Introduction

GST, or Goods and Services Tax, is a single tax replacing many others on things we buy and services we use. In the food sector, GST applies to everything we eat, with varying tax rates for different foods. Businesses selling food need to calculate GST for food items to avoid trouble and understand the food product GST rates that affect prices.

Input Tax Credit in the food industry acts like a discount on taxes for businesses buying ingredients. To follow the rules, businesses must comply with GST regulations for food. These changes in GST are significant for the food sector, creating a rulebook for businesses to ensure accurate tax payments.

Understanding these changes is crucial for both businesses and consumers, influencing the prices of favourite snacks or meals. This introduction sets the stage for further discussions on tax rates and the importance of compliance for everyone involved.

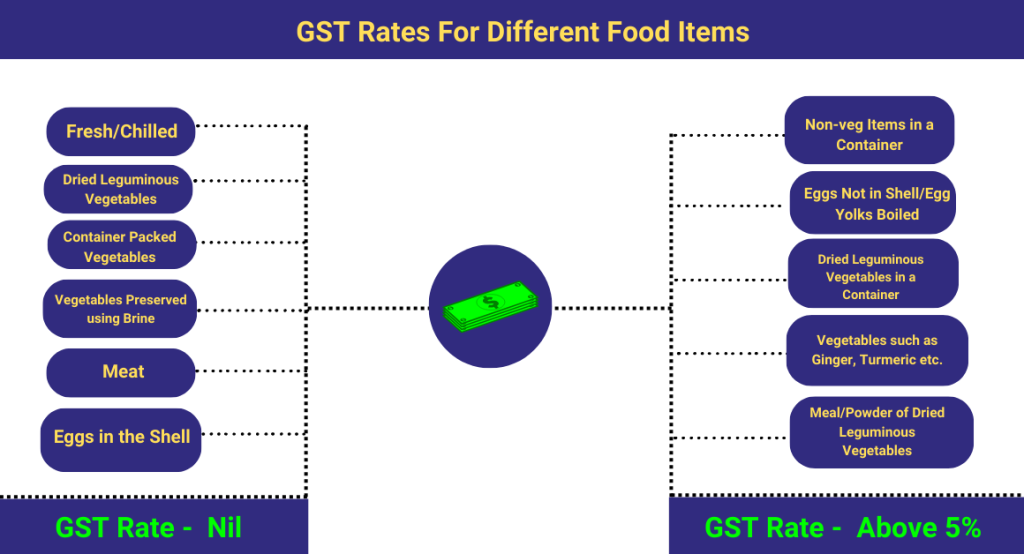

Understanding GST Rates for Different Food Items

Imagine GST (Goods and Services Tax) as a kind of tax that’s like a small portion of the money we spend on things, including food. Now, when it comes to food, not all of it gets taxed the same way. Different types of food can have different amounts of tax.

Let’s understand the GST rates on different food items:

| Food Items | GST Rate |

| Fresh/Chilled Vegetables (e.g., potatoes, onions, garlic) | Nil |

| Non-container Dried Leguminous Vegetables (packed, shelled) | Nil |

| Container Packed Vegetables (uncooked/steamed/boiled) | Nil |

| Vegetables Preserved using Brine/Other Means | Nil |

| Meat (not in a container, whether fresh or chilled) | Nil |

| Eggs in the Shell (fresh/cooked/preserved) | Nil |

| Non-veg Items in a Container (registered trademark/brand) | 5% |

| Eggs Not in Shell/Egg Yolks Boiled or Cooked by Steaming | 5% |

| Dried Leguminous Vegetables in a Container (registered brand) | 5% |

| Vegetables such as Ginger, Turmeric, Thyme, Curry Leaves | 5% |

| Meal/Powder of Dried Leguminous Vegetables | 5% |

| GST on fruits, vegetables, nuts, and edible plant parts preserved using sugar | 12% |

| GST on vegetables, fruits, nuts, and edible parts of the plant that are preserved/prepared using vinegar/acetic acid. | 12% |

