GST Registration process is completely driven online, and prospective taxpayers have to submit the required documents online. The approval process is also online. On submission of the required data and documents, the GST Registration application will be allocated to the concerned Jurisdiction Officer for approval. The Approval for GST Registration has to be completed in a time-bound manner.

At any given point in time, if the applicant wants to verify the Status of his/her GST Registration, the following steps have to be followed. Before understanding “How to check the status of your GST Registration? let’s understand some key terms

Temporary Registration Number

For every application being submitted on the portal, first, you get a TRN (Temporary Registration Number). Once the TRN is Generated, the detail form is ready to be filled. After submitting the detailed form, ARN is Generated. The taxpayers can check the status of GST registration online on the GST Portal through ARN generated by GST Department.

Application Reference Number

ARN stands for Application Reference Number, a unique number assigned to each registration application.

Track GST Registration Application status.

Tracking your GST registration can be done easily by using ARN Number. Following the steps through which Taxpayer can check the status of their GST Registration: –

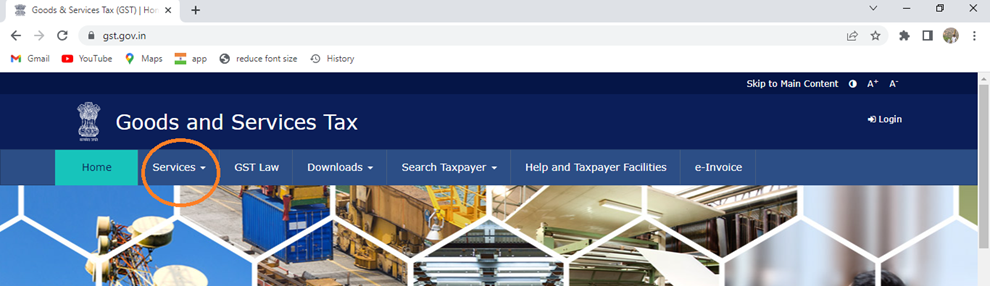

- There is an official site GST; visit the GST common portal (https://www.gst.gov.in/) using the right

- Selecting the ‘Service’ option provides the ‘Registration’

Read More: Benefits of GST Registration

- After selecting, you will get three options: –

- New Registration

- Track Application Status

- Application For Filling Clarification

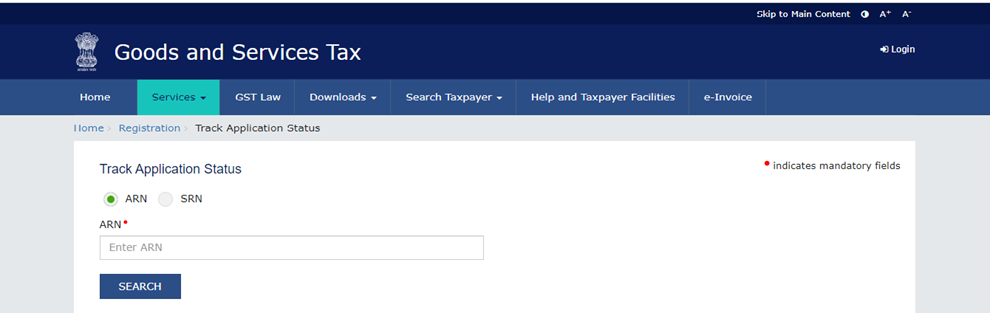

Click on ‘Track the Application Status

- A new page will be opened, where you must enter ARN, which is provided by the GST department at the time of submission of the application.

Status provided with ARN

From here, the taxpayer can check the status of their application Pending for Processing, Site Verification assigned, Pending for Clarification, Clarification filed- pending for order, Approved, Rejected.

Pending for Processing – this status implies that the application for GST Registration is submitted by the applicant, and the Department officials have not yet verified or checked the same.

Site Verification Assigned – This feature was not there previously, but of late, the Government has introduced it to identify fake registrations at the bud only.

Pending for Clarification – once the officer reviews the same, and he/she is not satisfied with the information submitted, the officer will call for clarifications, or if the data uploaded is not clear, the officer may ask for uploading of the same, which are clear and easy to read.

Clarification filed- pending for order – the status will change to “Clarification filed and pending for order, once the applicant submits the required clarifications or uploads the document again as requested by the officer.

Approved – if the officer is satisfied with the information provided first time or subsequently, the application for GST Registration will be approved.

Rejected – if the information provided is not clear or the documents are not clear or if the officer is not satisfied with the filed visit, he will reject the application.

Related Read: Geotagging in GST Registration: Understanding the Process and Benefits

The approval of GST registration is to be completed in a time-bound manner at each and every stage. CaptainBiz strongly recommends the applicants upload all the required documents at the time of filing of the application form only else, it will be delayed. Any potential delay in the approval of GST Registration can have an impact on the business also.