A receipt voucher is an essential financial document that makes record-keeping clear and structured in various transactions. This voucher is made expressly to confirm the receipt of money, products, or services.

A receipt voucher offers a thorough summary of the exchanged goods, their corresponding quantities or amounts, and the transaction date—whether for personal or business use. Anyone negotiating the complexities of financial transactions must understand receipt vouchers’ subtleties.

Types of Receipt Vouchers

In financial transactions, receipt vouchers are essential since they provide concrete evidence of a transaction’s completion. These vouchers are necessary for companies to keep correct records and guarantee financial transactions are transparent. There are various receipt voucher types, each with a distinct function.

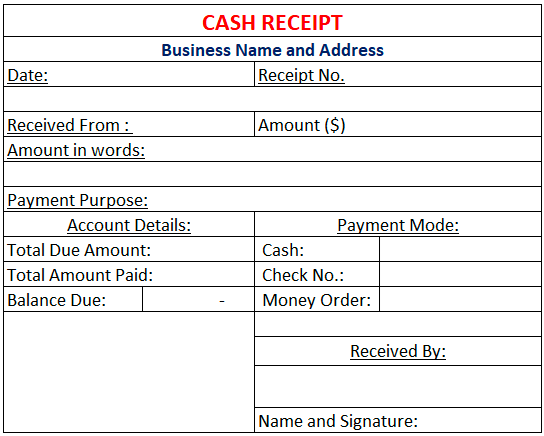

Cash Receipt Voucher

A simple document that lists debtor payments is a cash receipt voucher. Cash receipts are recorded whenever money is received in cash against sale invoices or an account.

Bank Receipt Voucher

A bank receipt voucher is a straightforward document detailing debtor payments. Bank receipts are created when a party sends a cheque or a demand deposit (DD) against sale invoices or an account. Bank credit balance falls when at least one ledger account is credited, and one bank account is debited.

General Receipt Vouchers

A general receipt voucher verifies the receipt of goods or payments. Typically, it includes details such as the date, received amount, payment method, and transaction summary. This essential financial record enhances accountability and transparency by offering proof of a finalized transaction.

To ensure accuracy in financial documents, the voucher may additionally contain information on the payer and beneficiary. Keeping track of and managing financial transactions in a commercial or personal setting requires a clear, organized general receipt voucher.

Significance of Different Receipt Vouchers

Receipt vouchers are available in several forms, each with a unique value in finance.

Record-keeping

- Receipt vouchers are essential paperwork for keeping precise and well-organized financial records.

- Facilitates convenient tracking of all incoming payments, which eases the account reconciliation process after the financial period.

Proof of Transaction

- Serves as concrete documentation of a business-to-customer transaction.

- Vital for settling disagreements and elucidating ambiguities in the future.

Decision Support

- Offers precise and current income data to help with well-informed business decisions.

- Assists in locating possible cost-cutting opportunities as well as valuable goods and services.

Financial Transparency

- Shows creditors, partners, and investors that financial information is transparent.

- It encourages confidence and trust among stakeholders, which boosts the company’s overall legitimacy.

Compliance and Auditing

- By offering a clear record of transactions, compliance and auditing support adherence to tax laws and other financial requirements.

- It makes audits more accessible and guarantees that financial records correspond with corporate operations.

Reimbursement for Expenses

- It provides proof of the company’s spending and aids in paying employees for out-of-pocket business expenses.

- It simplifies the reimbursement procedure and lowers the possibility of misunderstandings or disagreements.

Internal Controls

- Makes sure that all operations that generate money are tracked and documented, which strengthens internal controls.

- Keeps an open record of all financial transactions, lowering the possibility of fraud or money misuse.

Customer Relations

- Offering a polished and well-organized record of transactions enhances customer relations.

- Provides clients with a comprehensive record of their payments and purchases, which fosters customer trust.

Budget Monitoring

- Effective budget monitoring is supported by keeping track of all income-related transactions.

- It helps businesses make financial plans and decisions by enabling them to compare actual income to planned income.