| Food Items Prepared using Flour, Malt Extract, etc. | 18% |

| Chocolate and Other Cocoa Products | 18% |

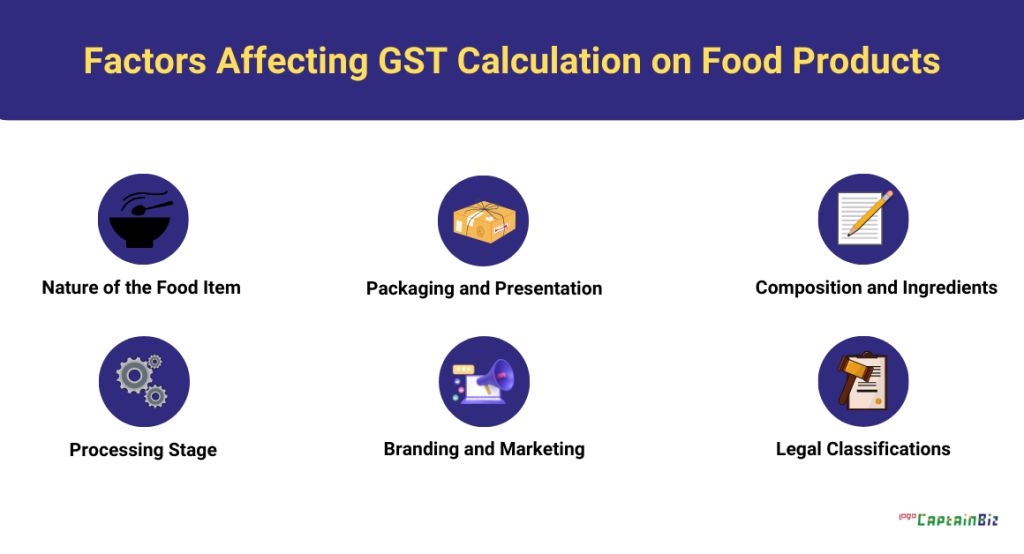

Factors Affecting GST Calculation on Food Products

When we talk about calculating the Goods and Services Tax (GST) on food products, there are several factors that come into play such as:

-

Nature of the Food Item:

- Whether food is raw or processed affects the GST rate, with fresh produce often having a different category than packaged items.

-

Packaging and Presentation:

- The packaging and presentation of food can affect GST calculation; branded items may have different tax implications than bulk or unbranded products.

-

Composition and Ingredients:

- The composition and ingredients of a food product matter, with certain additives or ingredients attracting different GST rates.

-

Processing Stage:

- The extent of processing influences GST rates; unprocessed foods may have lower rates, while heavily processed or ready-to-eat items may incur higher taxes.

-

Branding and Marketing:

- Whether a food product is branded or unbranded can be a factor, with branded items potentially having different GST treatment compared to generic equivalents.

-

Legal Classifications:

- Some foods have specific legal classifications affecting GST treatment; dietary supplements or functional foods may fall under distinct categories with varying tax rates.

Calculation Methodologies for GST on Food Products

When it comes to calculating the Goods and Services Tax (GST) on food products, there are specific methods and steps involved such as:

-

Taxable Value:

- Determine the taxable value of a food product, considering the transaction value or predefined rules, depending on the type of sale.

-

Applicable GST Rate:

- Identify the correct GST rate for a specific food item from the different slabs (0%, 5%, 12%, 18%, or 28%) and apply it to the taxable value.

-

Calculation Formula:

- Use the basic GST calculation formula – GST Amount = (Taxable Value * GST Rate) / 100.

-

Inclusive or Exclusive Calculation:

- Decide whether GST is calculated inclusive or exclusive of the selling price, with inclusive including GST within the price and exclusive adding GST on top.

-

Reverse Charge Mechanism (RCM):

- Be aware of cases where the reverse charge mechanism applies, making the buyer responsible for paying GST, and apply RCM rules when relevant.

-

Composition Scheme:

- Some small businesses may choose the composition scheme, paying GST at a fixed rate on total turnover, but they may not be eligible for Input Tax Credit (ITC).

-

Multiple Products or Services:

- If dealing with a mix of food products and services, segregate transactions and apply appropriate GST rates to each category.

-

Invoice Compliance:

- Ensure invoices comply with GST regulations, providing clear details such as GST amount, tax rates, and other necessary information.

