India is one of the largest countries in the world, with a robust economy made possible by the free movement of goods across various geographical anomalies. With a population of about 1.4 billion people, demand for goods is always high, whether you are down south in Tamil Nadu, up north in Ladakh, the Far East in Gujarat, or West Bengal. The E-way Bill System came into being to enhance the movement of goods in all four corners of the country.

What is the E-way Bill System?

An E-way Bill is a system used to generate a permit for transporting goods within and between states across the country. The permit generated in the E-way Bill portal contains all the details of the goods transported by the consignor and received by the recipient. It became mandatory for interstate supplies starting April 1, 2018, and intrastate supplies beginning April 25, 2018.

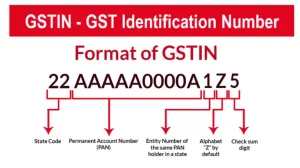

The E-way Bill applies to all people transporting goods worth more than Rs. 50,000. Therefore, one can only transport goods in a vehicle whose value exceeds Rs. 50,000 with the permit generated on the E-way Bill System website. In addition, the permit can be generated through SMS, Android apps, or site-to-site integration through API by entering the correct GSTIN.

The number of branches a business can have and locations to transport their goods is unlimited. Nevertheless, with expansion comes the challenge of compliance with various GST regulations. One common question is whether one should have multiple GSTINs if they operate two or more branches or have operations in different locations across the country.

According to the law, all businesses must register in every state they wish to operate from or make outward supplies from. The GST registration process is at the PAN India level, not at the store or state level. However, obtaining multiple GST registrations for all branches or locations is optional if a business operates in the same state. It’s only compulsory when the business has a footprint across state lines.

Multiple Registrations in the Same State

Previously, it was allowed to have a single registration for all branches. The rule changed in 2019, and businesses can now obtain it for each branch, whether in the same state or not. The different GSTINs apply to various business verticals. Therefore, one can have more than one GST registration for multiple businesses in the same state.

An example of this is a person who runs three hardware shops. They have the option to either use one GSTIN for all of them or get different GST numbers for each one. If they have an apparel store with a different business vertical from the hardware store, they must write it in a different business vertical with a separate GSTIN registration.

Registration for different business verticals

The legal framework mandates specific criteria for securing distinct registrations when a single business operates multiple branches within the same state:

- These should be more than one business vertical in the same state

- The business vertical doesn’t pay tax under the composition scheme

- Supplies between the business require a bill of supply/invoice, and GST is levied

Registering Multiple Business for E-waybill

Large-sized businesses with operations in cities in various states must register for the e-Way Bill to enhance the swift movement of goods in inner and interstate cities and comply with the Goods and Services Tax mandate. The e-Way Bill System was designed for businesses that would prefer a simple and time-saving system for generating the necessary permits or updating the consignment and vehicle details with a single file upload.

For businesses with multiple locations and branches, using the facility of bulk generation of e-way bills is crucial. The system makes generating multiple e-way bills or consolidated EWBs/updates in one shot of a single upload easy.

The e-way bill has four primary parties: the suppliers, the businesses supplying the goods; the recipients, who receive the goods; the transporters, who move the goods around; and finally, the tax officers. The supplier, recipient and transporter handle the goods in transit. The tax officer’s responsibility is to ensure that the suppliers and recipients account for all the goods in transit.

Under the Goods and Services Tax, all registered businesses with multiple locations and branches must complete the e-way bill registration on the e-way bill portal.

E-way Bill Registration for Registered Businesses

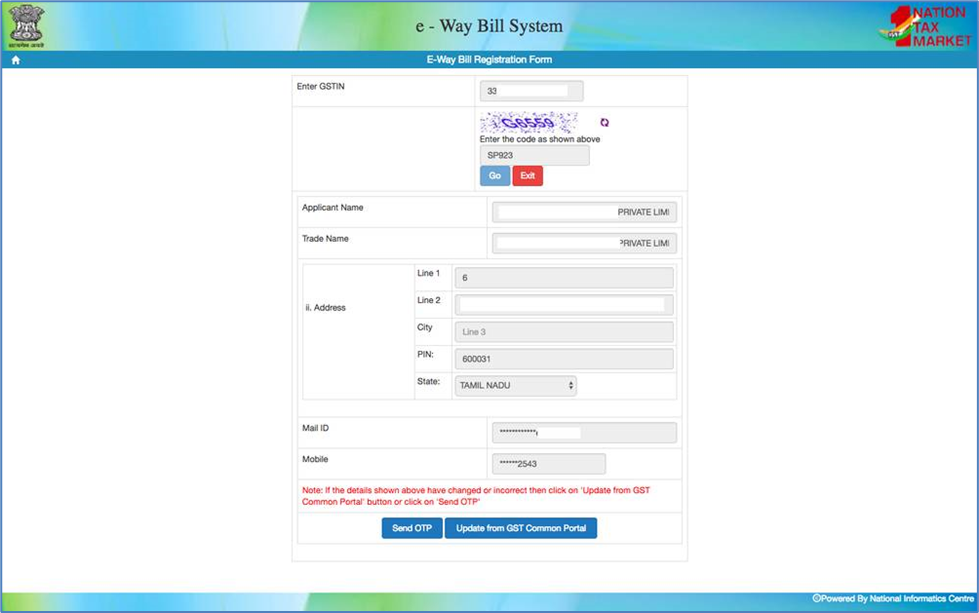

The steps to follow for registered businesses under GST for e-way bills are smooth and straightforward.

