The Goods and Services Tax (GST) is an indirect tax regime implemented in India in 2017 to streamline taxation on goods and services. It subsumes various Central and State-level indirect taxes into a unified tax structure. The education sector is a significant service industry that the introduction of GST has significantly impacted. This sector was earlier exempt from service tax; however, under GST, many services offered by educational institutions now attract tax.

Implementing GST on education services has had positive and negative implications. On the one hand, it has led to increased tax revenue for the government. On the other hand, it has made education more expensive, significantly higher education. This challenges the accessibility and affordability of education for economically weaker sections. There are also issues around interpreting and classifying educational services under the GST structure.

This article analyzes the GST on education in India – the tax rates, exemptions, classification issues, and the resulting impact on the quality, affordability, accessibility, and innovation of education services. It evaluates the role of GST in education accessibility across regions, genders, and marginalized groups. Further, it reviews the alignment of GST rates with education policies and provides recommendations for improvement.

GST on Education Services

Education services in India attract GST at multiple rates based on the type of institution and services offered. School education provided by non-profit entities such as government schools, municipalities, etc., are fully GST exempt. Coaching or tuition services schools provide a GST rate of 18%.

| Institutions | Exemption Criteria |

| Charitable Trust-Run Educational Institutions | Serving abandoned, orphaned, homeless children, mentally or physically abused persons, prisoners, or individuals aged 65 or above in rural areas |

| Government or Local Authority Educational Activities | Education activities by government, local authority, or governmental authority |

| Indian Institutes of Management (IIMs) | 2-year full-time residential PG programs in Management through CAT admission |

| Education by National Skill Development Corporation | Provided by the Indian government’s National Skill Development Corporation |

Table: Different Exemptions Available To Institutions

Private school education and higher education services like colleges, universities, and professional institutes attract a GST rate of 18% with input tax credits allowed. Other vocational education services attract a GST rate between 18% and 28%, depending on the type of course.

Education materials like books and notebooks attract 0% or 5% GST, whereas printed question papers and answer sheets attract 18% GST. Services like transportation, catering, security, etc., provided to educational institutions also attract 18% GST. Thus, a range of GST rates apply to goods and services related to the education sector.

Education services are classified under two broad categories under GST – services provided by educational institutions and ancillary services. Educational institutions are divided into five categories:

- Pre-school (nursery to higher secondary) – Exempt from GST

- Higher education institutions like colleges and universities are exempt from GST

- Vocational training institutes or coaching centers – 18% GST

- Private training institutions – 18% GST

- Other educational services like provision of books, uniforms, transportation – 5% GST

Some specifics in the classification of education services under GST:

- Coaching or training for competitive exams like JEE, NEET, CAT – 18% GST

- Yoga and meditation classes – Exempt if provided by recognized institutions, 18% otherwise

- Sports coaching centers – 18% GST

- Fee for courses run by private IT training institutes – 18% GST

While school education and most higher education services are exempt, ancillary services attract tax. These include:

- Transportation of students/staff – 5% GST with an input tax credit (ITC)

- Catering services to educational institutions – 5% GST without ITC

- Rental services of immovable property to schools, universities, etc. – 18% GST

- Supply of books, notebooks, stationary, uniforms, etc. – 5% or 12% GST

Some ambiguities exist in classification:

- Private higher education institutions with annual tuition revenue below Rs 1 crore are exempt, while those above it attract 18% GST.

- The distinction between coaching centers and vocational institutes is unclear.

Such issues have resulted in litigation and complicated compliance for educational institutions. It also increases the cost of education for students.

GST Impact on the Education Sector

The implementation of GST has impacted the education sector in the following ways:

-

Quality of Education

The increased cost of ancillary services due to GST has reduced the profitability of educational institutions, exceptionally affordable private schools, and vocational training centers. This limits their ability to invest in quality improvements.

However, increased tax revenue for the government can be used to fund public education and vocational training programs and enhance their quality.

-

Affordability of Education

GST levy on private coaching centers, vocational courses, and supplies like books, uniforms, etc. has made education more expensive. Critics argue this negates India’s Right to Education Act.

However, most primary, secondary, and undergraduate education remains exempt, mitigating the impact on affordability at the school level.

-

Accessibility of Education

The 18% GST on some private higher education services and coaching institutes has made professional and technical education less affordable, affecting access for students from lower economic backgrounds. Critics argue this can widen the social divide.

