Based on the principle of “one nation, one market, one tax,” the GST tax system is currently in effect and is the most significant tax reform in Indian history. The most extensive indirect tax system ever put into place has removed every barrier to state-to-state trade.

Whether optimism triumphs over doubt will depend on how our administration proceeds with its mission to transform the GST into a “good and simple tax.”

The Goods and Services Tax (GST) was implemented in 29 states and 7 Union Territories because it would benefit everyone equally. The government would make more money as revenue leaks would be closed, manufacturers and traders would profit from fewer tax files, clear laws, and easy bookkeeping, and consumers would pay less for the goods and services.

What is Tax Evasion?

Tax evasion is the unlawful practice of a person or business avoiding their tax obligations. GST tax evasion is widespread among Indians in the business class. They make enormous sums of money and devise several shady ways to escape the trap. Most carry out these unfair methods to avoid paying taxes.

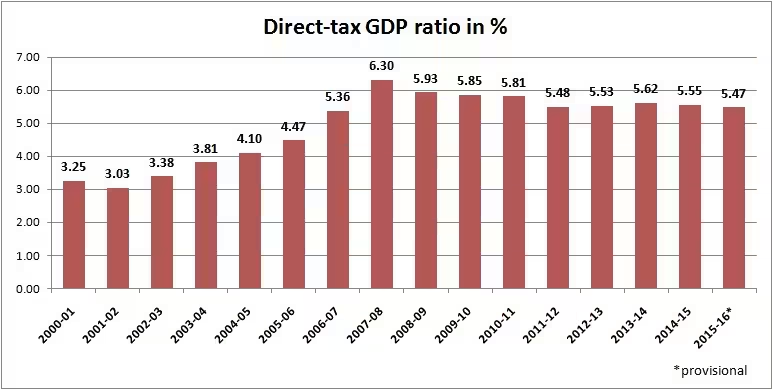

Image Source – firstpost.com

Smuggling instead of paying import taxes, state border taxes, and other fees: Many individuals and companies turn to smuggling to avoid paying customs duties, import-export taxes, and state taxes. According to Indian law, smuggling is illegal, and tax evasion carries harsher punishments.

-

- Inaccurate Income Tax Return Filing: One standard method of evading income taxes is to submit false information, such as understating your income, deductions, or engaging in fraudulent reporting. But that’s against the law.

- Keeping Up False Financial Records: Financial records such as account books and balance sheets that need to be more accurate might create the appearance of a low annual income. Additionally, some companies destroy their sales receipts to inflate their revenue and lower their annual tax obligations.

- Taking Tax Deductions With False Documents: Obtaining fictitious documentation—such as a handicap certificate—to demonstrate your eligibility for tax deductions under Section 80U is another method of tax evasion.

-

Not Presenting Any Income

Cash transactions are a common way to conceal their income. It follows that if you have no income on paper, you also have no tax obligations. Businesses usually do not produce sales invoices. Similarly, landlords might only take cash for rent payments rather than bank transfers or checks.

-

Keeping Cash in Foreign Bank Accounts

Foreign bank accounts are outside the purview of the Indian Income Tax Administration. Some people may store money in a bank account outside of the country.

Since this income cannot be identified while computing taxes, it is prohibited under the law. One can face legal repercussions for this offense if government agents find out about the money in foreign accounts.

-

Giving A Bribe To An Official

In India, offering a bribe is one of the most typical ways to commit tax evasion. Another approach to avoid paying taxes is to bribe an income tax official to alter the amount of tax owed.

Bribery is the method used by some to reduce or completely erase any tax debt owed in their names. Offering or taking a bribe is against the law. If you are found to be doing the same, strict measures will be accepted.

E-Invoicing and Reducing Tax Evasion

To curb tax fraud on Goods and Services Tax (GST) and increase adherence to the GST system, the government has lowered the threshold for businesses from Rs 10 crore to Rs 5 crore.