Also Read: Simplify Your Tax Calculations

Input Tax Credit (ITC) in Food Product GST Calculations

ITC Businesses can get credit for the taxes they pay on things they buy for making food. This includes taxes on materials, packaging, and other stuff needed to make and sell food. They can use this credit to reduce the taxes they need to pay when selling the final product. The idea is to subtract the taxes they paid on things they bought from the taxes they collect on sales, so they end up owing less in taxes overall.

Let’s say you run a bakery, and you’ve purchased ingredients like flour, sugar, and packaging material for making cakes. You’ve paid GST on these purchases, and now you want to calculate the Input Tax Credit (ITC).

Steps:

-

Ensure Eligibility:

- Make sure you meet all the conditions to claim ITC. This includes having valid tax invoices for your purchases.

-

Identify Eligible Inputs:

- Identify the things you bought for your bakery, like flour, sugar, and packaging material. These are your eligible inputs.

-

Check GST Compliance of Supplier:

- Check that your suppliers have followed GST rules. You should only claim ITC if your suppliers have paid the GST they collected from you to the government.

-

Collect Tax Invoices:

- Collect the invoices for your purchases. These invoices should show the amount of GST you paid.

-

Calculate Total Input Tax:

- Add up all the GST amounts you paid on your eligible inputs. This is your total input tax.

-

Maintain Proper Records:

- Keep good records of your invoices and the total input tax amount. This is important for your business records and might be needed during audits.

-

Calculate Net GST Liability:

- Subtract your total input tax from the total GST you collected from selling your cakes. This gives you your net GST liability.

-

Include in GST Return:

- When you file your GST return, report the total Input Tax Credit you claimed during that period.

Example Calculation:

Let’s say you paid a total of ₹1,000 as GST on your flour, sugar, and packaging material. When you sold your cakes, you collected ₹2,000 as GST from your customers. Your net GST liability would be ₹2,000 (GST collected) – ₹1,000 (ITC) = ₹1,000. This is the amount you would need to remit to the government.

Also read: INPUT TAX CREDIT UNDER GST

Compliance and Legal Issues Related to GST on Food Products

When dealing with Goods and Services Tax (GST) on food products, businesses need to be aware of certain compliance requirements and legal considerations. Here’s a breakdown of the key aspects:

-

Register Correctly:

- Register your food business under GST and get a GST identification number (GSTIN). Make sure you have the necessary documents.

-

Classify Products Right:

- Classify your food products under the correct GST rate. Keep an eye on any changes in tax rates.

-

Calculate GST Accurately:

- Use the right methods to calculate GST on your food products. Mistakes can lead to financial and legal issues.

-

Follow Input Tax Credit Rules:

- Follow the rules for Input Tax Credit (ITC). Ensure your suppliers are GST-compliant and collect valid tax invoices.

-

Understand Reverse Charge Mechanism (RCM):

- If RCM applies, understand and comply with these rules. It shifts tax payment responsibility to the buyer.

- Also read: Reverse Charge Mechanism

-

Anti-Profiteering Measures:

- Pass on any tax benefits to consumers. Non-compliance with anti-profiteering rules can lead to investigations.

-

Keep Accurate Records:

- Maintain accurate records, including invoices and supporting documents. This helps during audits or scrutiny.

-

Seek Legal Advice When Unsure:

- If you’re unsure about compliance issues, seek legal advice. It can help you understand and address potential problems early.

Challenges and Common Mistakes in Calculating GST on Food Products

There are different types of challenges in calculation GST on food products such as:

- Diverse GST Rates:

- The varied GST rates for different food items can be confusing. It requires businesses to accurately determine the applicable rate for each product.

- Complex Classification:

- The classification of food items under specific GST rates can be complex, especially for products with multiple ingredients or varying processing stages.

- Input Tax Credit (ITC) Management:

- Managing ITC for diverse inputs, including raw materials, packaging, and other supplies, requires careful tracking and documentation.

- Reverse Charge Mechanism (RCM):

- Understanding and correctly applying RCM for certain transactions can be challenging, leading to potential errors.

