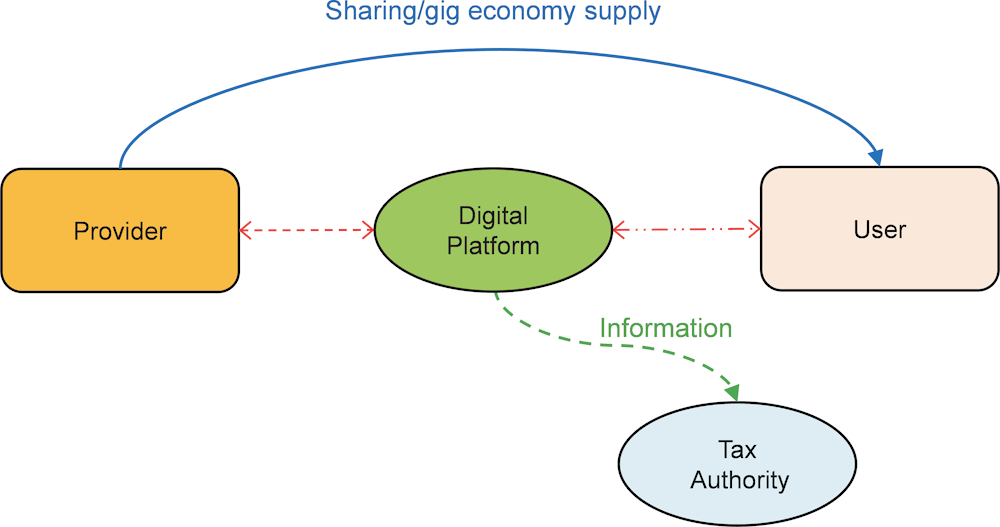

The gig economy, also known as the on-demand or sharing economy, has been on the rise globally over the past decade. It refers to temporary, flexible jobs organizations contract independent workers to perform. Often facilitated by digital platforms that connect businesses with freelancers, gig economy jobs span multiple industries, from transportation and delivery to professional services.

With the rapid growth of the gig economy, governments worldwide are grappling with questions about appropriate tax policies and structures. A key consideration is how consumption taxes like the Goods and Services Tax (GST) should apply to gig economy workers and transactions. This blog analyzes the relationship between GST and the evolving landscape of gig work.

The GST or Value Added Tax (VAT) system aims to tax the consumption of goods and services in an economy. Implemented in over 160 countries, GST is levied on the value added at each stage of production and distribution. The objectives are to consolidate multiple taxes into a single tax, broaden the tax base, enhance tax compliance, and promote exports. As the gig economy expands, policymakers must assess GST implications for gig platforms, workers, and end consumers.

This blog’s thesis is that while GST systems face limitations in keeping pace with the innovation and disruption of the GST gig economy model, policy reforms focused on compliance, administration, and worker welfare can lead to fair and efficient GST regimes for on-demand platforms and work.

GST and Taxation of Gig Workers

Applying GST systems for traditional businesses to gig economy transactions involves several challenges. Key issues include:

- Classification of workers as service providers, consumers, or businesses

- Determining liability to register for and collect GST

- Calculating GST on dynamic pricing models

- Managing filing obligations across geographies

- Tracking transactions on digital platforms

Countries have adopted diverse approaches to address these complexities. In Singapore and Australia, offshore digital platforms must register for GST if they facilitate supplies between local sellers and buyers. The UK and Canada have implemented reverse charge mechanisms, making the recipient liable to account for GST. India has mandated GST registration for drivers on ride-hailing apps. Malaysia requires platforms to register and account for GST even if suppliers are abroad.

Countries have taken differing approaches to the GST taxation of gig workers:

- Australia sets a low AU$75,000 registration threshold to capture most gig workers under GST. However, compliance can be complicated for small and part-time gig workers.

- The UK categorizes gig workers into subgroups like sole proprietorships and partnerships and mandates GST registration beyond a £85,000 threshold. This risks uneven compliance across groups.

- New Zealand simplifies input tax deductions for gig contractors registered under its scheduler tax system. But casual gig workers still struggle with compliance.

An optimal approach for India would feature a registration threshold that balances revenue gains with compliance costs for small gig workers. Preferential compliance procedures like quarterly instead of monthly filings could help gig workers adapt.

Subjecting gig workers to GST brings several benefits, such as improving tax coverage, ensuring they pay their fair share of taxes, promoting financial inclusion, and incentivizing digital transactions. However, complex registration, reporting rules, and lack of input tax credits could disproportionately increase compliance burdens on gig workers working at small scale or part-time.

Each model has tradeoffs. While reverse charges reduce compliance burdens for suppliers, recipients may need help to account for GST correctly. Making platforms responsible can improve tax monitoring but could also stifle innovation by startups. Every approach is flawed, but balancing stakeholder interests is critical. Overall, the gaps highlight that existing GST frameworks need help matching gig platforms’ scale and innovation efficiently.

