Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in many countries around the world. As a taxpayer, understanding and fulfilling your responsibilities under the GST system is crucial to ensure compliance and avoid penalties. This article aims to provide an overview of the various obligations and duties that GST taxpayers need to adhere to. From registering for GST and obtaining a GST Identification Number (GSTIN) to maintaining accurate records, collecting and depositing GST payments, filing GST returns, and meeting reporting obligations, we will explore the essential aspects of GST taxpayer responsibilities. Additionally, we will discuss audits, assessments, penalty provisions, and offer proactive steps to ensure GST compliance and minimize any potential risks. Whether you are a business owner or an individual, this article will help you navigate the GST landscape with confidence and stay on the right side of the law.

What is GST?

Taxes – they’re as unavoidable as a slow internet connection. But fear not, because the Goods and Services Tax (GST) is here to make things a little less confusing. GST is a consumption-based tax that is levied on the sale of goods and services. It’s like the ultimate tag team of taxes, combining the strengths of different taxes into one unified system.

Benefits of GST Implementation

So, why should you care about this fancy new tax? Well, first of all, GST simplifies the taxation process. No more juggling multiple taxes and trying to figure out which one applies to what. Second, it promotes transparency and reduces the scope for tax evasion. And let’s not forget that GST helps to eliminate the cascading effect of taxes, which means you won’t end up paying tax on tax on tax. Talk about a win-win!

Understanding Taxpayer Responsibilities under GST

Overview of GST Taxpayer Responsibilities

Now that you have a basic understanding of GST, it’s time to dive into the responsibilities that come with it. As a GST taxpayer, you have a few important tasks on your plate. These include registering for GST, maintaining accurate records, and filing timely returns. Think of it as a taxation trifecta – you can’t have one without the other two.

Importance of Complying with GST Regulations

Compliance may not be the sexiest word in the dictionary, but when it comes to GST, it’s essential. Non-compliance can lead to penalties, fines, and a whole lot of paperwork that nobody wants to deal with. By following the rules and regulations set forth by GST authorities, you can avoid unnecessary headaches and keep your tax affairs in order. Plus, who doesn’t love the peace of mind that comes with being on the right side of the law?

Registering for GST and Obtaining a GSTIN (GST Identification Number)

Eligibility Criteria for GST Registration

Ready to take the plunge into the world of GST? Before you do, you need to check if you meet the eligibility criteria for registration. Generally, businesses with an annual turnover above a certain threshold are required to register for GST. It’s like a VIP club, but instead of bottle service, you get a fancy GST Identification Number (GSTIN).

Documents Required for GST Registration

Now that you’re eligible, it’s time to gather up all the necessary documents for registration. Don’t worry, it’s not as daunting as it sounds. You’ll need things like proof of identity, address, and the details of your business. Just think of it as a glorified scavenger hunt – except you’re hunting for paperwork instead of hidden treasures.

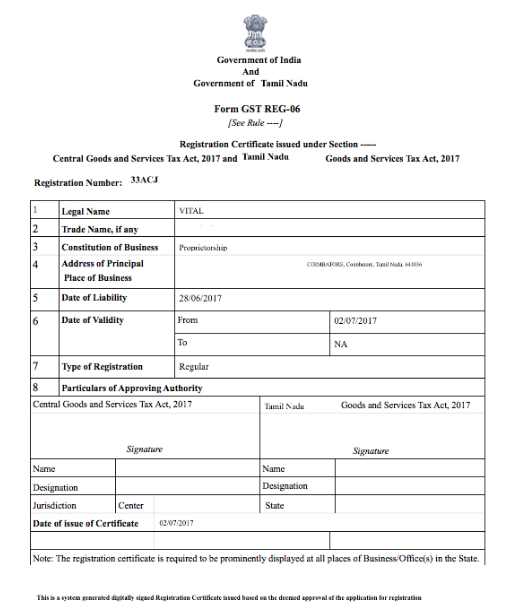

Process of Obtaining GSTIN

Congratulations, you’ve made it through the eligibility criteria and gathered all the documents. Now it’s time for the grand finale – obtaining your very own GSTIN. This involves submitting your application online through the GST portal and waiting for the authorities to work their magic. It’s like entering a lottery, except instead of winning money, you get a shiny new tax identification number. Definitely, a win in the world of taxes!

Also Read: How To Register For GST And Obtain Your GSTIN Number?

Maintaining Accurate and Timely Records for GST Compliance

Importance of Proper Record-Keeping

Remember all those times your mom told you to clean your room and you thought it was just a hassle? Well, maintaining proper records for GST compliance is like cleaning your room – a necessary evil. Accurate and timely record-keeping is crucial to ensure that you can provide the authorities with all the necessary information when the time comes. Plus, it helps you keep track of your business transactions and stay organized. Mama would be proud!

Essential Information to Maintain for GST Compliance

When it comes to record-keeping, there are a few key pieces of information you need to keep on your radar. This includes details of all your sales and purchases, invoices, tax payments, and any other relevant documentation. It’s kind of like being a detective, except instead of solving crimes, you’re solving tax puzzles. And trust us, Sherlock Holmes has nothing on a well-maintained set of GST records.

Best Practices for Record-Keeping

Now that you know what information to maintain, it’s time to talk about best practices. The key here is to be organized and consistent. Keep all your records in one place, use accounting software to make your life easier, and make sure to update your records regularly. It’s like starting a new exercise routine – consistency is key. If you can make record-keeping a habit, you’ll be well-prepared for any tax audits that come your way. Just remember to stretch before you start, both physically and metaphorically!