However, increased tax revenue can improve access for disadvantaged groups if used to strengthen public education institutions. Government funding of coaching for such students can offset the GST impact.

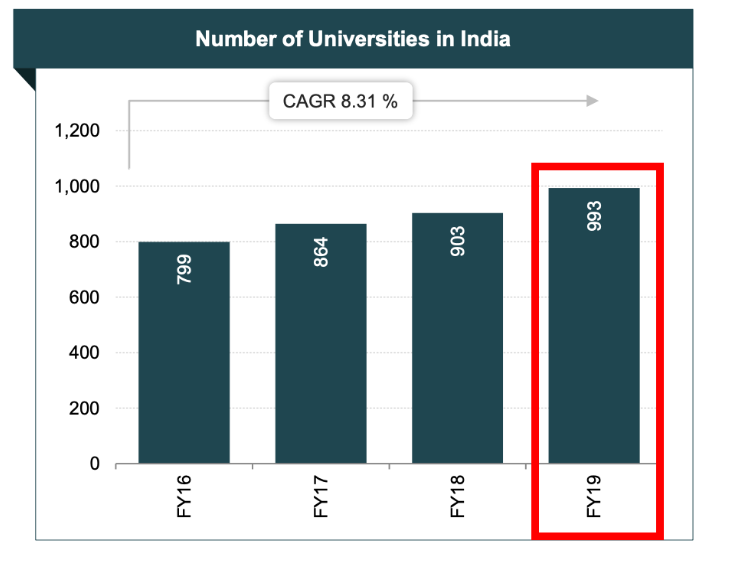

Image Source: All India Survey on Higher Education

-

Innovation in Education

Exemption for most private education institutions minimizes disruption by GST, allowing them to focus energy on pedagogical improvements.

However, ambiguities in classification lead some private institutions to alter their fee structures within the Rs 1 crore limit to remain exempt from 18% GST. This restricts their ability to invest surplus in educational innovations.

While GST provides increased tax income for funding public education, it negatively impacts private institutions, significantly higher education. Appropriate classification without ambiguities and exceptions and strong education policies are essential to balance government revenues with access, affordability, and quality improvement.

GST Role in Education Accessibility

India’s education access remains unequal, with sharp regional, gender, and socio-economic divides. GST implementation affects various determinants of access directly through cost escalation and indirectly through distributing its tax revenue into the education system.

- Private Sector Education: The Levy of GST on private sector education has increased costs, with many institutions hiking fees to maintain profit margins. This poses an accessibility challenge for students from middle and low-income families depending on private schools and universities.

- Digital Education: GST imposition on online educational content and services can make quality digital education more expensive. This hinders access to digital learning solutions, especially for remote areas with limited physical infrastructure.

- Gender Gap: Increased costs of private education under GST may disproportionately impact girls’ education uptake in India’s patriarchal society, where girls’ education is still seen as expendable by many rural low-income families. This can widen India’s gender gap in education attainment.

- Skills and Vocational Training: Application of 18% to 28% GST rates for vocational education and skills training can make crucial skill development programs costlier. This could constrain India’s efforts to reap the demographic dividend from its young population.

Factors Influencing Education Accessibility

-

Regional Divide

Literacy rates range from 75% in Kerala to 61% in Bihar, demonstrating wider gulfs between more and less economically developed states. GST’s burden on private sector education increases this gap by lowering demand from rural and lower-income households while revenue gains favor more urbanized conditions.

-

Gender Gap

India has a 10% gender gap in literacy driven primarily by socio-cultural factors. At the same time, GST itself has no direct gender implications; higher post-GST costs of private coaching and vocational courses disadvantage girls from conservative backgrounds who lack educational opportunities.

-

Social Marginalization

Scheduled castes and tribes have 20% lower literacy than the general population. By increasing education costs, GST risks further marginalization. However, higher government funding through GST revenues could expand public education targeting these groups.

Thus, GST negatively impacts education demand through increased prices, especially for disadvantaged students relying on affordable private schools, coaching centers, and technical courses.

However, enhanced tax revenue offers the government the opportunity to widen access by:

- Increasing funding and quality of public education and coaching programs.

- Providing targeted fee support for professional/technical courses to SC/ST, low-income groups, and girls.

- Expanding scholarships and exemptions on education supplies for disadvantaged students.

- Investing GST income from the education sector into literacy programs in poorer states.

But this requires government will and the design of supportive policies targeting marginalized segments. Access outcomes depend primarily on the distribution of GST tax income to balance added costs it levies on private sector education services.

