INTRODUCTION

In modern logistics and supply chains, an electronic waybill, or e-way bill, is generated using the GST portal and is essential for transporting goods. Any company or supplier transporting goods must create an e-way bill if the consignment value exceeds Rs. 50,000.

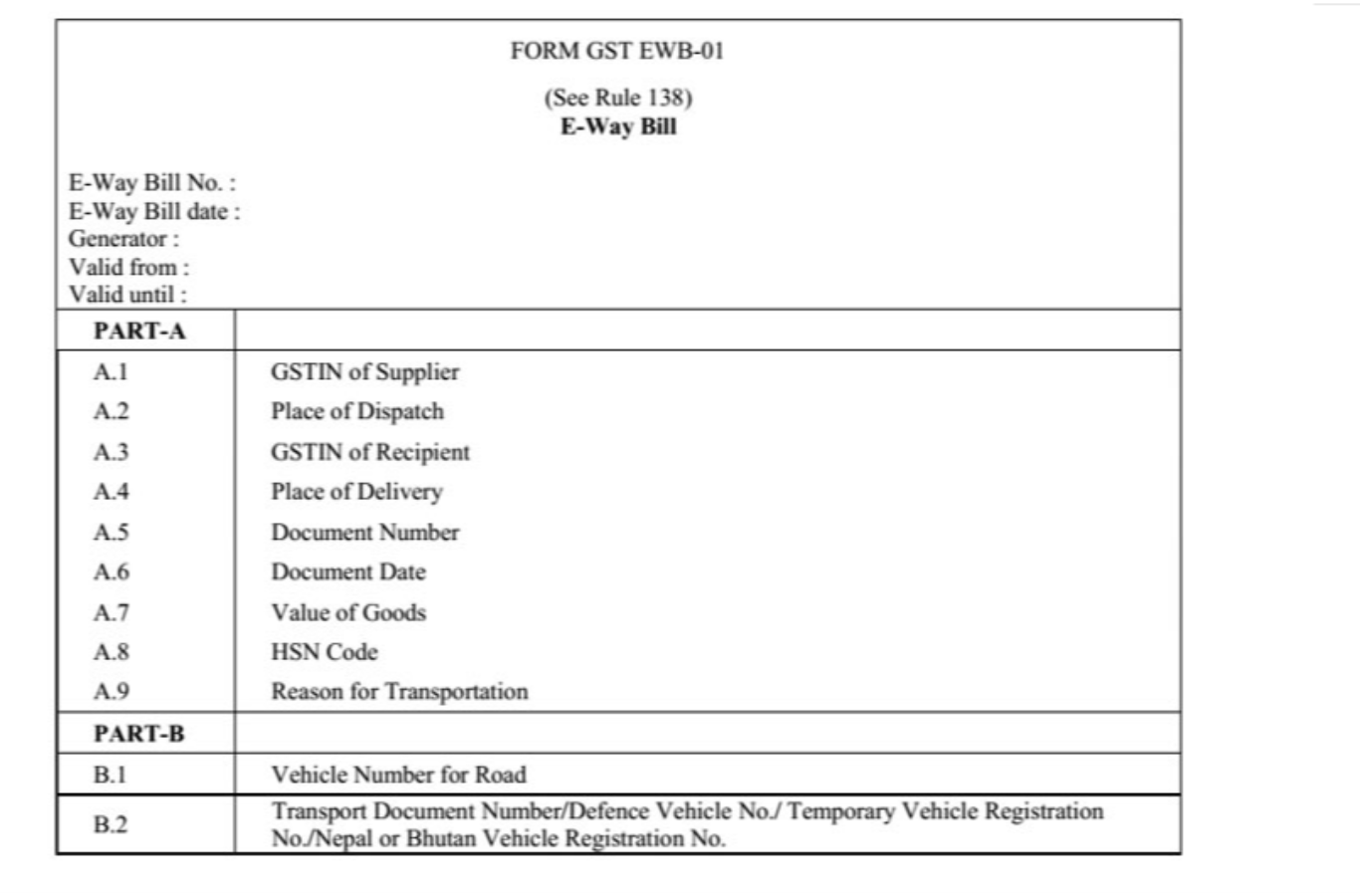

It contains two parts: Part A and Part B. Part A consists of information about the supply of taxable goods while Part B contains the vehicle identification details. In this article, we will look into the key points that regulate the necessary documentation and reporting requirements related to E-Waybills.

For smooth compliance and effective product transportation, it is imperative to comprehend and comply with these standards. Join us as we discuss the E-Waybill framework’s intricacies regarding reporting and documentation.

