The rollout of GST has brought seismic shifts to corporate India. This umbrella tax has integrated the chaotic web of taxes into one unified structure. In doing so, it has profoundly changed how businesses manage their finances and meet tax duties. This article examines the transformative impact of GST on enterprises. It zooms in on key elements like online GST compliance, e-invoicing mechanisms, and the overhaul of GST return filing.

The tides of technology make a digital-first approach indispensable today. GST has propelled businesses away from manual processes towards digital systems. Online GST compliance enables real-time visibility, fewer errors, and smoother audits. E-invoicing for GST modernises invoice generation to curb fraud and enable system integration.

Moreover, GST has overhauled the previously chaotic process of filing returns. It brings a unified return system and in-built data verification. This eases compliance for companies while improving monitoring for tax authorities. Upon closer examination, we see how GST has become a catalyst for superior corporate efficiency, operations, resource allocation, and global competitiveness.

Streamlining Tax Compliance: Impactful Additions of GST

-

Online protocols for compliance

The fact that the whole GST registration, return filing, payment processing, and other procedures are done online is one of its greatest benefits. The GST site serves as a central location for all compliance pertaining to GST. Here are a few of the most important online GST compliance processes:.

| Goods (Normal Case) | On or before date of removal/delivery |

| Goods (Continuous Supply) | On or before date of issue of account statement/payment |

| Services (General case) | Within 30 days of supply of services |

| Services (Banks & NBFCs) | Within 45 days of supply of services |

-

Hassle-free registration

The entire GST registration process is online, which has simplified the registration process. Businesses need to log on to the GST portal and provide required information like business details, upload documents, etc., to obtain GSTIN (GST Identification Number). The whole process is automated without any physical touchpoints.

-

Easy filing of returns

Taxpayers must file various returns, like GSTR-1, GSTR-3B, etc., online on the GST portal. The GST online compliance filing procedure is quite user-friendly, with built-in validations and editing tools. This has reduced errors and improved accuracy in GST return filing.

-

Seamless ITC claims

GSTR-3B and GSTR-2A reports are used to claim input tax credits. The credits are reflected automatically in the taxpayer’s computerised cash ledger. Multi-stage taxes like VAT were complex for ITC claims, but the GST online compliance procedure has made it very convenient under GST.

-

Single online payment

Taxpayers must submit a single consolidated monthly tax payment that includes all taxes such as SGST, CGST, and IGST. Payment can be made online through net banking, debit/credit cards, NEFT/RTGS, etc. A single payment replaces multiple payments made earlier under different taxes.

-

Real-time reporting

All the compliances, from registration to GST return filing and payment, are in real-time mode on the GST portal. Taxpayers receive immediate confirmation when they submit any form or payment. This helps resolve any issues immediately.

-

E-invoicing system

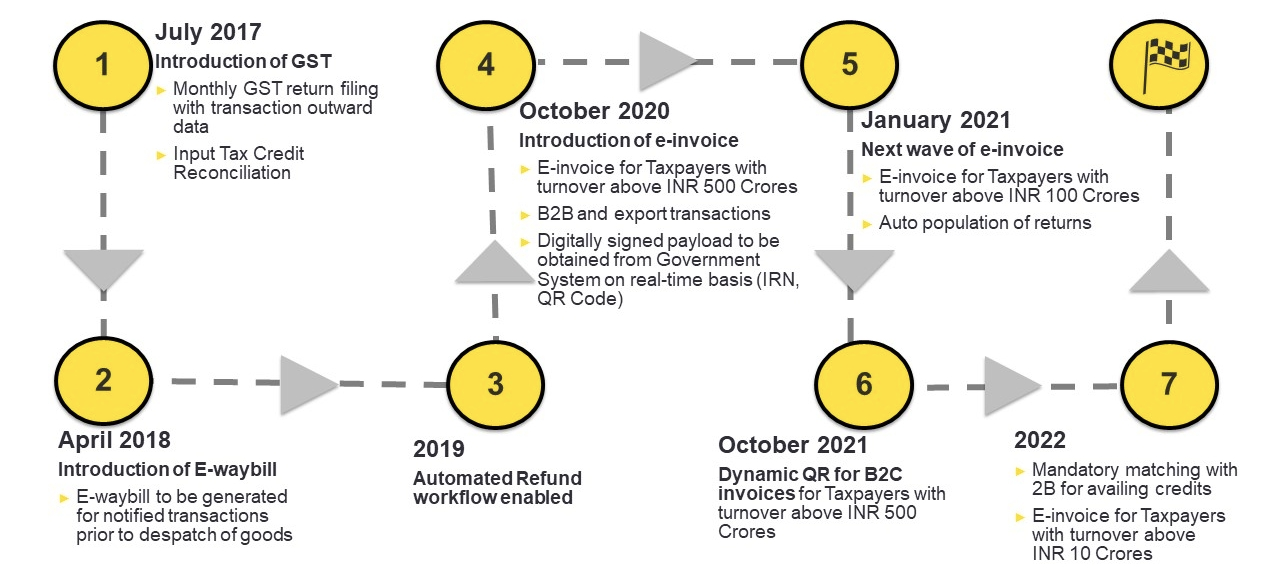

E-invoicing was introduced under GST in a phased manner. Under this system, taxpayers must generate GST invoices in a standard format from the Invoice Registration Portal (IRP). An invoice reference number (IRN) is issued against every invoice, which is then reported to the GST portal.

