The Goods and Services Tax, popularly known as the GST, is an indirect tax that replaced many indirect tax systems in India, including the excise duty, VAT, and services tax, among others. It is an indirect form of tax or consumption-based tax levied by the Government of India on all the goods and services parties of a supply chain.

Historically, the Goods and Services Tax was introduced in the year 1999 by the government of India under the Prime Ministership of Atal Bihar Vajpayee. He set up a board under the Finance Minister of West Bengal, Asim Dasgupta, to comprehensively establish a GST model. However, it failed to come to fruition.

However, in 2017, the National Democratic Alliance (NDA) government, led by the Bharatiya Janata Party (BJP), introduced the GST Bill. The Act came into effect on 1st July 2017 and is now a multi-stage, complete, destination-based tax that is levied on every value addition.

From a legal perspective, the GST provisions are inserted in the Constitution of India by the Hundred and One Constitutional Amendment Act. Article 269A of the Constitution mentions that the GST on supplies in the course of interstate trade or commerce shall be levied and collected by the Government of India.

Moreover, the GST shall be between the Union and the States as directed by relevant laws based on the recommendations of the Goods and Services Tax Council.

Reasons Behind The Success of GST

The Income Tax Department in India is a great source of information. Individuals and corporations file tax returns, which are augmented by information obtained from other sources such as credit card companies, banks, and more. This thorough data gathering goes beyond simple submissions.

To find possible areas of interest, the spending habits of those who are engaged in high-value transactions requiring significant outlays are closely scrutinized. This examination probes the financial behavior of organizations involved in large-scale transactions and offers valuable insights into their economic behavior. Combining data from many sources improves the department’s ability to evaluate revenue and expenses precisely, which leads to a more comprehensive picture of the financial environment.

The information provided is used by the property registrar to gather information about the parties to real estate transactions over a certain threshold. Advanced data analysis is made possible by every financial transaction connected to the PAN established with the tax department. Furthermore, information is obtained from a number of government agencies, such as the Ministry of Corporate Affairs, the Goods and Services Tax Network (GSTN), and SEBI.

The roaring success of GST and the invaluable data provided by the system knows no bounds. It has helped tax administration in ways that vouch for a more united India with an improved taxing landscape.

But before we get into the lens of administration, let’s take a closer look at the reasons behind the wide acceptance of GST!

-

Bidding Farewell To Multiple Taxes

GST tax administration has replaced multiple indirect taxes, which existed under the previous tax regime. Now, there is one single tax system instead of multiple systems, which makes it easier for the authorities to manage and levy taxes in accordance with various policies.

Further, it also makes tax compliance simpler. With the GST system, taxpayers are not bothered with complex and multiple return forms and deadlines. The centralized system takes care of it all.

-

Curbing Tax Evasion

GST laws in India are very stringent in comparison to previous indirect tax laws, which led to curbing tax evasion. Under the new system, taxpayers can claim an input tax credit only in cases where the invoices have been uploaded by their suppliers, which minimizes the chances of fake invoices and fraudulent claiming of input tax credits. Moreover, the e-invoicing is in line with this objective.

-

Indirect Taxes Subsumed

Previously, India had numerous indirect taxes, such as service tax, Central Excise, Value Added Tax (VAT), etc., imposed at various stages of the supply chain. Some taxes were under state jurisdiction, while others fell under the purview of the central government.

This arrangement resulted in confusion and complexities. To streamline and simplify the tax structure, the Goods and Services Tax (GST) was introduced. GST amalgamated several major indirect taxes into a single framework, alleviating the burden on taxpayers and enhancing the efficiency of tax administration for the government.

-

Increasing Numbers of Taxpayers

The updated tax system has effectively reduced instances of tax evasion. Its increased stringency has resulted in a notable surge in the number of taxpayers in India compared to the previous system. Additionally, the unified tax applied to both goods and services contributed to a significant increase in the number of businesses registering for taxation.

-

Eliminating Cascading Taxes

GST sought to remove the cascading effect of these multiple indirect taxes. Now, with the introduction of the GST data for tax compliance, the tax is levied only on the net value, which is added at each stage of the supply chain.

This system has helped to eliminate the cascading effect of taxes and significantly contributed to the hassle-free flow of input tax credits for both goods and services.

-

Online Procedures

The latest GST data for tax compliance are mostly carried out online. The online system is not only simple but also time-saving and efficient. It does not require loads of paperwork, and everything is stored digitally with no fear of losing documents.

From registration to refunds to bill generation, everything is done online on the official website. This has simplified the way people view the taxation system, offering ease of doing business in India.

-

Increase Consumption

The simplified nature of the new system has led to an uptick in the consumption rate. Previously, varying VAT rates in different states created imbalances in purchasing patterns.

The standardized GST rates have fostered consistent and competitive pricing nationwide, addressing disparities and promoting equilibrium in consumer choices. Consequently, this has resulted in increased revenues for the government.

