Businesses often seek advances as a protective measure for their interests. The received advance can be offset against the final payment, future supplies, or potentially refunded.

By GST regulations, the time of supply is determined at the point of receiving any advance payment for a transaction, irrespective of whether the actual supply has occurred. This signifies that the GST on the advance sum is obligated to be settled at the time of receiving the advance payment.

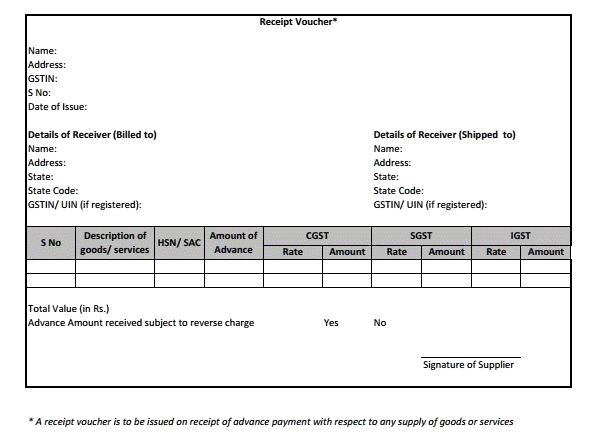

Customers’ advance payments can be documented by utilizing a receipt voucher. This voucher, specifically labeled as an advance receipt, can be generated with the necessary GST information and subsequently printed.

Meaning of receipt voucher

- Within the framework of Goods and Services Tax (GST), a receipt voucher functions as a document providing proof of payment receipt.

- It is employed to document the money received from a customer or client.

- This voucher includes crucial information such as the received amount, the payment method, and other relevant details.

- A receipt voucher is a crucial document which serves as tangible evidence of a financial transaction.

- Typically issued by a seller, service provider, or any entity receiving payment, the primary function of a receipt voucher is to formally acknowledge the receipt of payment and offer comprehensive details regarding the transaction.

- This document plays a key role in financial record-keeping, providing transparency and accountability in business transactions.

Details to be included in a GST receipt voucher

A receipt voucher, in general, should encompass specific details to establish a comprehensive record of the transaction. These commonly include:

| Transaction Identification | A unique voucher or transaction number to distinguish it from other receipts.

Consecutive serial number (document number). |

| Date | The date on which the receipt voucher is issued. |

| Supplier details | Supplier’s name, address, and Goods and Services Tax Identification Number (GSTIN). |

| Recipient details | Recipient’s name, address, and Goods and Services Tax Identification Number (GSTIN) if registered. |

| Description of goods | Clear and concise description of the goods or services for which the payment is made. |

| Advance amount received | The total amount received in currency or any other accepted form of payment. |

| Mode of Payment | Details regarding the method of payment, such as cash, cheque, credit card, or electronic transfer. |

| Purpose of payment | Specify if the payment is an advance for future goods or services or the final settlement. |

| Tax Details (if applicable) | Breakdown of tax components, such as central tax (CGST), state tax (SGST), integrated tax (IGST), union territory tax (UTGST), or any applicable cess. |

| Place of supply | The state name and its code for inter-State supply need to be mentioned. |

| Terms and Conditions (if any) | Any other terms or conditions pertaining to the transaction. |

| Applicability of reverse charge mechanism. | Reverse charge applicable or not (Yes/No) |

| Authorized Signatures | Signature or digital signature of the supplier or authorized representative to validate the authenticity of the receipt voucher. |

Ensuring that these details are included in a receipt voucher helps maintain transparency and serves as a reliable record for both parties involved in the transaction.

A sample receipt voucher

Importance of receipt vouchers

The importance of receipt vouchers is multi-faceted, contributing significantly to transparent and accountable financial practices for both businesses and individuals. The following points underscore the significance of receipt vouchers:

Legal Compliance

- Receipt vouchers fulfill legal requirements.

- They serve as documented evidence of financial transactions.

- This documentation is essential for adhering to tax regulations.

- They showcase revenue generation, and ensure compliance with financial laws.

Record-Keeping

- Receipt vouchers play a crucial role in maintaining accurate and organized records.