Additionally, the government has made available to central tax authorities a backend tool, which is GST anti-evasion measures called the Automated Return Scrutiny Module (ARSM) for GST returns.

The Automation of Central Excise and Service Tax (ACES)-GST backend application includes the ARSM, which uses data analytics to find irregularities and dangers in GST filings.

This makes it easier for tax authorities to examine the GST returns of Center Administered Taxpayers, who are chosen in accordance with the dangers the system has detected.

Also, the module produces notifications in the event that it detects any non-compliance.

What is GST-Registered E-Invoicing?

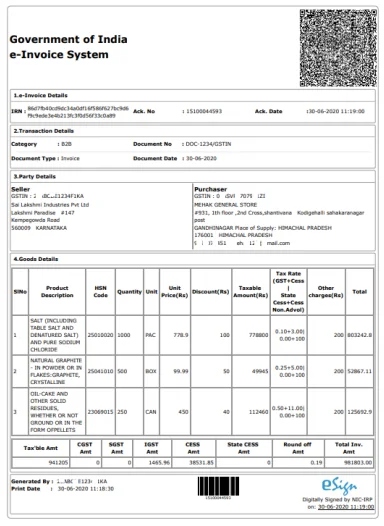

Through the use of e-invoicing, business-to-business (B2B) invoices, as well as other documents, are electronically verified for use on the GST site by the Goods and Service Tax Network (GSTN).

With e-invoicing, pre-generated standard invoices are submitted to a single e-invoice site, automating reporting by a single invoice detail entry. The Invoice Registration Portal (IRP), which instantly uploads the invoice data to the GST and e-Way Bill portals, assigns an identity number to each invoice.

Image Source : cleartax.in/s/e-invoicing-gst

By forcing the person initiating the movement of goods to input the required information via a digital interface prior to the movement of goods commencing, the E-Way Bill is a GST anti-evasion measures that facilitates faster movement of goods. The e-way bill is then generated on the GST portal. This produces e-way bills and removes the need for manual data entry when filing taxes.

The main goal of the e-invoice standard, which was accepted by the GST Council at its 37th meeting in September 2019, is to facilitate interoperability throughout the whole GST ecosystem.

Because there are so many instances of false invoices and illegal input tax credit usage, the GST authorities have pushed for the adoption of this e-invoicing system as GST anti-evasion measures. By giving the tax authorities real-time data access, this method is expected to minimize the number of frauds and the impact of GST on tax evaders, hence curtailing their actions.

Lowering the e-invoicing threshold is crucial because it means that more businesses, especially small and medium-sized ones, will have to abide by the rules and that more GST will be collected. It is also expected to raise the GST revenue base, decrease GST tax evasion, and provide tax authorities with more data to enhance compliance.

Offenses and Penalties under GST for Tax Evasion

The CGST Act lists GST offenses and the corresponding fines that apply. Sections 122 to 128 of the CGST Act deal with the provisions of offenses and penalties.

Union Budget 2023 February 1st, 2023

- E-commerce firms who fail to comply with the following shall be subject to a penalty of either Rs. 10,000 or the relevant tax amount, if greater:

- Permit an unregistered individual to sell products, services, or both through the operator unless they qualify for an exception.

- Permit any GST-registered individual to use the operator to supply any products or services outside of their registration state for which they are not qualified to do so.

- Operators, with the exception of those exempt from GST registration, do not accurately file GSTR-8 forms, including information on online sales made through them by e-tailers.

- It is proposed that the following offenses be decriminalized under the GST:

- When someone interferes with or stops an officer from carrying out their duties under the CGST Act

- When someone tampers with or destroys important documents or evidence

- When someone provides accurate information or needs to provide information mandated by the CGST Act

Incorrect or Fake Invoices

- Any products or services provided by a taxable person are given without an invoice or with a fraudulent invoice.

- In contravention of the GST regulations, he issues any invoices or bills without providing goods or services.

