The Indian taxation system is one of the complex systems under which businesses have to pay heavy taxes. It takes up a significant portion of the income generated and doesn’t leave it easy for you to maintain the other expenses and losses in your business. These taxes are one of the biggest headaches for all businesses. It is a reason why most people take the help of unfair practices to save tax liabilities.

However, there are certain ways you can use to reduce the tax burden on your shoulders. You just have to properly utilize the tax planning, deductions, and tax credits, and it will help you reduce significant tax liabilities without even breaking any law.

In this article, we have mentioned all the essential things to reduce your tax liabilities. Let’s start with the deductions !!

6 Tax Deductions for Small Businesses in India

Taxes are the unavoidable parts of any business that you have to pay to the government of India. This makes the businesses lose a significant amount of their income. But, there are certain deductions offered by the government that every business owner should take the benefit of.

Here, we have mentioned some of the deductions that you should not miss out on to claim for your business, may it be a small or big business firm.

1. Preliminary Expenses

All businesses are eligible to claim the deductions for the preliminary expenses under Section 35D of the Income Tax Act. These expenses are made before establishing your enterprise. It includes the preparation of project reports, market survey reports, legal charges for drafting necessary agreements, Memorandum of Association, Articles of Association, registering the company with ROC, and other such expenses. The only condition is that you should record them as preliminary expenses and deduct them from your gross income for the next 5 years. Here, you can either claim 5% of the cost of the project or 5% of the capital employed, based upon whichever is less for the reduction.

2. Additional Depreciation

Generally, manufacturing companies receive extra tax benefits with the help of additional tax benefits. Under section 35AD, the businesses can claim for the 20% additional depreciation along with the regular depreciation over the installation of new plant and machinery. It can be claimed in the year when you start using the assets. However, if you use the asset for less than 180 days in its first year of installation, then you are allowed to claim 50% of additional depreciation, i.e., 10%. The rest of the claim will be made in the following year. This additional depreciation of 20% will allow you to save a lot of tax in the long run.

3. Medical Insurance

Under Section 80D of the Income Tax Act 1961, you can claim tax deductions for your medical insurance premiums up to INR 25,000. Plus, you can even get coverage for spouses, children, and parents. However, it won’t be applicable if you’re having a startup along with a full-time job where your employer has provided you with medical insurance coverage.

4. Bad Debts Written Off

Any business doesn’t collect the total account receivables, as many claims are left to be settled for various reasons. It generally happens in the B2B business, including manufacturing or wholesale business, where the buyer business simply makes us wait a lot or even go bankrupt. This directly impacts our business payments. Here, the government gives you a deduction that you don’t need to pay the taxes over the amount that is mentioned in your books, but you are unable to recover it. However, you have to make sure that these bad debts should be mentioned as your income in the current year or any previous fiscal year.

5. Deduction Over Travel Expenses & Home Office

If you go on a business trip, you can claim deductions for your traveling fare and accommodations. It is suggested to spend more than one business day and rest/sleep to write off your travel expenses effortlessly. Many businesses also utilize their home as an office in order to cut down on operating costs. This decision also helps the business to reduce its tax liabilities by claiming deductions over expenses such as utility bills, depreciation, property tax, etc. Section 32 and Section 37 allow you to claim deductions for depreciation and other expenses, respectively.

6. Digital Payment Advantage

All small businesses, traders, wholesalers, and retailers are liable to opt for the presumptive taxation scheme under section 44AD. Here, the minimum of 8% of total turnover or gross receipts would be taken as your net income chargeable for taxes. However, if your receipts are in the digital (non-cash) form, then only 6% would be considered as the net income on which you have to pay the taxes. In the long run, it will help you save at least 40% of taxes. Hence, digital transactions significantly reduce your tax liabilities.

