Introduction to Indirect Taxation

Most people understand what direct taxes are, but many of us are unaware of the effects of indirect taxation. As opposed to direct taxes, indirect taxes are levied against a person or organization but are eventually paid by another party.

When the government seeks to tax someone directly, that individual pays the tax right away. Income tax is the most common example of a direct tax, and excise taxes on alcohol, and gasoline are common indirect taxes.

In a supply chain, a manufacturer pays the government a tax amount, but the manufacturer includes that tax amount in the product price. As a result of that, the customers end up paying extra money when purchasing that item.

In this article, we will provide a thorough indirect taxation overview so that you get a clear idea of this complicated matter.

We will discuss the below topics to clarify the issue:

- Types of Indirect Taxes

- Indirect Taxation Systems Across the Globe

- Economic Implications of Indirect Taxation

- Government Revenue and Indirect Taxes

- Recent Developments and Trends in Indirect Taxation

- Challenges and Future Outlook

Types of Indirect Taxes

Let us first discuss the most common types of indirect taxes.

1. Goods and Service Tax (GST)

The Goods and Services Tax (GST) has replaced the principal indirect taxes and now covers almost all kinds of indirect taxes that were paid to different tax authorities before the introduction of GST. GST is an indirect tax that is imposed on the supply of goods and services, to put it simply. Central Goods and Services Tax (CGST), Integrated Goods and Services Tax (IGST), State Goods and Services Tax (SGST), and Union Territory Goods and Services Tax (UGST) are the four main categories of GST. Different tax rates, ranging from 0% to 28%, have been established by the GST Council for various commodities and services.

Also Read: GST: The Complete Guide

2. Customs Duty

This is an example of an indirect tax that is imposed on imported products and in some cases, export items may also be subject to this charge. Regulations regarding the imposition and collection of this duty, import and export processes, and fines, are outlined in the Customs Act.

3. Service Charge

Companies and organizations that provide legal, consulting, and other similar services are required to pay this tax. The service tax was 14% before June 2016, however, the rate was increased to 15% with the addition of the Swachh Bharat Cess and Krishi Kalyan Cess. Small service providers are excluded from paying this tax if their annual revenue is less than ten lakh rupees.

4. Excise Duty

All commodities that are made in India are subject to this tax, and manufacturers are required to pay it. As a result, they frequently pass along the extra cost to the buyers. The Central Excise Act governs how this indirect tax is applied in India and how it should be imposed by the Central Government.

5. Stamp Duty

State governments impose this indirect tax on the transfer of real estate under their purview. Furthermore, stamp duty is required for all kinds of legal papers, and all the states have different charges for it.

6. Securities Transaction Tax (STT)

When equities are bought or sold through the Indian stock exchange, an indirect tax is levied. STT covers transactions involving shares, mutual funds, and futures and options. STT was implemented to end the long-term capital gains tax and lower the short-term capital gains tax.

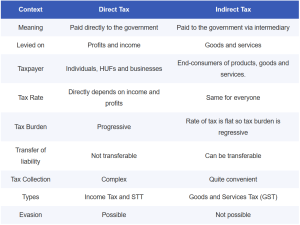

The chart below shows the most common direct and indirect taxes.

Indirect Taxation Systems Across the Globe

The global indirect tax systems also follow a few similar rules as India does. The main global indirect tax is sales tax, which is collected during transactions involving purchases made by consumers. When taxable products or services are sold, the majority of countries mandate that the seller collect sales tax and send it to the relevant tax authority.

- In every country, the states often have different taxation rates, and it can vary from 0% to 13% or more, depending on the country and state.

- In many countries, certain items and services, including raw food items and prescription medications are subject to full exemption and discounted pricing.

- Alcoholic drinks, tobacco products, and luxury items are almost always subject to additional taxes in many countries worldwide.

Economic Implications of Indirect Taxation

The overall impact of indirect taxes and the economic implications related to them can be a great concern for any country. We have described below the effects of indirect taxation on the general population and the national economy.

1. Simplified tax structure

Indirect taxation implemented correctly guarantees a simplified tax structure. The cost of the item or service is borne by the customer, and the maker or seller sends it to the government. When implemented more consistently throughout the nation, indirect taxes are progressive and provide the government, merchants, and consumers with a number of advantages. It has lessened tax overlapping, and there have been fewer tax scams.

2. Easy to collect the tax

When products and services are being sold or purchased, all of these indirect taxes are automatically collected. This process lessens the chance of tax evasion while assisting the government in quickly collecting taxes without delay.

The table below shows where and why direct and indirect taxes are applicable:

| Direct Tax | Indirect Tax |

| Tax on income or personal wealth | Tax on goods and services |

| It is progressive in nature | It is considered regressive in nature |

| The tax burden cannot be given to someone else | The tax burden can be passed along to the consumer |

Government Revenue and Indirect Taxes

The Government implements indirect taxation mainly to increase revenue and fill the treasury. When individuals disregard the indirect tax laws restrictions, they may face a variety of penalties as a result. Penalties are usually given for improper use of credits, failure to submit periodic returns, incorrect books of accounts, etc.

The below chart shows how the government increases revenue through indirect taxation trends.

Recent Developments and Trends in Indirect Taxation

In India, the two main indirect taxes are Customs duty and Goods and Service Tax (GST). On the basis of the GST Council’s recommendations, rate modifications under the GST statute have occasionally been announced. Moreover, notifications on Basic Customs duty rates are sent out periodically. It should be mentioned that, based on statements made by several industries, similar adjustments are also anticipated in the future for the rates of basic customs duty and GST.

