Introduction

A Proforma Invoice is an initial invoice sent to the buyer before delivering goods or services, containing details like goods description, quantity, price, and terms. It’s a commitment to sell at a specified price, not a demand for payment. Meanwhile, Goods and Services Tax (GST) is a tax on goods and services, collected by the government as a percentage of the money spent. GST applies to the supply of goods and services. Although a Proforma Invoice isn’t a payment demand, its commitment to sell makes understanding GST Proforma Invoice format and compliance crucial. In this section, we explore Proforma Invoice requirements under GST, emphasizing their significance in GST compliance.

Understanding GST under Proforma

Understanding GST under a Proforma Invoice involves knowing how the Goods and Services Tax (GST) works when using a preliminary bill (Proforma invoice) before the actual sale. Here’s a simpler explanation:

-

Proforma Invoice’s Purpose:

- A Proforma invoice is like a preview of a bill sent to buyers before delivering goods or services. It outlines what’s being sold, how much it costs, and other important details.

-

GST on Proforma Invoice:

- Even though a Proforma invoice shows a commitment to sell, the actual tax (GST) is charged when the real invoice is issued or when the goods or services are given to the buyer.

-

Advance Payments and GST:

- If a buyer pays in advance based on a Proforma invoice, some GST may apply to the advance. But the full tax is calculated and paid when the actual goods or services are delivered.

-

Proforma Invoice in International Trade:

- For international deals, Proforma invoices are used to share details with the buyer and for customs. Understanding GST rules for exports and imports is crucial in these cases.

-

Getting Back GST:

- Businesses need to be careful about when they claim back GST (Input Tax Credit). Usually, it’s done when the actual invoice is issued and the goods or services are given to the buyer.

-

Actual Invoice Takes Over:

- Once the goods or services are actually given to the buyer, a real invoice is issued, replacing the Proforma invoice. The GST is then calculated based on the actual transaction.

Also read: The Importance Of Including All Required Elements On A Tax Invoice

Legal Framework of Proforma Invoices under GST

GST involves understanding the rules and guidelines established by the law regarding the use of preliminary bills (Proforma invoices) within the framework of Goods and Services Tax (GST). Here’s a detailed explanation:

-

Purpose of Proforma Invoices:

- Proforma invoices serve as preliminary bills that provide details of a potential sale before the actual transaction takes place. They include information about the items or services, their quantity, value, and other relevant terms.

-

Legal Guidelines for Proforma Invoices:

- Under the legal framework of GST, there are specific guidelines that businesses must adhere to when using Proforma invoices. These guidelines ensure that the use of preliminary invoices aligns with the broader tax regulations.

-

Timing of GST Application:

- The legal framework dictates that the application of Goods and Services Tax is tied to the issuance of a tax invoice or the actual supply of goods or services. Proforma invoices, being preliminary, do not trigger immediate tax liability.

-

Advance Payments and GST Liability:

- In cases where advance payments are made based on a Proforma invoice, businesses must follow legal guidelines on how GST is applied to these advance amounts. The full tax liability, however, is typically triggered by the issuance of the actual tax invoice upon the completion of the supply.

-

International Transactions and Legal Compliance:

- For businesses involved in international trade, it’s crucial to ensure that Proforma invoices comply with legal requirements related to exports and imports. This includes adherence to GST regulations applicable to cross-border transactions.

-

Claiming Input Tax Credit (ITC):

- The legal framework specifies when businesses can claim Input Tax Credit. Generally, ITC is claimed when the actual tax invoice is issued, and the goods or services are supplied. This aligns with the legal principle that credits should be claimed when the recipient becomes liable to pay the tax.

-

Documentation and Record-Keeping:

- To comply with the legal framework, businesses must maintain accurate records of Proforma invoices. This documentation should include essential details such as the GSTINs of the supplier and recipient, a clear description of goods or services, and any applicable taxes.