Cash Flow Management

- It helps manage cash flow by offering information on the sources and timing of cash inputs.

- It helps companies find revenue collection trends and patterns, which improves financial stability.

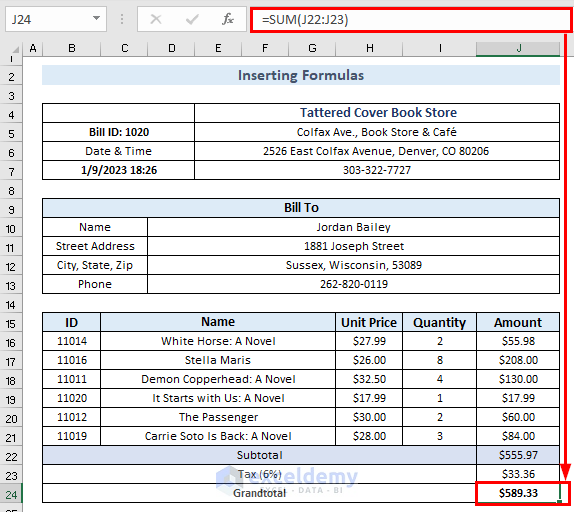

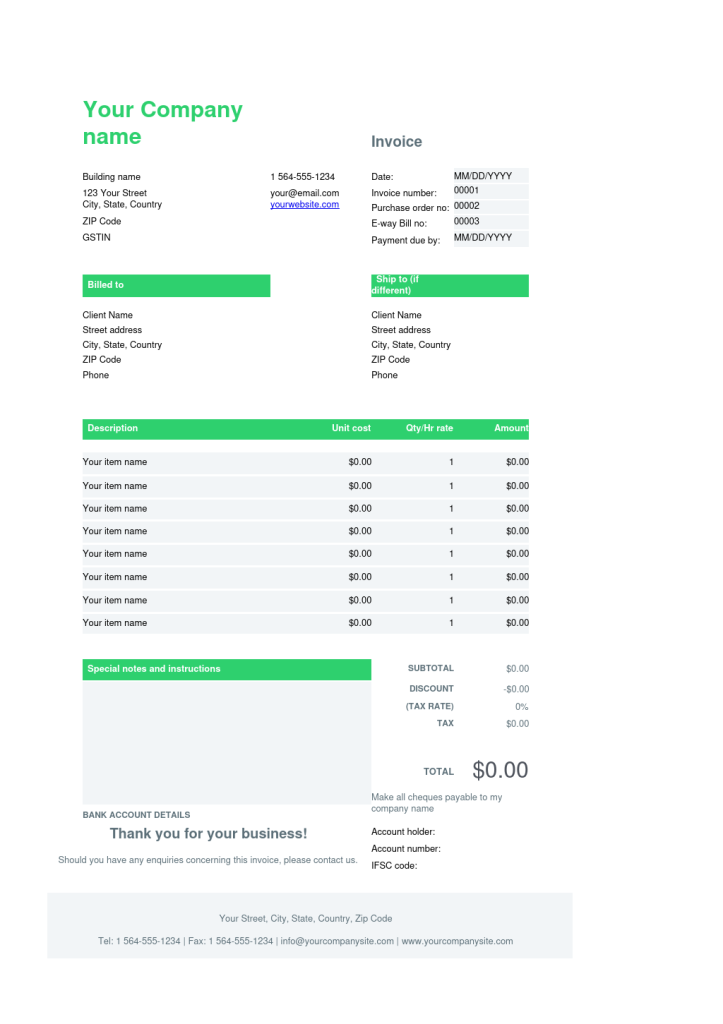

Key Components of a Receipt Voucher

A receipt voucher is an acknowledgment of goods and services or a payment receipt. It acts as proof that a transaction has occurred. Depending on the particular needs of the company or the type of transaction, the essential elements of a receipt voucher may differ but often consist of the following:

- Let them know right away with a title that this is a “Receipt Voucher.”

