Introduction

GST, or Goods and Services Tax, is a single tax on the supply of goods and services, aiming to streamline the taxation system by replacing multiple indirect taxes. It’s designed to make taxation simpler and more unified across the country.

TCS, short for Tax Collection at Source, is similar to TDS but with some differences. TDS is taken from payments under a contract, while TCS is collected by e-commerce operators from the money they get for goods or services sold online. It started on October 1, 2018, for most e-commerce operators.

TCS is a percentage of the money received for taxable goods or services. It’s covered by Section 52 of the CGST Act. From October 1, 2018, e-commerce operators need to collect TCS, with a few exceptions. We will discuss more about TCS under GST in this blog in detail. For instance, TCS is the tax that an e-commerce platform collects when a seller sells things through it, and the platform gets paid for those sales.

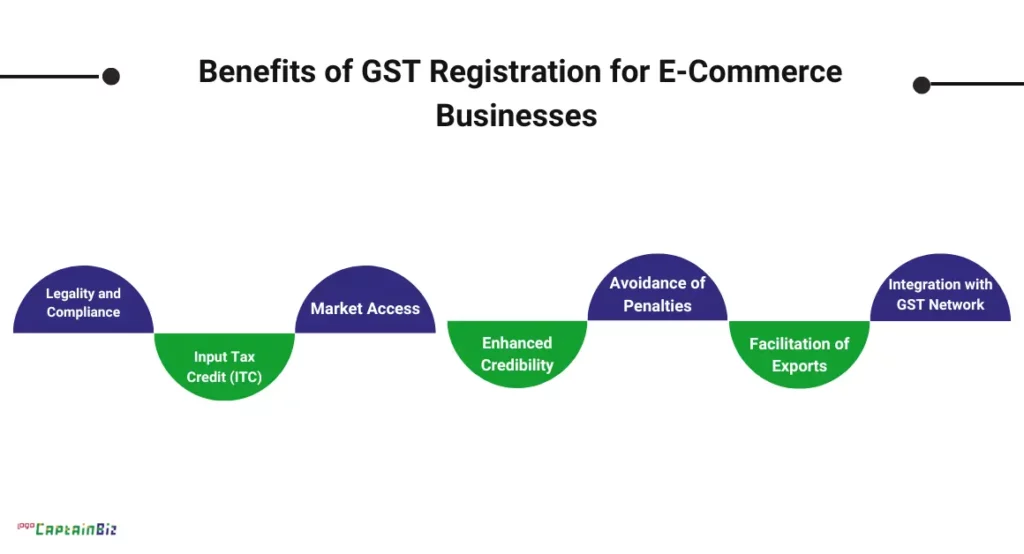

Benefits of GST Registration for E-Commerce Businesses

GST registration offers several benefits for e-commerce businesses in India:

- Legality and Compliance: Registering for GST ensures legal compliance with Indian tax laws, helping e-commerce businesses operate within the regulatory framework.

- Input Tax Credit (ITC): Registered e-commerce businesses can claim input tax credit on GST paid on purchases, reducing the overall tax burden and improving profitability.

- Market Access: GST registration enables e-commerce businesses to sell their products or services across state borders without facing multiple taxes, facilitating seamless interstate trade.

- Enhanced Credibility: GST registration enhances the credibility of e-commerce businesses among customers, suppliers, and financial institutions, fostering trust and confidence.

- Avoidance of Penalties: Non-registration or non-compliance with GST regulations can result in penalties and legal consequences. Registering for GST helps e-commerce businesses avoid such risks.

- Facilitation of Exports: GST registration is often a prerequisite for availing export benefits and incentives, enabling e-commerce businesses to expand their market reach globally.

- Integration with GST Network (GSTN): Registered e-commerce businesses can seamlessly integrate with the GSTN portal for filing tax returns, making compliance procedures more efficient and streamlined.

