Table of Contents

Power Up Your Business: Unleashing The Magic Of Purchase Order Formats In Word & Excel

Why You’ll Love Our Word and Excel Formats

- Easy in Word:

- Excel Magic

- Make it yours

- No More Manual Hassles

Uses of Purchase Order

| Uses | Description |

| Formalizing Requests | Standardizing the process of requesting goods or services from a vendor |

| Legal Protection | Act as a legally binding document that outlines the terms and conditions of the order. |

| Order Tracking | Provide a reference number for easy tracking and management of orders. |

| Payment Terms | Specifies payment terms, helping in financial planning for both parties. |

| Dispute Resolution | Acts as a reference in case of disputes related to quantity, quality, or delivery. |

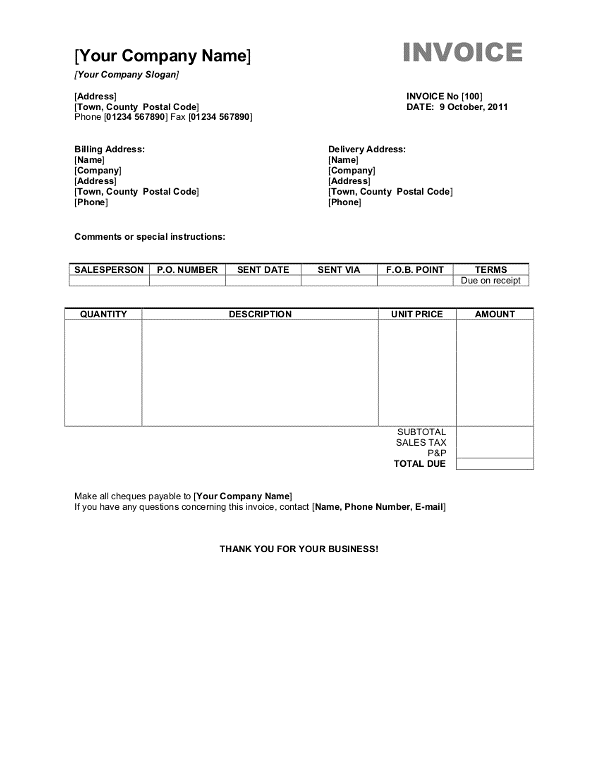

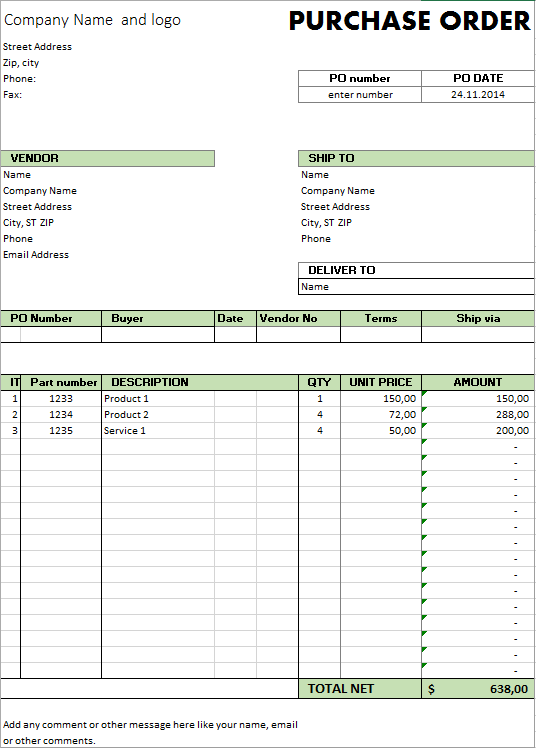

Purchase Order Format in Word

Enter Name And Phone to Start Download

One creates purchase orders using Word format which is usually in a convenient mode. Sensitive information entered includes supplier details, product description or specification, quantity, price, and others concerning the purchasing process. This system focuses on simplicity and it incorporates visuality hence convenient for users looking for a simplistic way of placing orders.