GST e-invoicing has improved tax compliance by providing the following benefits:

- Reduced number of bogus invoices as a result of IRN validation

- Improved reporting of B2B invoices, as details are updated in real-time

- Better tracking of tax liability in real-time for taxpayers

- Reduced data entry for GST return filing as details are auto-populated

Over 8,000 businesses have already started using GST e-invoicing. For taxpayers, it has simplified the process of submitting and reconciling tax returns.

-

Simplified GST Returns

The procedure for submitting GST returns has been gradually streamlined and made simpler. Initially, each transaction required a large data upload for GSTR-1, GSTR-2, and GSTR-3 to be submitted as separate returns. Later, this was made simpler by combining all of this into the GSTR-3B monthly form.

In 2019, the New Simplified GST Returns were approved by the GST Council. These returns are further simplified by:

- Monthly payment through GST PMT-08

- One main return, RET-1 for summary data

- Due dates are rationalised to the 13th of next month.

- The simplified returns have reduced the compliance burden on taxpayers significantly.

Enhanced Ease of GST Compliance Through Technology

GST implementation has seen extensive use of technology to enhance tax compliance for taxpayers. Some of the key initiatives are:

-

GSTN system

The Goods and Services Tax Network (GSTN) offers the IT infrastructure and platform for all GST compliance for taxpayers. The robust GSTN system allows real-time processing and eliminates physical paperwork.

-

GSPs and ASPs

GST Suvidha Providers (GSPs) and Application Service Providers (ASPs) provide technology services and solutions for filing returns and other compliances to assist small taxpayers further.

-

API integration

Taxpayers can directly integrate their accounting and ERP software with the GSTN system through APIs provided by GSPs and ASPs. This helps with seamless data flow and the auto-population of returns.

-

Taxpayer services

Facilities like online registrations, grievance redressal systems, call centres, tutorials, etc. provided by the GSTN portal help address taxpayer queries and issues.

Greater Transparency Under GST

GST has effectively employed technology to increase transparency in the tax system. Some ways in which this has happened are:

- Tax processes like registration, return filing, and refund processing are time-bound, online, and trackable.

- Electronic invoice compliance through the IRN/E-way bill provides a paper trail for B2B transactions.

- Standardisation of invoices in e-invoicing improves reporting.

- Real-time reconciliations through GST returns and auto-populated details.

- The enhanced transparency has reduced tax uncertainty and made it easier for taxpayers to comply with GST laws.

Simplified Registration and Compliance Norms for SMEs

Small and medium-sized companies (SMEs) are the foundation of the Indian economy. Recognising this, GST has provided a special focus on easing compliance for SMEs through measures like:

- Simple registration and composition scheme

- Nil / Low GST rates on goods provided by SMEs

- Lower compliance frequency of quarterly returns

- Minimal record-keeping requirements

- Increased threshold limits for registration

- Relaxed timelines for compliance

These relaxed norms for SMEs have led to a wider tax base and improved GST compliance.

Consolidated Tax Base

GST has consolidated multiple taxes, like excise duty, VAT, service tax, etc., levied by state and central governments into one tax. This has led to:

- Simplified registration, filing, and payment process

- Removal of cascading taxes

- Seamless flow of tax credits

- Common procedures across India replace state-wise rules

Instead of complying with multiple taxes, businesses must now comply with a single GST tax.

Improved Tax Governance

The GST Council, composed of all state finance ministers, controls national tax policy and GST administration. All decisions, like tax rates, laws, roadmaps, etc., are taken collectively by the Council for uniform implementation.

Tax governance has improved under GST due to the following:

- Collective policy and tax administration

- Resolution of inter-state tax conflicts

- national approach replaces state-wise variations

- Focus on consensus-based decision-making.

- Regular interactions, monitoring, and course corrections

- The shared governance has resulted in tax policy being consistent and stable.

Clarity and Certainty of Tax Laws and Procedures

Frequent changes in tax laws and procedures created confusion and uncertainty for taxpayers under previous regimes. GST has brought significant improvements on this front:

- GST laws cover all aspects of levies, procedures, compliance, etc.

- The law-making process is consultative, involving all stakeholders.

- Advance intimations are provided for changes in tax rates or compliances.

- Reasons documented for every change in laws or procedures

- Efforts towards maintaining the stability of laws without frequent disruptions

- Clarifications and FAQs were issued promptly to address concerns.