- He uses another legitimate taxable person’s identification number to issue invoices.

Fraud

- In order to avoid paying taxes, he files false returns or submits false financial information.

- Offers incorrect information or withholds information during proceedings.

Tax Evasion

- He gathers any GST but fails to send it to the government in a timely manner—three months.

- He still has three months to deposit any GST that he collects in violation of the rules of the government. Under GST, it will be illegal to fail to comply.

- He uses fraud to get a refund of any CGST or SGST.

- He claims to input tax credits without really receiving the products or services.

- He consciously reduces his sales to avoid paying taxes.

According to Business Standard, the Indian government hopes to recoup ₹50,000 crore in GST (goods and services tax) evasion in FY24 through their GST anti-evasion measures. It further stated that this sum is more than twice as much as what was retrieved in FY23 and may be the largest annual tax collection ever.

The GST authorities have discovered evasions of ₹1.36 lakh crore in FY24, and they have already recovered ₹14,108 crore of this. A ₹1.01 trillion evasion was found in FY23, leading to a ₹21,000 crore recovery.

It is anticipated that improper claims of input tax credit by insurance businesses, GST payments on foreign services under the reverse charge method, illicit clearances of tobacco goods, and property transactions will account for a significant amount of this recovery.

Wrapping Up

Since GST tax evasion is a serious crime in India and should be avoided at all costs, it is crucial to pay close attention to your income tax details, file your returns on time, and make sure you abide by all guidelines established by the government of India and the income tax department. Recurring attempts to evade tax can result in severe punishments.

Fraudulently attempting to lower your tax bill by concealing or underreporting income or by falsely reporting investments in order to maximize deductions and exemptions is known as tax evasion. Tax planning and GST tax evasion through illicit financial activities are crimes that carry severe punishments. To avoid penalties, it is crucial to comprehend the tax laws, get professional advice, and accurately disclose the required data.

Frequently Asked Questions

-

What exactly is the concept of destination-based tax on consumption?

The tax would be levied against the taxing body that is in charge of the site of consumption, which is also known as the place of supply.

-

What is the time frame for deciding cases of anti-profiteering provisions?

With the exception of the time required for the State-level screening committee and the Standing Committee to process complaints (which can take up to two months each), a maximum of nine months is allowed for case resolution.

-

Can action be taken under the anti-profiteering provisions in case the benefit of transitional credit availed is not passed to the consumers?

The CGST Act 2017’s Section 140(3) permits a transitional input tax credit, which must be transferred to the recipient in the form of lower pricing.

-

Should a customer pay extra GST on the Maximum Retail Price (MRP) affixed on goods?

No, the maximum retail price (MRP) that can be imposed on customers is inclusive of GST.

-

What will be the fate of the pending refund of tax/interest under the existing law?

The current law’s section 142(3) provisions shall be followed in handling the outstanding refund requests.

-

What is the place of supply of goods exported from India?

The location outside of India shall serve as the source of supply for items exported from India.

-

What occurs if a person neglects to submit their income tax return by the deadline?

You can file after the deadline under Section 139(4) of the Tax Act, but doing so would result in a belated return and a late cost of up to Rs 5,000.

-

After taxes are paid, does that mean obligations under the Income-tax Act end?

No, you are now in charge of ensuring that the tax credits are shown on your tax credit statement and in the TDS/TCS certificates you received.

- Are capital and revenue receipts alike subject to taxation?

Under the Income-Tax Law, all capital receipts are exempt from tax unless there is a specific provision for their taxation (certain capital receipts are chargeable to tax under the head “Capital gains”). In general, all revenue receipts are taxable unless they are specifically granted exemption from tax.

-

What happens if someone disregards the income tax notification that they are required to pay by Section 142(1) or Section 143(2)?

The assessing officer must use his best judgment after taking into account all of the pertinent information he has acquired and giving you a chance to be heard if you disregard the notification provided under Sections 142(1) and 143(2).