Indians hold a special love for gold. It’s more than just money. Gold is not just a precious metal. It represents tradition, culture, and wealth. For many years, gold has been crucial in our traditions. People use it as a valuable investment or to make fancy jewelry for special events.

It is now essential to understand the gold GST calculation. Because the Goods and Services Tax is now in existence in India. You can get extensive knowledge of GST on gold jewellery in India from this article. It also describes how to compute the gold taxation in India before you make your next purchase.

Introduction to GST on Gold Jewellery in India

Jewellery made of gold is subject to GST for individual buyers. The making charges are subject to GST as well. Different rates apply to different parts of gold transactions under the GST framework.

It is important to note that different GST rates apply to the costs of producing, importing, and purchasing gold. However, there are no tax duties for those who sell old gold or use the money to buy new jewelry.

The following table shows a comparison of gold rates before and after the implementation of the GST system:

| Particulars | Before GST | After GST |

| VAT | 1% | Nil |

| Sales tax | 1% | Nil |

| Making Charges | Nil | 5% |

| Import duty | 10% | 10% |

| Gold value(GST rate) | Nil | 3% |

Understanding GST Rates for Gold in India

The GST council establishes the GST rate on gold, and any adjustments to the rate are set after examining market conditions and other criteria. Gold is currently subject to a 3% GST rate, which consists of a 0.5% state GST and a 2.5% central GST (CGST) (SGST).

Although the GST rate on gold is the same throughout India, there are separate rates that apply to imports, expenses incurred in the production of gold jewelry, and the purchase of physical and digital gold. It is given as follows:

- GST rates for gold import: Foreign countries often supply a significant portion of India’s traded gold. It incurs a 12.5% customs duty, consisting of 10.5% basic customs duty and 2.5% AIDC. Social Welfare Cess and GST may also apply during import. These regulations undergo periodic government updates. In the pre-GST era, the customs duty was around 10%. Currently, importing Rs. 50,000 worth of gold into India attracts a customs duty payment of Rs. 6250 Gold

- GST rates for gold ornaments-making charges: The purchase bill clearly outlines gold jewelry-making charges, subject to a 5% GST rate (2.5% SGST and 2.5% CGST). In India, this 5% GST is also applicable to manufacturing or repair fees for gold jewelry. If the cost of making or repairing your gold jewelry is Rs. 1000, the GST payable for the service is Rs. 50.

In 2017, the first-ever 18% GST rate was applied on charges. Gold taxation in India is currently just 5%. This current rate is less than the 12% tax on charges for producing and fixing gold in the time before GST.

- GST Rate for Physical Gold Purchases: In India, the value of purchases of gold is now subject to a 3% GST tax. This 3% is applicable for GST on gold jewellery. This same rate applies to calculating GST on gold bars or gold coin purchases.

This current 3% GST replaces the earlier 1% VAT (Value Added Tax) and 1% service tax from the pre-GST era. Experts suggest that the higher GST on gold is implemented to discourage gold imports into the country.

- GST on the Purchase of Digital Gold: In India, 3% GST applies to the amount spent while purchasing digital gold. For instance, if you invest Rs. 5000, your real investment will be Rs. 4850 after a 3% GST reduction. This change happens only once at the time of investment. Gold Exchange Traded Funds and Gold Mutual Fund purchases in India are not subject to GST right now.

Determining Gold GST Calculation for Purchases

The procedure for gold GST calculation is not that complicated. A percentage of the entire gold transaction value, which includes the gold’s worth as well as any other costs including making charges, taxes, and other levies, is used to compute the GST.

You must do the following calculations to get the GST charge on the price:

|

|

|

For instance, if you pay 5,000 rupees for taxes. The production charges and purchase charges for gold jewellery are 50,000. The total transaction value comes to 55,000. A 1,650 extra GST cost is required, which is equivalent to 3% of ₹55,000. Therefore, ₹56,650 is the total amount you must pay for the gold jewellery.

Also Read: Understanding GST On Gold: Rates, Impact, And Compliance In 2023

GST Implications on Gold-Making Charges and Labour Charges

Section 8 of the CGST Act categorizes the sale of gold ornaments or jewellery to ordinary individuals as a composite supply of goods and services. The gold itself is considered goods, and making charges or value addition relates to job work.

The GST rate of 3% applies to the total jewelry value, irrespective of whether making charges are itemized separately, as clarified by the CBIC in its sector-specific FAQs on GST for gold.

Businesses involved in gold mining and distribution follow the same GST registration threshold limits as regular taxpayers and can access the composition scheme under Section 10 of the CGST Act. Gold merchants often enlist goldsmiths or gold-making labor for job work on supplied gold bars or biscuits to create jewelry, subject to a 5% GST rate.

If unregistered, goldsmiths charge making fees, and the merchant pays 5% GST on a reverse charge basis. Consumers dealing directly with registered goldsmiths also face a 5% GST.

GST doesn’t apply when unregistered individuals sell or exchange gold jewelry at jewelry shops. Transactions by dealers or gold companies like Attica Gold, Aashraya Gold Company, or Manappuram Gold Loan involving second-hand gold jewelry are subject to GST based on the gold value under Rule 32(5) of the CGST Rules, given specific conditions are met.

Input Tax Credit (ITC) and GST on Gold

The Goods and Services Tax system allows businesses to employ the Input Tax Credit mechanism. It helps to claim credit for the taxes they have paid on their purchases. However, the Input Tax Credit for gold is subject to restrictions and conditions. They are as follows:

- ITC on Gold Purchases for Business Use: Businesses that sell gold jewelry or ornaments to customers could get a tax credit for the GST they pay when purchasing gold for their business. The GST obligation on the final supply of gold items may be mitigated by this credit.