- They give a detailed record of financial transactions.

- They assist businesses in tracking income, reconciling accounts.

- They also help facilitate the preparation of comprehensive financial statements.

Dispute Resolution

- Receipt vouchers act as tangible proof of payment.

- They become invaluable in resolving disputes or discrepancies.

- In the case of misunderstandings between parties, a receipt voucher serves as a reference point for verifying transaction details and clarifying any issues.

Financial analysis

- Receipt vouchers contribute to financial analysis and budgeting efforts.

- They offer insights into the sources of income, transaction frequency, and the nature of expenditures.

- This information is instrumental in making informed financial decisions and planning for the future.

Transparency and Integrity

- Receipt vouchers help document each financial transaction.

- They contribute to the overall transparency and integrity of financial operations.

- This transparency is essential for building trust with stakeholders, including customers, investors, and regulatory bodies.

Audit Trail

- Receipt vouchers create a reliable audit trail.

- They allow for the systematic review and verification of financial transactions.

- This is particularly important during internal or external audits.

- Receipt vouchers provide a comprehensive overview of financial activities.

Receipt voucher for small businesses

- Accurate record-keeping is essential for small businesses, particularly from the view point of GST compliance.

- Receipt vouchers assume a critical role in this regard.

- A receipt voucher for small businesses serves as meticulous documentation of received payments.

- The issuance of a receipt voucher for each transaction is a fundamental practice.

- It aids small businesses in maintaining orderliness and ensuring precise income reporting.

- Beyond mere documentation, GST receipt vouchers also facilitate the process of claiming input tax credit.

- Small businesses can leverage valid receipt vouchers to assert the GST paid on their purchases.

- This consequently diminishes their overall tax liability.

- It is vital to underscore the necessity of meticulously filling out receipt vouchers with precise details.

- This safeguards against potential discrepancies during GST audits.

Receipt vouchers for small businesses serve various essential functions. These include:

Streamlining Documentation

Vouchers act as crucial supporting documents for export declarations and customs processes, facilitating efficient and organized documentation.

Facilitating Tax Compliance

Receipt vouchers play a key role in tracking and recording export earnings, aiding businesses in accurate tax calculations and reporting, thereby contributing to overall tax compliance.

Ensuring Payment Verification

These vouchers serve as tangible proof of payments received from buyers, ensuring the fulfillment of contractual obligations and providing a transparent record of financial transactions.

Resolving Disputes

In instances of discrepancies, receipt vouchers play a pivotal role as evidentiary support. They help to resolve disputes related to payment receipts and ensure transparency in financial transactions.

Receipt voucher for exporters

- Exporters find value in utilizing GST receipt vouchers to manage their transactions effectively.

- When exporters engage in the sale of goods or services to foreign buyers, GST is typically not applicable.

- However, if the transaction involves an Indian buyer, GST becomes relevant.

- In such instances, exporters are required to issue receipt vouchers to the Indian buyer, incorporating the GST component.

- The issuance of GST receipt vouchers by exporters serves a dual purpose.

- Firstly, it ensures the accurate collection of taxes.

- This guarantees that the correct amount is collected and remitted to the government when GST is applicable.

- Secondly, these vouchers act as documented evidence of the transaction.

- This offers a valuable resource for audits and other compliance-related activities.

- GST receipt vouchers serve as a vital tool for exporters.

- It helps them navigate tax obligations and maintain a transparent record of their transactions.

Receipt vouchers for exporters serve various vital functions. These include:

Streamlining documentation

Serve as essential supporting records for export declarations and customs procedures.

Validating transactions

- Furnish evidence of payments received from foreign buyers.

- Ensure fulfilment of contractual commitments.

Ensuring tax adherence

- Contributing to the meticulous tracking and recording of export earnings.

- Facilitate accurate tax computations and reporting.

Addressing disputes

Should discrepancies arise, receipt vouchers function as crucial evidence in resolving payment-related disputes.

Strategies for Optimal Use of Receipt Vouchers

Adopt pre-numbered vouchers

Mitigate risks of loss, duplication, and unauthorized use.

