GST Rates & HSN Codes on Make-up, Perfumes, Skin Care & Hair Products – Chapter 33

Introduction The GST Council of India notified the GST rate for different goods and services in June 2017. Also, the Indian Government mapped the GST

Introduction The GST Council of India notified the GST rate for different goods and services in June 2017. Also, the Indian Government mapped the GST

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

Approximately 300 million individuals are attempting to initiate around 150 million businesses globally. Given a startup success rate of about one-third, it can be estimated

Embarking on the journey of classifying chemical products with the right Harmonized System of Nomenclature (HSN) code can feel like navigating through a dense forest

The 42nd GST Council meeting was conducted virtually on October 5, 2020, with Smt. Nirmala Sitharaman, the Finance Minister, serving as chairperson. Along with senior

Harmonized System of Nomenclature (HSN) codes offer a uniform item classification system essential to global trade and business. Adopted by numerous nations globally, these codes

Stakeholders in international trade, governments, and enterprises can benefit from adopting and using Harmonised System of Nomenclature (HSN) codes. Products can be categorised systematically and

Introduction The HSN code or Harmonized System Nomenclature is a globally accepted six or 8-digit product classification method used for trading purposes. It is maintained

Introduction The Harmonized System of Nomenclature (HSN) designations serve as a standardized product classification system essential to international trade. The World Customs Organization (WCO) created

परिचय जब से भारत में जीएसटी (वस्तु एवं सेवा कर) लागू किया गया, उद्यमियों और अंतिम ग्राहकों दोनों ने इसके लाभ और हानि के बारे

Construction services play a crucial role in India’s economic framework, representing a substantial sector that makes an approximate 9% contribution to the nation’s GDP. GST,

Every regular taxpayer under Goods and Services Tax (GST) in India is required to file GSTR-9. This is particularly true for taxpayers whose annual turnover

GST applies to every supply of goods or services unless a specific exemption is provided by GST law. “Labour Services” is a very usual nature

GST on fruit, nuts and peels of citrus fruits and melons According to section 2 of chapter 8 of the GST Act, the GST tax

Plastic products are classified under different HSN codes based on their specific characteristics and composition. The most common HSN code for plastic products is 39.

With the implementation of GST system in India significant structural changes shaped businesses operate and pay taxes. One of the crucial aspects of GST is

Do you start your mornings with a potent dose of caffeine from a freshly brewed cup of Joe? Or do you prefer a slightly less

In the Evolving world of technology, computers and laptops have become an integral part of our daily lives. Whether for work, education, communication or entertainment,

India is known for its rich agricultural heritage, producing a wide variety of cereals, including rice, wheat, barley, and more, with the introduction of the

“Reading is an act of civilisation; it’s one of the greatest acts of civilisation because it takes the free raw material of the mind and

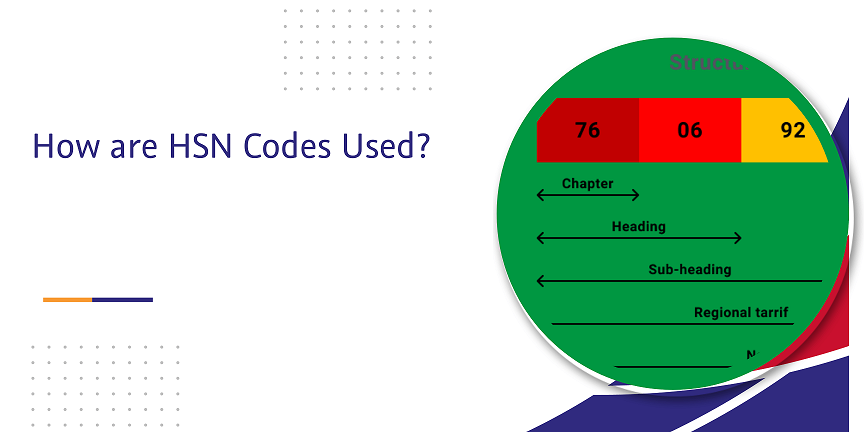

What is HSN Code HSN stands for ‘Harmonized System Nomenclature’. The WCO (World Customs Organization) developed It is a multipurpose international product nomenclature that first

In the dynamic landscape of tax compliance, keeping current is vital for business success. GST offers transparency updates on tax obligations and enhances the overall

Understanding HSN Code, It’s Full Form? HSN stands for “Harmonized System of Nomenclature”. The HSN code is a numerical classification system used to categorize goods

Works contract means a service contract involving supply, a mixture of service and transfer of goods. Examples of works contracts are the construction of a

What is HSN Code If you are a business owner in India, you are likely familiar with the Goods and Services Tax (GST). The GST

In the dynamic landscape of taxation, the Goods and Services Tax (GST) has been a game-changer in simplifying the indirect tax system in India. One

Understanding HSN Codes and Their Significance in GST HSN, or Harmonized System of Nomenclature, is a globally recognised classification system for products. It’s a standardised

[ez-toc]Implementation of mandatory mentioning of HSN codes in GSTR-1 In the intricate tapestry of the Goods and Services Tax (GST) framework, HSN codes are essential

© Copyright Logo Infosoft. All Rights Reserved