Introduction

A Digital Signature Certificate (DSC) is an electronic form of a signature. It’s used to sign documents online, ensuring that the document is authentic and has not been tampered with. DSCs are used because they Authenticate the identity of the signer, Secure the document, ensuring it is safe and not altered, Legally Bind the signer to the document, making it official and compliant with regulations.

When you file GST returns or other documents on the GST portal, certain users are required to sign these documents using a DSC. This is particularly important for companies and LLPs (Limited Liability Partnerships). DSCs can sometimes cause errors. These errors can prevent you from successfully filing your GST returns. This guide will help you understand and fix these DSC errors, making the GST filing process smoother.

This comprehensive guide will help you understand the nature of DSC errors in GST, identify common reasons behind them, and provide a step-by-step solution to fix these errors effectively.

Understanding the DSC Error in GST

Digital Signature Certificate (DSC) errors are a common hurdle faced by many when filing GST returns. Understanding and resolving these issues can save time and ensure compliance with GST regulations.

Common Reasons for DSC Errors

| Reason | Description |

| Incorrect Installation | The DSC might not be installed properly on your computer. This can prevent the system from recognizing the DSC, leading to errors when trying to sign documents. Solutions include reinstalling the DSC and ensuring all necessary software components are correctly installed. |

| Browser Compatibility | Some web browsers do not support the DSC plugin needed for GST filings. This can result in the digital signature not working as expected. Preferred browsers for DSC activities include Internet Explorer and Google Chrome. Ensure the DSC plugin is enabled and compatible with the browser version. |

| Expired Certificate | If the DSC has expired, it will no longer be valid for signing documents. This issue requires renewing the DSC through the certifying authority. Always check the expiration date of your DSC and renew it in advance to avoid interruptions. |

| Multiple Certificates | Having multiple DSCs installed on the same system can create conflicts, making it difficult for the GST portal to determine which DSC to use. To resolve this, use only one DSC at a time and remove any duplicate certificates from the system. |

| Driver Issues | The DSC requires specific drivers to function correctly. If these drivers are missing, outdated, or not installed properly, the DSC will not work as expected. Ensure you download and install the latest drivers from the official website of your DSC provider and restart your computer after installation. |

Impact of DSC Errors on GST Filing

DSC errors can significantly disrupt the GST filing process. Here are five detailed impacts:

-

Delay in Filing:

- Description: When DSC errors occur, they can cause significant delays in the filing process. These delays may arise due to the time required to diagnose and fix the error.

- Impact: This delay can push filing past the deadline, potentially resulting in late fees or penalties.

-

Rejection of Returns:

- Description: If a DSC error prevents the proper submission of GST returns, the GST portal may reject the filing.

- Impact: Rejected returns mean that the filing is not considered complete, and the taxpayer must resolve the issue and resubmit, further delaying compliance.

-

Non-Compliance Issues:

- Description: Persistent DSC errors can lead to non-compliance with GST regulations. This can happen if the errors are not resolved promptly and filings are not completed on time.

- Impact: Non-compliance can result in legal consequences, including fines and audits, which can be time-consuming and costly.

-

Increased Administrative Burden:

- Description: Resolving DSC errors often involves additional administrative tasks, such as contacting technical support, reinstalling software, and troubleshooting.

- Impact: This increases the workload for the taxpayer or their staff, diverting resources from other important tasks and potentially increasing operational costs.

-

Financial Penalties:

- Description: Delays and non-compliance due to DSC errors can lead to financial penalties imposed by tax authorities for late or incorrect filings.

- Impact: These penalties can add up, leading to significant financial losses for the taxpayer, in addition to the potential damage to their reputation with tax authorities.

