Introduction

The tax system has a significant part to play in a nation’s growth. The government spend the taxes collected on the development of the nation. The infrastructure, healthcare, roadways etc are all developed through the money received through tax.

The launch of Goods and Service Tax (GST) has played an important role in simplifying the indirect tax structure. Many countries have benefitted a lot from this. It’s very necessary to understand the GST summary for individuals as well as businesses. The GST summary gives an overview of tax obligations and credits received.

In this article, we will study how GST summaries can be accessed. We will also understand why is it so important and different ways of accessing GST summary.

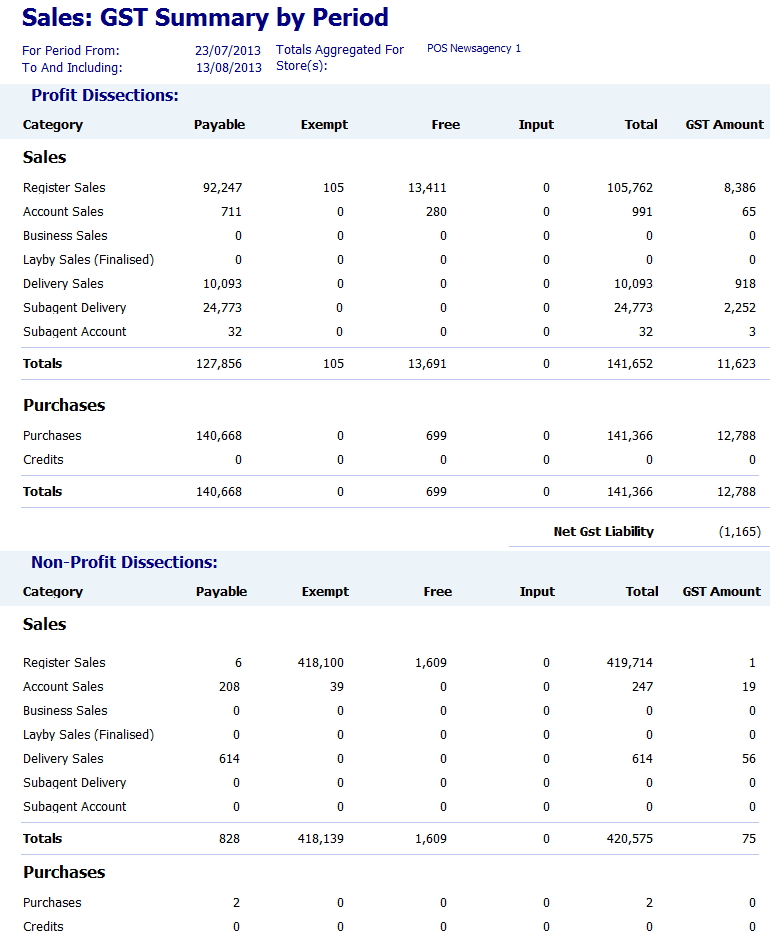

Example of GST Summary :-

Source:- https://www.possolutions.com.au/blog/how-to-check-my-gst-in-detail

Introduction to GST (Goods and Services Tax)

Goods and Services Tax (GST) is a multi-stage, destination-oriented tax system that is imposed on every value addition. It replaces the indirect tax system which includes excise duty, VAT, service taxes etc. GST creates a uniform and transparent tax structure.

GST revolves around the principle of charging the tax based on value addition at each stage of the supply chain. GST integrates goods and services into a single tax structure. Through this integration, it helps in reducing the rolling effects of taxes which are used to increase the prices of goods and services.

GST avoids a double taxation system. It adds tax only at the value added at each stage. This helps in reducing the total tax burden.

GST is also considered a destination-based tax system. As here the tax revenue is collected at the consumption location instead of the production place. Due to this the revenue that is generated from GST is circulated among the consuming states.

GST has been structured into multiple slabs according to the diversified nature of goods and services. As per this multi-slab structure, a low tax is levied on essential items and a higher tax is applied on luxury items.

The GST can be applied properly by proper collaboration between the central and state governments. Central GST (CGST) is administered by the central government and State GST (SGST) is taken care of by the state government. In addition to this central government levies and collects Integrated GST (IGST)

Also Read: GST: Everything You Need To Know

Understanding the Basics of GST Summary

GST summary is a comprehensive record which provides a brief of your tax and liabilities. It includes the details of sales, purchases, and tax payments thereby offering a clear overview of financial transactions taking place in a specified period. Let’s get into understanding GST summary and its basics.

-

Essence of GST

GST is a consumption-based tax system which has been designed to streamline the process of levying taxes on the supply of both goods and services. GST unifies the tax and levies a single tax on goods and services. Here the concept is to apply tax based on value addition at each stage of the supply chain.

-

Destination-Consumption-based tax system

Destination-based consumption tax system is an important aspect of the GST system. It means that tax revenue shall be collected at the place of consumption and not at the place of production. This encourages the fair and equitable distribution of resources. This is because revenue generated from GST is distributed among the states.