Part-B supply E-waybill procedure

According to the guidelines for e-way bills, Part B of Form EWB 01’s e-way bill seeks to gather information about the consignment and related details, including:

|

|

|

|

|

|

|

To create Part-B of the E-Waybill, follow these steps:

- Register via the E-Waybill Portal: Using your login credentials, visit the official E-Waybill portal.

- Choose ‘Generate E-Waybill’: Select the option to create a new E-Waybill after logging in.

- Fill in Part-A details: Provide all necessary details in Part-A, such as consignment, recipients, seller, and transporter information.

- Select the ‘Part-B’ Option: On the form for creating E-Waybills, choose the option to include Part-B details.

- Enter Reporting Requirements: Provide the necessary details, including the vehicle number, document type, and any other relevant details.

- Attach any supporting documentation: Upload any necessary supporting documents, such as shipping bills, invoices, or other documentation.

- Evaluate and Verify: Verify the accuracy of all entered information by checking it twice. Verify and submit in the generated E-Waybill together with the Part-B information.

- Create E-Waybill: Click the button to create the E-Waybill after verifying the information. The System will issue an individual E-Waybill number.

- Download/Print E-Waybill: You can download/ print the generated E-Waybill with Part-B details. This document is essential for the movement of goods.

- Dispatch with Goods: Gives the transporter the printed E-Waybill. It is a necessary document, so make sure it travels with the goods.

Reporting requirements for E-waybill in Part-B supply

Part B of the E-Waybill reporting requirements is essential to the smooth flow of goods, particularly for road transportation. The following circumstances must occur for Part-B of FORM GST EWB-01 to be filed:

-

Consignor or Consignee as Registered Persons:

- When transporting goods by road in a private, hired, or public conveyance, a registered person, consignor, or recipient is required to electronically generate an e-way bill in FORM GST EWB-01.

- The process entails providing PART B of FORM GST EWB-01 on the common portal with the necessary information.

-

Transporter’s Role in E-Waybill Generation:

- If a registered consignor or consignee fills out Part A of the FORM GST EWB-01 and the goods are scheduled with a transporter for subsequent delivery, the transporter is in charge of filling Part B of the form.

- Using the data from PART A, the transporter electronically creates the e-way bill on a common website.

-

Transfer of Goods and Conveyance Details Update:

The consignor, recipient, or transporter must update the conveyance details in PART B of FORM GST EWB-01 on the common portal before any transfers of goods between conveyances during transit.

-

Unregistered Persons’ Option:

When an unregistered individual initiates the transportation of goods, they can generate the e-way bill in FORM GST EWB-01 on the common portal as set by the rule, either through their conveyance, a hired one, or through a transporter.

-

Transfer of Information for Transporter-Generated E-Waybills:

- If the consignor or consignee fails to create the e-way bill and the goods are sent to a transporter for road transportation, the registered person has to provide transporter information on the common portal.

- After that, using the information provided by the registered person in PART A of FORM GST EWB-01, the transporter creates the e-way bill on the shared site.

E-waybill documentation for Part-B transactions

The necessary documentation for Part-B transactions in the E-Waybill procedure is as follows:

- A printed or digital version of the E-Waybill with Part-B information. This document is essential for in-transit verification.

- A copy of the invoice or bill of supply for the goods. It includes product information, quantity, and value should all be included in this document.

- You will need a copy of the document that the transporter issues, like a waybill or truck receipt if the transporter generated the Part-B.

- Make sure you carefully record the vehicle number. Tracking the flow of goods requires it to match the information given in Part-B.

- Keep a record of the consignor and consignee’s information, such as their address, phone number, and GSTIN.

- Give a detailed description of the goods being transported, including the Harmonized System of Nomenclature (HSN) code.

- Record the updated conveyance details on the E-Waybill portal if there is a movement of goods from one vehicle to another while traveling.

- To confirm their accuracy and legitimacy, make sure all the relevant papers are signed and dated.

Also Read: Procedures and Documentation for Handling Expired E-waybills

Compliance obligations for Part-B supply in E-waybill

In an E-Waybill, Part-B supply compliance standards entail adhering to specific rules and procedures to ensure the timely and lawful delivery of goods. They consist of:

- The E-Waybill is not regarded as complete until Part-B has been input. Otherwise, the EWB printout might not be acceptable for the transfer of goods.

- Except for moves within the same state that take less than 50 km to complete between the consignor and the transporter, moving goods necessitates filling out Part-B of the e-way bill.