Features of a purchase order for Word

User-Friendly Bliss:

Say goodbye to tech headaches! Using our word interface is easy even for technologically gifted individuals as well as those who do not use computers much.

Enough Customization :

We understand one size doesn’t fit it all. Customization of templates is a work in progress twisting around layouts, inclusion and exclusion of fields that’ll be your own unique self. Your brand, your rules!

Ease of Editing Magic:

Need to make changes quickly? No problem! What Word can do is a few clicks; adjust the size, detail, and so on. Go with the flow for vendor and buying commitments.

Professional Style:

Your purchase orders have to be equally professional-looking as your business or enterprise is. Word’s formatting capabilities can give your file that shines so it sticks in people’s minds.

Universal Compatibility:

Your purchase order is there where the word is. Normal compatibility across different systems ensures you get the same accessibility with no particular software program.

Seamless Integration:

Word can help you link your purchase orders with other file types such as contracts and specifications. It is all about conducting a thorough assessment of your business.

Exporting Freedom:

Need to share or keep? Send out your purchases with utmost convenience through different means.

Print-Friendly Marvel:

Need tough copies? No issues! When you are done, the quality of the resultant images on paper will be equal to that of a monitor’s image for our Word documents made for printing purposes.

Version Control Magic:

Be one without violence! A Word version control tool will help you to identify edited items, add new text, and interact quickly with your colleagues. Always update orders.

Error-Free Communication:

The spell checker coupled with the grammar tool assures you genuine products without spelling errors. Clear communication starts with impeccable documentation.

Enough Exporting Options:

Need to percentage or archive? This purchase order record is easy to export to PDF and better documents like PDF. Convenience at your fingertips!

Benefits Purchase order format of Word

- User-Friendly Simplicity:

Our MS Word format makes shopping simple. Bye hard problems, Say hello to create a Purchase Order.

- Customization, Your Way:

Modify it and have it customized for use in a purchase order which accommodates your logo or procedures flawlessly. In our opinion, the word form is flexible; hence, your product will appear as you feel.

- Effortless Editing Magic:

At what point do you improvise and change the order of events as it unfolds? No problem! Editing encompasses altering quantity, price as well as detail thereby making each deal flexible.

- Professional Presentation:

Effective management of the digital procurement process involves managing digital stakeholders through professionally prepared purchase orders. The use of Word makes you create memorable docs which are clear indicators that your business is top-notch.

- Universal Accessibility:

You’re shopping, wherever you go. Forums are easy to connect with provided one does not need specialized software to access.

- Harmonious Integration:

Allow easy reference to other documents and create a full set of purchase summaries which together will become a business document. Thanks to its document functionality, words ensure that all visions are conveyed adequately.

- Print-Ready Brilliance:

A notepad required for his urgent meeting? They are also created in the format of Word templates, which will ensure that the output image does not appear blurry after being printed on paper.

- Version Control Confidence:

Make one with confidence! His version control tool allows him to keep track of changes to be able to provide updated information about purchasing orders thus, it is an essential tool that facilitates teamwork.

- Error-Free Precision:

Bye to the shameful typo! Word’s spelling checker and grammar ensure that your purchases do not leak any data; instead, they are achieved.

Want to switch up your retail experience? Get started on your next order using our Purchase Order Format in Word. Make sure that each purchase is made unique, delights stakeholders, and increases your efforts.

