Introduction to GST rates

GST transforms India’s direct tax structure into a unified, complex tax network. An important aspect of GST is the determination of tax rates applicable to various goods and services. Understanding the GST rate is important for businesses and consumers as it directly impacts pricing, compliance, and overall financial performance. In this discussion, we look at GST rates, the factors that influence their decisions, the rate difference, and the impact of these rates on the wider economy. This common sense is crucial for the implementation of GST, it clarifies and simplifies the decision-making process across sectors.

Understanding GST Rate Structure

A good understanding of the GST model is important for businesses and consumers and can impact the entire financial landscape by influencing their financial decisions. In this review, we understand the complexity of the structure of GST rates and examine the decisions that affect these rates, the different categories that divide these rates, and the impact on business dynamics. This understanding is essential to overcome the complexities of GST, increase transparency, and make informed decisions across multiple jurisdictions.

Impact of GST Rates on Business Strategies

GST has brought a major change in India’s tax structure, with integrated taxes replacing direct taxes. At the heart of the system is the GST rate structure, which affects every aspect of the economy. Understanding the impact of GST rates on business strategies is important for businesses to develop effective financial plans, pricing strategies, and compliance standards. In this comprehensive discussion, we explore the various ways that GST rates shape business strategy, including pricing, supply chain management, and overall financial planning.

Industry-Specific Insights on GST Rates

The introduction of Goods and Services Tax (GST) in India has led to major changes in property taxes, impacting businesses across various sectors. To implement policy, pricing strategies, and overall financial planning, businesses need to have an in-depth understanding of the GST rate-specific market. In this comprehensive analysis, we understand the unique considerations and challenges arising from the GST rate across different sectors, providing insights that are not only sector-specific but also have global implications.

Manufacturing:

In manufacturing, the role of the GST rate is the impact of taxes on raw materials, production processes, and final products. Businesses must synchronize their cost structures and pricing strategies with applicable GST rates and consider the impact of product tax credits, which is important for companies.

Also Read: How Does GST Impact Manufacturers?

Service Sector:

GST rate on services depends on the type of service provided. Service providers face the challenge of detailed segmentation to determine cost-effectiveness. The sector grapples with classifying services accurately under predefined rate slabs, demanding a nuanced understanding for precise compliance.

Also Read: How Does GST Impact The Service Sector?

FMCG (Fast-Moving Consumer Goods):

GST rates exert a direct influence on the pricing dynamics of FMCG products. Given the wide array of products in this sector, each falling under distinct GST rate slabs, businesses must fine-tune their product mix and pricing strategies to align with diverse rates, ensuring sustained market competitiveness.

Real Estate:

The real estate sector has undergone substantial changes with the advent of GST, particularly concerning input tax credit. GST rates on under-construction properties and the availability of input tax credit impact pricing decisions for developers, and buyers must consider applicable rates when investing in real estate.

E-commerce:

Operating in a dynamic environment, e-commerce businesses contend with varying GST implications based on transaction types such as B2B and B2C sales. A comprehensive understanding of diverse GST rates applicable to different online products is essential for compliance and formulating effective pricing strategies.

Automobile Industry:

The automobile industry faces distinctive challenges tied to GST rates, especially with different rates assigned to various vehicle types. Manufacturers and dealers must align pricing structures with these rates, considering factors like input tax credit availability and compliance intricacies.

IT and Software Services:

The IT and software services sector encounters nuanced challenges related to the classification of services and software under GST rate slabs. A clear definition is required to determine applicable costs and cost structure, including the impact on national and international markets.

