GST is levied on the supply of goods and services at each stage of the production and distribution chain. Credits for GST paid on inputs at every step are available for setting off the output GST liability. This helps in removing the cascading effect of taxes. Under the GST regime, all transactions must be recorded and matched by filing returns.

This generates a humongous amount of data. Analyzing this data manually to ensure compliance is an enormous and challenging task. This is where artificial intelligence (AI) and data analytics can be pivotal in enhancing tax administration and compliance under GST.

AI refers to computer systems’ simulation of human intelligence and learning capabilities. It includes techniques such as machine learning, deep learning, natural language processing, etc. AI can be applied in various aspects of GST management – from return filing, registration, refund processing, and auditing to analytics. It can dramatically increase tax administration efficiency, accuracy, and transparency. This article will examine how artificial intelligence (AI) may aid GST management and tax compliance.

AI for GST Reconciliation

The process of matching and comparing transaction information given by a taxpayer’s suppliers and customers with the data provided by the taxpayer in their GST returns is known as GST reconciliation.

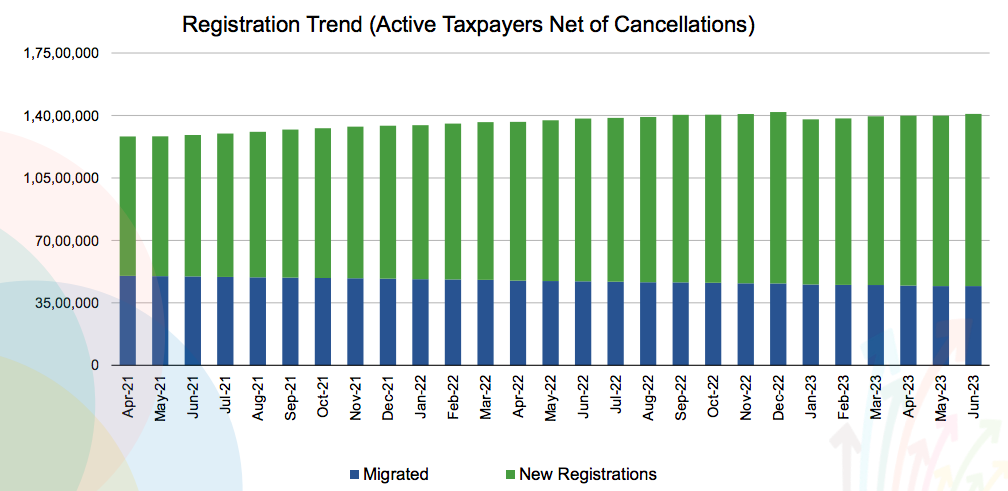

Overview of Trends in Registration from April’21 to June’23

Its goal is to guarantee accurate and consistent data across the GST supply chain. A wealth of information about supply, taxes collected and paid, and input tax credits claimed may be found in the GST forms that taxpayers complete.

Reconciling this enormous amount of data by hand is a complicated, time-consuming, and prone to mistake procedure. Businesses may have their input tax credits blocked as a result of even a slight data inconsistency. These obstacles in GST reconciliation can be addressed with AI and automation.

Some key ways in which GST AI can assist in reconciliation are:

- Automated data extraction: AI can quickly extract relevant data from uploaded invoices, purchase registers, sales registers, etc, through optical character recognition and intelligent data capture techniques. This eliminates manual efforts in data entry.

- Identifying discrepancies: By comparing the data across GST returns, invoices, financial records, etc, AI systems can rapidly highlight inconsistencies, mismatches and potential errors for further validation.

- Invoice and transaction matching: AI algorithms can accurately match the details of suppliers, nature of supply, tax amounts, etc., mentioned in invoices and returns. This minimizes reconciliation errors.

- Error correction: Once discrepancies are flagged, AI tools can also suggest the correct or most appropriate data to replace wrong information taxpayers provide. This reduces the need for revisions.

- Real-time reconciliation: AI enables continuous and almost real-time reconciliation against the traditional periodic cycles. This provides an updated view and dramatically reduces the time taken.

