Introduction

Goods and Services Tax (GST) is a tax on the sale of goods and services, simplifying the tax structure. Invoicing, the process of detailing a sale, involves creating a document called an invoice, providing information on goods, services, costs, and applicable taxes. GST invoicing guidelines outline the proper procedures for businesses to comply with tax regulations and maintain transparent financial records. Comprehending the importance of GST invoicing ensures businesses follow proper guidelines for creating GST-compliant invoices, fostering transparency and adherence to taxation rules.

Understanding GST Invoices

A GST invoice is a document that shows details of a transaction, like when you buy something or provide a service. It includes information about the goods or services and the taxes applied. Businesses use GST invoices to keep track of sales and purchases. It helps them follow tax rules and shows how much tax they need to pay or can claim back.

A GST invoice should include information like:

-

Seller’s Information:

- The name, address, and GSTIN (Goods and Services Tax Identification Number) of the seller must be clearly mentioned.

-

Buyer’s Information:

- Include the name, address, and GSTIN of the buyer to identify who the transaction is with.

-

Unique Invoice Number:

- Assign a distinct invoice number to each transaction for proper tracking and reference.

-

Transaction Date:

- Clearly specify the date when the transaction took place. This helps in maintaining a chronological record.

-

Description of Goods or Services:

- Provide a detailed description of the goods or services being sold to avoid any confusion.

-

Quantity of Goods or Services:

- Mention the quantity of the goods or services being sold to ensure clarity about the transaction.

-

Total Amount:

- Clearly state the total amount payable by the buyer, inclusive of taxes.

-

GST Amount:

- Break down the total amount to show the specific portion attributable to Goods and Services Tax (GST).

-

Mode of Payment:

- Indicate how the payment is made, whether by cash, card, or any other method.

-

Terms of Sale:

- Specify the terms under which the sale is conducted, including payment terms and any discounts offered.

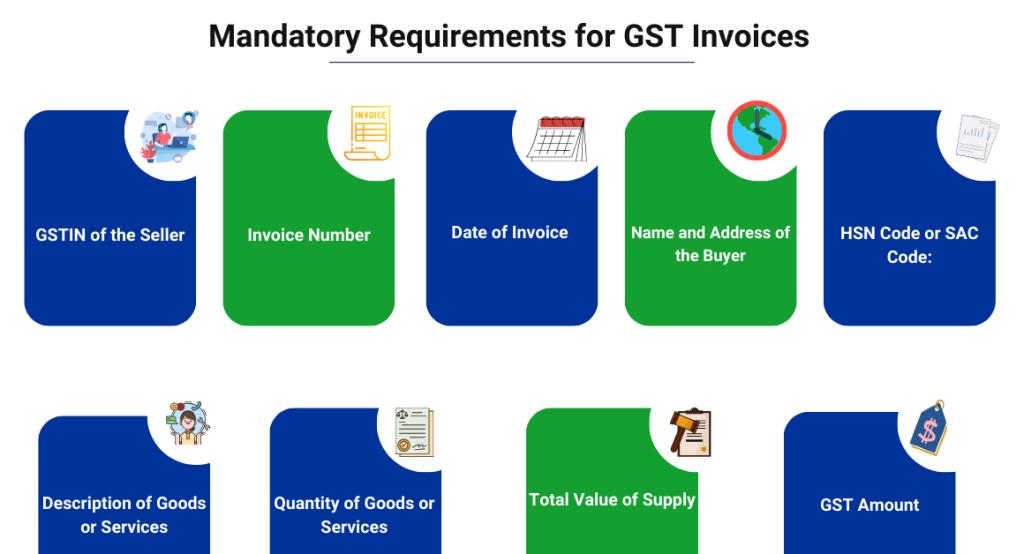

Mandatory Requirements for GST Invoices

The GST invoice issued should distinctly state details as outlined below:

-

GSTIN of the Seller:

- The seller must provide their unique GST Identification Number (GSTIN) on the invoice.

-

Invoice Number:

- Each invoice should have a unique identification number for tracking and reference.

-

Date of Invoice:

- Clearly mention the date when the invoice is issued to establish the timeline of the transaction.

-

Name and Address of the Buyer:

- Include the buyer’s name and address to identify who the transaction is with.

-

HSN Code or SAC Code:

- Mention the Harmonized System of Nomenclature (HSN) code for goods or Service Accounting Code (SAC) for services to categorize the products or services.

