Introduction:

State codes, just as the term itself suggests, are unique identifiers, generally alphanumeric, given to each state and union territory of a country. These codes are basically used to identify the geographical region. State codes are used to streamline the administrative process.

The above is done by their common use in various forms and documents, thus ensuring seamless communication between taxpayers and tax authorities. Though state codes are significant for the simplicity of administrative processes, the term may seem a little complex to the public. So here we are to help you understand what state codes are, their role in taxation, their significance, benefits, and much more with the help of this article.

Understanding the concept of state codes in taxation:

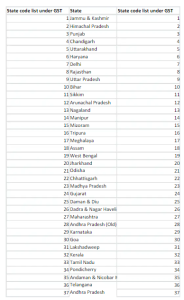

In our Indian taxation system, GST, the state codes are unique two-digit numeric codes assigned by the government to each state and union territory in India. For example, Delhi: 07, Andaman and Nicobar Islands: 35 etc.

https://www.scribd.com/document/459594648/state-codes

The concept of state codes is that state codes in taxation are very important for businesses, taxpayers, and policymakers. To make you understand the concept of state codes, here are a few things it does,

-

Identification and differentiation:

These unique markers are here to help the tax authorities and businesses clearly differentiate between regions. It’s like putting labels on state and union territories to help us understand where the money is coming from or going to.

-

Goods and Services Tax Implementation:

In our Indian taxation system, GST, a unique code, GSTIN, is given to all registered businesses. The GSTIN includes the state code; thus, when you look at the GSTIN, you’re not just looking at some random number but have a clear distinction of the hometown of that business. The state codes in our country are 01-37 for all the states and union territories.

-

Uniformity in communication:

In the world of tax and finance, state codes form a common language. The three main components of this world—taxpayers, businesses, and tax authorities—communicate with this language to ensure accuracy and clarity. The state codes are employed when you’re filling out tax forms, writing invoices, or dealing with official papers.

-

State-level taxation:

In our nation, some states levy their own taxes. Thus, seamlessly managing regional-level tax collection and then managing the taxation of state and central government state codes is of utmost importance.

Also Read: What are state codes?

The significance of state codes in regulatory frameworks

First, you need to know what regulatory frameworks are. These are the set of rules, laws, and guidelines established by a government to govern the collection and administration of taxes. These frameworks ensure fair and consistent tax practices, thus promoting economic stability and providing a structured system for revenue generation. State codes are here, acting as essential building blocks to contribute to the smooth functioning and efficiency of these regulatory frameworks in taxation. To know how, here is a list of its significance:

-

Geographical identification:

The state codes help you pinpoint the location of transactions. This helps to keep things organized as well as helps to implement the laws in such a way that they are followed seamlessly.

-

Standardized Communication:

In regulatory documents, it is utterly important to use a medium of communication that is universally understood. State codes are that medium that helps you, as a taxpayer, business, or tax administrator, to understand exactly which region is referred to.

-

Legal Compliance:

In our country, where states have the power to make some of their own rules, state codes become very important. So, when it comes to following the rules and making sure everything is legal, these state codes are like a guidebook that makes us understand which law belongs to which state.

Also Read: Understanding the Significance of State Codes in GST Administration

Navigating state codes for seamless business operations

We use state codes as a guide to ensure business activities across different regions are smooth and efficient. We employ state codes in various aspects of business and taxation, such as legal compliance, communication, resource allocation, etc. By doing so, we are streamlining our compliance with regional regulations and making informed decisions tailored to the specific requirements of each state. Therefore, navigating state codes for seamless business operations is significant. Here are few points to make to understand the same,

-

Precision of operation:

If you’re running a business and want to have a very fine understanding of the location of its operations, state codes are of great use. Operational precision could be used for setting up branches, distribution centers, or retail outlets, basically managing multiple locations.

-

Legal Adherence:

To ensure that the business is done the right way, legally, state codes are here to help. Different states have their own legal requirements and tax structures, so to make sure the business is done in compliance, state codes play a major role.

-

Supply chain efficiency:

If your business is involved in the supply chain, the logistics can be optimized with the help of state codes. It helps in efficient route planning, goods management, and distribution strategies, customized according to the states and union territories involved.

-

Strategic Expansion:

State codes can be used for market analysis and thus can evaluate the feasibility and potential challenges of entering a new market. You will also get to know the distinctive rules for that geographical region, so you can make informed decisions and manage risks.

