Tax payment and return submission on time and consistently ensures that the government has monies available for public welfare at all times. Several penalties are stipulated under the Act to ensure that taxpayers do not default on paying taxes or giving information. Non-compliance results in a penalty or punishment imposed on taxpayers.

Under-reporting of income

If the income assessed/re-assessed exceeds the income declared by the assessee, or if no return is filed and income exceeds the basic exemption level, a penalty of 50% of the tax payable on such under-reported income would be imposed.

If under-reporting results from income misreporting, 200% of the tax is due.

Failure to keep accurate books of accounts and other records

- Usually, the maximum penalty is $25,000.00.

- If the assessee has engaged in international transactions, the penalty shall be 2% of the value of such international or specified domestic transactions.

Penalty for misleading documents, such as invoices

If the income tax officer discovers that the assessee’s books of accounts in the proceeding contain the following:

- Forged or falsified documents, such as a fake invoice or a false piece of documentary evidence

- an invoice in respect of supply or receipts of goods or services issued by any person without actual supply or receipt of goods or services

- An invoice of supply or receipt of goods or services received from a person who no longer exists

- An omission of any entry relevant to total income computation.

The assessee may then be required to pay a penalty equivalent to the sum of such erroneous or omitted entries.

Undisclosed income

A 10% penalty is levied if the income determined includes hidden income. However, no such penalty will be imposed if such income was included in the return and tax was paid before the end of the prior year.

Where a search began on or after 1/7/2012 but before 15/12/2016,

- If concealed money is discovered during the investigation and the assessee pays tax and interest and files a return, a penalty of 10% of the undisclosed income is due.

- If unreported income is not admitted but is disclosed in the return submitted after such Search, a 20% penalty is imposed.

- In all cases where a search began on or after 1/7/2012 but before 15/12/2016, a penalty of 60% is imposed under certain circumstances.

Where a search began on or after December 15, 2016,

- If concealed income is admitted during the Search and the assessee pays tax and interest and files a return, a penalty of 30% of the undisclosed income is imposed.

- In all other circumstances, a penalty of 60% is imposed.

TDS/TCS

If a person fails to deduct or pay tax at source, he must pay a penalty equivalent to the amount of tax he could not remove or pay.

If a person fails to collect tax at the source, he must pay a penalty equivalent to the amount of tax he could not collect.

Failure to provide TDS/TCS statements or providing erroneous statements will result in a penalty ranging from $10,000 to $100,000.

Failure to provide information or providing false information on TDS deductions for non-residents will result in a penalty of $1,000,000.

Penalty for utilizing a method other than an account payee cheque/draft/ECS

Suppose a person takes/accepts a loan/deposit other than by Account payee cheque/account payee draft/ECS, and the aggregate amount exceeds 20,000. In that case, he is responsible for paying a penalty equal to the amount of the loan/deposit.

If a person receives $2,000,000 or more in aggregate from a person in a single day/transaction/relating to one incident, a penalty equivalent to that amount is payable.

If a person repays a loan/deposit and the amount refunded exceeds 20,000, and the amount was repaid other than via Account payee cheque/account payee draft/ECS, an amount equivalent to the loan/deposit is payable.

Failure to furnish statements/ information

- Failure to provide a statement of financial transaction or reportable account will result in a $500 penalty for each day of failure. In addition, if the failure is in response to a request to report on a specific financial transaction, the penalty is $1,000 per day of failure.

- A penalty of 50,000 will be imposed for providing an incorrect statement of a financial transaction/reportable account.

- Failure of a qualified investment fund to provide any statement/information/documents within the stipulated time frame would result in a $5,000 fine.

- Failure to provide any information or document in connection with an overseas transaction will result in a penalty of 2% of the transaction’s value.

- Failure by an Indian Concern to provide any information/document relating to an international transaction will result in a penalty of 2% of the transaction value, or $50,000 in some situations.

- If an Accountant/ Merchant Banker/ Registered Valuer is asked to provide a report/ certificate and such information is found to be wrong, a penalty of $10,000 is payable for each incorrect report/ information.

- Failure to disclose information by any person attending/assisting in the carrying on of any person’s business/profession in whose building/place the income tax authority has entered to collect information will result in a penalty of up to $1,000.

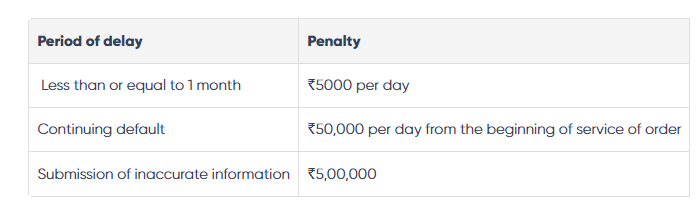

Non-compliance by any reporting organization required to provide a Country by Country report will result in the following penalties:

Also Read: Late Fees and Penalties for Non-Compliance in GSTR-10

Others

Failure to apply/quote/inform PAN/quoting false PAN will result in a $10,000 fine.