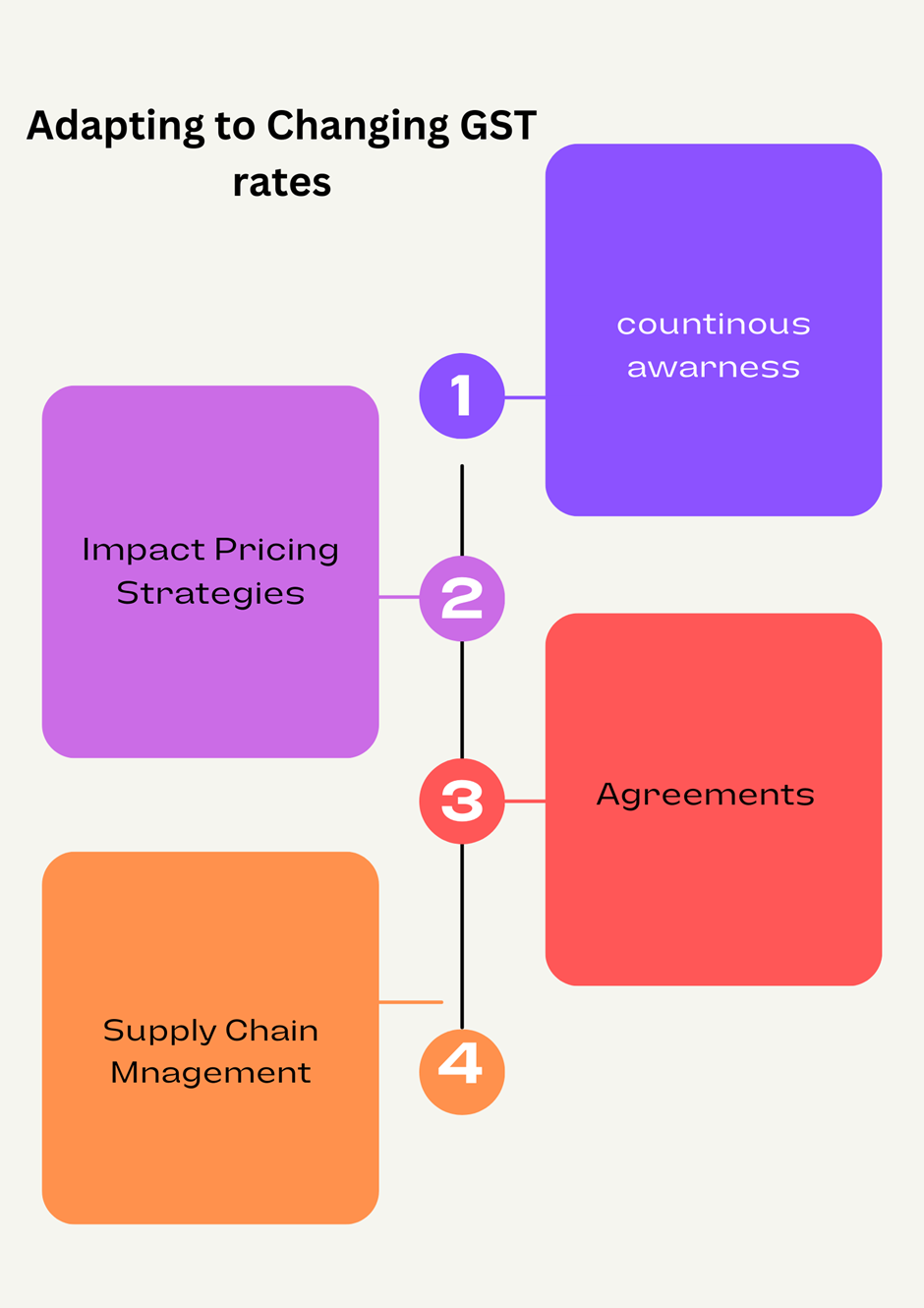

Adapting to Changing GST rates

In this research, we detail the strategies and considerations businesses need to make when faced with changes in GST rates.

Additional Information:

It is important to notify changes in GST rates for changes. Businesses need to have a robust system in place to constantly monitor announcements, notifications, and updates from the GST Council. This information allows businesses to plan ahead and quickly adapt to any tax changes.

Conclusion

In summary, the influence of Goods and Services Tax (GST) rates on business strategy holds paramount significance for enterprises grappling with the intricacies of indirect taxation in India. The ever-changing nature of GST rates demands a proactive and adaptable stance from businesses. As discussed in this exploration, the repercussions span pricing strategies, cost structures, compliance protocols, and overall financial planning.

Recognizing the direct link between GST rates and operational dynamics is imperative. Strategic alignment with current rates is not only vital for preserving competitiveness but also for ensuring adherence to regulatory requirements. The intricate nature of this impact emphasizes the need for a comprehensive understanding of GST rates and their far-reaching consequences on diverse aspects of business functioning.

In this era of continual regulatory evolution, businesses that incorporate an awareness of GST rates into their strategic blueprints are better positioned for success. Through staying well-informed, conducting regular impact assessments, and fostering adaptability, businesses can effectively navigate the challenges posed by GST rates. This approach not only guards against potential hurdles but also opens avenues for optimization, resilience, and sustained growth in the ever-shifting landscape of indirect taxation. Ultimately, a nuanced and strategic response to the influence of GST rates plays a pivotal role in shaping the trajectory of a business within the competitive Indian market.

Also Read: Revision Of GST Rate From 1 Jan 2024

FAQ

Q: What is the key takeaway regarding the impact of GST rates on business strategy?

A: The influence of Goods and Services Tax (GST) rates is pivotal for enterprises in India, necessitating a proactive and adaptable approach.

Q: How do changing GST rates affect various aspects of business operations?

A: Changing GST rates has implications on pricing strategies, cost structures, compliance measures, and overall financial planning for businesses.

Q: Why is strategic alignment with prevailing GST rates essential for businesses?

A: Strategic alignment with current GST rates is vital not only for maintaining competitiveness but also for ensuring regulatory compliance.

Q: What is emphasized regarding the intricate nature of the impact of GST rates?

A: The comprehensive understanding of GST rates and their far-reaching consequences on diverse aspects of business functioning is underscored.

Q: What advantages do businesses gain by incorporating awareness of GST rates into their strategic planning?

A: Businesses gain a better position for success by staying well-informed, conducting regular impact assessments, and fostering adaptability in response to the dynamic nature of GST rates.

Q: How does a nuanced and strategic response to the influence of GST rates contribute to business success?

A: A nuanced and strategic response is instrumental in navigating challenges, optimizing operations, fostering resilience, and ensuring sustained growth in the competitive Indian market.