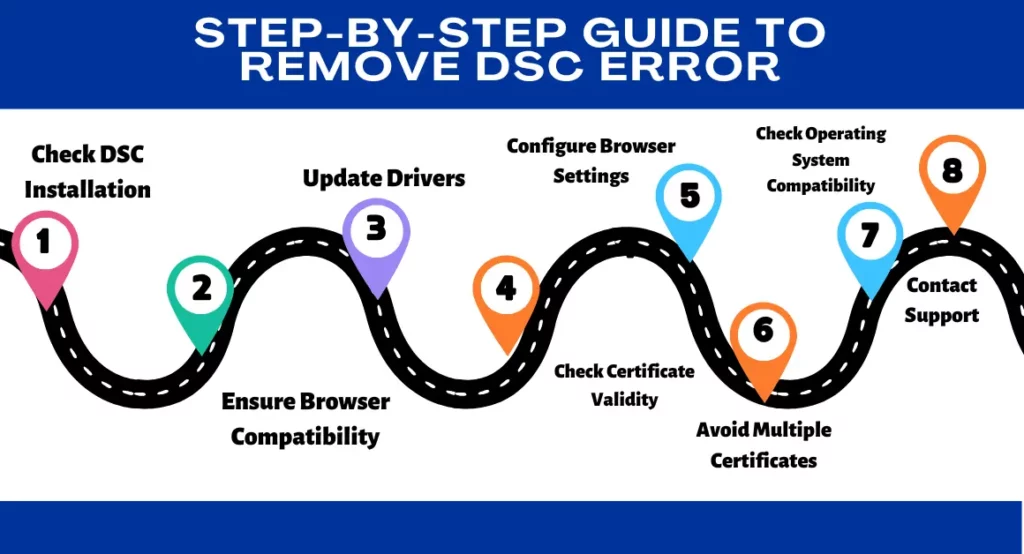

Step-by-Step Guide to Remove DSC Error

Here is a step-by-step guide to resolve DSC errors in GST:

Step 1: Check DSC Installation

- Verify Installation: Ensure the DSC is properly installed on your computer.

- Reinstall if Necessary: Uninstall and reinstall the DSC if issues persist.

Step 2: Ensure Browser Compatibility

- Preferred Browser: Use Internet Explorer or Google Chrome for DSC-related activities.

- Enable Plugins: Ensure the DSC plugin is enabled in the browser settings.

Step 3: Update Drivers

- Install Latest Drivers: Download and install the latest drivers for your DSC from the official website.

- Reboot System: Restart your computer after installing the drivers.

Step 4: Check Certificate Validity

- Verify Expiry Date: Check the validity of your DSC.

- Renew Certificate: If expired, renew the DSC through the certifying authority.

Step 5: Configure Browser Settings

- Security Settings: Adjust browser security settings to allow DSC operations.

- Clear Cache: Clear browser cache and cookies to prevent conflicts.

Step 6: Avoid Multiple Certificates

- Single Certificate: Use only one DSC at a time to avoid conflicts.

- Remove Duplicates: Remove any duplicate certificates from the system.

Step 7: Check Operating System Compatibility

- Update OS: Ensure your operating system is up to date.

- Check Compatibility: Verify that the DSC is compatible with your OS version.

Step 8: Contact Support

- Certifying Authority: Contact your DSC provider for technical support.

- GST Helpdesk: Reach out to the GST helpdesk for assistance.

Also Read: Know Everything About GST DSC Error And How To Fix It?

Conclusion

DSC errors in GST can be frustrating but are often solvable with the right approach. By following the steps outlined in this guide, you can troubleshoot and resolve most common DSC errors, ensuring a smooth GST filing process. Remember to keep your DSC updated, use compatible browsers, and seek support when needed.

Also Read: Unlocking The Power: Understanding The Benefits Of Digital Signature Certificates

FAQs

-

What is a DSC error in GST?

A DSC error in GST occurs when there is an issue with the digital signature certificate, preventing successful submission of documents on the GST portal.

-

How can I fix a DSC error in GST?

You can fix a DSC error by ensuring proper installation of the DSC, using a compatible browser, updating drivers, and checking the certificate’s validity.

-

Which browser should I use for DSC in GST?

Internet Explorer and Google Chrome are recommended for DSC-related activities in GST.

-

What should I do if my DSC has expired?

If your DSC has expired, you need to renew it through the certifying authority that issued it.

-

Can multiple DSCs cause errors in GST?

Yes, having multiple DSCs can cause conflicts and errors. It’s best to use a single DSC at a time.

-

How do I install the latest drivers for my DSC?

You can install the latest drivers by downloading them from the official website of your DSC provider and following the installation instructions.

-

What should I do if my operating system is not compatible with the DSC?

Ensure your operating system is up to date and check the compatibility of your DSC with the OS version. You may need to update or change your DSC.

-

How do I enable the DSC plugin in my browser?

You can enable the DSC plugin in your browser settings under the extensions or plugins section.

-

What are the common reasons for DSC errors in GST?

Common reasons include incorrect installation, browser compatibility issues, expired certificates, multiple certificates, driver issues, and operating system compatibility issues.

-

Who should I contact for help with DSC errors in GST?

You can contact your DSC provider for technical support or reach out to the GST helpdesk for assistance.