GST and Impact on Gig Workers

GST obligations add to administrative and cost burdens faced by gig workers who need to understand registration requirements, file returns, pay taxes, and stay updated on policy changes. However, GST can also benefit workers, for instance, by allowing input tax credits on business-related purchases. Key GST impact on gig workers include:

- Income and Expenses: GST registration can formalize gig work status but reduces take-home income. Eligibility for input tax credits on equipment, tools, and assets counterbalances higher costs.

- Compliance and Convenience: GST compliance has high learning curves, given gig work complexity. Digital tools that automate processes can significantly improve convenience.

- Welfare and Protection: GST requirements could expand social coverage for gig workers by boosting legal worker status. However, additional costs may reduce worker retention and income security.

On the income side, GST registration would grant gig workers access to input tax credits on business purchases, improving take-home earnings. However, GST also restricts input credits for personal expenses, which could raise costs for gig workers without separating business accounts. Many gig workers operate informally without separate commercial registrations, so they would find it difficult to account for GST expenses correctly.

GST could promote financial inclusion and formalization of gig work by incentivizing bank account ownership and digital payments to claim input tax deductions. However, costs related to GST compliance, like accounting software, filing services, and record-keeping, can be disproportionate for gig workers earning supplemental income from part-time work.

While the GST regime simplifies indirect taxes with online registration and filing, small-scale gig workers would require hand-holding to compute GST liabilities across districts and states correctly. Gig platforms like Uber, Ola, Swiggy, and Urban Company can play a helpful role here by factoring tax calculations and filings into their apps and processes.

| Share of Gig workers (UPS) | Share of Gig workers (USS) | Share of Gig workers (UPSS) | |

| 2011-12 | 0.57 | 0.18 | 0.54 |

| 2017-18 | 1.18 | 0.4 | 1.16 |

| 2018-19 | 1.18 | 0.28 | 1.15 |

| 2019-20 | 1.37 | 0.49 | 1.33 |

Table: Share of gig workers from the total workforce from 2011-12 to 2019-20

Welfare protection for GST taxation of gig workers remains a concern, given the lack of employment benefits and social security. GST design could aid in this area by channeling a share of gig sector GST revenues to fund dedicated social security schemes for gig workers. Austria provides one example with its unique ‘social security fund’ for self-employed workers.

Overall, governments need balanced policies that incentivize GST compliance while ensuring costs do not make gig work economically unviable. Online platforms using technology to simplify procedures can create significant value. The state must also strengthen social support systems to protect the incomes and well-being of gig economy participants.

GST and The Future of The Gig Economy

The coming decade will likely see the GST gig economy grow exponentially, fueled by demographic shifts, urbanization, desire for flexibility, and technological advancements enabling access to work globally. GST policy will need to adapt to critical developments:

- Digitization: Digital transactions will become ubiquitous, creating GST compliance risks and opportunities to leverage technology for simpler processes.

- Globalization: Cross-border gig work is surging. Governments need to coordinate on GST rules to address jurisdictional complexities for foreign platforms and workers.

- Diversification: As gig work permeates more industries, authorities will face challenges applying standardized GST structures across diverse transaction modes and pricing models.

While the above shifts may compound GST complexities, technology holds exciting potential to design innovative and agile solutions. Blockchain, cryptocurrencies, mobile payments, and online banking offer ways to build transparency and traceability. Accessible platforms can also enable convenient tax filing, payment, and refunds for GST taxation of gig workers.

Key challenges arise from the ambiguity around the employment status of gig workers and the enforcement of labor regulations by platforms. GST treatment should align with evolving consensus and court judgments on whether gig workers qualify as independent contractors or employees. As gig work formalizes into recognized employment and commercial establishments, they automatically qualify for standard GST provisions.

Efficient GST administration can directly catalyze innovation and competitiveness promises of India’s platform/app-based gig economy. Allowing instant input tax credits on inter-state gig work would boost pan-India market access for niche services. Regional and seasonal gig jobs could also gain as GST subsumed multiple local levies.

Targeted measures within the GST design can help the gig economy realize its productivity potential. These include lower registration thresholds for labor-intensive sectors, exempting small platform transaction fees from GST, favorable GST treatment for microwork platforms and online talent marketplaces, zero rating education delivered via the gig economy, and incentivizing digital transactions.

Such provisions would help platforms promote the financial inclusion of gig workers, drive India’s startup and microwork ecosystem, improve skill development outcomes, and tap global demand for remote, high-skill Indian talent. As GST systems worldwide grapple with taxing the borderless gig economy, technology is likely to be integral to the creation of robust, equitable, and dynamic policies.