The usual GST rate is about 18%, and the rate of customs tax is around 30.98%. Although the general amount of basic customs tax is 10%, the precise charge varies according to the type of products being imported, how they are classified, and their HSN.

In recent years, there have been some new developments in the indirect taxation system.

- For the purpose of tax collection, the goods and services tax is often split into tax slabs of 0%, 5%, 12%, 18%, and 28%.

- Precious and semi-precious stones are subject to a special charge of 0.25%.

- Precious metals like gold, silver, and products made from them are subject to a special tax rate of 3%.

Challenges and Future Outlook

The government frequently imposes indirect taxes on all taxpayers to increase government revenue from indirect taxes. This system means both the wealthy and the poor are required to pay the tax even though it is not fair to the poor because indirect taxes can place a significant financial burden on individuals with lower incomes.

Also Read: Updates in Indirect Tax – Interim Budget 2024

Conclusion

The government decides to charge indirect taxes to increase revenue but the main issue with this type of taxation is that even the poorest people need to pay them. These indirect taxes are charged equally to all taxpayers, regardless of their financial situation, so it can economically hurt individuals with lower earnings than it affects the wealthy.

Many people now view the system of indirect taxation as regressive because of this troubling factor. Another problematic issue is that many customers, wealthy or poor, are unaware of the indirect tax money they pay since these taxes are hidden in the cost of products and services. Today, experts often recommend that people should be aware of the indirect tax system so that they can make informed decisions while buying goods.

Also Read: Indirect Taxes: Strategies for Financial Attainment

FAQs

-

What is the indirect taxation system?

The tax imposed by the government on products and services is known as an indirect tax. The seller of a product or service pays the government certain taxes, but as a result of that, the seller increases the price of the product. In the end, the customers end up paying the tax money. Therefore, there are two distinct individuals who end up paying taxes, the seller who pays the tax to the government, and the customer who pays part of that tax amount to the seller.

-

Is custom duty a type of indirect tax?

Yes, customs duty is a type of indirect tax, and it covers all imported commodities, as well as some items that are exported from the nation. Ensuring that every commodity entering India gets taxed is the primary goal of this tax. Import tax is the name for the tax levied on goods that are imported, and export duties are the charges imposed on goods that are exported. The Customs Act lists many different categories of customs duties that apply in India.

-

Is GST an indirect tax?

The Goods and Services Tax, or GST, replaced the nation’s several indirect taxes when it was introduced. With the implementation of the new tax regime, the mandatory levies have now been eliminated. Service tax, state excise duty, extra excise duty, and special additional custom charges are among the taxes covered by the GST at the state level. Sales tax, purchase tax, entertainment tax, luxury tax, entry tax, as well as taxes on betting and lottery gaming, are among the taxes covered by GST at the central level.

-

Difference between Direct and Indirect Tax?

Individual taxpayers’ income and earnings are subject to a direct tax assessment, which is then paid to the government directly. Services and goods rendered by HUFs and enterprises are subject to indirect tax, which is paid to the government through a middleman. Indeed, the rates for indirect taxes are the same for all taxpayers, while the rates for direct taxes depend on an individual’s income or profits. Unpredictable and regressive indirect taxes are indeed possible. These levies have the potential to raise inflation and stifle industry expansion.

-

What is the most common example of indirect tax?

Import tariffs are the most typical example of an indirect tax because when a good enters the nation, its importer is responsible for paying the customs duty. The cost of the customs duty is essentially included in the product that the customer ends up paying if the importer decides to resale. Although they probably won’t realize it, the customer will be indirectly responsible for the customs duty.

-

How does the indirect tax system work?

As opposed to direct taxes, indirect taxes are levied against a person or organization but are covered by another party in the end. When the government taxes someone directly, that individual is the one who pays the tax right away. However, for indirect taxes, that is not the case. Income tax is the most obvious example of a direct tax, and examples of indirect taxes are gasoline, alcohol, and cigarette excise duties.

-

What are the disadvantages of indirect taxation?

Indirect taxes can increase the product price because the sellers or manufacturers who pay the tax often include it in the product MRP to make up for that tax amount they paid. That is why it is possible for indirect tax to be regressive, and many industries are not favored by indirect taxes. Taxes are imposed on products and raw materials, raising the cost of manufacturing and preventing industries from growing since they limit their ability to compete in the market.

-

How can I know if I am paying indirect taxes?

In every aspect, direct and indirect taxes are completely different because direct taxes are imposed on one’s income and are paid directly to the government. On the other hand, indirect taxes are quite the opposite, and you give it to the government whenever you buy products that were already taxed by the government. The indirect tax rates are the same for all taxpayers, which is unfair to many people who are financially less secure.

-

Can indirect taxation affect inflation?

Many types of goods and services are subject to indirect taxes, and in contrast to direct taxes, everyone who purchases these goods must pay indirect taxes. Prices for products and services may increase as a result of indirect taxes. If retailers are unsure about the exact tax amount, they may overcharge the customer, and this overestimation can occur on a range of products and services and at different levels.

-

Does indirect tax have any regressive impact?

Yes, it is considered by many that indirect tax has a regressive impact. A wide range of products and services are subject to indirect tax, and as a result too many people end up paying the indirect tax. All individuals are subject to these taxes in the same way, regardless of their income bracket, and those in lower income categories get disproportionately affected by the high product prices.