- When shipping supplies, the e-way bill should always include the vehicle number of the actual vehicle carrying the goods.

- A vehicle breakdown or transshipment may necessitate changing the vehicle number after the e-way bill is generated or after the goods begin transit. In these situations, the new vehicle number in Part B of the EWB can be updated by the transporter or generator of the e-way bill.

- Along with the transporter ID in Part-B, it is necessary to include the vehicle number.

- The transporter then completes Part-B to generate the e-way bill based on the data supplied by the provider.

- The provider may complete Part-B information on his own if he transports the goods in a vehicle that he owns or hires.

Legal considerations for E-waybill in partial supplies

Legal issues for E-waybills in partial supply include ensuring the following of all applicable rules and regulations to prevent fines or other legal consequences. In the context of partial supplies—that is, only a portion of the goods listed on a single invoice—it is imperative to comply with certain E-waybill regulations. The following are important legal factors to remember:

- Accurate Documentation: The E-waybill should indicate that the shipment is a partial supply. The invoice that comes with the E-waybill should include information about the total invoice amount and a clear statement of the quantity being transported as part of the partial supply.

- Single E-waybill for Entire Invoice Value: While supplying goods in partial shipments, a single E-waybill is generated for the whole invoice value. Ensure that the E-waybill correctly reflects the whole amount of the products indicated on the invoice, even if the goods will be sent in installments.

- Observance of GST Regulations: As partial supplies may impact tax calculations and reporting, make sure you comply with the Goods and Services Tax (GST) requirements. Ensure the E-waybill compliance with the guidelines set forth by the tax authorities and is in line with the GST invoice.

Also Read: Legal Provisions and Penalties for Non-compliance with E-waybill Expiry

Part-B supply and E-waybill best practices

Following these best practices enhances the efficacy of supply chain management by encouraging effective and compliant E-Waybill procedures:

- Timely Generation of the E-Waybill: Prepare Part-B of the E-Waybill well in advance of the start of the goods movement. On-time submission guarantees regulatory compliance and helps prevent delays.

- Accuracy of Information: Verifies the accuracy of all the information filled out in Part-B, including transporter IDs, vehicle numbers, and other pertinent data. This improves overall compliance and reduces the possibility of mistakes during inspections.

- Verification and Compliance of Documents: Check that the information on bills of supplies and any supporting documentation matches the data on the E-Waybill. This procedure aids in preserving conformity and uniformity during the shipping process.

- Updates on Proactive Conveyance Details: Proactively update the conveyance data in Part-B on the E-Waybill portal if items are transferred from one conveyance to another while in transit. This guarantees regulatory compliance and real-time tracking.

- Consistent Awareness and Training: Employees participating in the E-Waybill process, such as consignors, consignees, and carriers, should get frequent training. Keeping them updated on modifications to the rules, best practices, and updates contribute to the continuous improvement of compliance awareness.

Challenges in E-waybill for partial supplies

Sending only a portion of the items listed on a single invoice is the reason for certain challenges in the E-waybill for partial supply. A partially supplied quantity must be explicitly stated in the document, even if an e-waybill for the entire invoice amount is generated.

This situation commonly arises when completing orders in installments or when certain goods are temporarily out of stock. It is a challenge to ensure regulatory compliance and preserve transparency in the transportation and delivery process while appropriately representing the partial nature of the supply within the current E-waybill framework.

It might be difficult from a logistical and administrative aspect to strike the correct balance when communicating incomplete supply information; this calls for accuracy and clarity to enable smooth tracking and monitoring throughout the supply chain.

Also Read: Challenges and Solutions in Tracking and Managing E-waybill Expiry

Exemption for certain Part-B supplies in E-waybill

Certain commodities have an exemption in the E-waybill system if the transit distance is very low. Provision of certain data in Part B of FORM GST EWB-01 becomes unnecessary if goods transit within the same State or Union Territory for a distance not exceeding fifty kilometers (50km) from the supplier’s place of business to the transporter’s place of business for subsequent transportation. This covers the sender, the receiver, and the carrier.

Furthermore, there is no need to update the conveyance details in PART B of FORM GST EWB-01 on the common portal if the goods are being transported within the same State or Union Territory for a distance of up to fifty kilometers from the transporter’s place of business to the recipient’s place of business.

E-waybill for phased deliveries

A popular logistics technique called “phased deliveries” is dividing a big cargo into smaller shipments. To comply with regulatory standards, create separate E-waybills for every shipment when managing such staggered deliveries. Here are instructions for creating E-waybills for deliveries that happen in phases:

- Understanding Phased Deliveries: Determine whether a consignment has to be split up into smaller parts because of its size or the kind of delivery. When carrying the full quantity at once is not feasible, phased deliveries are a common option for large-scale projects or bulk goods.