Conclusion

This blog has discussed key issues, debates, and future directions at the intersection of GST and the ascendant gig economy. We summarized the objectives of GST policy and the landscape of on-demand work platforms and practices. The analysis focused on central themes of GST compliance burdens for platforms and workers, costs versus welfare benefits, country approaches, and technology’s evolving role.

No blanket solutions exist to optimally levy GST on gig transactions while balancing productivity and equity aims. However, ensuring fair player practices, worker consultation, and harnessing innovation can lead to efficient, emerging-technology-powered GST systems for the platform economy. Extending social security nets is also vital. Agile, collaborative policymaking will enable taxation regimes to be responsive to economic transformations.

Further research can support evidence-based GST reforms for the gig economy via on-ground case studies, comparative jurisdictional analyses, and pilots leveraging emerging technologies. Stakeholder surveys can also provide valuable insights on balancing tradeoffs and interests. As digital disruption accelerates, responsive and ethical GST policies are crucial in supporting sustainable work futures.

FAQs

-

What is the gig economy, and what are its unique characteristics?

The gig economy refers to temporary, flexible, independent working arrangements in organizations that contract external workers to perform specific tasks or projects.

- Reliance on short-term contracts or freelance work instead of permanent jobs.

- Flexibility in working hours and schedules.

- The use of digital platforms or mobile apps to connect businesses and workers.

Components of gig work include independent contractors, freelancers, project-based workers, on-demand workers, temporary staffing, and self-employment.

-

What is driving the growth of India’s gig economy?

Factors propelling India’s booming gig economy include increased workforce participation, especially among women, millennials, and retirees seeking part-time work, income security promised by part-time work options, flexibility to manage personal responsibilities, preferences for remote working and digital self-employment in post-pandemic times, aspiration for entrepreneurship among skilled professionals, access to global demand for online contract workers, and growth of startups and digital commerce relying on agile gig work.

-

How large is India’s gig economy workforce expected to be in the coming years?

Industry projections forecast India’s gig economy to grow at a 17% CAGR over the next five years, reaching around $455 billion in transaction value by 2024. GST taxation of gig workers in India is estimated to reach over 23 million by 2029. Sectors like professional services, transportation, manufacturing, healthcare, education, and financial services are all poised to see accelerating growth in gig work adoption.

-

What is GST, and what objectives does it aim to achieve?

GST, or Goods and Services Tax, is a broad-based and unified indirect tax regime levied on manufacturing, selling, and consuming goods and services across India. It aims to subsume all indirect central and state taxes under a single tax administration in order to reduce tax cascading and leakage by bringing uniformity. The goals of GST include simplified tax structure, enhanced tax compliance, elimination of state tariffs, and creation of a common national market.

-

What are some options for applying GST to transactions in the gig economy?

Taxing the burgeoning GST gig economy transactions under GST warrants clear guidelines regarding registration thresholds, categorization of gig work into goods or services provided, allowing input tax credits for gig workers, low-cost compliance mechanisms given small-scale of gig work, clarification of state jurisdiction for tax administration, and role of digital platforms in TDS, filing and remittances.

-

What are some critical challenges in extending GST to the gig sector?

Challenges include:

- Tackling tax evasion given the informal nature of some gig work.

- Addressing compliance burden on small & part-time gig workers.

- Varied arbitration on gig worker status as independent contractors or employees.

- Handing registration and filing for inter-state movement of labor.

- Documenting ambiguous delivery terms and in-contract services.

- Lack of input tax credits for workers.

- Misreporting turnover to avoid thresholds.

-

How can GST registration be beneficial for gig workers despite compliance burdens?

GST registration would grant gig workers access to input tax credits on business expenses, improve take-home earnings, incentivize digital payments and financial inclusion to claim benefits, bring access to banking and identification infrastructure, reduce harassment from overlapping local authorities, and provide overall tax homeostasis under a unified regime.

-

What implications does GST have for the welfare and social security of gig workers?

GST makes gig work more formalized, but compliance costs can reduce incomes, especially for small gig workers. Intelligent GST design could retain thresholds, simplify registration, allow quarterly filings, provide input tax credits, and channel a share of GST proceeds from the gig economy towards funding dedicated social security schemes for gig workers lacking employer-tied benefits.

-

How can an efficient GST system catalyze innovation and productivity across India’s booming gig economy?

Well-designed GST provisions can directly drive innovation, level playing field, and access to pan-India and global markets for India’s tech-based gig platforms by allowing input tax credits on inter-state work, reducing local levies, keeping registration simple under the unified tax, supporting microwork and online talent marketplaces, and incentivizing digital transactions.

-

What further policy and administrative reforms regarding GST could benefit India’s gig economy?

Further upgrades around optimal thresholds, gig work categorization, facilitating inter-state input credits, channeling GST revenue for gig worker welfare, sharpening tax codes for digitally delivered services, and incentivizing platform-based compliance would help India’s GST and gig economy reinforce each other’s unprecedented growth and productivity potential