Implement systematic filing

Organize receipt vouchers chronologically or categorically for easy retrieval.

Verify details

Cross-reference voucher information with other pertinent documents such as invoices or bank statements.

Authorize designated personnel

Restrict the issuance and signing of vouchers to authorized individuals for better control.

Ensure secure storage

Safeguard vouchers in a designated secure location to prevent damage or loss.

Explore digital alternatives

Consider the integration of online accounting software or applications for efficient management of receipt vouchers.

Maintaining GST compliance is vital for the seamless operation of businesses. GST receipt vouchers play a vital role in simplifying transactions and ensuring legal compliance. Issuing these vouchers enables businesses to streamline record-keeping, build customer trust, and ease the complexities of tax filing and audits. It is crucial to consistently follow the regulations and guidelines established by the Government of India concerning receipt vouchers for a genuinely seamless transaction experience. For firms, it is important to stay compliant and efficient to pave the way for a successful journey in the competition business landscape.

Frequently Asked Questions (FAQs)

-

What is the meaning of a Receipt Voucher?

A receipt voucher functions as an official document that formally acknowledges and records the receipt of payments. It encompasses various forms of payment, such as cash, bank deposits, or any other payment methods, and serves as evidence of the transaction in exchange for goods or services rendered. This document not only acts as evidence of payment but also establishes a transparent and systematic record of financial transactions.

-

What are the components of a Receipt Voucher?

A typical receipt voucher includes essential details such as:

- Voucher number: A distinct identifier for tracking each transaction.

- Date: The specific date of the transaction.

- Payer’s Name: The identity of the party making the payment.

- Amount Received: The total payment received, inclusive of any applicable taxes.

- Mode of Payment: Indicates how the payment was made. Cash, cheque, online transfer, etc.

- Description of Goods or Services: A concise explanation of the purpose of the payment.

- Recipient’s Signature: Confirmation and validation of the payment receipt.

-

Is it possible to electronically issue receipt vouchers?

Yes, a receipt voucher can be generated electronically through the GST portal, as long as it adheres to the stipulated requirements under the GST laws. This electronic issuance streamlines the process and ensures compliance with regulatory standards.

-

Are there any specific format requirements for a GST receipt voucher?

Yes, specific format requirements are mandated by GST laws for the GST receipt voucher. These requirements encompass mandatory fields and details that must be incorporated into the voucher to guarantee adherence to regulatory standards and facilitate seamless compliance.

-

Are GST receipt vouchers valid as tax invoices?

No, GST receipt vouchers do not qualify as valid tax invoices. Their primary purpose is to serve as evidence of payment for the provided supplies. For a tax invoice, a separate document meeting specific criteria outlined in GST regulations is required.

-

Can a single receipt voucher cover multiple supplies?

No, a single GST receipt voucher should only pertain to a singular supply. In the case of multiple supplies, it is imperative to issue distinct vouchers for each supply. This practice ensures clarity and adherence to regulatory guidelines.

-

Are there any penalties associated with non-issuance of GST receipt vouchers?

Yes, there are penalties stipulated under GST regulations for either failing to issue a GST receipt voucher or issuing one with inaccuracies. It is crucial to comply with the prescribed requirements to avoid legal complications and financial consequences. Strict adherence to the regulations helps maintain the integrity of financial transactions and fosters a compliant business environment.

-

What are some options other than traditional paper receipt vouchers?

- Utilizing electronic vouchers created and stored within accounting software.

- Embracing mobile applications designed for electronically capturing and managing voucher information.

- Using online platforms dedicated to securely storing and sharing digital vouchers.

-

How does a tax invoice differ from a GST receipt voucher?

A tax invoice is issued in the context of a taxable supply of goods or services, documenting the transaction itself. On the other hand, a GST receipt voucher is specifically generated for advance payments, refunds, or other transactions that fall outside the scope of a typical tax invoice.

-

What are the possible outcomes of providing an inaccurate or incomplete receipt voucher?

Issuing a receipt voucher with errors can result in penalties and non-compliance with GST regulations. It is crucial to verify and guarantee the accuracy and completeness of all details within the voucher to avoid such consequences.