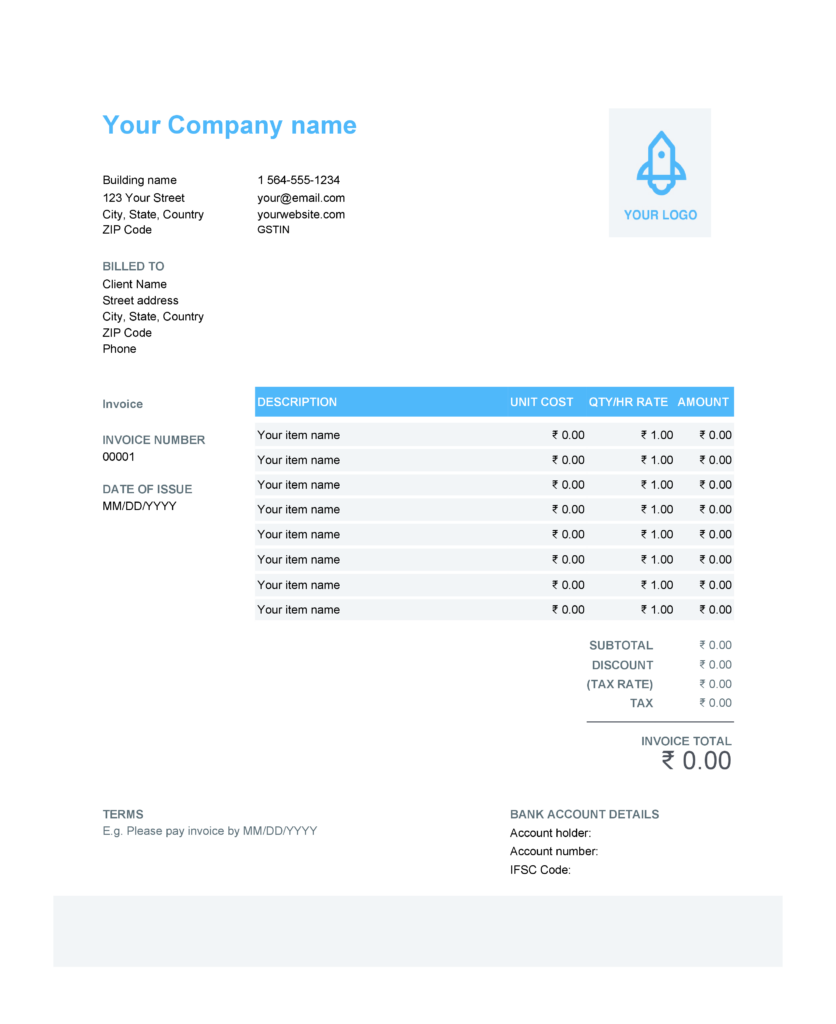

Purchase Order Format in Excel:

Enter Name And Phone to Start Download

Nevertheless, Microsoft Excel utilizes powerful spreadsheet capabilities in an Excel format. The automated handling of accounts that are provided by this product has been made easy. It is particularly useful if one deals with accounts of purchase orders, tax returns, and other similar calculations.

One characterizes Excel as a dynamic tool for organizing data, each product being crafted with unique templates geared towards easing buying. Templates can be created as per their specifications adding some of these functionalities seamlessly.

Interesting news! Meet Word and Excel buy system specially designed for us. We are saying goodbye to the complex shopping process and welcoming our simple templates of living for easy life.

Elements of Purchase order format in Excel

- Sleek and Customizable Design

Show a smart, well-groomed look by using a complicated customized Excel template peculiar to top professionalism.

- Automated PO Numbering

This would allow tracking of any order simply by use of a computer-generated purchase order number.

- User-Friendly Interface

We have developed a simple and easily operated Excel interface for key procurement details, which your team can easily get involved in.

- Comprehensive Vendor Details

Easy access to important data on a sales agent and quick reporting.

- Effortless Item Tracking:

Provide space for the item code, description, number, per unit price, and total cost per item to facilitate ease of tracking.

- Clear Payment Terms:

State multiple modalities of payments, amounts, and dates of remittance by payees.

- Shipping and Delivery Management:

Set up effective procedures for the flow of information and shipping duration which correspond with the suppliers.

- Additional Charges Transparency:

Other costs like charges and taxes should have clear labels, such that the details of such expenses are available for transparency.

