Introduction

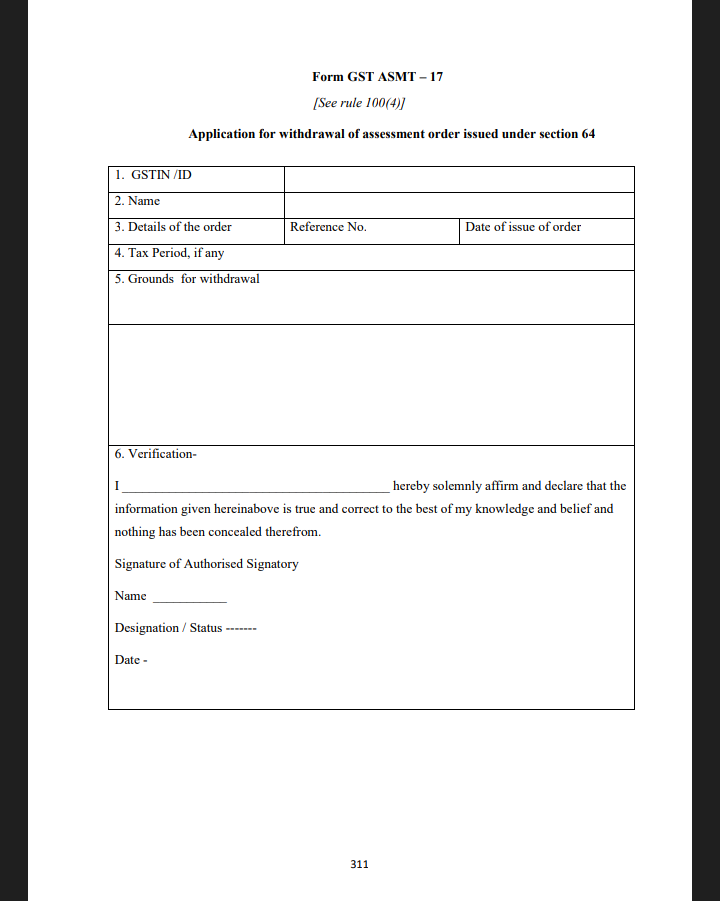

In this article, we will be navigating through the Withdrawal of the GST Summary Assessment Order in Form ASMT-17. But first things first we need to understand what form ASMT-17 is. You can understand Form ASMT-17 in GST as a key document playing an important role in the withdrawal of Summary Assessment Orders. This form is basically utilized by the authorities to officially retract or cancel a previously issued Summary Assessment Order under the GST framework. The withdrawal process may include reevaluation, corrections, or procedural reasons, impacting businesses subject to GST compliance.

Let’s dive into this world of GST and understand the complications of Form ASMT-17 in a simplified manner.

https://www.webtel.in/image/Form%20GST%20ASMT%20%E2%80%93%2017-_nnnnn.pdf

Introduction to GST Summary Assessment Orders

We must know that GST Summary Assessment Orders are official documents issued under the GST framework. These documents are useful to get quicker resolutions about tax liability of a taxpayer. Let’s delve deeper and get to know about this in detail.

-

GST Summary Assessment Orders

Under GST there is a simplified mechanism for tax evaluation. This simplified mechanism is your Summary Assessment Orders. These orders rely on available information to evaluate tax obligations.

-

Purpose and Significance

If you look at the purpose of GST Summary Assessment Orders, it is there to facilitate easy tax determination. It enables you to comply with regulations timely and reduces administrative complexities. These have significance when a detailed assessment might be impractical or time-consuming.

-

Issuance and Criteria

The tax authorities often issue these without delving into detailed investigations. The criteria for issuing such orders may include urgency, simplicity of the case, or situations where a detailed assessment might be challenging.

-

Implications for Taxpayers

The taxpayers need to understand the implications of these as these orders directly impact the assessed tax liability. Businesses must make sure that they comply to avoid penalties or legal complications. Timely submission of relevant documents and cooperation with tax authorities are essential aspects for businesses subject to such orders.

-

Challenges and Revisions

Challenges arise during the processes and then arise the need for revisions. In situations where errors, new information, or procedural issues are there then withdrawal or correction of previously issued orders is done. Now, this is where Form ASMT-17 comes into play for the GST ASMT-17 withdrawal process.