Using AI and automation for GST reconciliation makes the entire process more efficient, timely and accurate. It can minimize frivolous tax demands and speed up the settlement of legitimate input tax credit claims, improving business cash flows. The government can also identify suspicious transactions faster for further verification.

AI for GST Scrutiny

Scrutiny of taxpayer’s profiles and tax returns is undertaken by tax authorities to detect tax evasion and ensure compliance with GST laws. Considering the large tax base under the GST regime, manual scrutiny of all records is not feasible. AI can enable optimal utilization of human resources for scrutiny purposes.

Some of the ways in which AI can assist in meaningful GST scrutiny are:

- Risk-based targeting: By analyzing past return data, AI systems can identify taxpayers with suspicious transaction patterns or high-risk profiles for scrutiny. This makes the process sharper and more streamlined.

- Detection of under-reporting: AI can spot deviations in tax payment patterns, sudden drops in reported turnover, discrepancies in returns, etc, that may indicate tax evasion or under-reporting of liability.

- Verification of input tax credit: AI tools can match ITC claims with corresponding invoices and liability reported by suppliers to find abnormal or fraudulent credits claimed.

- Due diligence of refunds: AI algorithms can do quick background checks of taxpayers claiming refunds to identify suspicious or ineligible refunds and prevent revenue leakages.

- Automated notices: Systems can be programmed to automatically issue scrutiny notices, follow-up communications, summons, etc, based on pre-defined risk parameters and minimize manual efforts.

- Maintaining audit trail: AI enables proper record keeping of all scrutiny proceedings – notices sent, submissions made, next steps, etc – providing transparency.

AI enables tax officers to identify high-risk taxpayers and automatizes routine procedures. This gives the tax officers more time to look into complicated cases and qualitative scrutiny examination. The process is also transparent to taxpayers.

AI for GST Analytics

As a result of the implementation of GST AI, there is now a massive volume of structured and unstructured data available across different systems, such as returns, registration databases, audits, refunds, and appeals, among others.

The potential for using data analytics as a strategy for improving GST compliance and tax administration becomes significantly enlarged with AI.

Some critical applications of AI-driven analytics include:

- Detecting fraudulent transactions: By spotting anomalous patterns in taxpayers’ profiles, AI can identify potential fake billers, circular traders, shell companies, etc, even if returns look regular.

- Monitoring tax performance: AI tools can track KPIs like tax collections, filing percentages, pendency of audits/refunds, etc, across regions, sectors, and periods. This supports data-driven decisions.

- Segmenting taxpayers: AI techniques like clustering can help classify taxpayers as per risk level, filing patterns, sector, etc, enabling targeted outreach or audit actions.

- Forecasting tax revenues: AI algorithms can make reasonably accurate GST collection estimates for future periods based on past trends, economic outlook, etc.

- Analyzing impact of policies: AI can gauge the impact of changes in tax slabs, filing dates, rules, etc, through simulation models. This aids policy formulation.

- Automating mundane tasks: AI chatbots can handle standard taxpayer queries on registration, filing, refunds, etc, freeing up resources.

- Multilingual support: NLP techniques enable AI systems to process and respond in local languages, bridging access barriers.

Thus, AI-powered analytics provides actionable and strategic insights from GST data that can significantly improve tax administration, policymaking and taxpayer services. It will also enhance transparency and objectivity.

AI for Tax Compliance

Tax compliance involves taxpayers understanding, correctly calculating tax liabilities, timely filing accurate returns, and making due payments.

