Introduction

Goods and Services Tax (GST) is a behind-the-scenes tax that influences the prices you pay when buying goods or using services. It combines taxes on both goods and services, simplifying the tax system. When you make a purchase or avail of a service, a portion of the money you pay contributes to the government as GST. Understanding the liability of GST involves identifying who needs to pay this tax. Think of it as a small portion of your spending that goes to the government. This “liability” is about recognizing which individuals or businesses are responsible for contributing this portion to the government. In upcoming discussions, we’ll delve into the details of GST liability criteria, explore entities liable for GST, understand GST exemptions and exceptions, outline the responsibilities of GST payers, and assess the impact of GST on different sectors.

Understanding GST Liability

When you buy something or use a service, a part of the money you spend goes to the government as GST. “Liability” here means responsibility. So, this is all about figuring out who has the responsibility or obligation to pay this tax.

Here’s a breakdown:

-

Registration Thresholds:

- Businesses need to register for GST if their yearly sales go beyond a set limit, and understanding these limits is crucial to know when GST registration is required.

-

Taxable Supplies:

- GST is applied to the sale of goods and services. This section explains the kinds of transactions considered taxable supplies, forming the basis for GST liability.

-

Interstate Transactions:

- When businesses conduct transactions across state borders, they engage in interstate transactions, which come with specific considerations for GST liability.

-

Reverse Charge Mechanism:

- In certain situations, the responsibility to pay GST shifts from the seller to the buyer. This is called the reverse charge mechanism, and knowing when it applies is crucial.

-

Time of Supply:

- GST liability is connected to when a transaction occurs. This section clarifies the events triggering liability concerning the timing of the supply.

-

Exemptions and Composition Scheme:

- Some transactions may be exempt from GST, and there’s a composition scheme for specific businesses. This part explains these aspects and their impact on GST liability.

-

Input Tax Credit (ITC):

- Businesses can balance the GST they pay on purchases against the GST they collect on sales. Understanding Input Tax Credit is vital for effective management of GST liability.

-

Voluntary Registration:

- Even if a business doesn’t meet the mandatory turnover threshold, it can opt for GST registration voluntarily. This section explores the reasons and considerations for such voluntary registration.

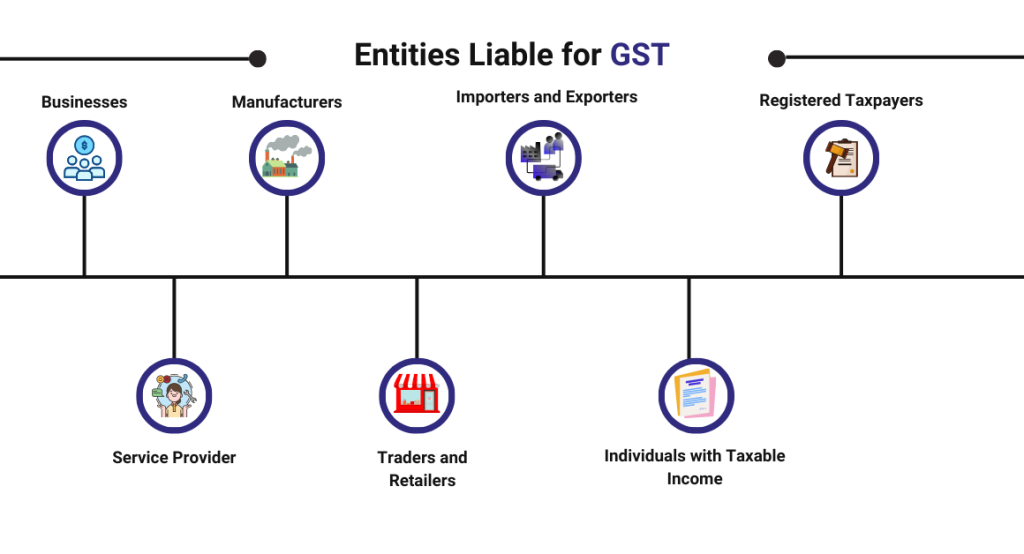

Entities Liable for GST

It focuses on identifying the different types of individuals or businesses that are obligated to pay the Goods and Services Tax (GST). In simpler terms, it’s about figuring out who needs to contribute a small part of the money from their transactions to the government as GST.