The overall clarity and certainty around GST laws and processes have reduced compliance burdens and costs for taxpayers.

Simplified Tax Audits and Assessments

The ambiguity in previous tax laws often led to increased tax assessments and audits. GST has adopted several measures to simplify the audit and assessment procedures:

- Risk-based criteria for selection of taxpayers under audit/assessment

- An audit is limited to the verification of declared income and taxes only.

- Assessments based on documentary pieces of evidence rather than coercive powers

- Time-bound completion of audits and assessments

- scheme for performing audits electronically via email/portal

- Appeals mechanism against orders by authorities

The streamlined tax audit and assessment have reduced the arbitrariness and harassment of taxpayers.

Improved Tax Compliance And Business Efficiency

The collective GST impact on business efficiency of the above measures—unified procedures, online processing, minimal physical interface, transparency measures, and clarity in laws—has:

- Reduced the compliance time and costs for taxpayers significantly

- Minimised opportunities for rent-seeking and harassment

- Improved tax compliance levels across the country

- Increased tax collections despite lower tax rates

- Enhanced overall business efficiency and productivity

GST implementation has created a tax environment encouraging voluntary compliance and improving competitiveness.

Conclusion

The Goods and Services Tax has been one of the biggest indirect tax reforms, positively impacting taxpayers nationwide. Technology-driven digital procedures, strong and transparent systems, and simplified tax systems have made compliance simpler and more efficient. Despite some initial teething problems, the gains over the last several years have raised tax collections and streamlined corporate operations.

The convenience of filing returns is one of GST’s most notable achievements. In addition to streamlining compliance, switching from a multi-form reporting system to a single consolidated return produced data validation, decreasing mistakes and increasing overall accuracy.

The change to GST online compliance has driven companies into the digital era and provided real-time data accessibility, lowering the chance of mistakes and permitting more efficient audits. Implementing GST e-invoicing has standardised and expedited the invoice-generating process, which is critical in reducing fraud and promoting interoperability across varied corporate platforms.

This strategy shift has simplified compliance and ushered in a new era of higher business efficiency. Companies operate in a setting that fosters growth, innovation, and worldwide competitiveness via improved resource allocation and streamlined processes. As GST develops, it should positively impact businesses’ ability to adhere to tax laws, fostering an atmosphere that strengthens businesses and promotes economic resiliency.

FAQs

-

How has GST benefited small businesses?

Small businesses with turnover below Rs. 40 lakhs can opt for the Composition Scheme and file quarterly returns only. The threshold limit for registration has also been increased to Rs. 40 lakhs from Rs. 20 lakhs earlier. Relaxed timelines, low compliance frequency, and lenient procedures have reduced the compliance burden for small businesses.

-

How has return filing become easier under GST?

Various GST returns, like GSTR-1, GSTR-3B, etc., must be filed online on the portal. The process is quite user-friendly, with features like validations while filing, edit facility, saving drafts, etc. GST has reduced errors and improved accuracy in return filing through online procedures.

-

How has GST simplified the payment process?

A single GST payment has replaced multiple earlier taxes under VAT, service tax, etc. The consolidated tax payment is made online through NEFT, credit card, UPI, etc., on the GST portal. A single payment instead of multiple payments has made the process more convenient.

-

How has e-invoicing improved compliance under GST?

GST e-invoicing has made B2B transactions more transparent. As information about B2B suppliers is updated in immediate form on the IRP and GST portals, it has decreased fraudulent invoices and enhanced reporting. The compliance burden has been reduced as return filing data gets auto-populated.

-

How has the tax audit process become easier under GST?

GST tax audits are now risk-based, time-bound, and limited to verification of declared details only. The electronic evaluation method has made it possible to conduct audits by email rather than in person. Rationalised audit norms have reduced arbitrary assessments.

-

How has GST eliminated the cascading of taxes?

GST has subsumed multiple taxes into a unified tax structure. The seamless flow of input tax credits under GST has eliminated the cascading effect of taxes. This has reduced hidden costs for businesses.

-

How has GST enhanced transparency?

Most GST details are available in the public domain, which reduces tax evasion. E-way bills and IRN on B2B invoices provide a paper trail of transactions. Overall, transparency measures like e-invoicing and real-time return filings have improved compliance.

-

How has GST reduced tax uncertainty?

By having a stable law-making process, advance intimations of changes, and timely clarifications, GST has reduced ambiguities in tax procedures. The overall clarity has minimised tax uncertainty.

-

How has GST improved business efficiency?

Simplified compliance, internet procedures, a limited physical interface, and harmonised tax regimes have considerably decreased GST compliance duration and expenses for enterprises. This has enhanced overall business efficiency and productivity.

-

Can you explain how GST has widened the tax base and benefited government finances?

GST has brought formerly unorganised sections of the economy into the official economy, broadening the tax base. Many enterprises that were previously exempt from taxation have become compliant, resulting in a considerable increase in tax income for the government.