| State Code | State Name | Total Taxpayers |

| 1 | Jammu and Kashmir | 1,40,547 |

| 2 | Himachal Pradesh | 1,22,838 |

| 3 | Punjab | 3,89,563 |

| 4 | Chandigarh | 30,832 |

| 5 | Uttarakhand | 1,96,623 |

| 6 | Haryana | 5,15,466 |

| 7 | Delhi | 7,77,354 |

| 8 | Rajasthan | 8,52,289 |

| 9 | Uttar Pradesh | 18,31,914 |

| 10 | Bihar | 6,12,169 |

| 11 | Sikkim | 10,788 |

| 12 | Arunachal Pradesh | 17,432 |

| 13 | Nagaland | 10,412 |

| 14 | Manipur | 13,811 |

| 15 | Mizoram | 7,809 |

| 16 | Tripura | 30,990 |

| 17 | Meghalaya | 30,382 |

| 18 | Assam | 2,24,785 |

| 19 | West Bengal | 7,28,776 |

| 20 | Jharkhand | 1,99,311 |

| 21 | Odisha | 3,24,992 |

| 22 | Chattisgarh | 1,72,409 |

| 23 | Madhya Pradesh | 5,19,307 |

| 24 | Gujarat | 11,54,585 |

| 25 | Daman and Diu | 0 |

| 26 | Dadra and Nagar Haveli | 15,571 |

| 27 | Maharashtra | 16,92,819 |

| 29 | Karnataka | 9,93,388 |

| 30 | Goa | 42,413 |

| 31 | Lakshadweep | 359 |

| 32 | Kerala | 4,04,062 |

| 33 | Tamil Nadu | 11,23,094 |

| 34 | Puducherry | 23,810 |

| 35 | Andaman and Nicobar Islands | 5,706 |

| 36 | Telangana | 5,06,705 |

| 37 | Andhra Pradesh | 4,11,069 |

| 38 | Ladakh | 8,222 |

| 97 | Other Territory | 90 |

| 99 | Center Jurisdiction | 470 |

| Grand Total | 1,41,43,162 |

Table: Active Taxpayers by State (As of Aug 31, 2023)

Non-compliance can attract penalties and prosecution. AI techniques can enable taxpayers, as well as tax professionals, to improve compliance with GST laws.

Some critical applications are:

- Automated data extraction: AI can quickly pull out relevant information from purchase/sales invoices, agreements, inventory records, etc, required for GST calculation. This reduces the compliance burden.

- Calculation of tax liability: Based on transaction data, AI tools can automatically compute GST payable, eligible input tax credits, etc, with great accuracy.

- Filing of returns: AI’s natural language and optical character recognition capabilities can be leveraged to auto-populate GST returns from financial records.

- Reconciliation support: AI systems can highlight data mismatches for rectification before filing returns by comparing books of accounts with suppliers’ returns.

- Reminders for due dates: AI chatbots integrated with GST systems can timely inform taxpayers regarding deadlines for filing returns, making payments, etc, so that they avoid penalties.

- Guidance on law: Taxpayers can obtain reliable clarifications on GST provisions applicable to their specific transactions from AI assistants trained in the law and precedents.

- Record maintenance: AI solutions can digitize invoices, waybills, accounts, etc, ensuring proper record keeping as required under GST for easy access.

Thus, AI has immense scope to simplify the tax compliance process for taxpayers, allowing them to focus more on their core business activities. It also provides the comfort of accuracy and reliability regarding compliance.

GST Impact on Tax Efficiency

While GST implementation posed several challenges initially, GST AI for tax administration is now enhancing the efficiency of India’s reformed indirect tax system.

Some of the ways in which AI is positively impacting tax efficiency under GST are:

- Better tax coverage: By analyzing multiple data sources, AI aids in the identification of tax evaders, fake entities, under-reporting cases, etc., widening the tax net.

- Improved filing frequency: Intelligent nudges and prompts encourage voluntary compliance and regular filing discipline among taxpayers as per due dates.

- Faster processing of returns and refunds: Automating validation, matching and verification steps enables quicker processing of returns and refund disbursals.

- Targeted audits: AI-enabled risk profiling allows focus on high revenue-yielding audits compared to arbitrary selection earlier. This improves ROI.

- Increased tax collections: Owing to the above benefits, monthly GST collections consistently crossed ₹1.4 lakh crore mark over the past year, pointing to increased efficiency.

- Reduced tax evasion: AI makes it harder for tax evaders to go undetected, discouraging fraudulent activities over the long run.

- Higher perceived compliance costs: Intensive use of data and technology increases the perceived likelihood of getting caught for non-compliance, altering cost/benefit considerations.

Thus, while GST AI for tax compliance and administration were initially riddled with technology challenges, AI is steadily transforming it into an efficient and future-ready tax system. However, concerns around data privacy, suitability of AI models, and taxpayer rights require equal attention for balanced outcomes.