- Log in to the waybill.nic.in website.

- Click on “e-Way Bill Registration.”

- Enter the GSTIN number and click “Go”, after which the e-way bill registration form should appear.

- For registered businesses, the Applicant Name, Trade Name, “Address and “Mobile Number will be auto-generated.

- Click on the “Send OTP” button to receive an OTP on the registered mobile number.

- Provide a user ID or name for creating an account on the e-way bill portal. The username should include 8 to 15 alphanumeric characters and can also consist of special characters. Once a request is submitted, the selected user ID or user name is to be validated and assigned where appropriate.

- Once the e-way bill portal approves the User ID or User Name, provide a Password.

- If everything checks out, the user ID/user name and password are created and registered with the e-way bill portal, thus completing the registration process.

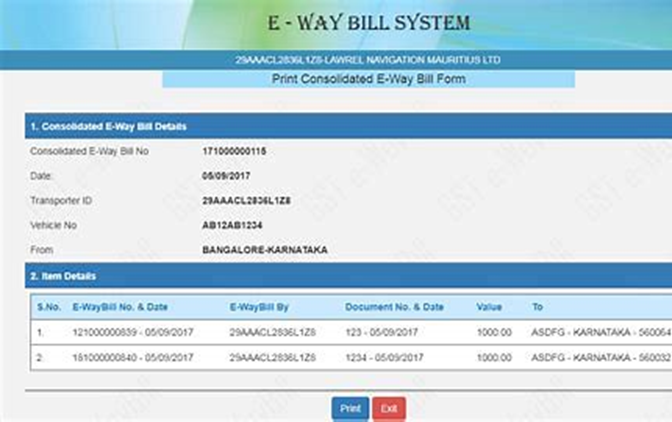

Generating Consolidated e-Way Bills

When transporting consignments to various destinations or business branches, having different e-way bills for the various goods is mandatory. A consolidated e-way bill contains details of all the e-way bills related to the consignments.

The consolidated e-Way Bill applies to transporters or suppliers who wish to transport multiple consignments of goods in a single conveyance or vehicle. The requirements for generating the consolidated e-Way bill on the e-way bill portal are:

- One must have an account on the e-way bill portal.

- One should have an invoice/bill/Challan detailing the goods in transit.

- Transporter ID or the vehicle number for transportation if by road

- The transporter must have all the individual e-way bill numbers.

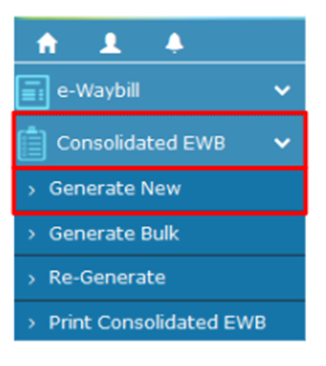

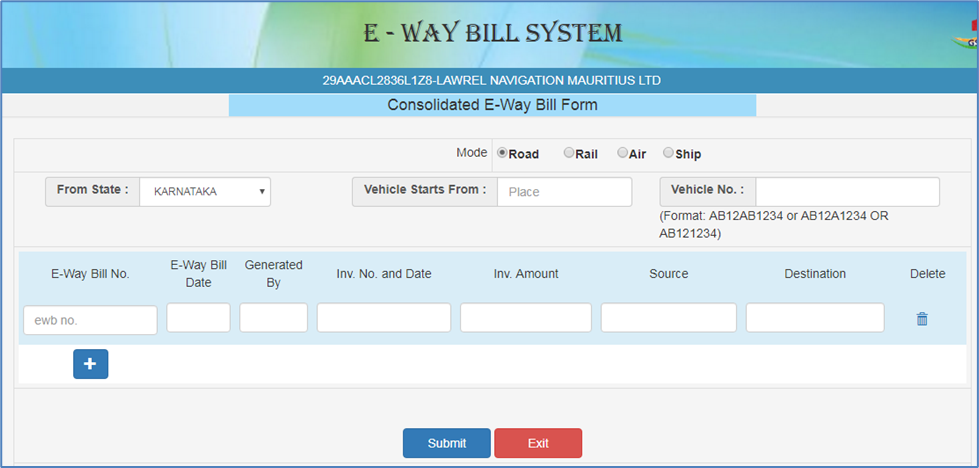

Generating Consolidated e-Way Bill Process

Open the e-way bill portal.

Click on ‘Generate New’ under the ‘Consolidated EWB Option.’