- For branding and identification purposes, use the name and logo of the issuing organization.

- Give the name and contact details of the payee (company or organization) and the payer (client or customer).

- Indicate the amount and unit cost of the pertinent goods or services, if appropriate.

- Declare the transaction date, the time the money was transferred, or the delivery of the products or services.

- Provide the purpose of the transaction, whether it’s to settle an invoice or to purchase products or services.

- Indicate the total sum in textual and numerical form.

- Declare your chosen payment method, such as cash, cheque, credit card, etc.

- You can expedite the reconciliation procedure by including details like the cheque number or transaction reference. If applicable, give the name and account number of your bank.

- List any additional expenses or taxes that apply.

- The receipt voucher must be signed by an organization official with authority to be considered authentic.

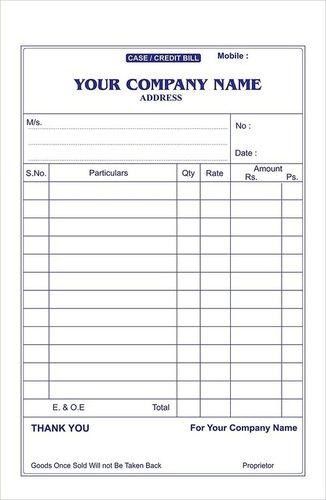

Understanding Receipt Voucher Format

Depending on the company and the type of transaction, a receipt voucher format may change. However, the following components are typically present in all formats:

Common Mistakes in Receipt Voucher Preparation

Accurate financial record-keeping and adherence to accounting rules depend on adequate reporting income and receipts. Nonetheless, people and companies may commit typical errors when creating receipt vouchers. Here is a thorough summary that touches on many facets of this subject:

Inadequate Data

- Error: Not including essential information about the transaction, like the date, the money received, and the goal.

- Consequence: Tracking and reconciling transactions may need clarification due to incomplete vouchers.

Absence of Supporting Documentation

- Error: Forgetting to include essential supporting documentation, such as invoices or receipts.

- Consequence: The transaction’s legitimacy may be jeopardized, and audits may challenge the absence of supporting documents.

Incorrect Classification

- Error: Assigning receipts to the incorrect category for expenses or income.

- Consequence: Financial records may be distorted by misclassification, making evaluating the business’s financial performance more challenging.

Ignoring Tax Compliance

- Error: Failure to include relevant tax information in receipt vouchers.

- Consequence: Penalties and legal problems may arise from failure to comply with tax requirements.

Error in Recording

- Error: Need to record receipts quickly.

- Consequence: Accurate financial reporting and timely financial decision-making can be impeded by delayed recording.

Inadequate Audit Documentation

- Error: Not keeping up-to-date, comprehensive records for auditing needs.

- Consequence: Insufficient documentation may raise issues during audits, resulting in penalties or other legal implications.

Reconciliation Failure

- Error: Failure to routinely reconcile bank statements and other financial documents with receipt vouchers.

- Consequence: Differences between the company’s records and accurate bank balances may arise from unreconciled transactions.

Lack of Authorization

- Error: Not getting permission or authorization before creating the receipt voucher.

- Consequence: Unauthorized transactions may result in fraud and poor money management.

Missing Supporting Documents

- Error: Failure to affix required supporting documents, such as receipts or invoices.

- Consequence: The transaction’s legitimacy may be jeopardized, and audits may challenge the absence of supporting documents.

Inconsistent Numbering

- Not keeping a consistent numbering scheme for receipt vouchers is an error that should be corrected.

- Consequence: Tracking transactions with inconsistent numbers may become confusing and prone to mistakes over time.

