Introduction

Goods and Services Tax (GST) is a tax on the sale of goods and services, simplifying the tax structure. Invoicing, the process of detailing a sale, involves creating a document called an invoice, providing information on goods, services, costs, and applicable taxes. GST invoicing guidelines outline the proper procedures for businesses to comply with tax regulations and maintain transparent financial records. Comprehending the importance of GST invoicing ensures businesses follow proper guidelines for creating GST-compliant invoices, fostering transparency and adherence to taxation rules.Understanding GST Invoices

A GST invoice is a document that shows details of a transaction, like when you buy something or provide a service. It includes information about the goods or services and the taxes applied. Businesses use GST invoices to keep track of sales and purchases. It helps them follow tax rules and shows how much tax they need to pay or can claim back. A GST invoice should include information like:-

Seller’s Information:

- The name, address, and GSTIN (Goods and Services Tax Identification Number) of the seller must be clearly mentioned.

-

Buyer’s Information:

- Include the name, address, and GSTIN of the buyer to identify who the transaction is with.

-

Unique Invoice Number:

- Assign a distinct invoice number to each transaction for proper tracking and reference.

-

Transaction Date:

- Clearly specify the date when the transaction took place. This helps in maintaining a chronological record.

-

Description of Goods or Services:

- Provide a detailed description of the goods or services being sold to avoid any confusion.

-

Quantity of Goods or Services:

- Mention the quantity of the goods or services being sold to ensure clarity about the transaction.

-

Total Amount:

- Clearly state the total amount payable by the buyer, inclusive of taxes.

-

GST Amount:

- Break down the total amount to show the specific portion attributable to Goods and Services Tax (GST).

-

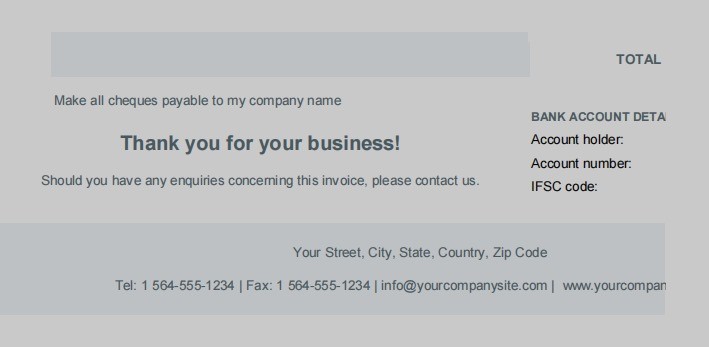

Mode of Payment:

- Indicate how the payment is made, whether by cash, card, or any other method.

-

Terms of Sale:

- Specify the terms under which the sale is conducted, including payment terms and any discounts offered.

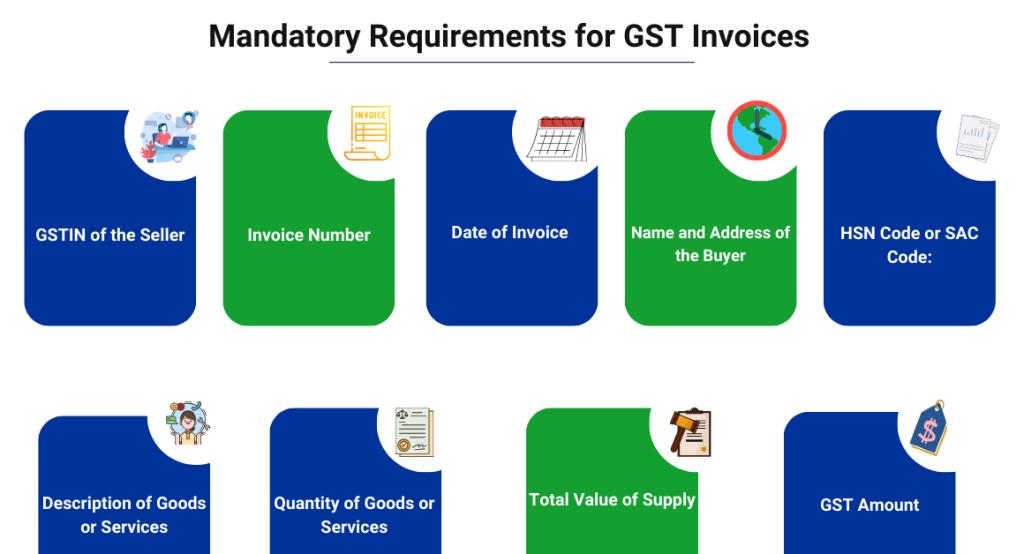

Mandatory Requirements for GST Invoices

The GST invoice issued should distinctly state details as outlined below:

The GST invoice issued should distinctly state details as outlined below:

-

GSTIN of the Seller:

- The seller must provide their unique GST Identification Number (GSTIN) on the invoice.