Provide the following information:

- Select ‘Mode’ of transport- Rail/Road/Air/Ship.

- Select ‘From State’ from the drop-down.

- In the ‘Vehicle Starts From’ field, enter the location where the goods are transported.

- Enter ‘Vehicle No’ and add EWB no.

Submit the form after entering all the information.

E-way Bill Registration for Transporters

Transporters are at the heart of the supply chain, ensuring swift movement of goods for businesses with multiple locations or branches. Whenever goods are in transit, they are tasked with carrying the e-way bill permit detailing the consignment in their possession. Consequently, they must also register for an e-way bill.

Registering for an e-way bill is straightforward, even for unregistered taxpayers transporting goods.

The steps to register for an e-way bill for unregistered transporters are as follows:

- Log in to the waybill.nic.in website

- Click on “Enrolment for Transporters,” and an e-way bill registration form will appear. The form comes with compulsory fields that must be filled and non-compulsory fields that one can skip. In the form, the transporter will have to provide the following details:

- Select State, and enter your legal name as per PAN.

- Enter your Trade Name, if any and provide your PAN.

In addition, one will have to provide particulars of the principal place of the business handling the goods. The information required to verify the business includes:

- State* where the business is located, City / Town / Locality / Village, Road / Street

- Name of the Premises / Building, including Building No. / Flat No

- Contact Information: email address and mobile number used for authentication

- Telephone and Fax Number with STD

Once the above information is shared, one must upload a document showing address proof. In addition, one must share ID Proof. Finally, the transporter must set up their login details by selecting a username and setting up a password for their account.

Upon submission of the form, the e-way bill portal will generate a 15-digit identification number and provide user credentials, thereby finalizing the registration process. After the setup is complete, the transporter can furnish the 15-digit Transporter ID to clients. By including this ID in the e-way bill, the transporter gains access to the same on the e-way bill portal, enabling entry of the vehicle number for the consignment’s movement.

Generating Multi-Vehicle under E-way Bill

The process of developing an e-way bill for a multi-vehicle option entails the following:

- Log in to the e-way bill portal, click on the “Change to multiple vehicles” under the menu option, and enter the e-way bill number for which multiple vehicle information is needed.

- Provide information on the mode of transport to be used, i.e., road, rail, air, or water.

- Select yes under the question ‘do you wish to move goods in multiple vehicles?’

- The starting point and ending point of transportation should be detailed. Also, provide information on the original consignments, quantity and measurement as in the invoice. Input the “Remarks” for group creation to modify the details of multiple vehicles in the e-way bill. This comes after selecting the “Reason” for utilizing the multi-vehicle option, such as transhipment or transporting goods in smaller vehicles.

- Upon the consignment’s arrival at the transhipment location, you can update vehicle information for each group.

- Provide the number of the document that the transporter gave you and how much goods the vehicle is carrying. Fill in this information in Part-B of the vehicle’s details for every group you selected.

Conclusion

Large-sized businesses with branches and operations have consignments across the country at any given time. The e-Way Bill system came into being to enhance the generation of the needed permits needed to move goods from one location to another. The e-Way bill carried by transporters on transit details all the goods on transit and is mandatory for consignments worth more than Rs. 50,000. The e-way bill permit is generated from the GST common portal by registered persons or businesses that cause the movement of goods.

Frequently Asked Questions

1. What is an e-way bill?

It is a license or document required to be carried by a person in charge of transporting goods worth more than Rs. 50,000. The permit is generated by the registered persons or transporters tasked with moving goods before the commencement of such movement.

2. How can I generate the e-way bill from different registered business places?

A taxpayer can generate the e-way bill from their account from any registered business place. However, they must enter the Address accordingly in the e-way bill. They can also create multiple sub-users, assign them to these places, and generate the e-way bills.

3. How can a taxpayer under GST register for the e-way bill system?

All persons under GST shall register on the e-way bill portal, namely http://gst.kar.nic.in/ewaybill, using their GSTIN. Once the GSTIN is entered, the system sends the OTP to the registered mobile number. After authenticating the OTP, the system enables the person to generate their username and password for the e-way bill system. After providing the username and password, an e-way bill will be generated.

4. What are the requirements for e-way bill generation?

A person must be registered, and if the transporter still needs to be registered, enrollment on the common portal of the e-waybill before the e-way bill is mandatory. The documents include tax invoices, bills of sale, or delivery Challan and the transporter’s ID, who is transporting the goods.

5. What is a consolidated e-way bill?

The consolidated e-way bill contains multiple e-way bills for multiple consignments carried in one conveyance (goods vehicle). The transporter must carry one consolidated e-way bill instead of multiple e-way bills for the consignors and consignees’ various consignments in one vehicle.

6. What modes of transportation are used to carry the goods with the e-way bill?

Depending on preference and availability, goods can be transported by road, rail, air, or ship. The e-way bill must be updated accordingly with the appropriate mode of transportation or conveyance number. The details of the conveyance specified in the e-way bill on the portal should match the details of the conveyance through which goods are being transported.