Top 5 Tax Credits for Small Businesses in India

The Indian government is taking a lot of initiatives to incentivize small businesses. Both central and state governments understand that there are heavy taxes on the businesses to handle, at least in the initial stage. Therefore, there are various tax credits offered by the Indian government to reduce over-tax liabilities.

Here, we have mentioned the 5 important tax credits for small business in India that allows businesses to legally reduce their tax liabilities, just by putting in a little extra brain and effort.

1. Startup India Initiative

Startup India Initiative is one of India’s leading programs to promote innovative entrepreneurial small businesses and startups. In this program, you claim the tax exemption over your entire income for 3 consecutive financial years under section 80 IAC of the Income Tax Act. It is an initiative from the government’s end to reduce the financial burden from the shoulders of small and newbie businesses. In fact, businesses can re-invest this money into their operations and expand it.

2. Export Promotion Capital Goods (EPCG) Scheme

The EPCG scheme is one of the incentivized schemes from the government’s side to all the small export business owners. It avails the effective tax credits for small businesses in India. Under this scheme, you will be able to import the capital goods for pre-production, production, and post-production without giving any customs duty. In this way, businesses can invest more money in increasing the quality of their goods and services.

3. Special Economic Zones (SEZ)

There are tons of benefits and incentives available for the small businesses that work within the SEZ boundaries. For instance, small businesses get a 100% tax exemption over export income for these SEZ units under Section 10AA of the Income Tax Act for the first 5 years, a 50% tax exemption for the following 5 years, and a 50% exemption for the plowed back export profit for the next 5 years. Moreover, you will also get the tax holiday period and exemption from various customs and excise duties.

4. Credit Linked Subsidy Scheme (CLCSS)

Credit Linked Subsidy Scheme is a leading support program from the government’s side to small manufacturing businesses. The Ministry of Micro, Small, and Medium Enterprises (MSMEs) has introduced this scheme to upgrade modern plant machinery with the help of state-of-the-art technology by additionally helping them with a 15% capital subsidy over the available loan from a financial institution. This directly boosts the production of small-scale industries and enhances the business’s productivity and competitiveness in the market.

5. Employment Generation Scheme

Employment Generation Scheme is initiated by the various governments in India. Under this scheme, the businesses who are creating job opportunities will receive the additional tax credit and subsidy. It helps the small businesses to significantly reduce their operation and hiring cost. In this initiative, the government is trying to establish more micro enterprises in the non-farm sectors and help the unemployed youth.

Tax Planning Strategies for Small Businesses in India

Here we’ve mentioned the tax planning strategies for small business in India:

1. Select the Right Business Structure

There are various types of business structures, such as OPC, Pvt. Ltd., LLP, Sole Proprietorship, etc., and each entity has its own tax liabilities. Therefore, you should diligently select your business structure based on how many taxes you can bear in the initial stage. Moreover, you’ll get different types of deductions and exemptions based on your business structure.

2. Maintain Proper Records

You have to properly maintain all of your financial records including income, expenses, receipts, and invoices. It is one of the fundamental tax planning strategies for small businesses in India. When you have the organized documents, you can better plan your tax saving opportunities, deduction, and tax credits.

3. Write off Initial Expenses

When you start a new business, you generally have to face a lot of expenses in order to set it up properly. This initial expenditure will be considered as the “capital expenditure.” According to Section 35D of the Income Tax Act 1961, these expenses can easily be deducted in the first 5 years in 5 instalments. However, the maximum amount of deduction can not be more than 5% of project cost or capital employed in your business.

4. Select Simplified Tax Regimes

Simplified tax regimes allow the businesses to represent their income at a prescribed rate of 6%, 8%, or 50% under Section 44AD/44ADA of the Income Tax Act. In this way, you don’t have to maintain heavy book records.