Compliance standards related to state codes

As we’ve already discussed in India, different states have different rules for operating businesses and taxation. Thus, the set of rules and regulations that need to be followed by businesses to operate legally in different states are basically compliance standards related to state codes. The standards ensure adherence to state-specific codes. Some of these standards are given below:

-

Tax Compliance:

When you’re running a business in a state or across different states, the tax regulations must be complied with. This includes accuracy and precision in the calculation, collection, and payment of state taxes. To identify the correct tax jurisdiction and ensure compliance with state laws, the incorporation of state codes is important.

-

Legal regulations:

Legal compliance by businesses is also very important to avoid penalties for not following the rules and state codes are the ones ensuring this compliance. Businesses must know and adhere to state-specific laws related to business operations, including employment and even industry-specific rules. They can take aid from these state codes to determine the applicable legal framework for each location.

-

Consumer protection laws:

Consumer rights are very important, and some states have specifically made consumer protection laws that businesses must follow. Such laws include product safety and advertising practices as well. Thus, business practices can be customized accordingly.

-

Environmental Regulations:

Along with human safety and protection, the protection of the environment is also very crucial. This is ensured by industry- and state-specific laws to be followed by businesses for environmental protection. The businesses ensure that they are operating in an environmentally responsible manner.

Best practices for incorporating state codes in documentation

State codes as well are very clear now, these are unique codes or identifiers given to each state or union territory and consist of only two numeric digits. Incorporation of state codes in documentation refers to the practice of including these codes for various purposes, such as legal compliance, record-keeping, and communication. Here are some best practices to consider for incorporation:

-

Consistent Formatting:

When you are using state codes in documentation, you need to make sure that the format is maintained uniformly, i.e., is the same across all the documents. This practice will then ensure clarity and ease of reference for the respective reader.

-

Include in address blocks:

Whenever you are doing documentation, make sure to include the state code as part of the address block. Use standard codes, include them in address blocks, and see for yourself what a lasting effect it leaves on mailing addresses, invoices, and legal documents.

-

Database Integration:

In this era of IT, you can include state codes in databases and information systems. The use of the latest will then be helpful, as it will reduce errors and ensure consistency in the use of state codes across various documents. This will save a lot of your time and effort.

Maximizing benefits through accurate use of state codes

After getting all the necessary information about state codes, we will implement all that we have gathered. Accurate use of state codes has great advantages in business and taxation and some of it are given below,

-

Efficient Tax Management:

When you incorporate the state codes appropriately, the tax management system for your business will become much simpler. Incorporating this practice during documentation will help in accurate calculations, collections, and remittance of taxes according to state laws. This will reduce the chances of errors and ensure financial compliance.

-

Targeted marketing and sales:

Market and sales analysis are very important for any business to flourish. Thus, understanding state codes helps in such analysis for specific regions. The use of state codes accurately aids in making targeted marketing strategies to meet the needs of each state. You can also mitigate risks by using it.

-

Improved government relations:

When businesses use state codes accurately and follow the protocols, a commitment to laws and transparency in operations is reflected. This eventually leads to positive government relations.

Also Read: Why Are State Codes Important?

Conclusion:

We have learned about the state codes and their importance, so we can say that state codes are of utmost importance for taxpayers, businesses and tax authorities. Understanding its concept is crucial because it is a non-ignorable part of the taxation process and thus needs to be understood and used carefully and efficiently.

Frequently Asked Questions (FAQs):

-

What are state codes?

State codes are just unique identifiers in the form of alphanumeric codes given to each state of a country.

-

What are state codes in India?

In India, state codes are just a two-digit unique number between 01 and 37 given to each state and union territory.

-

What is the use of state code?

State codes are used to address and uniquely identify the state or union territory in the process of taxation.

-

How is the state code related to laws?

Every state has its own set of rules and regulations for taxation and the state code gives reference to the state so that the laws there can be referenced for a seamless taxation process.

-

What does the state code do?

The state code gives you the location of the operation of the business.

-

How are state codes important for legal compliance?

State codes will give you the operational precision to tell you to follow the rules and regulations of that region.

-

How are state codes related to decision-making and risk mitigation?

In businesses, state codes help with market analysis and thus aid in financial compliance.

-

How do state codes help in improving the reputation of businesses?

State codes will help you with legal compliance, thus creating a positive impact on the government and improving its reputation.

-

How do state codes help with customer satisfaction?

Through market analysis, you will get to know the unique demands of the customers in that region, thus helping with customer satisfaction.

-

How can I use state codes accurately in documentation?

There are various ways to do the same but make sure to keep the format of state codes uniform and in such a way that it is easier to be referenced by the reader.