-

Invoice Number:

- Each invoice should have a unique identification number for tracking and reference.

-

Date of Invoice:

- Clearly mention the date when the invoice is issued to establish the timeline of the transaction.

-

Name and Address of the Buyer:

- Include the buyer’s name and address to identify who the transaction is with.

-

HSN Code or SAC Code:

- Mention the Harmonized System of Nomenclature (HSN) code for goods or Service Accounting Code (SAC) for services to categorize the products or services.

-

Description of Goods or Services:

- Provide a clear and detailed description of the goods or services being sold.

-

Quantity of Goods or Services:

- Specify the quantity of the goods or services being transacted.

-

Total Value of Supply:

- Clearly state the total amount payable by the buyer, including taxes.

-

GST Amount:

- Break down the total amount to show the specific amount of Goods and Services Tax (GST).

-

Place of Supply:

- Indicate the place where the goods or services are delivered or where the service is provided.

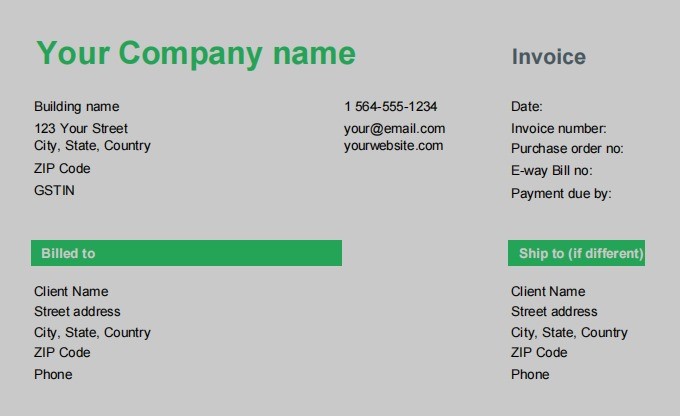

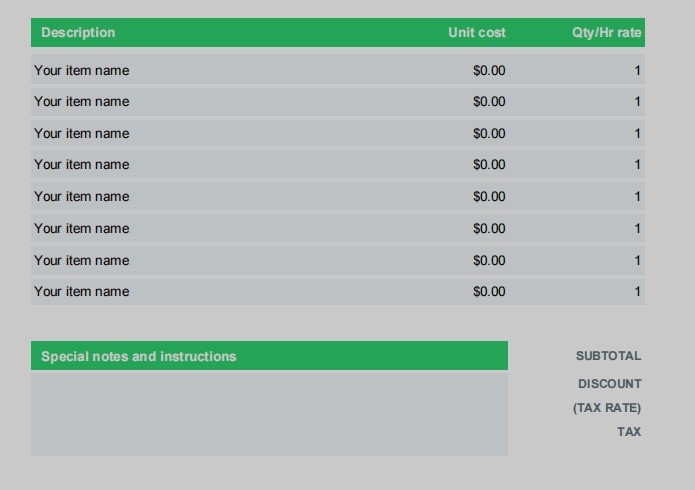

GST Invoice Format and Compliance

Let’s break down in details:-

Name, address, and GSTIN of the supplier:

-

Tax invoice number up to 16 characters:

-

Date of issue:

-

Name, address, and GSTIN of the recipient (if registered):

-

If the recipient is not registered and the value is more than Rs.50,000:

-

HSN code of goods or Service Accounting Code for services:

-

Description of goods/services:

-

Quantity of goods and unit in UQC:

-

Total value of supply of goods/services:

-

Taxable value of supply after adjusting any discount:

-

Applicable rate of GST:

-

Amount of tax (with breakup of amounts of CGST, SGST, IGST, UTGST, and Cess):

-

Place of supply and name of destination state for inter-state sales:

-

Delivery address if it is different from the place of supply:

-

Whether GST is payable on a reverse charge basis:

-

Signature of the supplier or his authorized representative:

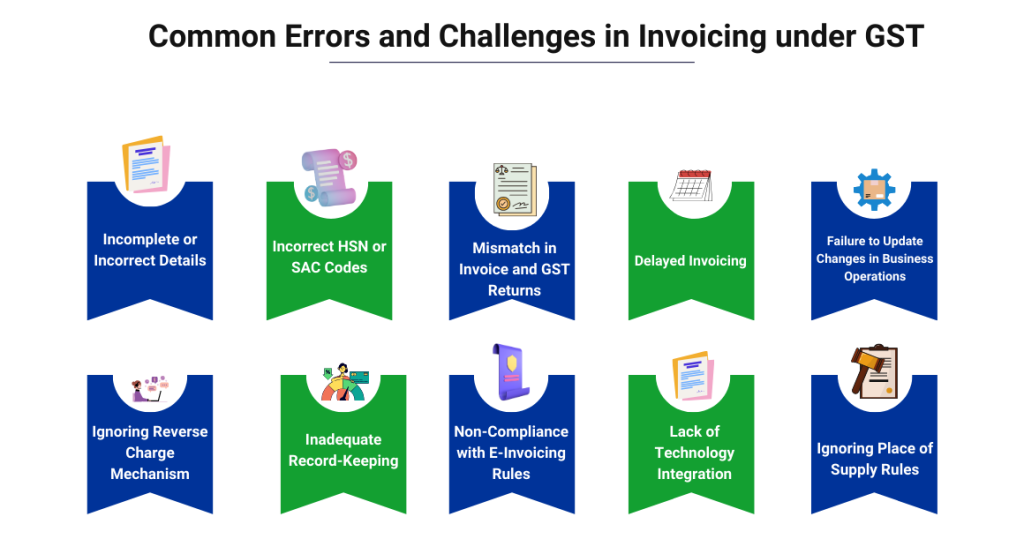

Common Errors and Challenges in Invoicing under GST

Common Errors and Challenges in Invoicing under GST are:

Common Errors and Challenges in Invoicing under GST are:

-

Incomplete or Incorrect Details:

- Error: Missing or inaccurate info on the invoice.

- Challenge: May cause confusion, processing delays, and non-compliance with GST rules.

-

Incorrect HSN or SAC Codes:

- Error: Wrong HSN for goods or SAC for services.

- Challenge: May lead to tax miscalculations and non-compliance.

-

Mismatch in Invoice and GST Returns:

- Error: Discrepancies between invoice and GST returns.

- Challenge: Can trigger audits, disrupting business.

-

Ignoring Reverse Charge Mechanism:

- Error: Neglecting buyer-paid GST (reverse charge).

- Challenge: Results in incorrect tax treatment and non-compliance.

-

Inadequate Record-Keeping:

- Error: Poor maintenance of records.

- Challenge: Difficulties during audits, potential penalties.

-

Non-Compliance with E-Invoicing Rules:

- Error: Not following electronic invoicing rules.

- Challenge: Legal repercussions and business disruptions.

-

Lack of Technology Integration:

- Error: Not using tech for invoicing, leading to manual errors.

- Challenge: Errors, increased costs, and inefficiencies.

-

Ignoring Place of Supply Rules:

- Error: Neglecting to determine and mention the correct place of supply.

- Challenge: Applying wrong GST rates, risking non-compliance.

Benefits of Compliant Invoicing under GST

There are many benefits of compliant invoicing under GST includes:-

Input Tax Credit (ITC) Claim:

-

Legal Compliance:

-

Smooth Business Operations:

-

Credibility and Trust:

-

Avoidance of Penalties:

-

Reduced Audit Risks:

-

Seamless Supply Chain Management:

-

Facilitates Easier Access to Finance:

-

Improved Cash Flow Management:

-

Efficient Tax Planning:

-

Enhanced Competitiveness:

-

Adaptation to Digital Transformation:

Importance of Technology in GST Invoicing

Using technology in GST invoicing means using computers or software to make invoices instead of doing it by hand. It’s important because: 1. Accuracy: Technology helps to avoid mistakes in invoices, making sure all the details are correct. 2. Efficiency: It makes the process faster and smoother, saving time for businesses. 3. Compliance: Technology ensures that invoices follow all the rules set by the government for GST, keeping the business in line with the law. 4. Record-keeping: Digital invoicing makes it easy to keep track of all transactions, helping businesses manage their finances better.Conclusion

In conclusion, doing invoicing the right way under GST is really important for businesses. It helps them follow the rules and keeps everything in order. Proper invoicing makes sure businesses can get benefits like credits, avoid problems with the law, and run smoothly. So, it’s a big part of how businesses work and stay successful. Also Listen: CaptainBiz Account Main Sales Invoice Banane ki ProcessFAQ’s

-

What is GST and why does it matter for invoicing?

-

What is a GST invoice and what information should it have?

-

What are the must-haves in a GST invoice?

-

How does the GST invoice format help businesses stay compliant?

-

What are some common mistakes in invoicing under GST?

-

Why is it important to avoid errors in GST invoicing?

-

How does compliant invoicing under GST benefit businesses?

-

Why is technology important in GST invoicing?

-

Can businesses use paper invoices instead of digital ones for GST?

- How does GST invoicing relate to the overall success of a business?

Master GST invoicing with our simple guide—create correct, compliant invoices and boost your business!

Anjali Panda

Senior Content Writer

Anjali Panda, a skilled wordsmith and literature enthusiast, earned her bachelor's degree in English Language and Literature from KiiT University. Her Highest Qualification Holding an MBA in Finance, she effortlessly blends academic knowledge with practical insights in her finance-centric content. Presently, Anjali is leveraging her financial expertise at BitWale, a startup, where she plays a pivotal role in optimizing the company's overall financial operations