-

Efficient Logistics and Distribution System

GST eliminates the necessity for extensive documentation and paperwork in the goods supply process, streamlining procedures. This reduction in administrative tasks minimizes transportation cycle times, enhancing overall supply chain efficiency and reducing turnaround times, consequently facilitating warehouse consolidation.

Moreover, the implementation of the e-way bill system has enhanced the efficiency of transit and destination processes, resulting in cost reductions, particularly in terms of high logistics and warehouse expenses.

52nd GST Council Meeting Recommendations – Detailed Insight

How is GST Data Leveraged for Tax Administration?

Governments now possess a potent tool to enhance efficiency, transparency, and compliance, thanks to the transformative impact of utilizing GST data in tax administration. GST, being a consumption-centric tax, generates an extensive dataset of economic transactions, offering tax authorities crucial insights into the financial activities of businesses.

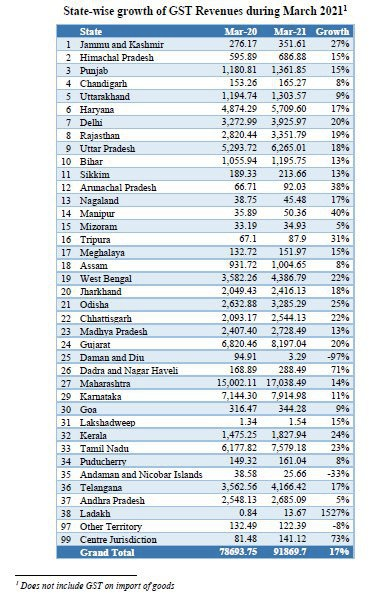

sample report that helps in identifying trends based on the GST data

The Indian government leverages GST data to ensure adherence to tax laws, streamline tax collection procedures, and identify potential instances of tax evasion. The reduction in manual errors has significantly enhanced the precision of tax assessments, facilitating proactive measures against tax fraud and enabling timely decision-making with the availability of real-time data.

Moreover, the application of advanced analytics and data mining techniques to GST data proves highly advantageous. It empowers tax authorities to discern noncompliance patterns, pinpoint high-risk taxpayers, and optimize audit selection.

Such a proactive approach not only safeguards government revenue but also fosters a fair and equitable tax system. The pivotal role of GST data in shaping modern tax administration supports economic growth and reinforces a robust fiscal framework.

Conclusion

Without a doubt, as India’s history unfolds in the coming years, the alterations brought about by GST will be recognized as catalysts propelling development and progress. These initial years signify a period of infancy, demanding further nurturing to facilitate the transformation of this system into a forward-thinking, amiable adult that contributes to the overall well-being of society.

As the GST tax administration progresses and undergoes enhancements, it holds the potential to revolutionize Indian tax administration. It has already paved the way for a more efficient and transparent system, establishing itself as an essential component of the indirect tax landscape in India. With aspirations to function as a singular indirect tax system, supplanting various other taxes on goods and services, GST aims to make the overall system more effective and fruitful.

Frequently Asked Questions

-

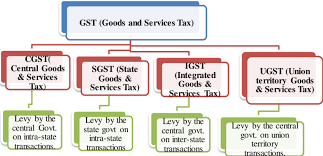

What kinds of GST are there?

There are four distinct types of Goods and Services Taxes (GSTs): Union Territory Goods and Services Taxes (UTGST), State Goods and Services Taxes (SGST), Integrated Goods and Services Taxes (IGST), and Central Goods and Services Taxes (CGST).

-

What is the taxable event under GST?

A taxable event under GST is the supply of goods or services or both. CGST and SGST/ UTGST will be levied on intra-State supplies. IGST will be levied on inter-state supplies.

-

Can I register for GST online?

Yes, GST registration can be done online. You must be careful while filling up the GST REG-01 form as you apply for GST online.

-

What is the time limit for taking a registration under GST?

As per the registration rules, a person should register within thirty days from the date on which he becomes liable to registration in a manner and subject to such conditions prescribed.

However, a casual taxable person and a non-resident taxable person should apply for registration at least five days prior to the commencement of business.

-

Whether the proper officer rejects an Application for Registration?

Yes. According to sub-section 10 of section 25 of the CGST/SGST Act, the proper officer can reject an application for registration after due verification.

-

Whether the registration granted to any person is permanent?

Yes, the registration certificate, once granted, is permanent if not surrendered, canceled, suspended, or revoked.

-

Can the registration certificate be downloaded from the GSTN portal?

Yes, after registration approval, the applicant can download the Registration Certificate from the GST common portal.

-

Which authority will levy and administer GST?

The Central Authority levy and administer CGST & IGST, while respective states and Union Territories levy and administer SGST and UTGST.

-

Who will decide the rates for the levy of GST?

The Centre and the State Authorities jointly decide the rates levied as the CGST and SGST. However, any changes in the rates are notified on the recommendations of the GST Council.

-

Is there any fine for not filing a GST return on time?

Yes, if you fail to file your GST returns on time, you will be fined ₹20 for nil returns and ₹50 for all other returns. The cost can vary from time to time.