GST brought about an epic transformation of the indirect tax system in India, creating a unified, transparent. The efficient tax regime benefiting businesses and uplifting the economy of our country. As per the GST Act, all individuals and businesses providing goods or services, or both, are required to register under GST. The government has provided the common GST portal, which is an online platform for businesses to register and file their returns as part of the compliance process. The online registration process is very simple and completely free. After GST registration online, the business is issued a GSTIN and registration certificate. Only after the registration certificate is issued can a business start its actual business operations.

Eligibility Criteria for Online GST Registration

- All businesses supplying goods with an annual turnover of more than Rs. 40 lakhs in a financial year are compulsorily required to register under GST. The threshold limit for businesses in the north-eastern states of Himachal Pradesh, Jammu & Kashmir, and Uttarakhand is Rs. 20 lakhs.

- All service providers whose annual turnover exceeds Rs. 20 lakhs in a financial year are required to register under GST, and for the special category (businesses from the North Eastern States, J&K, HP, and Uttarakhand), the threshold limit is Rs. 10 lakhs.

- It is mandatory for special categories of businesses, such as casual taxable persons, input service distributors, e-commerce providers, interstate goods and service providers, non-resident taxpayers, TDS/TCS taxpayers, taxpayers liable to pay tax under the reverse charge mechanism, and OIDAR providers, to register for GST.

- Interstate suppliers of goods and services are mandatorily required to register under GST, irrespective of turnover.

- Persons making supplies of goods and services on behalf of other taxable persons, whether as agents or otherwise

- Separate registration is required for branches that are opened in different states and for different business verticals in the same state.

- For branches of a business in the same state with the same business vertical, one common GST registration is sufficient.

Documents required for GST registration

- CIN (Certificate of Incorporation) of the company, valid PAN

- Memorandum and articles of association, partnership deed, and LLP deed as applicable

- List of Proprietor/Partners/Karta/Managing Directors and whole-time directors, members of the managing committee of associations, the board of trustees, etc., of the company with their identity proofs, address proofs, and photographs

- Names of authorized signatories for companies, their addresses, and identity proofs

- Business Registration Proof

- Address Proof of Principal Place of Business

- Bank account details

- Valid email ID and mobile phone number.

Similar Read: GST Registration for Services: Documents Required

Step-by-step Guide to GST Registration Online

There are two parts to the online registration form. The first part is for preliminary verification. After the verification is done, a unique reference number is generated, known as the “Temporary Reference Number” (TRN). This number is required for continuing the process in Part B.

Part A

- Step 1: The applicant has to go to the GST portal at www.gst.gov.in. Navigate to services, and click on the registration button. There they have to select ‘New Registration’.

- Step 2: The user has to fill in the details in Part A of the GST REG-01 form, like the status of the applicant. whether tax deductor, tax payer, tax collector (e-commerce) or GST practitioner, state, district, legal name, PAN, email address, and mobile number.

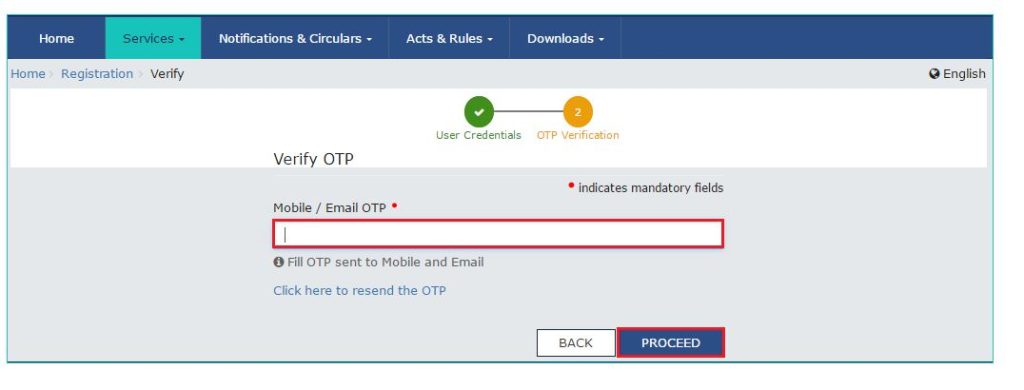

- Step 3: This step is for verification by the applicant. The OTP will be sent to the person’s mobile number and email address. After entering the OTP, the user has to click on proceed when the applicant’s temporary reference number (TRN) is displayed. It is a 15-digit number that is also sent to the mobile and email addresses of the applicant and is valid for fifteen days.

If the applicant wishes to continue to Part B, he can login and go to ‘My Saved Applications’ and continue to Part B of the registration form.

After verification, a new webpage is displayed where the system will ask the applicant to enter the TRN.

- Step 4: The applicant has to enter the temporary reference number, the captcha code, and proceed.

- Step 5: A new webpage is displayed in this step, where the applicant has to enter the OTP sent to his mobile and email and click on proceed.

- Step 6: After OTP authentication, a new webpage is displayed, and the status of the application is shown as ‘Draft’. Next, the applicant has to click on the ‘Action’ button, after which Part B is enabled.

Step 7: Enter details in Part B.

Part B comprises various fields under 10 sub-heads, in which the applicant has to enter the details carefully because the information cannot be amended later. If any mistakes occur, the registration has to be cancelled, and a fresh registration has to be done.

The ten tabs are Business Details, Promoter/Partners, Authorized Signatory, Authorized Representative, Principal Place of Business, Additional Places of Business, Goods & Services, State Specific Information, Aadhar Authentication, and Verification. The applicant has to click on each tab and enter the details.

Entering bank account details has been optional and can be entered later with an amendment application. When the user logs in to the portal for the first time after the GSTIN has been granted, the system will prompt them to file a non-core amendment application to enter the bank details. While entering the details in the fields like the principal address of the business, authorized signatory details, etc., supporting documents are required to be uploaded to the portal.

Step 8: The next step is Aadhar authentication. If the applicant chooses the Aadhar authentication method, then physical verification of business is not required, except in certain specified cases where physical verification is mandatory, irrespective of whether the applicant chooses Aadhar verification or not. Manual authentication can be done by uploading e-KYC documents, including Aadhar, passport, voter ID, etc.

Step 9: Verification of the GST REG-01 Form: The next step is verification, which can be done using a digital signature (for companies, partnerships, and LLPs, a digital signature is compulsory). For the applicants who have chosen the Aadhar authentication method, a link is sent to the authorized signatory to complete the process online. This verification is compulsory and must be completed after the submission of GST REG-01 to complete the registration.

Step 10: After the verification, the applicant has to click submit. The application will be assessed by the portal by checking the details of the business entity, email ID, PAN, and Aadhar with the respective online databases. After successful verification of the details, the ARN is generated, and the acknowledgement is communicated to the applicant in the form GST REG 02 via registered email from the authorized signatory.

The application then moves to the GST officer for processing, and if the documents and information are in order, and after Aadhar authentication, the registration certificate and GSTIN are issued within seven working days from the date of submission of the application. The applicant can login to the GST portal and download the certificate.

Related Blogs: How to Check GST Registration Status ?

Different Statuses of GST Registration

Conclusion

GST registration is a simple online process, making compliance requirements like filing returns and paying tax liabilities easier. The government has provided the GST portal, where businesses can register for free by filling out the form, uploading the required documents, and performing proper authentication. There are many benefits of GST, the main being the provision of input tax credit, which eliminates the cascading effect of taxes on consumers. It also brings transparency to tax filing, eliminating tax evasion. By bringing all businesses under one umbrella through the concept of one nation, one tax, there has been a great economic transformation in our country.