you may promote your company and its image in a good light. This includes both the invoice procedure and the document itself, which should be properly organized with the company logo, URL, and use of formal language. Streamlined invoicing and payment collection processes lead to happier customers. A company’s reputation might also take a hit from badly maintained systems.

Consequences of incomplete tax invoice

There are consequences of incomplete tax invoice penalties for violations of GST, such as the non-issue or inaccuracy of tax invoices. The consequences of incomplete tax invoice are detailed below:

| Situation | Penalty |

| Not generating an invoice | Maximum of 100% of payable tax or Rs.10,000 |

| Incorrect invoice | Rs.25,000 per incorrect invoice |

| Penalty for aiding fraud | Maximum Rs. 25,000 |

| A penalty for not submitting GSTR | 10% of tax due or Rs. 10,000 |

| Late GSTR filing penalty. | As per Act, late fees are Rs. 100 per day. The total is 100 for CGST and 100 for SGST. |

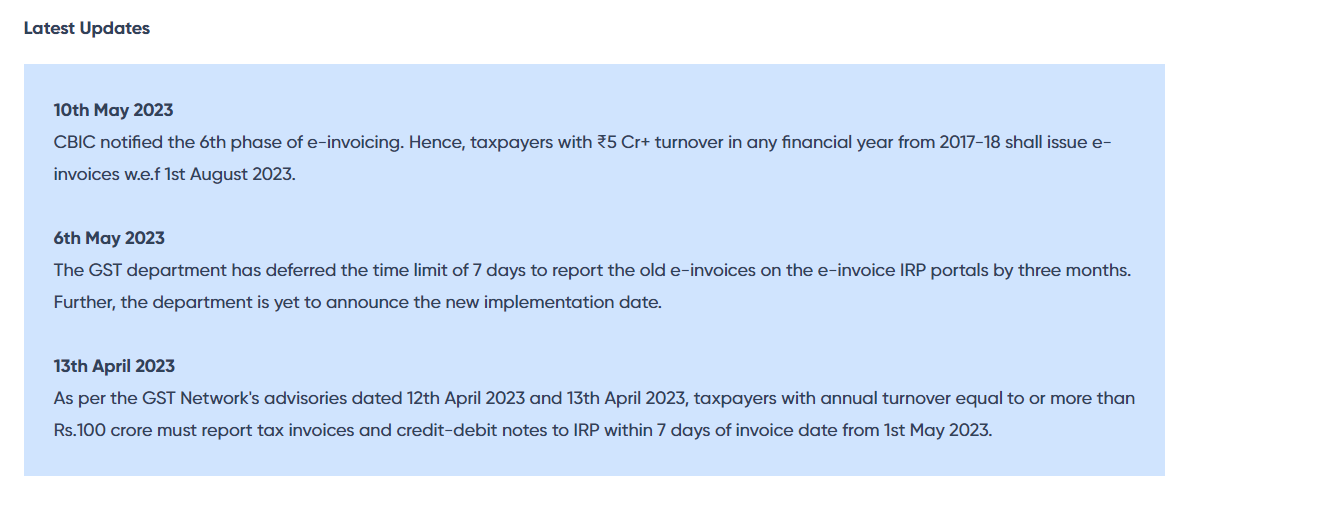

Latest Updates

How to avoid incomplete tax invoice

How to avoid incomplete tax invoice

In order to comply with tax authorities, your tax invoice must have all the necessary information. As a rule, this comprises:

- Be sure to include the tax registration number, supplier’s name, and address.

- In addition to the client’s name and address, if applicable, please provide their tax identification number.

- Make sure that the date of issue and unique sequential numbers are included on each invoice.

- Products and services should be defined precisely.

- Please specify the unit count and cost.

- Declare the whole amount due.

- Please provide VAT, GST, and payable amounts.

- Maintain a sequential tax invoice numbering system.

- Make sure the purchase date matches the delivery date.

Best practices for complete tax invoice

In order to make sure that billing is accurate and done on time, you should utilize invoicing software. This will help streamline the invoicing process. Not only can it help you keep tabs on payments and late bills, but it may also automate the process of making and distributing invoices. In theory, it might reduce error rates and save time. Sp lets a look into best practices for complete tax invoice in detail.

#1. Verified and precise billing details

Accurate information is required for tax invoicing. Businesses should check that their invoices have all the necessary details.

- Name of the client and their contact details

- Your company’s name and contact details

- Issue date and invoice number

- Services to clients

- Individual service costs

- Taxes, discounts, additional costs

- The sum due

- Terms of payment

- The payment deadline

- Late or nonpayment policies

#2. Create a genuine business invoice.

Include all of the costs associated with a transaction in your company invoices, including the item(s) price, packing, delivery, hourly rate, and more. Giving the consumer the information might assist them in understanding how you arrived at the total cost.