In the realm of GST, several entities or players are involved, and each has a role to play in contributing to this tax. The entities liable for GST include:

-

Businesses:

- Companies and enterprises involved in buying or selling goods and services, regardless of size, often have GST liability based on their transactions.

-

Service Providers:

- Individuals or companies offering services, like consultancy or professional services, fall under GST liability.

-

Manufacturers:

- Entities engaged in producing goods, including companies that create and sell physical products, typically have GST liability.

-

Traders and Retailers:

- Those in the trade and retail of goods, including wholesalers and retailers, are liable for GST to ensure its application at various stages of the distribution process.

-

Importers and Exporters:

- Businesses involved in international trade, whether importing or exporting goods, have GST liability associated with their cross-border transactions.

-

Individuals with Taxable Income:

- Individuals with significant taxable income, especially if engaged in business activities, may also have GST liability in some cases.

-

Registered Taxpayers:

- Entities meeting specific criteria, like reaching a turnover threshold, are required to register for GST, making them liable to comply with GST regulations and fulfill their tax obligations.

Criteria for GST Liability

It outlines the conditions that determine when individuals or businesses need to pay Goods and Services Tax (GST) in India. Let’s break down these criteria in simple terms:

-

Turnover Threshold:

- When a business’s total sales cross a certain limit (threshold), it becomes obligated to pay GST, with variations in this limit across states and business types.

-

Mandatory Registration:

- Some businesses must register for GST even if their turnover is below the threshold, based on their nature or specific sectors outlined by tax authorities.

-

Interstate Transactions:

- Businesses engaging in transactions between different states are generally liable for GST, ensuring proper taxation of goods and services moving across state borders.

-

Supply of Goods and Services:

- Any entity involved in supplying goods or services, including manufacturers, service providers, traders, and retailers, is likely to have GST liability.

-

E-commerce Operators:

- Companies operating online platforms facilitating the sale of goods or services are also liable for GST, ensuring online transactions are part of the tax system.

-

Taxable Individuals:

- Individuals with significant taxable income, especially those in business activities, may have GST liability.

Exemptions and Exceptions

In GST refer to certain special cases where individuals or businesses may not have to pay GST or where specific rules apply. Here are the details:

-

Small Businesses:

- Some small businesses with a turnover below a specified limit might be exempt from GST. This limit can vary based on the nature of the business.

-

Essential Goods and Services:

- Certain essential items like food, healthcare, and education services may be exempt from GST or have lower tax rates to make them more affordable.

-

Exported Goods and Services:

- Goods and services meant for export (sending outside India) could be exempt from GST or eligible for a refund, promoting international trade.

-

Specific Services:

- Some services, such as healthcare and educational services, might enjoy exemptions or special treatment under GST.

-

Government Transactions:

- Certain transactions involving the government or government agencies may be exempt or have specific rules under GST.

-

Precious Metals:

- The sale of precious metals like gold may have specific rules, including exemptions or different tax rates.

-

Agricultural Products:

- Some agricultural products and related services might have special provisions or exemptions under GST.

Responsibilities of GST Payers

The responsibilities of GST payers involve things they need to do to follow the rules of Goods and Services Tax (GST). Let’s break it down:

-

Registration:

- GST payers must register their business with the government by providing details to tax authorities if they meet the criteria.

-

Charge GST on Sales:

- When selling goods or services, GST payers add the right amount of tax to the selling price, collecting this extra money to later remit it to the government.

-

File Regular Returns:

- Payers regularly report to the government on how much GST they collected and paid by filing returns, akin to reports on their sales and purchases.

-

Maintain Records:

- Keeping accurate records of all sales, purchases, and expenses is crucial for filling out precise GST returns.

-

Pay GST on Time:

- Timely payment of the correct amount of GST is crucial to avoid penalties or issues with tax authorities.

-

Comply with GST Rules:

- Adhering to government-set rules is essential, and payers must stay informed about any changes in GST regulations, adjusting their business practices accordingly.

-

Inform About Changes:

- Payers need to promptly inform the government about any changes in their business details, such as address or ownership.

-

Refund Claims (if applicable):

- If a payer has overpaid GST, they can claim a refund by following the prescribed process to recover the extra money.

