The Goods and Services Tax (GST) registration is a mandatory requirement for businesses and individuals operating in countries where GST is implemented. Registering for GST ensures compliance with tax regulations and allows businesses to collect and remit the appropriate taxes. However, knowing where to submit the GST registration application form is crucial for a smooth and efficient registration process. In this article, we will explore the various methods and platforms available for submitting the GST registration application form, whether online through government portals or offline through traditional methods. Additionally, we will provide an overview of the required documents and step-by-step guidance to help you navigate the GST registration process.

GST registration

So, you’ve decided to jump on the GST bandwagon and register your business for it. Good move! But now you might be wondering, where on earth do I submit the application form? Fear not, my friend, for I am here to guide you through this perplexing process.

Firstly, let’s quickly touch upon what GST registration is all about. GST (Goods and Services Tax) is a unified tax system that has been implemented in many countries, including India. It aims to streamline the taxation process by replacing multiple indirect taxes with a single tax.

Importance of GST registration

Now, why should you bother with getting registered for GST? Well, my friend, there are several benefits to it. Firstly, it is mandatory for businesses whose turnover exceeds a certain threshold. It also enables you to avail various input tax credits, making your business more cost-effective. Additionally, being GST-registered gives your business credibility and opens up new avenues for growth and expansion. So, it’s definitely a step worth taking!

Online platforms for GST registration

To streamline the GST registration process, businesses in India can leverage various online platforms.

Here’s an overview of the key platforms, presented in a table format for clarity:

| Platform | Description |

| GST Portal (www.gst.gov.in) | – The official government-run portal for GST registration and compliance. – Free to use. – Offers comprehensive services, including application, document upload, payment, status tracking, return filing, and more. |

| GST Suvidha Providers (GSPs) | – Third-party service providers authorized by the GSTN to facilitate registration and other GST-related activities. – Charge a fee for their services. – May offer additional features like integration with accounting software, assistance with compliance, and expert support. |

| Online Legal and Tax Services | – Platforms like Vakilsearch, ClearTax, LegalRaasta, and IndiaFilings provide GST registration services along with other legal and tax-related services. – Charge a fee for their services. – Offer user-friendly interfaces, expert guidance, and support throughout the process. |

Factors to Consider When Choosing a Platform:

- Ease of Use: Evaluate the platform’s interface and user experience.

- Features: Ensure it offers the services you need, such as return filing, compliance assistance, and customer support.

- Reliability: Choose a platform with a proven track record and secure infrastructure.

- Cost: Compare fees charged by different platforms.

- Expertise: Consider platforms with GST experts who can provide guidance and support.

Additional Considerations:

- Direct Filing: Businesses can directly file for GST registration on the GST portal without using third-party services.

- Government-Run Apps: The government offers mobile apps like “GST Rate Finder” and “GST App” for tax rate information and compliance assistance.

- State-Specific Registration: Certain states may have their own online portals for GST registration.

Introduction to online registration

In today’s digital world, it’s no surprise that there are online platforms available for GST registration. These platforms make the registration process quick, convenient, and hassle-free.

Popular online platforms for GST registration

When it comes to online platforms for GST registration, there are a few key players in the market. Platforms like ClearTax, GSTN, and Taxmann provide user-friendly interfaces and step-by-step guidance to help you navigate the registration process smoothly. These platforms often have additional features like GST compliance tools, which can be handy for managing your GST-related tasks in the long run.

Also Read: How To do GST Registration Online

Offline methods for GST registration

Offline registration

Now, we understand that not everyone is a fan of the digital realm. If you prefer to take the traditional route, fret not, because offline methods for GST registration are still available.

Traditional methods for submitting GST registration

When it comes to offline methods, the most common way to submit your GST registration application is by visiting the nearest GST Seva Kendra or GST office. Here, you can collect the necessary forms, fill them out, and submit them to the concerned authority. Remember to carry all the required documents along, as missing even one can result in your application being rejected.

Government portals for submitting GST registration application

To facilitate GST registration, the Indian government has established multiple online portals designed to streamline the process.

Here’s a concise overview of the key portals, presented in a table format for clarity:

| Portal | Description |

| GST Portal (www.gst.gov.in) | – The primary and official government-run portal for GST registration and compliance. – Offers a comprehensive suite of services, including application submission, document upload, payment, return filing, and compliance management. – Integrates seamlessly with other government systems for efficient data exchange. |

| MCA21 (www.mca.gov.in) | – Portal managed by the Ministry of Corporate Affairs (MCA), primarily for company registration and compliance. – Offers GST registration services for companies incorporated through this portal. |

| Startup India Portal (www.startupindia.gov.in) | – Dedicated portal for startups in India, providing various services and support initiatives. – Facilitates GST registration for eligible startups. |

| Udyam Registration Portal (udyamregistration.gov.in) | – Portal for registering Micro, Small, and Medium Enterprises (MSMEs). – Offers integrated GST registration services for MSMEs. |

Key Considerations:

- Eligibility: Some portals cater to specific business types (e.g., startups, MSMEs).

- Integration: Choose a portal that aligns with existing business registrations or compliance platforms.

- Features: Assess the features and support offered by each portal to meet specific needs.

- Reliability: Ensure the portal is authorized by the government and has a strong reputation for reliability and data security.

Additional Considerations:

- Ease of Use: Opt for a portal with a user-friendly interface and clear instructions.

- Customer Support: Prioritize portals with reliable customer support to address queries or issues.

- Integration Capabilities: If using other business software, consider portals that integrate seamlessly.

Official government portals for GST registration

If you prefer to cut out the middleman and go straight to the source, the government has provided official portals for GST registration. The most well-known one is the GST portal (https://www.gst.gov.in), which is managed by the Goods and Services Tax Network (GSTN). This portal provides a one-stop solution for all your GST-related needs.