- Terms and Conditions Clarity:

Tell them about what is required, and how much they can lose in case they go wrong, and agree on openness of their dealings. Promote transparency in suppliers’ relationships, and clarify risks and terms of your business engagement.

- Authorized Signature Section:

Authorize a section with proper signatures to ensure accountability in the long run.

- Notes and Comments Flexibility:

Comments should be straightforward and explain the template, while also meeting and fulfilling another specific instruction or suggestion.

- Branding Integration:

Make sure to include your logo prominently on the front door and be clear that this is a place of business, not a home.

- Secure File Protection:

Also, secure files for your purchase orders and keep your data confidential.

- Efficient Record Keeping:

Searching for such history will take only a click as all that will be necessary is using any computer-based system.

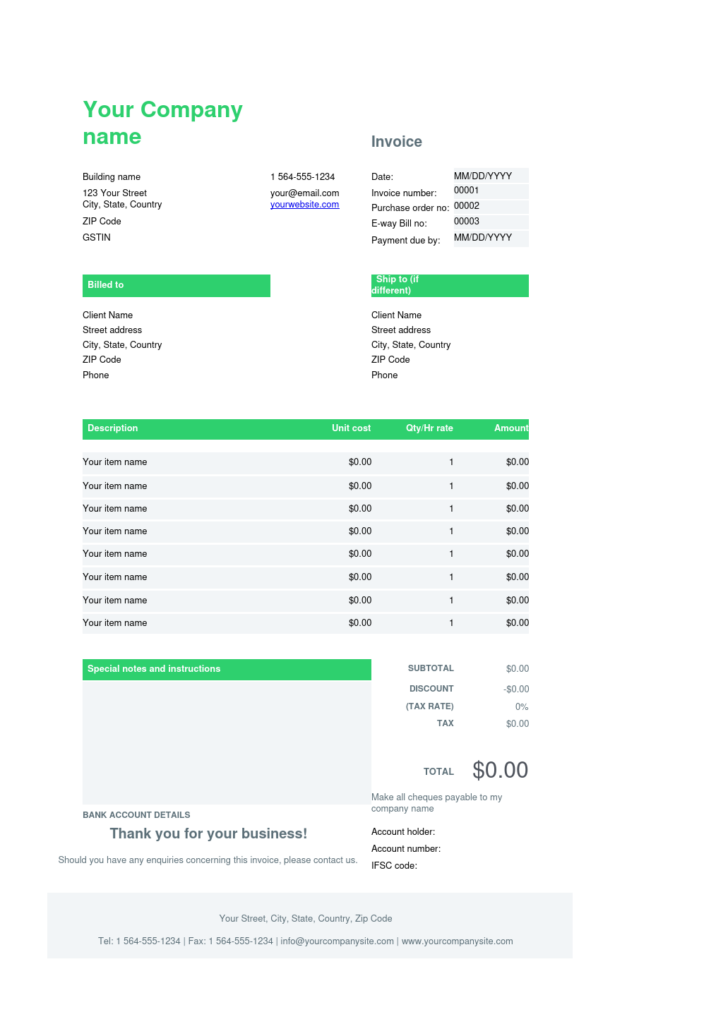

Advantages of purchase order format in Excel

1) Time-Saving Automation:

Reduce the time value so as to improve your workflow and avoid any manual errors. Therefore, utilize tools like purchase order numbers and accounting as examples.

2) Customization for Your Brand:

Use distinct colors, names, and designs that will stay on the supplier’s minds as signs of a true professional.

3) Enhanced Accuracy and Clarity:

Distinguishably structure for individual checking of each data item and minimize errors.

4) User-Friendly Interface:

Make the interface simple enough that your crew will understand it without difficulty, so as to facilitate rapid acceptance and seamless integration into your business operations.

5) Centralized Vendor Information:

Put together all the vital vendor information in one place and allow for better communication facilitating better supplier relationships and an informed attitude.

6) Real-Time Item Tracking:

They provide real-time visual analytics that aids speedy decision- making based on current cost and volume data.