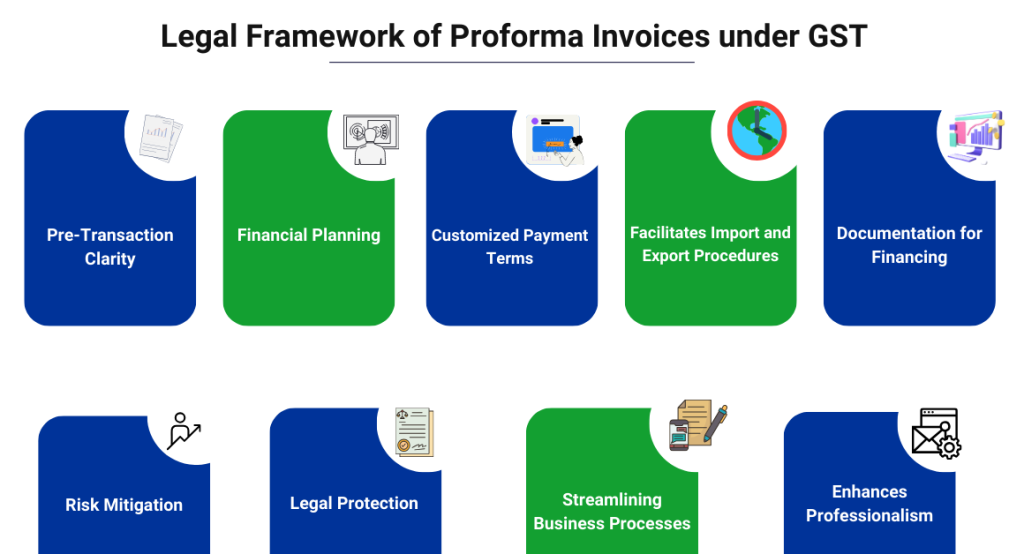

Benefits and Utility of Proforma Invoices

Benefits and Utility of Proforma Invoices outlines the advantages and practical uses of Proforma Invoices in business transactions. Here are some key points to elaborate on this topic:

-

Pre-Transaction Clarity:

- Proforma Invoices offer a clear breakdown of transaction terms before goods or services are delivered, preventing misunderstandings between buyers and sellers.

-

Financial Planning:

- Businesses can use Proforma Invoices for effective financial planning, providing a basis for better budgeting by outlining expected costs and revenues.

-

Customized Payment Terms:

- Proforma Invoices allow sellers to propose tailored payment terms before transactions, offering flexibility for negotiating favorable terms.

-

Facilitates Import and Export Procedures:

- In international trade, Proforma Invoices assist in customs clearance by providing detailed shipment information for smooth import and export processes.

-

Documentation for Financing:

- Proforma Invoices can serve as documentation for securing financing or credit, meeting the requirement of lenders for evidence of a pending transaction.

-

Risk Mitigation:

- Both buyers and sellers use Proforma Invoices to mitigate risks. Buyers assess potential costs before committing, and sellers gain assurance of genuine buyer interest.

-

Legal Protection:

- While not legally binding, Proforma Invoices offer some legal protection. In disputes, they serve as evidence of agreed-upon terms before the actual transaction.

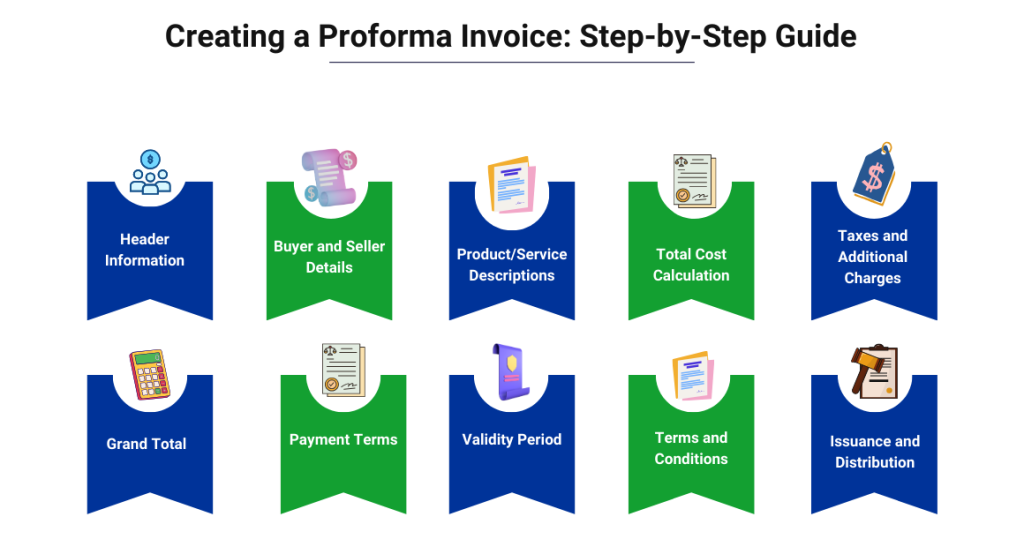

Creating a Proforma Invoice: Step-by-Step Guide

Creating a Proforma Invoice is a step-by-step process that involves generating a preliminary document detailing the estimated costs of goods or services. Here’s a guide on how to create a Proforma Invoice:

-

Header Information:

- Business name, logo, contact details.

- Unique invoice number and date.

-

Buyer and Seller Details:

- Customer name.

- Shipping and billing address.

- Customer and taxpayer’s GSTIN (if registered).

- Place of supply.

-

Product/Service Descriptions:

- Item details, including description, quantity, and unit.

- Total value.

-

Total Cost Calculation:

- Taxable value and discounts.

-

Taxes and Additional Charges:

- Rate and amount of taxes (CGST/SGST/IGST).

- Whether GST is payable on a reverse charge basis.

-

Grand Total:

- Total amount payable by the buyer.

-

Payment Terms:

- Proposed terms of payment.

-

Validity Period:

- Mention the validity period.

-

Terms and Conditions:

- Any certifications required by Customs Authorities.

- Signature of an authorized person from the supplier.

-

Issuance and Distribution:

- Issue the Proforma Invoice with a clear indication that it is not a demand for payment.

