Introduction to Goods and Services Tax (GST)

The Goods and Services Tax, commonly known as the GST, established the groundwork for an extensive overhaul of India’s tax structure. Since its implementation in 2017, the GST taxation system took the place of other indirect taxes imposed on various goods and services as a result of this tax reform.

GST is a comprehensive tax imposed at every value-addition stage and the tax is applied to products and services sold for consumption inside India’s national borders. As a result, the GST compliance benefits are many and has helped to streamline India’s indirect tax system.

In this article, we will discuss the topics that will clarify all your inquiries regarding the benefits of the GST system.

The Importance of GST Compliance

The advantage of a single tax is that it ensures that the cost of a certain commodity or service is the same in every state. That is the reason why the importance of GST compliance cannot be overstated. It is necessary to adopt certain common laws, such as e-way bills for the transportation of products and e-invoicing for transaction reporting, to implement GST compliance. Tax compliance has also been enhanced since taxpayers are not burdened by several return forms and deadlines.

1. Controls Indirect Taxes

At many points in the supply chain, India used to apply indirect taxes such as service tax, central excise, VAT, and other taxes. While the states oversaw certain taxes, the federal government oversaw others, but there was no centralized tax on goods and services, and then the GST was put into place. Under the GST, the primary indirect taxes were merged into one, and the government’s administration of tax compliance rules and taxpayers’ burden have been greatly reduced as a result.

2. Protection against Tax Evasion

Compared to earlier tax rules, the GST is far more stringent because taxpayers now only claim an input tax credit on invoices filed by each of their suppliers. This reduces the likelihood of fraudulent invoices being able to claim input tax credits, and the introduction of electronic invoicing has enhanced this objective even further. One of the main GST compliance challenges was tax fraud, but now the new system has greatly improved the effectiveness of the crackdown on noncompliant persons.

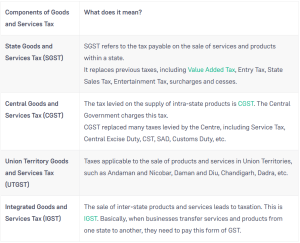

The below chart shows the types of GST and how those taxes are implemented.

Also Read: Different Types of Documentation Required for GST Compliance

Streamlining Operations Through GST Compliance

All GST-related processes can be completed online, including GST registration and GSTR filing. This system helps streamline operations and increases compliance among taxpayers.

- The tax-paying process has been considerably simplified, making it easier for people to complete their GST-related services in one place.

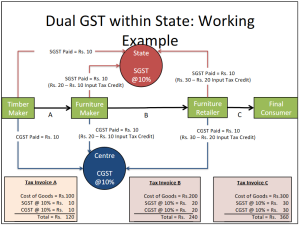

- The two halves of the Goods and Services Tax (GST) are Central GST (CGST) and State GST (SGST), and GST is imposed concurrently throughout the value chain by the Centre and the States.

- Every supply of goods and services above a certain sum is subjected to GST tax. On all transactions within a State, the State Goods and Services Tax (SGST) would be levied and collected by the States, while the Central Goods and Services Tax (CGST) would be collected by the Central Government.

- Every transaction involving the provision of goods and services will be subject to both the Central GST and the State GST, except for those that are exempted, fall outside the ambit of the GST, or are conducted below the designated threshold limitations.

- Unlike State VAT, which is imposed on the value of the items plus Central Excise, both Central GST and State GST would be levied on the same price or value.

The chart below depicts how the Dual GST model functions and how the process streamlines operations.

Financial Implications and Benefits of GST

Since the implementation of the GST Act, the financial implications of the system have affected every industry. The impact of GST on businesses cannot be overstated as the new act provided many benefits.

1. Competitive Pricing Boosts Consumption Levels

The adoption of the GST has resulted in a rise in consumption and indirect tax revenues. Due to the former tax regime’s cascading taxation, the final price of any goods became quite high. Prices are now more competitive both locally and abroad thanks to stable GST rates. As a result of more fair pricing, demand has also increased.