7) Financial Transparency:

Include good record keeping and write the document in such a way to show various terms of fees for payment, as well as charges that will result in financial cleanliness and no disputes.

8) Efficient Shipping and Delivery Management:

Effective organization of shipments, and tracking of delivery schedules. Ensure that all your goods are delivered in good condition and on schedule.

9) Risk Mitigation through Terms and Conditions:

Ensure that you clearly spell out your terms and conditions so that you are able to safeguard your interests and do not have disputes or any other non-compliance in your procurement.

10) Authorized Signatures for Accountability:

Designate spots where you can sign off and put into place ways of ensuring people adhere to what was agreed upon. Kept a diary about where, when, and what my girl got dirty in her pampers.

11) Flexibility for Special Instructions:

Make adjustable custom notes, and commenting fields matching for every order as per the specified demand. Additionally, you will have an opportunity to customize the template if there are any specific instructions given by your client.

12) Professional Branding Integration:

Polish your business credential by getting a classy match-up of your company’s logo and your name tag and do not forget to shop for a dash of fashion.

13) Secure File Protection:

Provide protection against unauthorized changes/accesses as well as assure the reliability and safety of purchase order data via file security.

14) Effortless Record Keeping and Auditing:

Make it simple for future reference or auditing purposes, whereby it is easy to get hold of historical purchase order details, as well as comply with the regulatory bodies.