Conclusion

Introducing GST led to fundamental changes in India’s indirect taxation structure and functioning. The expanded tax base and transaction data availability also made it ripe for GST AI for tax administration.

As discussed, AI shows immense promise in reconciling GST data, enabling brilliant scrutiny, providing data-driven insights and enhancing taxpayer compliance. It can drive speed, accuracy, objectivity and transparency in tax administration to levels not feasible manually.

While the full range of AI capabilities is yet to be leveraged, early applications and pilots have already delivered productivity improvements. Its benefits will likely increase exponentially as systems become more intelligent and sophisticated over time.

However, to fully harness AI’s potential, India’s tax administrators must reskill themselves in new technologies, frame appropriate rules to govern its use and make requisite investments. At the same time, adequate precautions must be taken to prevent any breach of taxpayer rights and data privacy.

Overall, responsibly deployed AI presents considerable opportunities to enhance the efficiency and effectiveness of GST in India, taking it closer to the original vision.

FAQs

-

How may artificial intelligence assist in the preparation and filing of GST returns?

AI technologies may extract information from bills and auto-fill return forms. They may also reconcile books of accounts with supplier returns before filing to identify discrepancies. Chatbots may help with legal issues, deadlines, and so forth.

-

What are the different GST tax slabs?

GST has four tax brackets: 5%, 12%, 18%, and 28%. Certain necessities, such as food grains, are tax-free. In addition to these slabs, some items, including gasoline, wine, stamp duty, electricity, and real estate, are nevertheless taxed individually by the state and federal governments under current taxation procedures. Service providers with less than Rs.20 lakhs in revenue may choose the composition plan with a flat tax rate.

-

What does “faceless assessment” mean?

A faceless assessment is one that is completed electronically without needing the taxpayer to attend the tax office or see the assessing officer in person. The whole procedure, from application to order passage, takes place on the GST site via virtual channels. The identity of the assessing officer is undisclosed to the taxpayer throughout the procedure, thus the phrase ‘faceless’.

-

How does faceless assessment benefit GST?

The faceless assessment process improves GST assessments by increasing openness, efficiency, and standardization. Assessments are assigned at random by an automatic mechanism, eliminating judgment. This eliminates harassment, corruption, and taxpayer costs. Tax officials’ anonymity resulted in impartial evaluations. Overall, it makes conducting business easier.

-

What is the faceless assessment procedure under GST?

The key steps are as follows: the taxpayer applies online, the tax officer electronically verifies documents, the assessment unit initiates scrutiny, clarifications are sought through the portal, a draught assessment order is issued, a review unit examines it, and finally, the final assessment order is issued and communicated through the portal.

-

What are the advantages of a faceless evaluation?

Significant advantages include lower compliance costs and time for taxpayers, no physical interaction with tax officers, consistency in assessment, transparency, speed, efficiency, anonymity and ease for taxpayers, and a reduction in harassment and corruption.

-

What options are available if the taxpayer is dissatisfied with the order?

If a taxpayer is dissatisfied with the final assessment order, he or she may first request for correction of errors on record. If the taxpayer is still dissatisfied, he or she may submit an appeal with the Appellate Authority within three months after contact. The Commissioner will then hear the matter of Appeals.

-

Is it possible to obtain a personal hearing under a faceless assessment?

When the tax officer issues a show cause notice, the taxpayer may seek a personal hearing via video conferencing. After determining whether a personal hearing is required or warranted, the Chief Commissioner has the ability to authorize the denial or acceptance of the hearing request.

-

Is there a set deadline for finishing faceless assessments?

According to GST rules, the tax officer must complete a faceless assessment within 9 months after the end of the fiscal year in which the tax period to be assessed falls. For example, for fiscal year 2019-20, the evaluation should be completed by December 31, 2020.

-

What is the monetary limit for situations covered by faceless evaluation?

Cases when the tax obligation exceeds Rs. 5 crore are now subject to faceless assessment. This restriction is intended to be steadily decreased over time in order to cover a greater number of situations via the faceless route.