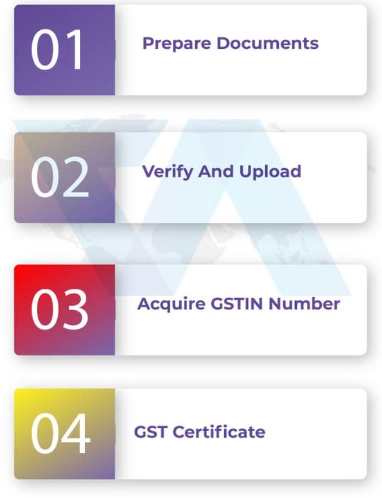

Step-by-step process of submitting application on government portals

Submitting your GST registration application on government portals is relatively straightforward. Just visit the official GST portal and follow the step-by-step instructions provided. Make sure you have all the necessary documents handy before you begin, as you’ll be asked to upload them during the application process. Take your time, double-check everything, and before you know it, you’ll be one step closer to becoming a proud GST-registered business owner!

Remember, whether you choose to go the online or offline route, ensuring your business is GST-registered is crucial for its growth and compliance. So, go ahead and submit that application form, my friend.

Authorized service providers for GST registration

Introduction to authorized service providers

When it comes to navigating the complex world of GST registration, sometimes a little expert help can go a long way. Authorized service providers are professionals or companies that specialize in assisting businesses with their GST registration applications. These service providers are trained and certified by the government to provide accurate and reliable guidance throughout the registration process.

Benefits of using authorized service providers

Using authorized service providers for your GST registration can bring numerous advantages. Firstly, these experts have an in-depth understanding of the registration requirements and can help you ensure that your application is error-free, increasing the chances of a successful registration. They can also provide timely updates on any changes in the registration process, saving you from potential headaches. Additionally, their expertise can help expedite the registration process, allowing you to start your business operations sooner.

Detailed steps for submitting GST registration form online

Preparing necessary documents for online submission

Before diving into the online submission process, it’s crucial to gather all the necessary documents. These typically include your PAN card, proof of address, photographs, and bank account details. Additionally, depending on your business type, you may need to provide additional documents such as incorporation certificates, partnership deeds, or trust deeds. Having these documents ready in advance will save you time and ensure a smooth online submission process.

Step-by-step procedure for filling the online form

Filling out the GST registration form online may seem intimidating at first, but fear not! The process is designed to be user-friendly. Simply access the official GST portal and follow the step-by-step instructions provided. You’ll be asked to input your business details, personal information, and upload the necessary documents. Take your time, double-check the information entered, and submit the form. After submission, you’ll receive an Application Reference Number (ARN) for future reference.

Also Read: How to Obtain GST Registration

Documents required for GST registration application

List of mandatory documents for GST registration

When applying for GST registration, certain documents are mandatory to ensure compliance. These include your PAN card, proof of address, photographs, and bank account details. It’s important to ensure that these documents are accurate and up-to-date, as any discrepancies could lead to delays in the registration process.

Additional documents that might be required

In addition to the mandatory documents, there may be additional requirements based on your business type. For example, if you’re running a private limited company, you’ll need to provide the incorporation certificate and the memorandum of association. On the other hand, if you’re a partnership firm, a partnership deed will be required. It’s essential to consult the official GST guidelines or authorized service providers to determine the specific documents needed for your business type.

Also Read: What are the documents required along with the GST registration application form?

Frequently Asked Questions (FAQs) about GST registration process

Common queries related to GST registration

When it comes to GST registration, it’s natural for questions to arise. Common queries include “Who needs to register for GST?” and “What are the registration thresholds?” You’re not alone in seeking answers to these questions, so let’s address them to clear up any confusion.

Answers and clarifications for FAQs

For those wondering who should register for GST, generally businesses with an annual turnover exceeding the threshold set by the government are required to register. However, there may be exceptions for certain categories of businesses, such as small-scale suppliers. Regarding the registration thresholds, they vary for different states and business types, so it’s essential to check the official guidelines or seek assistance from authorized service providers to determine the specific thresholds applicable to your business. In conclusion, understanding where to submit the GST registration application form is essential for businesses and individuals seeking to comply with tax regulations and operate legally. Whether you choose to go the online route through government portals or opt for traditional offline methods, it’s crucial to follow the prescribed steps and provide the necessary documents. By effectively completing the registration process, you can ensure a smooth transition into the GST regime and enjoy the benefits of being a registered taxpayer. Stay informed, stay compliant, and navigate the GST registration process with confidence.

Frequently Asked Questions (FAQs) about GST registration process

1. Are there any fees associated with the GST registration process?

Yes, there is a fee for GST registration. The fee amount may vary depending on the country and the type of business entity. It is advisable to check the official government website or consult with authorized service providers to determine the applicable fees.

2. Can I submit the GST registration form offline if I prefer not to use online platforms?

Yes, you can choose to submit the GST registration form offline. Traditional methods such as visiting the appropriate tax office or designated registration centers are available for offline registration. However, online registration is often more convenient and efficient.

3. What are the essential documents required for GST registration?

The exact list of required documents may vary depending on the country and the nature of the business. Generally, you will need documents such as proof of identity, address proof, bank account details, business registration documents, and any other relevant supporting documents. It is recommended to refer to the official government guidelines or consult with experts to ensure you have all the necessary documents.

4. How long does it take to complete the GST registration process?

The processing time for GST registration can vary depending on factors such as the country, the method of submission, and the completeness of the application. Typically, it can take anywhere from a few days to a few weeks to complete the registration process. Online registrations generally have a faster turnaround time compared to offline methods. It is important to plan ahead and submit the application well in advance to allow for any possible delays.