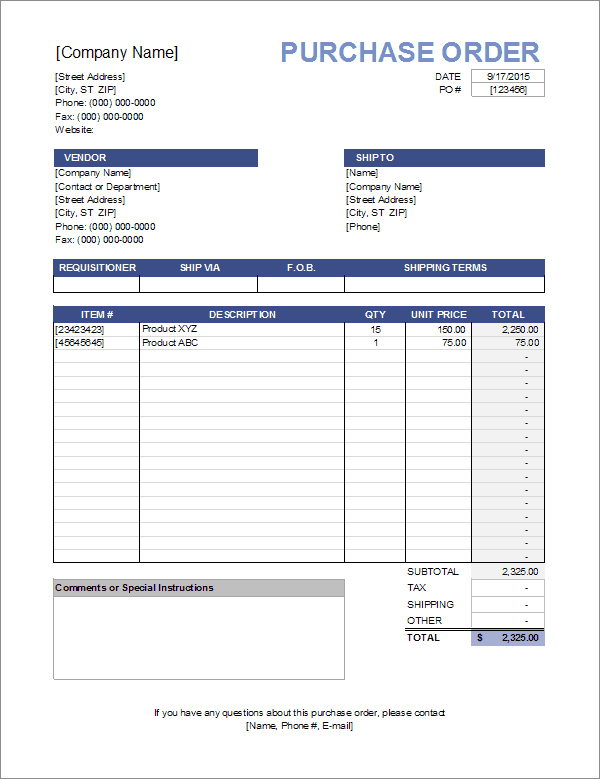

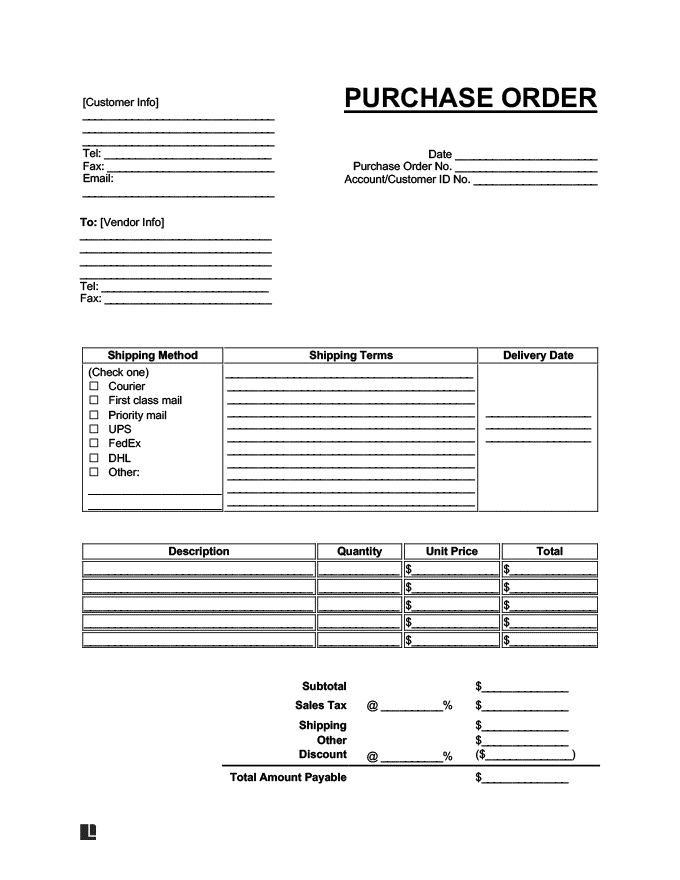

Purchase Order Sample

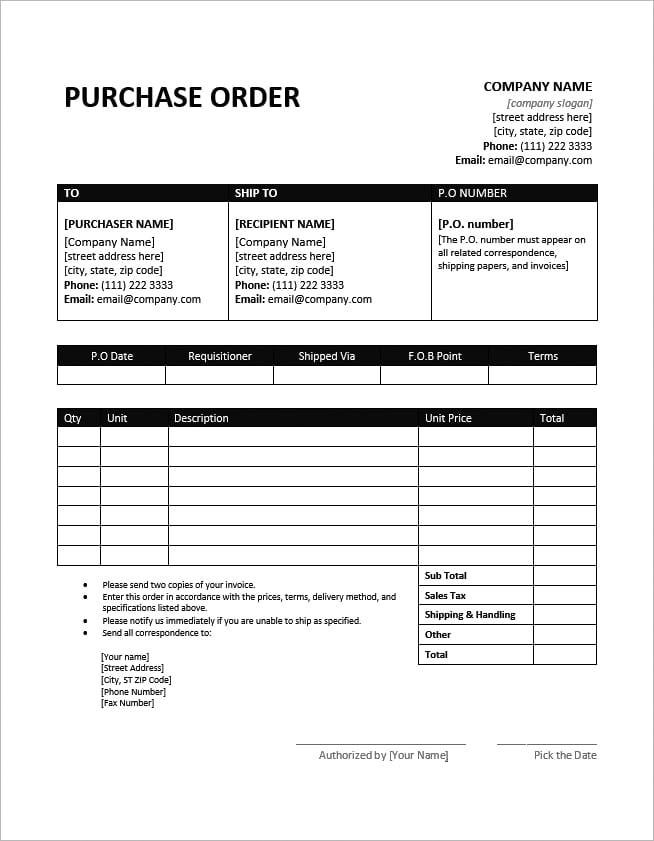

Purchase Order Template

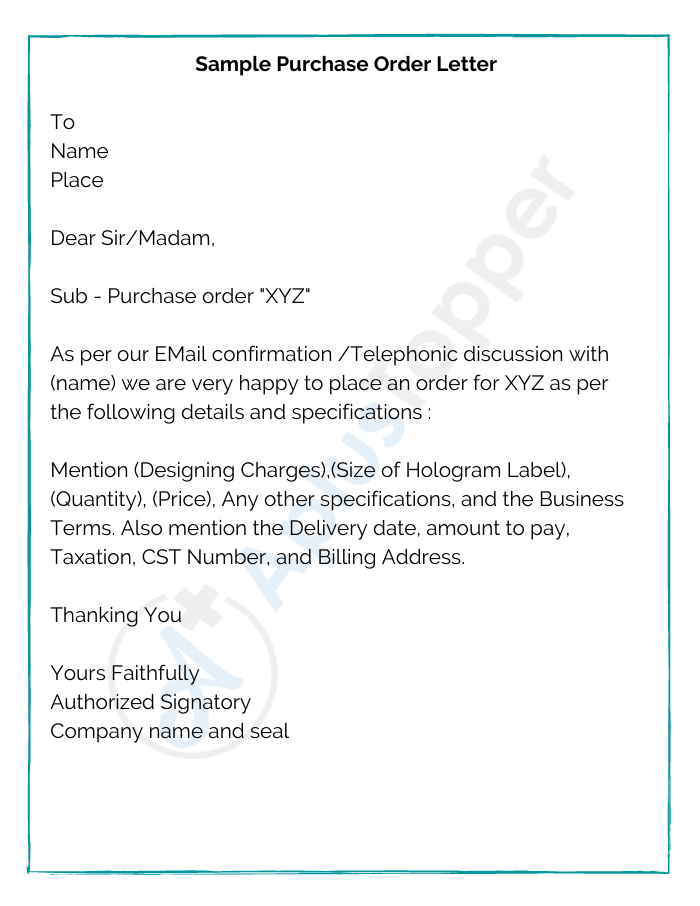

Purchase Order Letter Format in Word

Conclusion

The Procurement Plan you are referring to is not just a plan; it’s a covert strategy for changing your way of working. These formats will elevate your shopping experience with a pinch of professionalism and taste for functionality. Therefore, the Word makes it the simple world of making beautiful and all-embracing orders. The Purchase Order Format for Excel will be a game changer among the very few that even with its looks; virtually sends out an amazing brand statement making it fanatics will start buying.

The imagination should be able to visualize a world whereby the pressing of buttons is used in making calculations and observations. It is not just an Excel sheet. It is an automated checklist that will save you time and guard against the most typical mistakes.

Also Read: How to Calculate GST in an Excel Sheet: Step-by-Step Guide

FAQ

What is it about your purchase order formats that make me say yes?

In our Word and Excel formats, we provide a straightforward but professional manner in which you present your purchase process. These automated features have Customizable templates and easy to follow interfaces, which enhance your procurement process.

What is actually special about this particular Word format?

However, the word format gives such attractive and descriptive templates that help an individual edit in a creative way and put on logos as well. This is ideal for people whose preference is to purchase orders on paper.

In what manner will this Excel format be helpful in my workflow?

Automation enthusiasts are now more than ever, excited about the Excel format. It makes complicated math easier, allows you to track changes instantly without interruptions, and guarantees the precision of your accounting reports. Perfectly appropriate for lovers of spreadsheets in the storage of information.