-

Description of Goods or Services:

- Provide a clear and detailed description of the goods or services being sold.

-

Quantity of Goods or Services:

- Specify the quantity of the goods or services being transacted.

-

Total Value of Supply:

- Clearly state the total amount payable by the buyer, including taxes.

-

GST Amount:

- Break down the total amount to show the specific amount of Goods and Services Tax (GST).

-

Place of Supply:

- Indicate the place where the goods or services are delivered or where the service is provided.

Also read: Mandatory Information To Include In A Tax Invoice For Goods

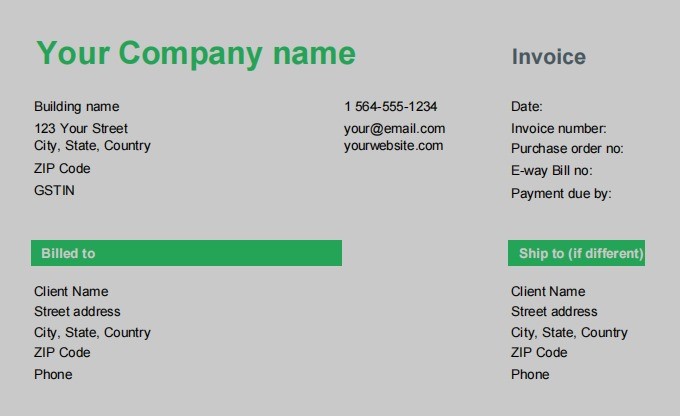

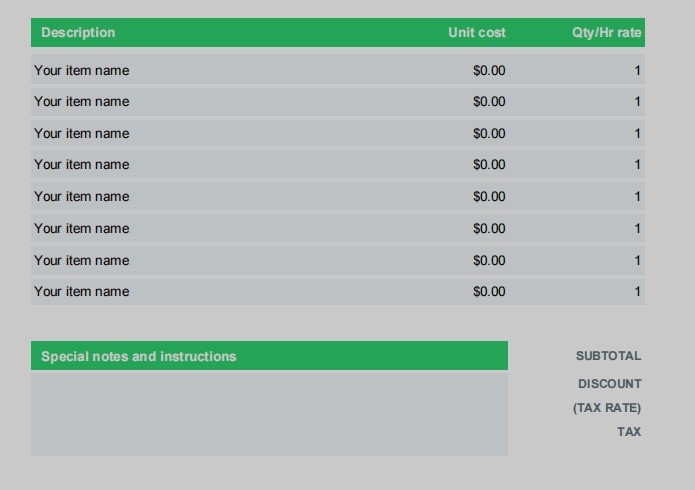

GST Invoice Format and Compliance

Let’s break down in details:

-

Name, address, and GSTIN of the supplier:

The seller’s details, including their name, address, and GST Identification Number (GSTIN), should be clearly mentioned.

-

Tax invoice number up to 16 characters:

Each tax invoice should have a unique identification number of up to 16 characters, generated consecutively for each financial year.

-

Date of issue:

The date when the invoice is issued should be clearly specified for record-keeping and reference.

-

Name, address, and GSTIN of the recipient (if registered):

Include the buyer’s details, such as name, address, and GSTIN, if they are registered under GST.

-

If the recipient is not registered and the value is more than Rs.50,000:

Provide additional details, including the name, address, delivery address, state name, and state code.

-

HSN code of goods or Service Accounting Code for services:

Assign the Harmonized System of Nomenclature (HSN) code for goods or the Service Accounting Code (SAC) for services to categorize the products or services.

-

Description of goods/services:

Clearly describe the goods or services being sold to avoid any ambiguity.

-

Quantity of goods and unit in UQC:

Specify the quantity of goods in numbers and the unit (e.g., meter, kg) using the Unit Quantity Code (UQC).

-

Total value of supply of goods/services:

Clearly state the total amount payable by the buyer, including the value of goods or services.

-

Taxable value of supply after adjusting any discount:

Mention the taxable value after accounting for any discounts offered.

-

Applicable rate of GST:

Clearly mention the rates of Central GST (CGST), State GST (SGST), Integrated GST (IGST), Union Territory GST (UTGST), and Cess applicable to the transaction.

-

Amount of tax (with breakup of amounts of CGST, SGST, IGST, UTGST, and Cess):

Break down the total tax amount to show the specific amounts of CGST, SGST, IGST, UTGST, and Cess.