- Distribute the document to the buyer for review and confirmation.

Proforma Invoice vs. Commercial Invoice

| Proforma Invoice | Commercial Invoice |

| Issued Before Transaction | Issued After the Completion of Transaction |

| Not Legally Binding | Legally Binding Document |

| Provides Preliminary Information such as the description of goods or services, quantity, price, and other terms to give the buyer a clear understanding. | Contains Final Details of the Transaction such as actual costs, quantities, and other specifics related to the delivered goods or services. |

| Not a Demand for Payment | Serves as a Request for Payment |

| Used for Customs Clearance that means Proforma Invoices are commonly used in international trade for customs clearance. Customs authorities use the information on the Proforma Invoice to assess duties and taxes on the imported goods. | Required for Customs Clearance in International Trade that means Customs authorities require a Commercial Invoice for clearance of imported goods. It provides detailed information on the goods, aiding in accurate assessment of duties and taxes. |

| Helps in Pre-Transaction Planning | Used for Post-Transaction Record and Accounting |

| May Include Estimated Costs | Includes Actual Costs and Details of Goods/Services |

| More Flexible in Terms that means Proforma Invoices often offer more flexibility in negotiating terms. Buyers and sellers can discuss and agree upon terms before the issuance of the official Commercial Invoice. | Terms are Usually Agreed Upon Before Issuing: It means, while some terms may be negotiated before, the Commercial Invoice is issued after the transaction is completed. It reflects the terms agreed upon in the Proforma Invoice or any subsequent negotiations. |

| Common in International Trade | Commonly Used in Domestic and International Trade |

Also Read: Commercial Invoice Vs. Proforma Invoice: What’s the Difference?

Importance of Proforma Invoices in International Trade

Let’s delve into the importance of Proforma Invoices in the context of international trade:

- Customs Clearance: Proforma Invoices are crucial for getting goods through customs smoothly. They provide detailed information about the shipment, helping customs authorities assess duties and taxes accurately.

- Clarity in Transaction Details: In international trade, Proforma Invoices ensure everyone is on the same page before shipping. They outline details like the type and quantity of goods, pricing, and other terms.

- Currency and Price Confirmation: Proforma Invoices confirm the agreed-upon currency and pricing terms for international transactions. This helps prevent disputes and ensures a clear understanding of the financial aspects.

- Documentation for Financing: Proforma Invoices can be used as proof for securing financing or credit. Lenders may require evidence of a pending transaction, and Proforma Invoices provide a basis for assessing creditworthiness.

- Risk Mitigation: Proforma Invoices help reduce risks for both buyers and sellers. Buyers can assess costs and terms beforehand, while sellers ensure genuine interest from the buyer before shipping.

- International Trade Regulations Compliance: Proforma Invoices assist in complying with international trade regulations by providing the necessary information to meet specific country requirements.

- Negotiation and Agreement: Proforma Invoices serve as a starting point for negotiations in international transactions. They allow both parties to agree on terms before finalizing the deal.

Conclusion

In conclusion, Proforma Invoices under GST are crucial for trade. They help in clear transactions, especially with the Goods and Services Tax involved. Proforma Invoices play a significant role in making sure that everyone understands the details of a transaction and contributes to the smooth flow of business. Overall, they hold great importance under the GST system, ensuring transparency and clarity for both buyers and sellers.

FAQ’S

-

What is a Proforma Invoice?

A Proforma Invoice is a document that describes a transaction before it happens, showing details like the goods, quantity, and price.

-

How does GST apply to Proforma Invoices?

GST is applied to Proforma Invoices based on the applicable rates for goods or services. It ensures the tax is considered even before the actual transaction.

-

Is there a legal framework for Proforma Invoices under GST?

Yes, Proforma Invoices under GST follow specific legal requirements and comply with the regulations set by the government.

-

What are the benefits of using Proforma Invoices?

Proforma Invoices help in financial planning, provide clarity before a transaction, and are useful in negotiations between buyers and sellers.

-

How do I create a Proforma Invoice?

To create a Proforma Invoice, include details like the description of goods, quantity, agreed price, and terms. Ensure it aligns with GST regulations.

-

How is a Proforma Invoice different from a Commercial Invoice?

Proforma Invoices are preliminary and not legally binding, while Commercial Invoices are final and legally binding documents issued after the transaction is complete.

-

Why are Proforma Invoices important in international trade?

Proforma Invoices play a crucial role in customs clearance and provide essential information for international transactions, ensuring a smooth process.

-

Can Proforma Invoices be used for financial transactions?

Proforma Invoices can serve as documentation for securing financing or credit from financial institutions.

-

What happens if there are discrepancies between the Proforma Invoice and the actual transaction?

Discrepancies can lead to misunderstandings. It’s crucial to communicate any changes and agree on the final terms before completing the transaction.

-

Are Proforma Invoices mandatory for all transactions under GST?

Proforma Invoices are not mandatory under GST, but they are highly beneficial for clarity and transparency in business transactions.