Understanding Withdrawal of GST Summary Assessment Order

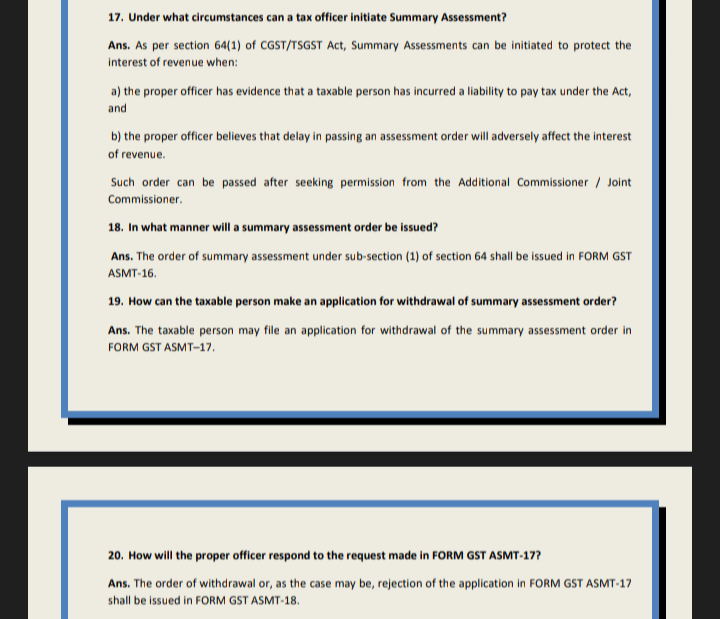

https://taxes.tripura.gov.in/sites/default/files/ASSESSMENT%20%26%20AUDIT%20FAQ.pdf

The withdrawal of GST Summary Assessment Orders is important for businesses. Understanding Form ASMT-17 withdrawal is what will offer you a standardized mechanism to rectify your assessments. Businesses need to understand the evolving landscape of GST regulations.

-

Context and Purpose

This withdrawal is done when tax authorities need to change a previously issued order. There are many reasons for withdrawal. A few of these could be errors, discrepancies, or new information. The main purpose here is to correct the inaccuracies. This also ensures a fair and accurate representation.

-

Form ASMT-17 as the Withdrawal Instrument

Understanding Form ASMT-17 withdrawal is that it is an instrument under the GST framework. This form has all the necessary details and procedures that are required for the correction of an order. Tax authorities use this form to communicate the withdrawal officially. This helps to maintain transparency and adhere to regulatory protocols.

-

Circumstances Leading to Withdrawal

The circumstances which lead to withdrawal include discrepancies in the assessed amount. This may include errors in the information considered or procedural irregularities. These parameters are important in Understanding Form ASMT-17 withdrawal.

-

Implications for Taxpayers

For a taxpayer, ASMT-17 order withdrawal implications are very crucial. It helps businesses to stay vigilant and responsive to developments. In this way, it helps businesses to prevent penalties and legal consequences. Clear communication and cooperation with tax authorities is also maintained.

-

Legal Framework and Compliance

The GST ASMT-17 withdrawal process works under the GST regulations. Therefore, businesses need to know about all the legal provisions related to the withdrawal of assessment orders. They need to comply with the requirements. This includes submission of requested documents on time and cooperation with authorities.

Reasons for Withdrawal of GST Summary Assessment Order

Now here we need to understand that these reasons are important for the smooth functioning of the tax assessment process. Here are a few of the reasons that led GST ASMT-17 withdrawal process

-

Error Correction

The most common reason for the GST ASMT-17 withdrawal process is the errors in the original assessment. These errors could be due to computational mistakes or misinterpretation of data. This leads to authorities retracting the order.

-

Provision of New Information

When there is an emergence of new information after their initial assessment, withdrawal may be possible. This happens when taxpayers provide additional data which affects the tax liability. The authorities then choose to withdraw the existing order to incorporate the updated information.

-

Procedural Irregularities

GST ASMT-17 withdrawal process may take place when there are procedural irregularities. These irregularities include differences in processes. In addition, when the process is not followed there’s a need for re-evaluation.

-

Ambiguities in Interpretation

When there are uncertainties in tax rules and regulations interpretation, authorities choose to withdraw the initial order. This leads to a thorough examination.

-

Judicial or Regulatory Directives

GST ASMT-17 withdrawal process may be done due to a court’s decision. In such cases court charges guidelines and these guidelines do not match with the original order. Thus withdrawal is done.

Process of Initiating Withdrawal

The GST ASMT-17 withdrawal process involves several key steps that you need to follow. It must be understood that these steps are essential for both tax authorities and taxpayers. This process ensures a transparent and accurate resolution of the GST Summary Assessment Order.

-

Identification of Need

Tax authorities identify whether withdrawal is needed or not. They consider factors such as errors, new information, procedural irregularities, or changes in GST regulations.

-

Internal Review

The authorities conduct an internal review. This review validates the reasons for withdrawal. This step ensures that the decision is legally fair.