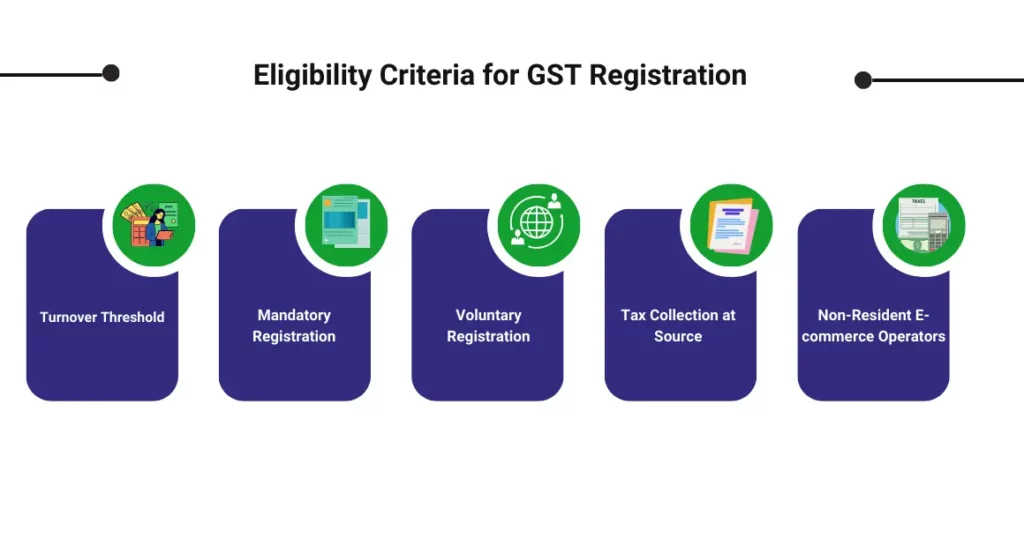

Eligibility Criteria for GST Registration

The eligibility criteria for GST registration for e-commerce businesses in India include:

- Turnover Threshold: E-commerce operators are required to register for GST if their aggregate turnover exceeds the prescribed threshold limit, this threshold is INR 20 lakhs (INR 10 lakhs for special category states).

- Mandatory Registration: E-commerce operators are mandatorily required to register for GST, irrespective of their turnover, if they are engaged in inter-state supply of goods or services.

- Voluntary Registration: E-commerce operators can opt for voluntary GST registration even if their turnover is below the threshold limit. This option can be exercised to avail input tax credit benefits or to comply with contractual obligations.

- Tax Collection at Source (TCS): E-commerce operators liable to collect TCS under GST provisions are required to register for GST, irrespective of their turnover.

- Non-Resident E-commerce Operators: Non-resident e-commerce operators providing services to persons in India are also required to register for GST.

Also Read: How To Obtain GST Registration – GST Registration Process

Navigating Tax Collected at Source (TCS) Under GST

TDS, or Tax Deducted at Source, is a way of collecting tax at the time money is paid. For example, if you earn interest from a bank, the bank deducts a part of it as tax before giving it to you. TCS covered by Section 52 of the CGST Act.

Understanding Tax Collected at Source (TCS) Requirements for E-commerce Platforms

Certain operators who run e-commerce platforms need to collect TCS. TCS is needed when these operators gather payments from customers for vendors or suppliers. When these operators pay the collected money to the vendors, they must subtract TCS and pay the remaining amount.

Here are some exceptions to this rule for e-commerce platforms:

- Hotels and nightclubs (if the suppliers are not registered)

- Passenger transport services like radio taxis, motor cabs, or motorcycles

- Services like plumbing or carpentry (if the suppliers are not registered)

Overview of TCS Deduction Rates for E-commerce Sales

Dealers or traders who sell goods and services through e-commerce will get paid after a 1% TCS deduction. The CBIC set this rate in Notification No. 52/2018 for CGST Act and 02/2018 for IGST Act.

So, for sales within a state, 1% TCS will be taken, split as 0.5% each for CGST and SGST. And for sales between states, the TCS rate will also be 1%, as per the IGST Act.

GST Registration Requirements for E-commerce Operators and Suppliers

Mandatory Registration for E-commerce Operators: Every e-commerce operator required to collect TCS must register under GST.

- Exclusions for Suppliers: Suppliers who sell through an e-commerce platform generally need to register under GST. However, suppliers providing specific services mentioned in Section 9 (5) of the CGST Act, such as radio taxi services, accommodation services, or housekeeping services, don’t need to register if their turnover doesn’t exceed the specified threshold.

- Exemption for Service Suppliers: Suppliers of services selling through e-commerce platforms are exempt from GST registration if their turnover is below the specified threshold limit, provided they don’t make inter-state supplies.

- No Exemption for Goods Suppliers: Suppliers of goods selling through e-commerce platforms are not exempt from GST registration.

- State-wise Registration: An e-commerce company must register under GST in every state where it supplies goods or services.

Also Read: A Step-By-Step Guide To GST Registration For E-Commerce Businesses

Tax Collected at Source (TCS) Rates for Different Goods and Transactions

| Goods | TCS Rate |

| Alcoholic Liquor | 1% |

| Tendu Leaves | 5% |

| Timber obtained under forest lease | 2.5% |

| Timber obtained by any mode other than under a forest lease | 2.5% |

| Any other forest produce not being timber or tendu leaves | 2.5% |

| Scrap | 1% |

| Minerals, being coal or lignite or iron ore | 1% |

| Motor Vehicles |

Due Dates for Deposit of Tax Collected at Source (TCS) under GST

The due date for depositing Tax Collected at Source (TCS) under GST typically varies based on the type of taxpayer and the frequency of TCS filing. However, as a general guideline:

- Monthly Deposit: For most taxpayers, TCS collected during a particular month must be deposited to the government by the 10th of the following month. For example, TCS collected in April should be deposited by May 10th.