5. Utilize the Benefits of Deductions, Tax-Saving Schemes, and Depreciation

There are various popular income tax deductions under sections 80C, 80D, 80E, 80G, etc., that allow businesses to minimize taxable income. Moreover, you can also utilize certain additional tax-saving schemes such as NPS, EPCG, CLCSS, and ELSS. It will help you directly reduce your taxes. Lastly, depreciation is a tax-deductible expense that businesses should diligently use to reduce taxable income and tax liabilities.

6. Smartly Plan Your Investments

Investment plans are one of the best options to multiply your money while saving taxes on it. If you smartly invest in some of the options, it will allow you to claim the tax exemption while filing the Income Tax Returns (ITR). Don’t forget to benefit from these investments under the tax planning strategies for small businesses in India.

7. Claim Your Input Tax Credit

New GST regime allows you to claim for the input tax credit over the items you’ve purchased in the name of your business. This will simply help you get back your taxes over those items as they were purchased for the use of business. Plus, you also have to properly maintain all the ITC records to receive your claims successfully.

8. Properly Plan Your Capital Gains

Capital gains refer to the profit earned over the sales of assets such as stocks, mutual funds, and property. Every business owns such assets that allow them to make more money. The best thing is that you can claim several exemptions and deductions under the Income Tax Act to reduce your tax liabilities.

9. Lastly, Take a Professional Guidance

The Indian taxation system is a very complex procedure. Thus, it is always better for any business to take guidance from a CA or tax consultant, as they have the practical knowledge and experience to reduce the tax liabilities. In this way, you’ll also be able to get your strategies re-checked by a professional.

GST: Everything You Need to Know for Small Business

Tax Avoidance vs Tax Evasion

Generally, Tax Avoidance is considered a legal approach to reduce or avoid taxes by following lawful activities. Here, you properly utilize the deductions and exemptions. In contrast, Tax Evasion is considered an illegal approach to avoid taxes by either showing a lesser income or overstating the expenses.

Below, we have mentioned an in-depth comparison between tax avoidance and evasion. Let’s begin.

| Parameters | Tax Avoidance | Tax Evasion |

| Meaning | It is a legal way to reduce the tax liability without breaking any law. | It is an unlawful method to eliminate tax liabilities. |

| Used For | Minimize tax liabilities legally | Eliminate taxes illegally |

| Attributes | Immoral | Illegal and objectionable |

| Objective | To reduce tax liabilities by utilizing scripts of laws | To reduce tax liabilities by utilizing unfair means |

| Concept | Takes the undue advantage of the loopholes in the system | Intentional manipulation of accounts through fraud |

| Implication | Utilize lawful and justified practices | Utilizing the punishable and offensive practices |

| When does it happen? | It is usually done before the event of tax liabilities | It is generally done after the occurrence of tax liabilities |

| Consequences | This might just result in legal penalties | Results in imprisonment and penalty |

| Permissible | Permissible | Non-Permissible |

GST and The Fight Against Tax Evasion

How to Prepare for a Tax Audit?

Tax Audit refers to the process of examination and assessment of the account books of a business conducted by a CA (chartered accountant) or tax agency to verify its tax compliance. The businesses are legally and mandatorily required to practice regular audits under Section 44B of the Income Tax Act (ITA). It allows the government to easily review all business transactions, including the required income, expenses, deductions, and credits.

In the tax audits, you will be able to catch any possible errors in your books that you have to resolve immediately. Otherwise, you might have to face legal penalties or punishments based on the errors found in your books. You should not take this process lightly, as it can have a direct negative impact on the reputation of your business.

Therefore, we have mentioned a step-by-step process here to help you prepare for the tax audit:

1. Maintain Proper Records

First, you should properly maintain your financial records, including income, expenses, losses, and deductions claimed over your tax returns. It is essential to have accurate, complete, and up-to-date records. Moreover, you can also maintain digital records in order to enhance its accessibility and ease of retrieval.

2. Keep Your Returns Accurate

You should adequately re-check the figures mentioned in your ITR (Income Tax Returns) files. It is a legal process, so it is required to make sure that everything is mentioned accurately.