And there you have it – a crash course in GST taxpayer responsibilities. Now go forth and conquer the world of taxes with confidence and a touch of wit. Happy taxing, folks! Professional Assistance for Complex Matters.

Also Read: Different Types of Documentation Required for GST Compliance

Collecting and Depositing GST Payments

Understanding GST Payment Mechanism

Collecting and depositing GST payments might sound like a daunting task, but fear not, it’s not as complicated as it sounds. GST payment mechanism refers to the process of collecting the Goods and Services Tax from your customers and then depositing it to the government. It’s like being the middleman between your customers and the taxman.

Collecting GST from Customers

When it comes to collecting GST from your customers, the key is to be transparent and upfront about it. Make sure to clearly mention the GST amount on your invoices and communicate the total price including GST. Nobody likes hidden surprises, especially when it comes to taxes.

Depositing GST Payments to the Government

Once you’ve collected the GST from your customers, it’s time to deposit it to the government. You can do this through the GST portal or any authorized bank. Remember, it’s important to deposit the GST payments within the specified time frame to avoid any penalties. Nobody wants to anger the taxman!

Also Read: How to Check GST Payment Status?

Filing GST Returns and Meeting Reporting Obligations

Overview of GST Return Filing

Filing GST returns might not be the most exciting task on your to-do list, but it’s an important one. GST return filing involves reporting your sales, purchases, and GST liability to the government. It’s like giving a progress report to the taxman.

Different Types of GST Returns

There are different types of GST returns depending on the nature of your business. It’s like a menu with options catered to your specific needs. Whether you’re a regular taxpayer, a composition scheme participant, or an input service distributor, there’s a GST return form just for you.

Reporting Obligations for Specific Business Scenarios

Sometimes, specific business scenarios can make your reporting obligations a bit more challenging. For example, if you’re involved in exports or if you have branches in different states, there are additional requirements you need to fulfill. It’s like having extra levels in a video game – a bit more challenging, but not impossible.

Audits, Assessments, and Penalty Provisions under GST

Types of GST Audits

Audits! Just the word can send shivers down your spine. But don’t worry, it’s not as scary as it sounds. GST audits are conducted by the tax authorities to ensure compliance and accuracy in your GST filings. There are different types of audits, such as random audits, audit by department, or special audits. Think of it as a thorough inspection of your financial records.

Assessments and Reconciliation Processes

Assessments and reconciliations can sometimes feel like solving a puzzle. After the audit, the tax authorities may assess your GST liability or initiate a reconciliation process to ensure everything is in order. It’s like double-checking your work to make sure all the pieces fit perfectly.

Penalties for Non-Compliance and Avoiding Penalties

Nobody likes penalties, especially when it comes to taxes. Non-compliance with GST regulations can result in penalties, fines, or even legal repercussions. But fear not, the key to avoiding penalties is to stay informed and be proactive. Keep yourself updated with the latest GST regulations and seek professional assistance when needed.

Proactive Steps to Ensure GST Compliance and Avoid Penalties

Regularly Reviewing GST Regulations and Updates

Staying informed is the best defense against non-compliance. Make it a habit to regularly review GST regulations and updates. It’s like reading the latest fashion trends but for taxes. Be in the know and avoid any surprises.

Conducting Internal GST Compliance Audits

Just like Spring cleaning, conducting internal GST compliance audits can help you keep things in order. Take a close look at your business processes, documentation, and record-keeping practices. It’s like decluttering your tax responsibilities, making sure everything is in its rightful place.

Seeking Professional Assistance for Complex Matters

Sometimes, things can get a little too complex for our liking. When that happens, it’s best to seek professional assistance. Tax consultants or accountants can help navigate through complex scenarios and ensure you’re on the right track. It’s like having a superhero sidekick to help you defeat the tax villains. In conclusion, understanding and fulfilling your responsibilities as a GST taxpayer is vital for maintaining compliance and avoiding penalties. By registering for GST, maintaining accurate records, collecting and depositing payments, filing returns, and meeting reporting obligations, you can ensure that you are adhering to the GST regulations. Additionally, staying updated on any changes in GST laws, conducting internal compliance audits, and seeking professional guidance when needed are proactive steps that can help you stay on track. By following these guidelines, you can navigate the GST system effectively and ensure a smooth and compliant taxation process.

FAQ

1. Do I need to register for GST?

Registration for GST is mandatory if your annual turnover exceeds the prescribed threshold set by the tax authorities. However, certain businesses may opt for voluntary registration even if their turnover is below the threshold to avail of the benefits associated with GST registration. It is advisable to check the specific regulations and consult with a tax professional to determine your registration obligations.

2. What are the consequences of non-compliance with GST regulations?

Non-compliance with GST regulations can lead to various penalties and legal consequences. These may include monetary fines, interest on late payments, suspension or cancellation of GST registration, and even criminal prosecution in severe cases. It is crucial to understand and fulfill your GST responsibilities to avoid such penalties and maintain a good compliance record.

3. How often do I need to file GST returns?

The frequency of filing GST returns depends on the type of taxpayer and the turnover. Generally, regular taxpayers are required to file monthly or quarterly returns, while small taxpayers may have the option to file returns on a quarterly basis. It is essential to familiarize yourself with the specific requirements in your jurisdiction and ensure timely filing to avoid any penalties or late fees.

4. Can I claim input tax credits under GST?

Yes, under GST, eligible taxpayers can claim input tax credits. Input tax credit allows you to offset the GST paid on purchases or expenses against the GST collected on sales. It helps in reducing the overall tax liability. However, there are certain conditions and restrictions related to input tax credit claims, and proper documentation and compliance with GST regulations are necessary to avail of this benefit.