The Indian tax system has been the center of attention for the people in power and the common man alike. The GST tax revenue became a prominent talk of the town, giving way to diverse opportunities throughout the industries.

All trade barriers between states have been erased by the world’s most comprehensive indirect tax system. One stroke of the pen has united India’s 1.3 billion citizens under the Goods and Services Tax (GST).

The economy is reforming by eliminating internal tariff barriers and combining central, state, and municipal taxes with GST government revenue. The rollout has revived hopes that India’s fiscal reform initiative will accelerate and boost the economy.

However, concerns about disruption stem from a fast transition that may not be in the country’s best interests. Our administration’s success in making the GST government revenue a “good and simple tax” will determine whether optimism triumphs over uncertainty.

In this article, we will cover some of the most crucial aspects when it comes to discussing the impact of GST on tax revenue and its implications for other adjoining factors.

The Concept of Introducing the GST in India

The Goods and Services Tax was introduced in all 29 states and 7 union territories to benefit everyone. Plugging revenue leaks was certain to lower consumer prices and increase government revenue. Manufacturers and merchants would gain from fewer GST tax revenue filings, transparent laws, and easy bookkeeping.

GST was adopted to streamline the tax system, reduce tax cascading, provide a consistent tax rate nationwide, and promote a more efficient and transparent tax system. Transition issues and complex compliance plagued GST’s initial deployment. Even today, GST is being improved and simplified to make it more efficient and business-friendly.

Also Read: What is GST Registration: Everything You Need to Know

The Effects of the GST in Short-Term

Customers will pay more tax on most goods and services. Most daily products are now taxed at the same or higher rate. The GST would also demand compliance fees. Small-scale manufacturers and traders, who also oppose compliance, may find it too expensive. In India, the Goods and Services Tax has had several noteworthy immediate effects:

-

Unified Tax System

By bringing all of India’s states under a single indirect tax system, the GST Tax revenue has successfully removed trade barriers. The goal of this simplification is to improve the ease of doing business by making it simpler for companies to operate across state lines.

-

Impact on Prices

Given that many everyday items now face greater or comparable taxes than they did under the old tax system, customers may have to pay more for most goods and services shortly. Small-scale producers and traders may find it more costly to operate as a result of compliance expenses related to GST government revenue, which could further increase costs.

Image Source – researchgate.net

-

Transitional Difficulties

There were worries about possible interruptions due to the hurried adoption of the GST. However, with excellent execution by the government, the GST could really be termed a “good and simple tax.”

-

Complex Tax Structure

There are currently three tax rates (state, central, and integrated) and five tax bands under India’s GST. Revenue considerations are the cause of this complexity, which should eventually be made simpler by following the lead of nations with lower tax rates and tax slabs.

-

Tax on Tax Elimination

In the long run, GST government revenue may assist in lowering inflation and enhancing macroeconomic indicators by doing away with the “tax on tax” or the cascading effect of taxes.

-

Expansion of Tax Base

By attracting more taxpayers to the formal sector, the implementation of the GST has effectively expanded the tax base. The significant rise in GST tax revenue registrations, which suggests more taxpayer compliance, is indicative of this.

Over 38 lakh taxpayers switched to GST after its inception, and this quadrupled to nearly 64 lakh by September 2017. In addition, the total number of active GST government revenue registrations as of March 31, 2020, reached 1.23 crore, thanks to an increase of 58 lakh new registrations.

This incredible gain, which is about 90%, indicates a large tax base expansion. This shows a change in taxpayer compliance, with more people and businesses formalizing.

-

Increase in Tax Income

The GST has helped the government raise tax income. Revenue has increased consistently, notwithstanding sporadic variations brought on by rate cuts and product rationalizations, which has assisted in containing the budget deficit.

-

Electronic Waybill System

The Electronic Waybill system has enhanced the transparency of the tax system, which has resulted in a reduction in tax evasion and an increase in tax compliance.

Electronic Waybills were a crucial part of the GST tax revenue, which sought to boost tax compliance and reduce tax evasion. Early technical issues have been resolved, making the system easier to use. The 2019 fiscal year generated 56 crore E-way bills. This figure shows intra- and inter-state trade.

In fiscal year 2020, this value rose 13% to over 63 crore. Effective deployment of the E-way bill system has increased tax system transparency.

-

Simplified Tax Brackets

The number of products that are subject to the highest GST rate has decreased over time, and the tax bands and rates have become simpler as a result. The general public and businesses alike have shown their support for these innovations.

-

Legal Amendments

The government has released several decrees, circulars, and notices to prevent tax evasion and expedite administrative procedures. The GST government revenue regime is now more dependable and efficient thanks to these legislative changes and clarifications, which also lower compliance costs and simplify the tax code for individuals.

Read More: GST: Latest Updates, Regulations, and Implications

The Way Things Will Be in the Future

GST tax revenue is projected to lower tax rates and slabs over time. Countries where the Goods and Services Tax has altered the economy use two or three tax rates. One tariff is the average, whereas the other is lower for essential commodities and higher for luxurious commodities.

India now has 5 tax bands and 3 rates: integrated, central, and state. Cess is applied in addition to these taxes. Because of revenue concerns, the government has not considered reducing taxes.

Tariffs may be reviewed following the RNR (revenue-neutral rate), according to the government. In the medium term, macroeconomic indices should improve due to the money generated by GST tax revenue. Inflation would be reduced if the tax domino effect, or “tax on tax,” were removed.

Regeneration of Income from Taxes and Other Sources

It is expected that broadening the tax base will boost tax receipts and assist in containing the budget deficit. Additionally, exports and FDI would also see a rise.