GST and Education Policy

To optimize gains from GST for education, existing policies need better alignment with its rates and exemptions. Some gaps require redressal:

-

Support for Affordable Private Education

Budget private schools are exempt from GST but face added costs for supplies and services. Education policies should provide targeted financing support to these budget schools that increase access for lower-income families.

-

Incentives for Private Sector Participation

The ambiguity of classification rules creates compliance hurdles for private companies in e-learning, vocational training, extracurricular education, etc. Policies must provide clear classification guidelines and incentives for increased private participation to boost capacity.

-

Scholarships for Professional Education

18% GST on private higher education and technical courses reduces affordability, exactly when India needs to expand its skills and professional education capacity. Government scholarships targeting girls and disadvantaged groups can offset this.

-

Vocational Training Infrastructure

Exemptions for public vocational training institutes divert activity from efficient private options. Instead, policies should focus on subsidizing capital and infrastructure to boost overall capacity and access.

-

Education Cess Reinvestment

GST subsumed education cess levied for funding education. The government should mandate full reinvestment of incremental tax revenue from the education sector into literacy, research, and skill development programs.

Thus, GST lowers the demand for education from the private sector. This necessitates policies to redistribute GST income back to education purposes—improving public systems targeting poorer students, incentivizing private participation, and funding professional education capacity expansion. Further, education policies should align with GST rates and exemptions to optimize outcomes rather than distort incentives.

Conclusion

GST implementation has impacted India’s education sector in several ways—increasing private education services costs while providing incremental government tax revenue. For students, it poses a trade-off between the quality and affordability of personal education options versus enhancing public system capacity through higher government spending funded by GST income.

Unfortunately, government expenditure on education remains below global standards, indicating suboptimal investment of enhanced revenue under GST into the sector. This risks worsening inequities in access and quality, especially in higher education.

However, some course corrections at the education policy level offer opportunities to reinforce outcomes, including increased public investment in technical education and coaching programs for the marginalized, targeted scholarships for girls in professional courses, incentives for private sector participation, and funding support to budget private schools that contribute substantially today to K12 access goals.

As the tax matures, continuous evaluation of GST rates and exemptions based on a framework assessing outcomes on education quality, access, affordability, and innovation is critical. This can help balance revenue needs with sector impacts, especially on students and institutions from less privileged backgrounds. Frequent alignment between tax rates and the priorities set out in national education policies can optimize the trade-offs involved.

Also Read: How Digital Billing Solutions Simplify Challenges for MSMEs

FAQs

-

Which education services are exempt from GST?

Pre-school and higher education provided by non-profit educational institutions are exempt from GST. This includes educational institutions’ services to students, faculty, and staff.

-

What is the GST rate applicable for coaching centers and training institutes?

Coaching centers and private training/skill development institutes attract a standard GST rate of 18%. This includes coaching for competitive exams like JEE, NEET, and CAT and training for sports, yoga, meditation, IT skills, etc.

-

Is GST applicable on hostel accommodation provided by educational institutions?

Yes, hostel accommodation provided by schools, colleges, and other educational institutions, except those run by charitable trusts, attracts a GST of 18% without input tax credit.

-

What GST rate applies to the supply of books, uniforms, etc., to students?

Supply of books, notebooks, pens, school bags, and other stationery items to students attracts 5% GST if the per unit retail sale price is up to Rs 1,000. It is 12% if the cost exceeds Rs 1,000 per unit. Uniforms also attract 5% GST.

-

Is GST levied on the transportation of students and staff by educational institutions?

Transportation of students, faculty, and staff provided by educational institutions, except accredited vocational institutes, is exempt from GST.

-

Are private companies providing e-learning courses required to pay GST?

E-learning courses or content supplied by private companies to educational institutions for students attract a GST of 18%.

-

What GST applies to rental services of immovable property provided to schools, colleges, etc?

Rental or leasing services of vacant land, buildings, or hostels to educational institutions attract 18% GST.

-

Is GST levied on education cess collected by schools and universities?

Education cess levied by educational institutes is taxable under GST at 18%.

-

Are PhD students required to pay GST on their fellowships or stipends?

No, PhD fellowships, stipends, or similar forms of financial assistance for research purposes are fully exempt from GST.

-

Which ancillary education services attract 18% GST?

Ancillary services like supply of catering to educational institutions, the conduct of extracurricular activities by private companies, and training or coaching related to recreation like sports, performing arts, etc., attract 18% GST.