Will it be possible to use the templates with our logo and brand?

Exactly! The document is in a flexible format for both Word and Excel. That is to say; you can incorporate your company’s color and styles and include your organization’s logo, ensuring that the purchase order document reflects your company brand.

Are these formats user-friendly?

Yes, they do. Simplicity is important to us. The two versions feature convenient interfaces that are user-friendly, easing the transition for your team and guaranteeing an easy navigation process.

What is it about these forms that improve financial transparency?

To assist you in including your company within our purchasing policies, we establish payment terms and co-payments as well as other financial conditions. It is meant to prevent any disagreement or complication that may develop between you and your suppliers.

May I add my specific instructions or terms and conditions to this template?

Both contain provisions for a supplemental section in the form of special instructions, terms, or conditions. It will enable you to articulate your requirements to the suppliers clearly.

Can one track shipments and deliveries in Excel format?

Yes, it is. With the MS Excel file format, it is even possible to track materials including their quantities and delivery times. This is a crucial aspect that will allow you to deal with shipping and also receive the product in good time.

What role do they play in keeping records?

Both facilitate effective record keeping. Records management would be systematic providing you with simple historical process information for research or audit purposes.

Are the templates secured?

Indeed, data security is paramount. But these are easy to use yet the best way is to use Word or Excel security, in which case specify a password for private information.