- Create Separate E-Waybills: Make a separate E-waybill at each phase of the delivery process. This guarantees adherence to rules and makes precise tracking and record-keeping easier.

- Reference Original Invoice: Link the original invoice for the full shipment to every E-waybill. This link keeps the transaction’s integrity intact and gives tax authorities and other stakeholders a clear reference point.

- Include Phase Number: On every E-waybill, clearly state the phase number (e.g., Phase 1 of 3, Phase 2 of 3). This data is essential for monitoring the delivery’s progress for every phase.

- Use Online E-Waybill Portal: Use the official web gateway to create E-waybills. Enter the necessary information for each phase separately, making sure the data corresponds to the characteristics of that specific shipment.

- Submit and Verify: After entering the details, submit it using the web interface. Before applying, take time to ensure that all the information is correct and comprehensive.

- Generate E-Waybill Number: Following verification, the system will generate each phase’s E-waybill number. For future reference and compliance inspections, make a note of these numbers.

Audit and verification of E-waybill in Part-B supply

E-waybill audits and verifications for Part-B goods require careful documentation by the appropriate authority. The appropriate officer shall quickly record a summary report in Part A of Form GST EWB 03 within 24 hours after conducting an inspection of goods in transit.

After the inspection, it is necessary to submit the final report in Part B of the same form within three days.

Unless particular information suggesting tax evasion becomes available later, there is no need for a second physical verification of the same conveyance if a physical verification of the goods on it has already been completed at a single location inside the state during transit.

This simplified reporting solution minimizes unnecessary verifications for items in transit within a state while guaranteeing effective monitoring of E-waybill compliance.

Conclusion

In summary, companies must take the initiative to navigate the E-waybill regulations for Part-B supply. It is critical to stay up to date with changing legal frameworks to guarantee smooth transportation and adhere to tax compliance requirements.

Businesses may increase operational efficiency and reduce the risk of non-compliance by carefully outlining every need of Part-B in the e-waybill. Adopting strong documentation procedures and embracing technology advancements will further enable companies to navigate the changing landscape of e-waybill administration while simultaneously enhancing performance.

By doing this, businesses may maintain regulatory requirements, optimize workflows, and effectively manage the intricacies of modern supply chain dynamics.

Also Listen: CaptainBiz Ke Sath Apne Reports Ko Generate Karein

FAQs

Q1: What is Part B of the e-waybill?

Part B of the e-waybill mainly has the details of the vehicle used for the transportation of goods.

Q2: How do I handle e-waybills for phased deliveries of a single consignment?

Create separate e-waybills for each phase, referencing the original invoice and specifying the phase number.

Q3: Does the exemption for not updating details in PART B apply to both intrastate and interstate movements?

The exemption applies only to intrastate movements within a state or Union Territory for distances up to 50 kilometers.

Q4: Which methods are used to generate e-way bills?

The following options are available to a registered individual to produce an e-way bill:

| Web-based System |

| SMS-based facility |

| Android App |

| Site-to-Site Integration |

| Goods and Services Tax Suvidha Provider |

| Bulk Creation Facility |

Q5: If the conveyance vehicle breaks down, what should be done?

When a vehicle breaks down while transporting products with an e-way bill, the transporter can get it fixed and use the same e-way bill to go to the destination. If the transporter has to replace the vehicle, they must use the ‘Update vehicle number’ Part- B of the e-way bill gateway to input the new vehicle information.

Q6: When is the E-Way Bill applicable?

The e-way bill is applicable for any consignment of goods of value exceeding INR 50,000. Even in the case of an inward supply of goods from an unregistered person, the e-way bill is applicable.

Q7: Who is an E-Way Bill a Consignee and Recipient?

A consignee is a person who has the legal right to receive the goods. When consideration is involved, the person who pays the consideration is known as the Recipient.

Q8: What is the recipient’s deadline for acceptance?

An E-Way bill is considered accepted after 72 hours if the recipient does not reject it. A Recipient must maintain a record of every E-Way bill that is created.

Q9: What is the Consolidated E-way Bill Form that needs to be filled out on the Common Portal?

The Consolidated E-way bill is subject to Form GST EWB-02.

Q10: Which Documents Do You Need to Give the Transporter?

Below given is the curated list of the documents you need to give to the transporter:

| Bill of supply |

| Delivery Challan |

| Tax Invoice |

| Copy of the E-way bill |