Image Source – economictimes.indiatimes.com

Industry experts believe the largest tax overhaul ever will boost firms. They fought tax evasion, rationalized tax rates, and streamlined administrative processes. Maintaining the reliability of the largest online tax system in the world, GSTN, was another of the administration’s main goals.

Stocks, bonds, and other investments can provide dividends, interest, and capital gains. Capital markets help investors build wealth and income.

Effects of India’s Groundbreaking Tax Reform

The GST took effect in India on July 1, 2017. One of the most thorough and ingenious economic strategies ever. This historic tax reform increased economic growth, streamlined company operations, and simplified the convoluted tax system in the nation.

Some statistics and key indicators must be examined to assess the efficacy of this significant change. Let’s look at the impact of GST in detail:

-

The Accumulation of Funds

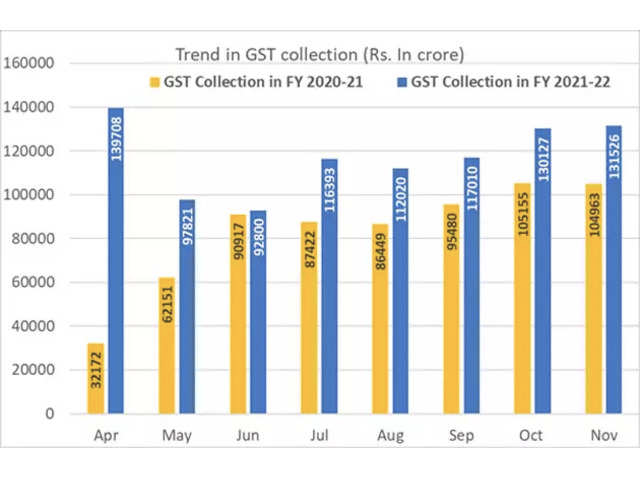

The revenue from GST is a vital indicator of system performance. The government earned 7.4 trillion Indian rupees in the first nine months of 2018. The government collected around 11.7 million crore Indian rupees in 2019, up significantly.

Rate reductions and product rationalizations caused problems in the 2020 fiscal year. Despite these hurdles, FY19 revenue was INR 12.2 lakh crore, up roughly 4%.

Despite occasional fluctuations due to government laws and economic conditions, revenue has increased steadily.

-

Modifications in the Rates

Tax brackets and rates were simplified in the GST government revenue reform to simplify things for businesses and consumers. This area has advanced significantly.

The 28% GST is only applicable to 3% of goods. Currently, 25% of all items are liable to a 12% tax rate, 25% to a 5% GST rate, and about 50% to an 18% tax rate. The public’s resounding acceptance of the government’s essential tax cut demonstrates their dedication to rationalization.

Clarifications and Amendments to Existing Legislation

The goods and services tax (GST) statute has undergone significant changes. This is primarily a result of the wide range of taxpayer demands. To combat tax evasion and accomplish other goals, the government has responded to these demands with about 30 decrees, 145 circulars, and almost 700 notices.

These legal clarifications have extensively improved the efficiency of the GST impact on tax collection. The GST’s influence on tax collection has marked a watershed moment in India’s economic progress. The statistics and important indicators in this article demonstrate how this transition has benefited many other sectors.

However, potential future results and obstacles must be considered. As the economy and taxpayer duties evolve, the GST system must be changed. Tax evasion prevention and the upkeep of a compliant system are always top considerations.

Bottom Line

The government has a major responsibility for addressing the issue of improving the capacities of people involved with limited resources. These mainly include small-scale producers and dealers. This must be created in order to lower the total cost of compliance. This might also make it necessary to make revisions to better suit the majority’s wishes.

Frequently Asked Questions (FAQs)

-

What is GST? How does it work?

India will have a single common market owing to the GST, which is one indirect tax for the entire country.

-

The business of a taxable person is in multiple states. Every supply costs less than ten lakhs. From one state, he makes an interstate supply. Does he have to register?

If his total sales in all of India exceed Rs. 20 lacs (Rs. 10 lacs in Special Category States) or if he is involved in inter-state supplies, he must register.

-

Do we receive a new GSTIN, or can we utilize the provisional one? Can we use our temporary GSTIN while waiting for the new one to be issued?

Within ninety days, the provisional GSTIN (PID) must be changed to the final GSTIN. Yes, until the final GSTIN is released, the provisional GSTIN may be utilized. PID and the final GSTIN would match.

-

When selling goods to unregistered dealers, do registered dealers need to record the Aadhaar or PAN?

Under the GST Act, it is not necessary to obtain the customer’s Aadhaar or PAN details.

-

Are all charges for freight, transportation, and packaging included in sales invoices subject to GST? How is the bill charged?

The value must include all costs, and an invoice must be sent out reflecting this. Please refer to the invoice rules and Section 15 of the CGST Act.

-

Does a sunset provision exist in the Anti-Profiteering Law?

Yes, the Anti-Profiteering Authority has a two-year sunset clause.

-

Will service fees, like those imposed by certain restaurants, be seen as payment for a supply and, therefore, subject to taxation?

Under GST, there is no differentiation between goods and services. Like any other supply, service charges are subject to GST. Furthermore, it is clear that service charges are not statutory levies.

-

Who can make a GST payment?

GST is typically owned by the company that provides the goods or services. However, in other situations, such as imports and other registered supplies, the recipient could be held accountable under the reverse charge procedure.

-

Does every trader have to register for the GST?

Any trader with a yearly revenue over Rs. 20 lakh is required to register for the Goods and Services Tax.

-

What GST ceiling is in place?

The Central Government has set the threshold limits for GST registration for commodity providers at Rs. 20 lakh and Rs. 40 lakh. However, since the GST also determines each state’s revenue, the state governments are required to decide on the threshold limit within a week.