2. Efficient Distribution and Logistics

Among its numerous benefits, GST promotes warehouse consolidation, improves supply chains and turnaround times, and shortens transportation cycle times. Under a single indirect tax system, the delivery of products does not require much paperwork. Because of the e-way bill system under the GST, the industry gains the most in terms of passage and arrival efficiency from the removal of interstate checkpoints, and that lowers the high expenses related to logistics and warehousing.

3. Online System Helps Businesses Operate Quickly

In the past, taxpayers had a great deal of trouble communicating with different tax authorities under each tax law. Furthermore, even though returns were filed online, the majority of the evaluation and reimbursement procedures were carried out offline. Almost all GST processes are now done online, including registration, return filing, refunds, and the creation of e-way bills. This has made it easier to conduct business and substantially streamlined taxpayer compliance.

4. Uniformity of Tax Rates

By guaranteeing uniform indirect tax rates throughout the nation, the Goods and Services Tax (GST) improves predictability and facilitates corporate operations. Put otherwise, the GST provides uniformity when people conduct business, and the location of the business owner does not affect tax rates.

5. Elimination of the Tax Cascading Effect

There is less tax cascading with GST because now a system is in place that works across state lines and throughout the value chain. This has lowered ongoing operating expenses as GST has taken the role of other indirect taxes at the federal and state levels. With the support of a strong end-to-end IT infrastructure, the GST is less complicated and easier to manage than any previous indirect taxes imposed by the State and the federal government.

Also Read: Benefits Of GST Registration

Ensuring Regulatory Compliance: Strategies and Best Practices

GST is a multi-stage and comprehensive tax that is a replacement for several indirect taxes across the nation. The tax is applied to products and services that are sold for consumption inside India’s national borders. The government has put various GST compliance strategies in place so that the rules of the GST act are not misused for personal gains and fraudulent activities are stopped by the authorities.

- The maximum retail price is reflected by applying GST to the final market price of products and services that are internally manufactured.

- When purchasing products or services, customers must pay this tax, because it is included in the final cost.

- Across the nation, the GST rates on various goods and services are applied consistently. Nonetheless, different tax slab rates have been applied to different categories of goods and services.

- Necessary products have been placed in lower and zero slab rates, while comfort and luxury products are classed under higher slab rates. This classification’s primary goal is to guarantee that citizens receive an equitable distribution of wealth.

Check out this chart that shows the tax rates imposed on various products by the GST Act.

| 5 percent | Essential goods, food items, life-saving drugs, etc. |

| 12 percent | Apparel items, packaged food, medicines, etc. |

| 18 percent | Electronic items and most services |

| 28 percent | Luxury goods, cars, tobacco, drinks, etc. |

Also Read: How GST Has Made It Easier For Businesses To Comply With Tax Laws?

Conclusion

The goods and services tax (GST) is imposed on the majority of products and services that are sold for domestic use. Although customers pay the GST, the companies that sell the products and services are the ones that send it to the government. However, GST may disproportionately affect those whose income is in the lowest levels.

To solve these issues, the government has implemented GST-exempt products and lowered GST rates on food and life-saving drugs. To lessen the burden of GST on small businesses, the government also provides an income limit below which paying GST is not necessary. However, all businesses must follow the GST compliance rules because the GST system can provide uniformity and much needed structure in the tax system.

FAQs

-

What are the main objectives of GST?

The introduction of GST aimed to establish a centralized tax system for goods and services to make tax administration easier, and most taxes were combined into one under this Act. Many old indirect taxes were replaced by the GST to establish uniform tax rates for goods and services that all states would have to abide by. There was a significant percentage of tax evasion before the GST was implemented, but since its implementation, it has made a significant difference.

-

What are the three components of GST?