-

Place of supply and name of destination state for inter-state sales:

Indicate the place where the goods or services are supplied and specify the destination state for inter-state sales.

-

Delivery address if it is different from the place of supply:

Include the delivery address if it differs from the place of supply.

-

Whether GST is payable on a reverse charge basis:

Clearly state whether GST is payable on a reverse charge basis if applicable.

-

Signature of the supplier or his authorized representative:

The invoice should be signed by the supplier or their authorized representative to validate its authenticity.

Also Read: Excel Mastery: Crafting the Perfect GST Tax Invoice Format for Your Business

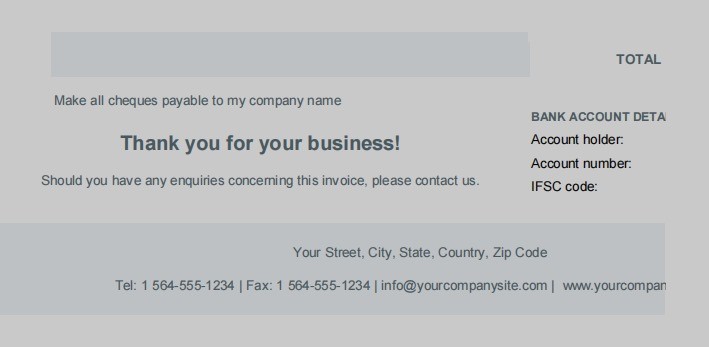

Below image shows the details of GST Invoice format:

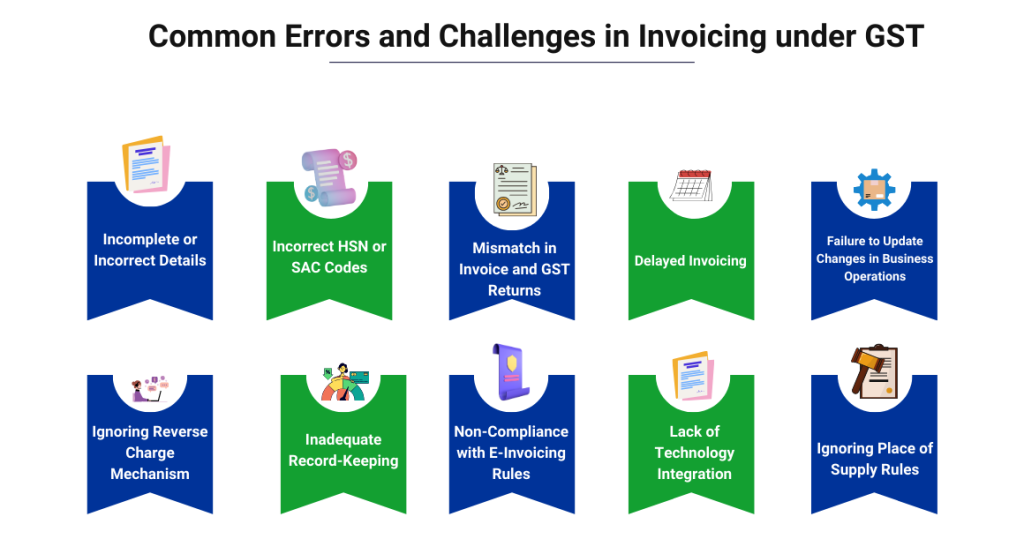

Common Errors and Challenges in Invoicing under GST

Common Errors and Challenges in Invoicing under GST are:

-

Incomplete or Incorrect Details:

- Error: Missing or inaccurate info on the invoice.

- Challenge: May cause confusion, processing delays, and non-compliance with GST rules.

-

Incorrect HSN or SAC Codes:

- Error: Wrong HSN for goods or SAC for services.

- Challenge: May lead to tax miscalculations and non-compliance.

-

Mismatch in Invoice and GST Returns:

- Error: Discrepancies between invoice and GST returns.

- Challenge: Can trigger audits, disrupting business.

-

Ignoring Reverse Charge Mechanism:

- Error: Neglecting buyer-paid GST (reverse charge).

- Challenge: Results in incorrect tax treatment and non-compliance.

-

Inadequate Record-Keeping:

- Error: Poor maintenance of records.

- Challenge: Difficulties during audits, potential penalties.

-

Non-Compliance with E-Invoicing Rules:

- Error: Not following electronic invoicing rules.

- Challenge: Legal repercussions and business disruptions.