3. Prepare Supporting Documents

Tax audits should always be backed up with supporting documents in order to prove the authenticity of your figures. For instance, you should keep your bills, invoices, bank statements, and receipts all ready to clarify any confusion if it occurs.

4. Take a Professional Guidance

Every business is suggested to take guidance from a CA or tax consultant, as they can help you properly guide over the tax planning and deal with the possible complexities. Plus, they can even assist you in your audit process.

5. Take Timelines Seriously

Whether it is filing tax returns, responding to legal notices, or any other formalities, you have to take the timelines seriously. If you miss the timeline anyhow, you will have to face legal penalties or punishments.

6. Have Proper Cooperation With Auditor

During the audit of your business, you should maintain proper cooperative behavior with the auditor. Avail them with all the necessary answers and documents to create a positive image of your business.

7. Have Contingency Funds

Running a business is not a joke, as many times, you might have to face tax dues, interests, or penalties during the audits. Thus, you should have some contingency funds to cope with any unexpected tax liability, dues, or fines.

How to File Your GST Returns Correctly?

GST returns are a compulsory part of all businesses running in India. Simply, every business has to file its returns every year in order to maintain its business legally.

Though GST is to be considered a little complex process, you can easily fill the returns now through online methods. Below, we have mentioned a step-by-step guide to file your returns correctly:

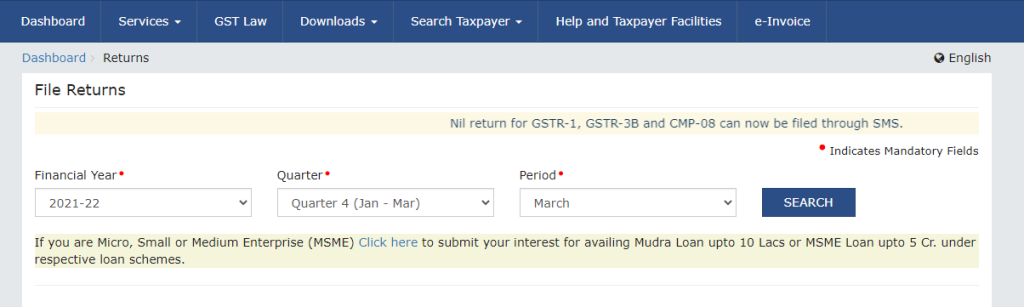

Step 1: First, you have to visit the GST Portal and login there using your required username and password.

Step 2: Go into the “Services,” and you will find the Returns dashboard. Tap on it and enter the financial year for which you’re filing the returns. Make sure to select the right one from the drop-down menu.

Step 3: Now, click on the “Prepare Online” option and the type of return you have to file.

Step 4: You just need to fill out all the required details, along with mentioning any late fees if needed. Once the details are filled, save the form and just fill it.

Step 5: After submitting your GST returns, you will find the required status to be changed to “Submitted.”

Step 6: Now, scroll down, and you have to proceed by clicking on the “payment of tax.” You will also get an option there named “check balance” to let you view cash and credit balances. Make sure to always check all this information before going forward.

Step 7: Click on the “Offset Liability” to clear your GST payment online in just a few minutes. When you see the confirmation over the display, click on the “ok” button.

Step 8: Lastly, you have to check the box against the declaration and select the authorized signatory from your drop-down list. Finish the process by clicking on the “file form with DSC” or “file form with EVC” and proceed ahead. Clear all the required payments for your required GST.

Conclusion

Taxes are one of the biggest hurdles of any business that you have to reduce in order to maintain the finances of your business correctly. It is one of the major reasons people opt for illegal methods to save their heavy tax liabilities. But, we have mentioned various legal ways in this guide that will allow you to reduce your tax liabilities. Moreover, we have also covered “how to file your GST return correctly?” to make sure that you appropriately fill up your returns without any possible errors.