Best Practices for Receipt Voucher Preparation

To guarantee accuracy, transparency, and compliance with rules, it is essential to generate receipt vouchers by established protocols. Consider the following key recommendations:

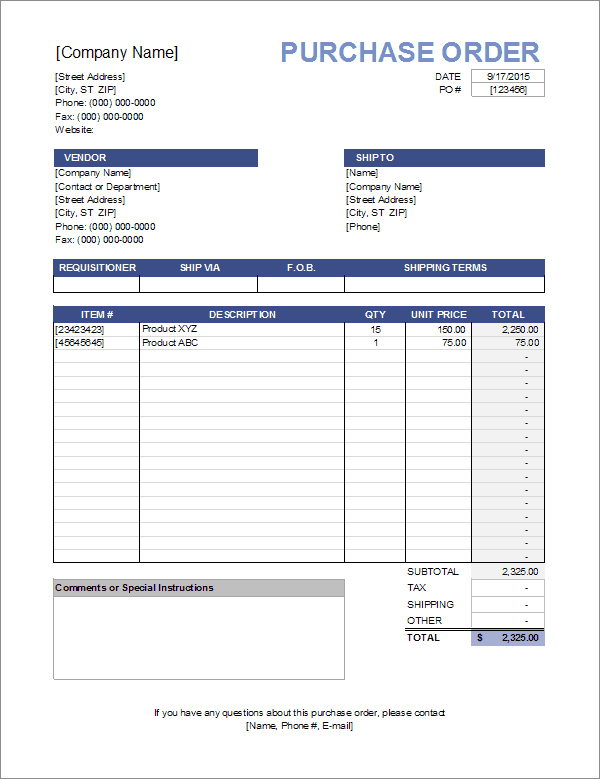

Standardized Templates

Develop consistent templates for receipt vouchers containing essential details like the date, voucher number, sender, received amount, payment method, and purpose of the funds. This ensures precise and standardized documentation.

Numbering in Sequence

Give each receipt voucher a sequential and distinct voucher number. This facilitates systematic tracking and referencing of transactions, which is beneficial for auditing.

Verification of Supporting Documents

Check invoices, purchase orders, and any other pertinent records as supporting documentation before creating a receipt voucher. This guarantees that the transaction information is appropriately reflected on the voucher.

Authorization and Approval

Create a transparent authorization procedure that specifies how receipt vouchers should be prepared and approved. To uphold internal control and stop fraudulent activity, authorized staff should only create and approve vouchers.

Coding and Categorization

Assign the correct account codes to each transaction and classify it correctly. This guarantees that financial statements adhere to accounting standards and appropriately depict the type of transactions.

Maintain Records

Maintain an organized file of all receipt vouchers and accompanying paperwork. When these records are filed and stored correctly, conducting internal reviews, inquiries, and audits is easier.

Date Accuracy

Verify that the transaction’s actual date is shown on the receipt voucher. Reconciliation, accounting principle compliance, and financial reporting depend on accurate data.

Accuracy in Quantities

Verify the accuracy of all numerical data, including quantities, by double-checking. Any differences in the sums could result in financial misrepresentations and even legal action.

Conclusion

Maintaining correct financial records and guaranteeing transaction transparency requires understanding the many kinds of receipt vouchers. Every receipt—cash, bank, or journal—has a distinct function in recording arriving monies. This thorough understanding enables companies to improve financial management, comply with regulations, and expedite accounting procedures.

A Comprehensive Guide to Receipt Vouchers: Everything You Need To Know

FAQs

Why do you need receipt vouchers in financial transactions?

Receipt vouchers help ensure openness and accurate record-keeping by offering verifiable proof of transaction completion.

How do the receipt vouchers help in business?

Receipt vouchers provide precise and current income data, enabling well-informed company decisions and helping to pinpoint areas where costs can be cut.

How are receipt vouchers helpful in auditing and compliance?

Receipt vouchers facilitate compliance with tax regulations, improve audit accessibility, and guarantee that financial records correspond with business activities.

What function do receipt vouchers serve in auditing and compliance?

Receipt vouchers facilitate compliance with tax regulations, improve audit accessibility, and guarantee that financial records correspond with business activities.

In what ways do receipt vouchers support decision-making in business?

Receipt vouchers provide precise and current income data, enabling well-informed company decisions and helping to pinpoint areas where costs can be cut.

Related Order and Invoice Templates