Below are the common mistakes and it’s solution in calculating GST on food products:

| Common Mistakes | Mitigation Strategies |

| 1. Incorrect Classification: | – Regularly train staff on GST classification rules. |

| – Implement automated systems for accurate classification. | |

| 2. Inaccurate GST Calculation: | – Use software tools for precise GST calculations. |

| 3. Ignoring ITC Rules: | – Establish robust procedures for tracking and claiming ITC. |

| 5. Lack of Record-Keeping: | – Use digital record-keeping systems for easy retrieval. |

| 6. Non-Compliance with RCM: | – Stay informed about RCM rules and apply them accurately. |

| 7. Poor Anti-Profiteering Practices: | – Implement clear policies for passing on tax benefits. |

Impact of GST Changes on the Food Industry

Here are the impact of GST changes in Food Industry:

- Pricing Adjustments:

- Impact: GST rate changes directly affect food product costs, potentially lowering prices with rate reductions or increasing them with rate hikes.

- Example: Lowering GST on fresh vegetables from 5% to 0% could make them more affordable.

- Supply Chain Dynamics:

- Impact: GST rate alterations impact supply chain decisions, influencing procurement, inventory, and logistics strategies.

- Example: Decreasing GST on packaging materials might impact production costs and storage plans.

- Consumer Behavior:

- Impact: GST-related price changes can influence consumer choices, especially for price-sensitive buyers.

- Example: Lowering GST on essential food items might encourage consumers to buy more of those products.

- Compliance Challenges:

- Impact: Updates in GST regulations pose compliance challenges, requiring businesses to adapt accounting practices.

- Example: Changes in Input Tax Credit rules may necessitate adjustments in accounting systems.

- Impact on Small Businesses:

- Impact: GST changes can uniquely affect small and medium-sized enterprises, impacting their operations and profit margins.

- Example: Increased GST rates on certain processed foods may affect profit margins for small food businesses.

- Market Competition:

- Impact: GST rate changes can influence market competition, prompting businesses to adjust pricing strategies.

- Example: Lowering GST rates may intensify competition among food producers, leading to price reductions.

Conclusion

In summary, precise calculation of Goods and Services Tax (GST) on food products is vital for businesses in the food industry. Accurate GST calculations help in determining fair prices, managing finances efficiently, and ensuring compliance with tax regulations. By understanding GST rates, utilizing Input Tax Credit, and staying informed about changes, food businesses can enhance financial stability and overall success.

FAQ’s

- What is GST, and how does it apply to food products?

- GST is a tax applied to goods and services, including food products, contributing a percentage to the product’s cost.

-

How do I know the GST rate for different food items?

- Check official GST rate schedules or consult resources to find the applicable rate for each food item.

-

What factors influence the calculation of GST on food products?

- The nature of the food item, packaging, ingredients, and processing stage determine the applicable GST rate.

-

How do I calculate GST on food products?

- Multiply the taxable value of the food product by the GST rate percentage using the formula: GST = (Taxable Value * GST Rate) / 100.

-

What is Input Tax Credit (ITC) in the context of food product GST calculations?

- Input Tax Credit allows businesses to reduce the GST they paid on inputs (like raw materials) from their total GST liability.

-

What legal issues should I be aware of regarding GST on food products?

- Ensure proper registration, accurate classification of goods, timely filing of returns, and compliance with rules to avoid legal complications.

-

What are common challenges in calculating GST on food products?

- Challenges include diverse GST rates, complex classifications, managing Input Tax Credit, and compliance with Reverse Charge Mechanism and anti-profiteering measures.

-

Can GST changes impact my food business?

- Yes, GST changes can affect pricing, supply chain, consumer behavior, and compliance. Staying informed and adapting to changes is crucial.

-

How can I avoid common mistakes in GST calculations for food products?

- Be vigilant about correct classification, use accurate calculation methods, adhere to Input Tax Credit rules, and ensure timely GST return filing.

-

Why is it important to understand the impact of GST changes on the food industry?

Understanding GST changes helps businesses make informed decisions, adapt to market dynamics, and ensure compliance, ultimately contributing to the success of the food industry.

Also read how to calculate GST on gold and Jewellery.