-

The Multi-Slab Structure

A multi-slab structure is involved in GST due to the diverse nature of goods and services. As per this structure lower tax is imposed on essential items and a higher tax is imposed on luxury items.

-

Dual GST system

A proper collaboration between central and state governments is required for the implementation of GST. The central government looks after CGST and the state government manages the SGST. Whereas IGST is taken care of by the central government.

-

Technology Integration

The proper functioning of GST has been made possible through an online portal and GST Network (GSTN). It helps in connecting various stakeholders and provides a platform for registration, filing and payment.

Why Obtaining a GST Summary is Essential?

The GST system has brought transparency to the taxation system. For businesses and individuals, knowledge about the GST summary is a necessity in today’s world. Here are some reasons why GST summary is so essential: –

-

Clarity in Tax Structure

A GST summary gives a clear overview of the taxation structure. This helps the business and individuals to understand the various components of tax. Due to this clarity, proper and accurate compliance is maintained.

-

Optimizing Tax Planning

A GST summary is an important tool for tax planning. Businesses can assess their operation concerning tax slabs and exemptions applicable to goods and services. Due to these businesses can optimize their tax liabilities by getting benefits of exemptions and deductions.

-

Facilitates Compliance and Filing

A proper understanding of GST is very important for compliance and filing requirements. A detailed GST summary consists of information about registration procedures, return filings and payment schedules. Due to this businesses can stay compliant with tax regulations.

-

Claiming Input Tax Credits

Businesses can claim an input tax credit for the GST which is paid for purchases made. This will reduce the overall liability. A detailed GST summary can help to validate input tax credit claims.

-

Adaptation to the Regulatory Changes

A GST summary becomes a base to stay updated on regulatory changes. Businesses can make changes in their business operation as per these regulatory changes.

Different Ways to Access a GST Summary

There are different ways for accessing GST summary as per the taxpayer’s requirement. Here is the brief of each way to obtain a GST summary: –

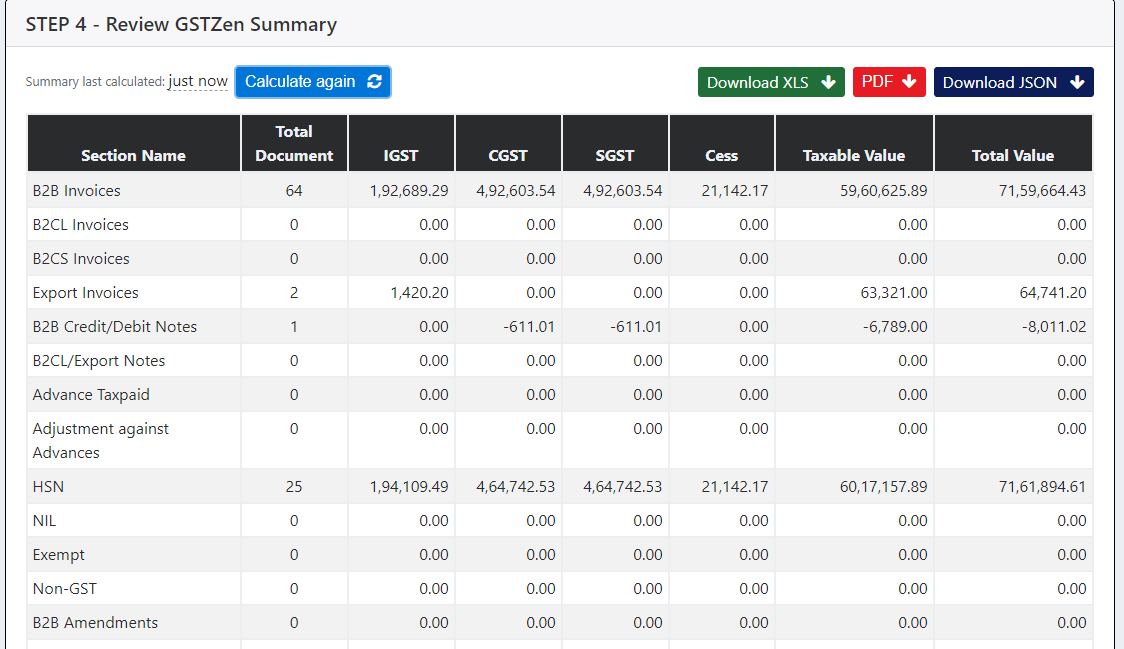

GST Summary Access example:-

Source:- https://www.gstzen.in/a/filing-monthly-outward-supply-return-gstr-1.html

-

Government Portals and Websites

Access to GST Summary online is the most convenient way these days for taxpayers. Tax authorities provide resources and summaries on online portals and websites. These resources can be easily accessed by the public.

-

GST Network Portal

The GST Network (GSTN) is an important part of the GST system. It’s very easy for taxpayers to get GST summary and other information from this portal. This portal processes GST-related activities like registration, return filing, payment etc.