-

Preparation of Withdrawal Request

Now a formal withdrawal request is prepared. This request includes the specific reasons for withdrawal. An explanation of the reasons leading to this decision is also given.

-

Completion of Form ASMT-17

The authorities then make the process formal using Form ASMT-17. This is the document for retracting or changing GST Summary Assessment Orders. This form is an official communication instrument.

-

Notification to Taxpayer

The taxpayer is then officially notified about the withdrawal. Along with reasons for withdrawal, there may be additional steps that the taxpayer needs to take.

-

Taxpayer Response and Cooperation

The taxpayer then responds to the GST ASMT-17 withdrawal process. The taxpayer cooperates with the tax authorities, which is very crucial.

-

Final Review and Approval

In this step, the tax authorities consider the responses from the taxpayer. After a final review, the decision to withdraw is then approved.

-

Documentation and Record-Keeping

All the documentation related to the GST ASMT-17 withdrawal process is stored. This includes Form-17 and all the communication between taxpayers and authorities. All the records are kept for smooth audit in the future.

Impact of Withdrawal on Taxpayers and Authorities

The Impact of ASMT-17 withdrawal on taxpayers and authorities is multiple. If we look at it in combined form, it tells you about the need for clear communication. In addition, it highlights the importance of compliance with regulations and cooperation with each other. Let’s look into it one by one.

Impact on Taxpayers

-

Financial Implications

The ASMT-17 order withdrawal implications lead to a reassessment of the tax liability of taxpayers. This impacts financial planning.

-

Compliance Requirements

Throughout the GST ASMT-17 withdrawal process taxpayers must be complied. They must provide requested information timely. Along with this, they must cooperate with authorities.

-

Communication and Clarity

Taxpayers need to have clear communication with tax authorities regarding reasons for withdrawal. The clarity will help the taxpayers to respond appropriately.

Impact on Authorities

-

Operational Efficiency

The withdrawal leads to the correction of errors and ensures tax assessments. This enhances operational efficiency.

-

Legal Compliance

Authorities must follow the Legal provisions for ASMT-17 order withdrawal. This includes proper documentation, notification to taxpayers, and compliance with regulations.

-

Resource Allocation

The GST ASMT-17 withdrawal process requires resource allocation. These resources include internal reviews, communication with taxpayers, and documentation.

Preventing Litigation

Withdrawal done on time ensures Legal provisions for ASMT-17 order withdrawal are complied with. This reduces potential disputes and legal challenges. Eventually, both taxpayers and authorities benefit.

Conclusion

To sum it all up we can say that the Withdrawal of GST Summary Assessment Order maintains the balance between efficiency and accuracy. By using Form ASMT-17, authorities rectify errors, incorporate new information, and uphold procedural integrity. This leads to businesses finding themselves in compliance with GST regulations. When we look at its impacts, it includes financial and operational efficiency. It also tells us that there must be mutual trust between taxpayers and authorities. By understanding this important process, businesses can create a transparent and cooperative tax environment.

Also Read: What Are The Benefits Of Integrating GST Registration With Your Invoice/ Billing Software?

Frequently Asked Questions (FAQs)

-

What is Form ASMT-17?

Form ASMT-17 in GST is a key document playing an important role in the withdrawal of Summary Assessment Orders

-

How is form ASMT-17 utilised?

The authorities use This form to officially retract or cancel a previously issued Summary Assessment Order under the GST framework.

-

What is the Withdrawal of the GST Summary Assessment Order?

It offers you a standardized mechanism to rectify your assessments.

-

What does the withdrawal process include?

The withdrawal process may include reevaluation, corrections, or procedural reasons, impacting businesses subject to GST compliance.

-

What are the GST Summary Assessment Orders?

Under GST there is a simplified mechanism for tax evaluation. This simplified mechanism is your Summary Assessment Orders.

-

What is the purpose of GST Summary Assessment Orders?

It is there to facilitate easy tax determination. It enables you to comply with regulations timely and reduces administrative complexities.

-

What is the significance of GST Summary Assessment Orders?

These have significance when a detailed assessment might be impractical or time-consuming.

-

What are the Reasons for Withdrawal of GST Summary Assessment Orders?

Error Correction, Provision of New Information, Procedural Irregularities, Ambiguities in Interpretation and Judicial or Regulatory Directives.

-

What are the steps involved in the Process of Withdrawal?

- Identification of Need

- Internal Review

- Preparation of Withdrawal Request

- Completion of Form ASMT-17

- Notification to Taxpayer

- Taxpayer Response and Cooperation

- Final Review and Approval

- Documentation and Record-Keeping

-

What are the implications for taxpayers in Summary Assessment orders?

The taxpayers need to understand the implications of these as these orders directly impact the assessed tax liability.