- Quarterly Deposit: Some small taxpayers may be eligible to deposit TCS on a quarterly basis. In such cases, TCS collected during a quarter must be deposited by the 10th of the month following the end of that quarter. For instance, TCS collected in the April-June quarter should be deposited by July 10th.

Impact of GST Registration on Pricing Strategy

The impact of GST registration on pricing strategy for e-commerce businesses can be significant and multifaceted:

- Tax Burden: GST registration imposes tax obligations on e-commerce businesses, including the collection and remittance of taxes such as CGST, SGST, or IGST. This tax burden needs to be factored into the pricing strategy, as it may affect the final price of goods or services offered to customers.

- Input Tax Credit (ITC): GST registration enables e-commerce businesses to claim input tax credit on taxes paid on purchases. This can reduce the overall tax burden and operating costs, allowing businesses to potentially offer competitive prices to customers.

- Compliance Costs: GST registration comes with compliance costs, including the maintenance of proper records, filing of returns, and other administrative tasks. These costs may impact pricing decisions, as businesses need to ensure that prices cover these additional expenses.

- Competitive Positioning: Pricing decisions in e-commerce are often influenced by competitive factors. GST registration can affect the competitiveness of e-commerce businesses compared to non-registered competitors. Businesses may need to adjust their pricing strategy to remain competitive in the market.

- Consumer Perception: Changes in pricing due to GST registration may influence consumer perception of value. E-commerce businesses need to consider how price adjustments may impact customer perception and willingness to purchase.

Also Read: How GST Rates Could Impact Your Business Strategy

Conclusion

In conclusion, GST registration offers several benefits for e-commerce businesses, including input tax credit and enhanced credibility. To register, businesses must meet eligibility criteria, ensuring compliance with tax laws. Navigating Tax Collected at Source (TCS) under GST requires understanding its provisions and compliance requirements. Moreover, GST registration impacts pricing strategy, considering tax burdens and competitive positioning. By navigating GST registration and TCS effectively, e-commerce businesses can optimize their operations and remain competitive in the market.

FAQ’s

-

What are the benefits of GST registration for e-commerce businesses?

Answer: GST registration enables e-commerce businesses to claim input tax credit, enhance credibility, and facilitate interstate trade without multiple taxes.

-

What are the eligibility criteria for GST registration for e-commerce businesses?

Answer: E-commerce businesses must register for GST if their turnover exceeds the prescribed threshold limit or if they engage in inter-state supply of goods or services.

-

How can e-commerce businesses navigate Tax Collected at Source (TCS) under GST?

Answer: E-commerce operators must understand TCS provisions, register for TCS under GST, collect TCS from buyers, file TCS returns, and remit collected TCS to the government within the specified timelines.

-

What transactions are subject to Tax Collected at Source (TCS) under GST?

Answer: TCS applies to certain transactions conducted through e-commerce platforms, such as sale of goods or services where payment is collected by the operator on behalf of the supplier.

-

How does GST registration impact pricing strategy for e-commerce businesses?

Answer: GST registration affects pricing strategy by imposing tax burdens, enabling input tax credit, and influencing competitive positioning, which e-commerce businesses need to consider while setting prices.

-

Are there any exemptions from GST registration for e-commerce businesses?

Answer: Small suppliers of services selling through e-commerce platforms may be exempt from GST registration if their turnover falls below the specified threshold limit.

-

When should e-commerce businesses deposit Tax Collected at Source (TCS) under GST?

Answer: TCS collected during a particular month should be deposited to the government by the 10th of the following month, or as per the prescribed timelines based on taxpayer type.

-

What documents are required for GST registration for e-commerce businesses?

Answer: Documents such as PAN card, Aadhaar card, proof of business address, bank account details, and authorization letter are typically required for GST registration.

-

Can e-commerce businesses claim input tax credit (ITC) under GST?

Answer: Yes, registered e-commerce businesses can claim input tax credit on GST paid on purchases, which helps reduce the overall tax burden.

-

What are the penalties for non-compliance with GST registration and TCS requirements?

Answer: Non-compliance with GST registration and TCS requirements may attract penalties, including fines and legal consequences, as per the provisions of the GST Act.