For instance, if you’re providing accounting or gardening services to a client, it would be helpful to provide a copy of your logbook or summary of hours. This way, they can see how many hours you worked and how much you charged each hour.

You could lose time and money if a client challenges an invoice since it might delay the whole invoicing process. They may help keep arguments and disputes to a minimum by making sure they fully comprehend the invoice.

#3. Become familiar with your clientele.

When it comes to customer care and support, the whole process of invoicing and payment is a practice. However, adding a personal touch may go a long way toward developing client loyalty.

Including a brief letter of gratitude on each invoice might be a straightforward way to accomplish this. After a predetermined number of meetings, you may also think about including a discount coupon on the invoices.

If you want to add some warmth to otherwise transactional messages, you can do so by including a remark that expresses gratitude to your customers and encourages them to get in touch with you with any queries or to submit a review for your company.

#4. Clear payment terms

Companies should include the payment due date and the allowed forms of payment on their invoices. This may assist in reducing misunderstanding and lower the possibility of late payment.

#5. The payment policies should be transparent.

When you are the owner of a small business, having rules that are both clear and well-enforced protects your time and cash flow while also setting expectations for your customers. Each of your invoices needs to have information regarding:

- How to make a payment

- Modes of payment that are valid

- Penalties for payments that are either late or missing

- Charges for absenteeism or cancellation

- Where to send inquiries or complaints

- In the case that you charge a deposit or make payments in instalments, upcoming payments

You should always rely on your payment conditions if there is a problem. Having them written down should make it easier to answer any inquiries or address any concerns that may arise during the billing process.

However, the value of your terms is directly proportional to the degree to which you enforce them.

#6. Invoices should be reconciled on a regular basis.

It is important for businesses to carry out invoice reconciliation on a frequent basis in order to guarantee that all payments have been received and recorded accurately. This might help locate and address any problems or inconsistencies that may have occurred.

#7. Make invoices a form of business promotion.

Even more so than with several email newsletters, your client pays more attention when they read the invoice you send.

Never, ever assume anything! Promoting your goods and services is possible with the help of invoices. Please do not overwhelm the document with requests; nevertheless, please inform them of any promotions or special deals you run.

The best way to show your appreciation for their support is to offer them a special discount on their bill.

You may speed up receiving funds from your client or customer by accommodating their payment choices and schedules, which can also improve their customer experience.

Conclusion

Although sending out tax invoices to customers may be time-consuming, it is the most efficient way to ensure that your business continues to function without downtime. Software that manages projects and generates tax invoices might be useful to you in optimizing the process of billing customers and the importance of complete tax invoices.

Whether you run a small or large company, automating billing and payment processes can help you save time and minimize the possibility of making mistakes. Physical paper invoices were often missing and disorganized throughout the billing process, including each stage. Consequently, the utilization of automated software may assist you in preserving a professional image.

FAQs

-

What is the purpose of an invoice?

Not only does it function as a paper trail for accounting purposes, but it also serves the aim of informing a client that payment becomes due.

-

Can a tax invoice be used as a receipt?

Tax invoices differ from receipts. A tax invoice lists the goods and services and the tax rate, whereas a receipt certifies payment.

-

How does GST affect tax invoices?

A registered taxpayer can submit a tax invoice to another taxpayer with complete transaction details, including the total tax payable, under the GST system. The GST system relies on it for tax collection and computation. It’s important to include all GST-required information on tax invoices to avoid fines.

-

How do tax invoices vary from ordinary invoices?

Tax invoices include the whole tax amount due, unlike standard invoices. Tax invoices are used for taxes, while regular invoices are used for goods and services payments.

-

Do tax invoices affect bills?

Both forms of invoices include payment details, but professional tax invoices are more detailed.

They have all the information the customer needs for their taxes, including details on the services or items they purchased. A bill can refer to any document that requests payment.

-

Who is responsible for writing the invoice?

An invoice, bill, or tab is a type of business document that sellers often give to buyers after a sale. It details the goods or services the seller-provided, the quantity of those goods or services, and the agreed-upon price.

-

Is tax invoice writing required?

You and your customer will have complete visibility into all financial dealings if you send tax invoices, but it’s not required. Accounting and tax return filing with the IRS can benefit from this.

-

Do you send out invoices before or after the payment has been received?

Your sector and the specifics of your company deal will determine this to a large extent. While some invoices serve as official estimates and payment due dates for specific companies, most bills are provided at regular intervals during a project or after the work or product has been delivered.

-

In what time frame is an invoice processed?

How your customer handles invoices can have a significant impact on this. Nevertheless, it is normal to anticipate payment no later than 30 days after invoice receipt. If all parties agree beforehand, some companies may choose shorter or longer payment periods.

-

Is an Invoice Proof of Payment?

The standard function of an invoice is to indicate the due date for payment.