Failure to apply/quote TAN/quoting fake TAN can result in a $10,000 fine.

The following defaults will result in a penalty of $10,000.

- refusal to respond to departmental questions

- Refusal to sign declarations made in income tax procedures

- Failure to comply with a summons to present evidence or produce records of accounts

- Non-compliance with a notice

Also Read: Can One PAN Card Be Used for Two GST Registrations?

Avoid hiding information in ITR filing

The importance of correct income reporting and appropriate deduction or exemption claims in the ITR filing procedure should not be underestimated. Seasoned tax professionals emphasize the dangers of declaring deductions without specific documentation of transactions and required substantiation. A diligent taxpayer avoids potential tax evasion quagmires by ensuring that their stated income matches Form 16.

For the Assessment Year (AY) 2023-24, the Income Tax Department has strongly warned against claiming inflated income or misleading deductions. These actions can result in hefty fines, such as a 12% annual interest charge, penalties of up to twice the amount of taxes, and possibly criminal prosecution.

Avoid these common errors in ITR filing

Certain stumbling blocks in the ITR filing process include:

- Improper tax deduction claims.

- Inappropriate use of exemptions.

- Failure to disclose losses.

- Inability to authenticate banking data.

The choice of the incorrect ITR form is a surprisingly standard error. Other common mistakes include:

- Incorrectly reporting the assessment year.

- Failing to disclose all income sources.

- Making errors in income and deduction calculations.

Choosing the suitable ITR form for one’s revenue sources is critical. Non-compliance with tax requirements can result in defective returns, penalties, and even refund denials.

Overpayment of income tax

Filing errors not only expose taxpayers to penalties and legal issues, but they can also result in unintentional tax overpayment. If a person fails to claim all applicable deductions or is unaware of certain lesser-known deductions, their taxable income may be artificially inflated.

Many taxpayers fail to claim deductions such as medical expenses for uninsured parents (Section 80D) or house loan deductions (Sections 24 and 80EE), resulting in a larger tax payment. Misinterpreting tax laws or omitting crucial tax code provisions can also result in unintentional tax overpayment.

How to rectify ITR filing errors?

Nobody is flawless, and mistakes do occur. The silver lining is that many mistakes committed during ITR filing can be corrected if discovered quickly. The Income Tax Department allows taxpayers to file a revised return to address any errors or omissions in the original filing.

Taxpayers are recommended to verify their filed ITR regularly for discrepancies and to submit a revised return that corrects any errors. This includes ensuring all details, from personal information to income and claimed deductions, are correct.

A thorough tax statement, Form 26AS, is a valuable tool for avoiding discrepancies. If the path through the tax jungle appears to be too complicated, it’s always a good idea to seek the assistance of a tax professional or chartered accountant to help remedy any complex problems and ensure the accuracy of the amended return.

Wrapping It Up

According to income tax laws, no documentation of claimed deductions/exemptions is required to be supplied when submitting returns. Returns are also completed quickly, and refunds are instantly transferred to the taxpayer’s bank account.

Taxpayers should, however, check that they are claiming the correct deductions/exemptions and maintain records as proof in case the tax agency sends a warning in the future.

Also Read: Common tax mistakes to avoid

FAQs

-

What happens if you file the incorrect tax return?

The Income Tax Department may reject your return if you file your ITR in the incorrect form.

-

What happens if I enter incorrect information in my ITR?

Section 139(5) of the Income-tax Act of 1961 allows taxpayers to file revised income tax returns if they made a mistake on their original ITR. According to Section 139(5), if an individual discovers an omission or incorrect statement after submitting their tax return, he or she may file an amended return.

-

What are the consequences of failing to report income?

According to Section 270A of the Income Tax Act, if a person under-reports or misreports his income, an assessing officer (AO), a commissioner (appeals), a significant commissioner, or a commissioner may order him to pay a penalty. The fine might range from 50% to 200%.

-

What exactly is an exemption claim?

An exemption is a monetary amount that can be subtracted from a person’s total income, lowering taxable income.

-

Is there a penalty for revising an ITR?

If you file an amended income tax return, there is no penalty or charge imposed by the IRS.

-

Can I make changes to my income tax return after it has been submitted?

Yes, any taxpayer may file a revised income tax return within three months of the end of the assessment year or the end of the return’s assessment, whichever comes first.

-

What is income tax misrepresentation?

“Misrepresentation” is defined as leading a party to an agreement, however innocently, to make a mistake about the substance of the object that is the subject of the contract.

-

What are the different types of exemptions?

Personal exemptions and dependent exemptions are the two sorts of exemptions.

-

How many exemptions are you allowed to claim?

If you are single and work more than one job, or if you are married and file taxes separately, you can claim two allowances.

-

Why should I request an exemption?

Tax exemptions reduce the amount of income that must be taxed. Instead of paying taxes on your gross earnings, you can deduct various amounts from this amount to calculate your AGI.