- ITC Restrictions for Personal Use: You can’t get an Input Tax Credit for buying gold for investment or personal use. Usually, ITC doesn’t cover personal expenses. It only applies to products and services used for business.

- Conditions for Claiming ITC: Companies need to ensure their suppliers follow GST rules and provide valid tax invoices to qualify for Input Tax Credits (ITC). If a supplier opts for the composition plan, they cannot claim ITC.

Impact of GST on Gold Prices and Market Dynamics

Gold transactions now fall under a different tax framework due to the GST, which took the place of several indirect levies. The gold business as well as consumers were impacted by this change in tax laws.

-

Tax Rate Influence on Gold Prices:

- Gold is subject to a 3% tax and a 5% tax on making charges, therefore the GST rate has a direct impact on the price of gold. Hence, it is very important in determining gold proof. GST has the potential to impact Gold taxation in India. It impacts the market’s average price of gold.

- Gold price fluctuations have an impact on consumer affordability. It has an impact on investment decisions and purchasing patterns. A higher GST rate may discourage buyers, even when a lower tax may boost demand.

-

Customer Behaviour and Market Reaction:

- The demand for gold is significantly impacted by changes in the GST rate. Particularly in the jewelry sector. In response to the current tax rates, customers may decide to choose different types of gold, change their preferred methods of buying, or postpone purchases.

- Changes in consumer behavior have an impact on market dynamics. Changes in client demand and preferences impact the whole performance of the gold industry.

-

Economic Contribution of the Gold Industry:

- The GST rate is closely related to the gold industry’s economic significance. Changes in tax laws affect the money that comes in from gold sales, which affects how much the business contributes to the economy.

- Maintaining a robust and sustainable gold market that is in line with larger economic objectives requires striking a balance between tax laws and the industry’s function.

GST Compliance for Gold Traders and Jewelers

Dealers and jewelers must follow the rules governing the Goods and Services Tax. Usually, this comprises:

- GST Registration: Gold dealers and jewelers must register for GST if their yearly sales exceed the threshold amount.

- Invoicing: All transactions, including the sale of gold items, require the issuance of proper GST invoices.

- HSN Code: GST compliance depends on the accurate use of the Harmonized System of Nomenclature (HSN) code for gold and associated goods in invoices.

- E-Way Bill: Moving gold items over a certain value between states requires the creation of e-way bills.

E-waybill Portal

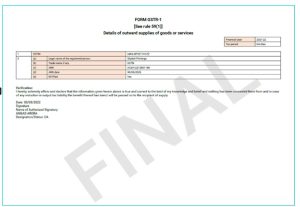

- GST Returns: Follow the GST requirements and file your GST returns on time. It includes GSTR-1, GSTR-3B, and so on.

Format of Form GSTR-1

- GST Audit: GST audits take place on businesses that have a turnover exceeding a pre-established level. It helps to ensure compliance with GST laws and regulations.

- Anti-Profiteering Compliance: Make sure anti-profiteering laws are followed to benefit customers from lower tax rates.

Conclusion

In summary, it is important to comprehend the relevant rates while calculating GST on gold bars and gold jewelry in India, particularly for gold bars. When calculating the tax implications, GST rates for gold ornaments are a significant factor.

Businesses active in the dealing of gold and jewellery must remain knowledgeable about these rates and adhere to the correct procedures. It can guarantee precise GST calculations and uphold tax legislation compliance.

The use of transparent invoicing methods and staying abreast of any modifications to the GST regulations would facilitate a seamless and legally compliant taxing procedure for transactions involving gold.

FAQs

Q1: How is the GST on gold bars calculated?

To calculate the GST on the bars, multiply the gold bar’s value by the applicable GST rate.

Q2: What is the GST rate that applies to gold coins?

On gold coins, the GST charge is also 3%. Coins sold by banks or government-approved dealers are an exception to this rule. In this instance, gold coins are exempt from GST.

Q3: Does GST apply to old gold?

No, old gold is not subject to GST. Gold that has been previously possessed and traded or sold is referred to as old gold. GST is not relevant in these kinds of transactions.

Q4: Is it possible for me to get a GST credit on the gold I purchased?

Yes, in most cases, companies that pay GST on gold used for commercial purposes are eligible to obtain an input tax credit.

Q5: Do handcrafted and machine-made gold jewelry have different GST calculations?

GST is often calculated on the total value, but it’s a good idea to verify the precise rates for various kinds of jewelry.

Q6: Are there any exemptions for GST on gold transactions?

There may be certain exemptions based on the nature of the transaction or specific government notifications. Check for updates regularly.

Q7: How often do I need to file GST returns for gold transactions?

GST returns for gold transactions are typically filed monthly, but the frequency may vary based on your business turnover.

Q8: Can individuals also be liable to pay GST on personal gold transactions?

Generally, GST does not apply to personal transactions involving gold, unless it involves a business activity.

Q9: Is there a separate category for antique gold items in GST calculations?

Specific categories may exist, so it’s crucial to check for any special provisions related to antique gold items.

Q10: What occurs if I compute GST on gold incorrectly?

Errors in computation may result in disparities and sanctions. It is important to guarantee precise computations and, if necessary, obtain expert guidance.

Also read how to calculate GST on chemical products.