IGST stands for integrated goods and services tax, which is 100% GST levied on interstate sales and collected by the central government. CGST stands for central goods and services tax, which is levied 50% on intrastate sales and collected by the central government. SGST/UGST stands for state/union territory goods and services tax, which is levied 50% on intrastate sales and collected by the state or union territory. The CGST and SGST are combined to form the IGST, and the state where the supplies are consumed appropriates the SGST. It is mandatory for the Central Government to provide an additional 42% of its GST share to the states.

-

How does the GST system work for the manufacturers and retailers?

The manufacturer is responsible for paying GST on the value added to the product during production as well as on the acquired raw materials. The service provider is in charge of paying GST on the purchase price of the product as well as any value additions made to it. Nonetheless, the amount of GST that must be paid might get reduced by the manufacturer’s tax payment. The retailer is responsible for paying both the margin they contributed and the goods they purchased from the distributor. The total amount of GST that has to be paid may be reduced by the retailer’s tax payment.

-

What are GST registration and GST returns?

Any business that qualifies for GST has to register on the GST site that the Indian government has set up. A special registration number known as the GSTIN will be assigned to the registered company or person. Businesses that earn Rs. 20 lakhs or more in revenue over the course of a fiscal year are mandated to register for GST, and the processing takes two to six business days.

A GST Return is an official document that a business/taxpayer is required to file with the government, containing details about their income. Registered dealers’ GST returns include information about their sales, purchases, input tax credits, and output GST.

-

Who is eligible for paying GST?

GST must be paid by companies/individuals that sell products or provide services inside India. However, in certain other situations, such as the importation of goods and supplies, the recipient may also be held accountable for GST. The Central Government has set the threshold limits for GST registration for commodity suppliers at Rs. 20 lakh. Since the GST also determines each state’s revenue, the State governments are required to decide on the maximum threshold.

-

How are imported products taxed under GST?

The Special Additional Duty (SAD) and the Additional Duty of Excise (CVD) that were used before GST implementation are now included in the GST Act. Article 269A of the Constitution states that all imports into India would be subject to IGST, a type of GST. In contrast to the current system, the States where the imported products go will now receive a portion of the IGT paid on such imports and will benefit from increased revenue from the taxation system.

-

Are the VAT and the GST the same system?

Value-added tax (VAT) and goods and services tax (GST) are similar taxes imposed on the sale of products and services. Nonetheless, there are a few significant variations between the two taxation systems. Whereas GST is only collected at the time of sale to the consumer, VAT is mostly collected at every stage of the manufacturing and distribution process. The scope of products and services covered by VAT is often greater than that of GST, and the rates of both taxes can change based on the kind of goods and services being offered.

-

What are the features of the GST returns filing procedures?

The planned GST return filing procedures state that a common return would benefit the federal government as well as state governments. The GST business operations will allow for the filing of eight forms for returns, and the majority of typical taxpayers would only use four forms when submitting their taxes. These include monthly returns, yearly returns, supply returns, and purchase returns. Quarterly returns must be filed by small taxpayers who have chosen the composition scheme, and all return filing must be done online.

-

What are the logistics and distribution systems under GST?

Multiple documents are not required for the transportation of products under this single tax system. The GST Act provides several advantages for both businesses and consumers because it reduces cycle times for goods transportation, and enhances the turnaround times of the supply chains. Every single industry benefits from the removal of arbitrary interstate checkpoints during transit because of the introduction of the e-way bill system. In the end, it assists in reducing the expensive storage and shipping expenses.

-

Does GST promote competitive pricing and increase consumption?

Yes, it is true that GST promotes competitive pricing and can even increase consumption. Since the introduction of the GST Act, tax revenues have increased because the level of consumption has increased nationwide. The former tax regime’s cascading impact of taxes resulted in higher costs of items in India than in international markets. Purchases in certain states were unbalanced due to reduced VAT rates, but consistent GST rates have helped make prices more competitive domestically and internationally.