Also Read: GST Taxpayer Responsibilities

Impact of GST Liability on Different Sectors

| Sector | Impact of GST Liability |

| Manufacturing | Manufacturers must consider GST when pricing their products, accounting for the tax on raw materials and adjusting their pricing strategy accordingly. |

| Retail | Retailers dealing with consumers need proper GST management to set accurate prices, ensuring neither overcharging nor undercharging customers. |

| Agriculture | Certain agricultural products may have exemptions or lower GST rates, ensuring affordability for both farmers and consumers, and understanding these provisions is crucial for the agricultural sector. |

| Services | Service businesses, like consultants, need to include GST in their charges, impacting the overall cost of services for clients. |

| Export | Exporters can claim refunds for the GST paid on inputs used in exported goods, promoting competitiveness in the international market and encouraging export-oriented businesses. |

| Construction | Construction companies, dealing with various material purchases affected by GST, must consider these costs when bidding for projects and managing budgets. |

| E-commerce | E-commerce platforms play a vital role in transactions and must ensure sellers comply with GST regulations, collecting and remitting the appropriate amount of tax to the government. |

Also Read: How Does GST Impact The Service Sector?

Penalties and Consequences

It refer to what happens if individuals or businesses don’t follow the rules. Here’s a detailed breakdown:

-

Late Payment:

- If GST payment isn’t made on time, there might be a penalty—a kind of fine for not paying the tax promptly.

-

Incorrect Information:

- Providing wrong or inaccurate information in GST returns can have consequences. It’s crucial to give correct details about sales, purchases, and financial transactions.

-

Non-Compliance:

- Businesses not following GST rules may face penalties, including not registering when required, not filing returns, or not maintaining proper records.

-

Underreporting Sales:

- Not declaring the correct amount of sales can lead to consequences. Reporting all sales accurately is essential to avoid penalties.

-

Avoiding Tax:

- Trying to avoid paying the correct amount of GST through transaction manipulation or income non-reporting can have serious consequences, with severe penalties for tax evasion.

-

Audit Issues:

- If tax authorities find discrepancies during an audit, there can be consequences. It’s vital to cooperate during audits and ensure all records are in order.

-

Repeat Offenses:

- Repeated failure to follow GST rules may result in increased penalties, with authorities taking stricter actions against consistent non-compliance.

-

Loss of Reputation:

- Businesses facing penalties and consequences might suffer damage to their reputation. Maintaining a good standing by adhering to tax regulations is crucial.

Also read: Penalty And Offences Under GST

Conclusion

We explores the world of GST, focusing on understanding who bears the responsibility for this tax. The key takeaways include the necessity for businesses to register, follow GST rules, and fulfill their tax obligations to avoid penalties. The impact of GST liability varies across sectors, affecting pricing, costs, and trade dynamics. Overall, recognizing the criteria, exemptions, and consequences associated with GST liability contributes to a fair and transparent tax system, ensuring everyone plays by the rules and contributes to government funds appropriately.

FAQ’s

-

What is GST, and why is it important?

GST, or Goods and Services Tax, is a type of tax on goods and services. It’s important because it simplifies the tax system, replacing multiple taxes with one comprehensive tax.

-

Who needs to pay GST?

Businesses, service providers, and individuals with significant taxable income may need to pay GST, depending on certain criteria.

-

How do I know if I’m liable to pay GST?

You are liable if you run a business, provide services, or meet specific turnover criteria. It’s important to understand the rules to determine your liability.

-

Are there exemptions from paying GST?

Yes, some small businesses, essential goods, and certain services may be exempt or have lower GST rates.

-

Can individuals be liable for GST?

Yes, individuals with significant taxable income or those engaged in business activities may be liable to pay GST.

-

What are the responsibilities of GST payers?

GST payers need to register, charge GST on sales, file regular returns, maintain records, and comply with GST rules to meet their responsibilities.

-

How does GST impact different sectors?

GST affects manufacturing, retail, agriculture, services, export, healthcare, education, construction, and e-commerce differently, influencing pricing, costs, and trade dynamics.

-

What happens if I don’t pay GST on time?

Late payment may lead to penalties. It’s crucial to pay the right amount on time to avoid consequences.

-

Can there be penalties for providing incorrect information in GST returns?

Yes, providing inaccurate information may lead to penalties. It’s essential to ensure the details in GST returns are correct.

-

How does GST impact businesses that trade internationally?

Businesses involved in export may benefit from GST refunds, making their products competitive in the international market. Understanding international trade rules is important for such businesses.