-

Lack of Technology Integration:

- Error: Not using tech for invoicing, leading to manual errors.

- Challenge: Errors, increased costs, and inefficiencies.

-

Ignoring Place of Supply Rules:

- Error: Neglecting to determine and mention the correct place of supply.

- Challenge: Applying wrong GST rates, risking non-compliance.

Also Read: Common Errors And Mistakes In Tax Invoices For Goods: Prevention And Correction

Benefits of Compliant Invoicing under GST

There are many benefits of compliant invoicing under GST includes:

-

Input Tax Credit (ITC) Claim:

Compliant invoicing lets businesses claim credit for GST paid on purchases, reducing overall tax liability.

-

Legal Compliance:

Adhering to GST invoicing rules ensures legal compliance, preventing penalties and contributing to smoother operations.

-

Smooth Business Operations:

Compliant invoicing aids transparent and efficient operations, supporting better financial planning and decision-making.

-

Credibility and Trust:

Accurate invoices build trust with customers, suppliers, and authorities, enhancing overall business credibility.

-

Avoidance of Penalties:

Proper invoicing minimizes errors, reducing the risk of penalties from tax authorities.

-

Reduced Audit Risks:

Compliant invoices decrease discrepancies during audits, allowing businesses to undergo audits smoothly.

-

Seamless Supply Chain Management:

Accurate invoicing streamlines supply chains, ensuring smooth movement of goods and services.

-

Facilitates Easier Access to Finance:

Compliant invoicing provides accurate financial records, easing access to financing from institutions.

-

Improved Cash Flow Management:

Proper invoicing ensures timely payments, enhancing cash flow management.

-

Efficient Tax Planning:

Compliant invoicing allows effective tax planning, utilizing exemptions and deductions.

-

Enhanced Competitiveness:

Businesses with compliant invoicing are more attractive to partners, customers, and investors.

-

Adaptation to Digital Transformation:

Compliant invoicing often involves digital practices, contributing to overall business digital transformation.

Importance of Technology in GST Invoicing

Using technology in GST invoicing means using computers or software to make invoices instead of doing it by hand. It’s important because:

1. Accuracy: Technology helps to avoid mistakes in invoices, making sure all the details are correct.

2. Efficiency: It makes the process faster and smoother, saving time for businesses.

3. Compliance: Technology ensures that invoices follow all the rules set by the government for GST, keeping the business in line with the law.

4. Record-keeping: Digital invoicing makes it easy to keep track of all transactions, helping businesses manage their finances better.

Conclusion

In conclusion, doing invoicing the right way under GST is really important for businesses. It helps them follow the rules and keeps everything in order. Proper invoicing makes sure businesses can get benefits like credits, avoid problems with the law, and run smoothly. So, it’s a big part of how businesses work and stay successful.

FAQ’s

-

What is GST and why does it matter for invoicing?

GST is a tax on goods and services, and it matters for invoicing because businesses need to follow its rules when making invoices.

-

What is a GST invoice and what information should it have?

GST invoice is a document that shows details of a transaction. It should have info like seller and buyer details, invoice number, date, and tax details.

-

What are the must-haves in a GST invoice?

GST invoice must have the seller’s name, address, and GSTIN, buyer’s details if registered, a unique invoice number, date, and clear details of goods or services.

-

How does the GST invoice format help businesses stay compliant?

Following the GST invoice format ensures that businesses meet the rules set by the government, helping them avoid legal issues and run smoothly.

-

What are some common mistakes in invoicing under GST?

Common mistakes include incomplete details, wrong HSN or SAC codes, and delayed invoicing, which can lead to penalties and other issues.

-

Why is it important to avoid errors in GST invoicing?

Avoiding errors is crucial because it helps businesses stay on the right side of the law, ensures smooth operations, and builds trust with customers and authorities.

-

How does compliant invoicing under GST benefit businesses?

Compliant invoicing lets businesses claim tax credits, follow the law, run operations smoothly, and build credibility with customers and partners.

-

Why is technology important in GST invoicing?

Technology is important because it helps businesses make accurate and fast invoices, follow rules, keep good records, and manage their finances better.

-

Can businesses use paper invoices instead of digital ones for GST?

Yes, businesses can use paper invoices, but using technology for digital invoices is recommended for accuracy, efficiency, and compliance.

- How does GST invoicing relate to the overall success of a business?

GST invoicing is a big part of how a business works. Doing it right ensures benefits, avoids problems, and helps the business run successfully in the long run.