-

GST Software Solutions

There are various software solutions available now that can provide you with the GST summaries. This software is integrated with accounting and ERP systems. Businesses can install this software to get GST summaries.

-

Professional Services

There are professionals also available who can help you to get a GST summary. They have good knowledge of taxation and can generate summaries as per the requirements.

Interpreting a GST Summary Effectively

GST has contributed a lot to modern-day taxation. Businesses need to have a proper understanding of the GST summary. This will help them to take advantage it. Here are key aspects of how GST summary interpretation can be done: –

-

Understanding the Basics

A GST summary provides a brief about taxes incurred and paid during a specific tenure. The document is divided into various section which describes different types of transactions and components. GST summary includes details of input tax credit, output tax credit, and the net tax payable.

-

Decoding Input Tax Credit

Input tax Credit is an important part of the GST summary. Businesses can claim the ITC on taxes paid on inputs like raw materials, and services that are used in the production. This interpretation requires regular reconciliation of invoices with GST summary.

-

Analysing Output Tax Liability

Output Tax liability is the taxes that a business gets from the sale of goods and services. This section summary needs very close observation of taxable supplies, exempt supplies and zero-rated supplies. By close examination of each transaction, businesses can calculate output tax liability accurately.

-

Net Tax Payable and Settlement

The culmination of input tax credit and output tax credit results in Net Tax Payable. It determines whether the businesses need to pay additional taxes or are liable for a refund. To effectively interpret this, you need to cross-verify the calculations. All liabilities shall be paid off on time to avoid any penalty charges.

-

Compliance with GST Rules and Regulations

Businesses shall take care that the amendments and compliance requirements are fulfilled. Audits on a regular basis and consultations with tax experts will help in staying compliant and optimizing the tax liabilities.

Importance of GST Summaries for Different Entities

GST summaries provide valuable insights into financial health, compliance and decision-making. Let’s understand the GST summary importance for different entities.

-

Small and Medium Enterprise (SMEs)

GST summary plays an important role in the maintenance of financial transparency and compliance in small and medium enterprises. Through accuracy in interpreting the input tax credit and output tax credit, SMEs can maximize the tax credit.

-

Large Corporations

A GST summary serves as a comprehensive record of the financial activities for large corporations that deal with huge volumes of transactions. This helps in internal audits and ensures compliance with GST regulations. Large corporations are also able to leverage the GST summaries by identifying the areas of improvement and improving the overall performance.

-

Individual taxpayers

Individual taxpayers can use GST summaries for comprehensive tax planning. It helps in maximizing the eligible deductions and credits. This increases their overall savings.

-

Government Authorities

GST summaries have a significant role to play in government authorities regulating tax collections. This summary gives a proper overview of tax contributions by various entities. This helps in efficient tax administration and also reduces the likelihood of tax evasion.

-

Financial Institutions

Financial institutions like banks and NBFCS require GST summaries for assessing credit worthiness of borrowers. This summary gives a brief overview of the entity’s financial health and overall fiscal responsibility. GST summaries of entities help in building trust with banks and NBFCs for getting credit.

Conclusion

Obtaining a GST summary is very important for individuals and businesses. GST summaries can ensure compliance, audit readiness and strategic financial planning. The process of getting a GST summary has some key steps. This will benefit the GST framework.

Businesses need to maintain proper financial records. Proper bookkeeping practices will serve as the foundation of a comprehensive GST summary. Businesses shall also implement accounting software to track GST liabilities and credits. This will smoothen the process of GST summaries.

Regular reconciliation of financial data with GST returns will help in getting an accurate GST summary. By observing best practices in businesses and integrating technology, entities will be able to get accurate GST summaries.

Also Read: Know Everything About GST Billing Software

Frequently Asked Questions

-

How do I obtain my GST summary?

One can access GST summaries online by going to GST’s official portal.

-

How to reconcile the GST summary with business accounts?

For reconciliation, you need to compare your GST summary with your business accounts. Take care that sales and purchase data are tallied.

-

Is there any restriction on the download of the GST summary?

The majority of portals don’t impose any download limits. You can download the GST summary as many times as needed.

-

Is it possible to get a GST summary online?

Yes, the GST summary can be downloaded from the online portal.

-

What is the difference between a GST summary and a GST return?

A GST summary is an overview of transaction related whereas a GST return is a detailed report filed with tax authorities.

-

Can I request a GST summary for multiple businesses?

Yes, you can request a GST summary for multiple businesses. Use appropriate channels for the same.

-

How do I download the GST summary?

You need to log in to the official tax portal. Then go to the GST summary section and select the desired tenure. Then click on the download option.

-

What information mentioned in the GST summary is confidential?

The confidential information on the GST summary includes financial details, business transactions, taxpayer data etc.

-

Is it possible to get a GST summary of previous years?

In the majority of cases, you can get access to the GST summary of previous years from the official tax authority portal.

-

Can I download the GST summary in a different format?

If the tax portal supports then you can download the GST summary in different formats like PDF, Excel etc.