Introduction

The unified taxation system of India, GST, has stringent compliance requirements. Businesses must maintain accurate records of all their financial transactions to comply with GST regulations. The traditional method of keeping track of invoices, bills, and orders is unsuitable for the digital environment. Especially when businesses must generate e-invoices, billing software is vital. You must choose the right software suitable for your business to ensure GST compliance and accurate tax calculations.

This blog will explore the differences between offline and online GST billing software and discover why the online solution is a better option.

Understanding Offline Billing Software

Offline billing software is any bill generation software you download to your computer. Once downloaded, you can use the software to generate as many bills as you want. You only need network access when you download the software. Then, you can generate bills without the need for an internet connection.

Collaborating with offline software is difficult if your accounting department involves professionals working on multiple devices. You must set up an on-premise network connecting accounting computers for team collaboration. Generally, small businesses don’t have the technological capabilities to create intranetworks and install a solution on-premise.

When the software is installed on a stand-alone device, anyone who wants to generate bills or manage accounts must use the same device. In case of device failure, you will lose all the details unless you have established rigorous backup mechanisms.

Generally, offline billing software comes at a fixed price. Once you pay for the software, you will own the licence for the life of the software. Many billing solution providers frequently update their software; you can install these updates whenever they become available.

GST-compliant bills generated using offline software can be downloaded as JSON files, which can be uploaded to the e-invoicing portal to generate e-invoices. Based on the software, you can download GST reports directly and upload them to the GST portal.

Using offline software enables you to record all business transactions whenever you want. It is ideal for businesses with limited or no reliable internet connectivity.

Understanding Online GST Billing Software

Online billing software is a solution you can access using your web browser. The software is available on the cloud and can be accessed anytime, anywhere. There is no need to download any program to your computer.

So, if your accounting department has multiple members, they can all access the software online and make changes. This improves collaboration among the team because every change made is reflected in the cloud-based solution for everyone to access. The online software tools come with access control options that you can use to define and limit user access to the software.

When you choose a cloud-based solution, you must ensure consistent and reliable internet connectivity. To generate bills, you must go online, log in to your billing solution, and generate statements. All the bills, invoices, purchases, and sales orders created using the billing software are stored in the cloud. This means that all the accounts are available to you at any time.

There is no need to worry about establishing backup solutions because the cloud-based solutions have disaster management systems. Online solutions ensure that you will never lose all your data.

Cloud-based GST billing software is ideal for businesses not wanting to be tethered to any device. These solutions are accessible from multiple platforms using multiple devices. You can generate bills on the go using any device, such as a smartphone or tablet.

The online solutions simplify GST compliance as you can upload invoice details directly to the e-invoice portal. You can also generate GST reports instantly using the software. The download option is also available to download the JSON file to prepare e-invoices. The GST reports downloaded can be uploaded directly to the GST portal. Integrating the GST network and e-invoicing portal reduces the need for manual data entry.

Unlike offline software solutions, you don’t have to pay a one-time charge for cloud solutions. There are no resource requirements. However, the online programs are usually offered as a subscription-based model. So, you must consider the monthly subscription charges for online solutions.

Cloud-based online solutions are often cheaper than software solutions. You will also get the latest updates because the online system automatically updates the GST regulations. Collaborating with tax authorities and auditors is much easier when the invoice details are available on the cloud. Pre-installed cloud security measures ensure data integrity and personal and sensitive data security.

Offline vs. Online Billing Software Comparison

Online and offline billing software have their own advantages and disadvantages. The comparison table below gives you a clear idea of the pros and cons.

| Offline GST Billing Software | Online GST Billing Software |

| Must be installed on a computer with recommended configuration | Access software from any device at any time from anywhere |

| Pay for software licence based on the number of computers on which the software is installed | Pay a small monthly subscription for limitless usage |

| Data must be stored on-premise on an encrypted server, which requires office space and security mechanisms | Data is available on the cloud for easy and instant access with cloud-based security protocols |

| Managing data spread across multiple computers is cumbersome | Risk-free data access directly accessible from the cloud |

| No real-time updates for the software | Always get the latest software version with real-time GST calculations and regulations update |

| Difficult to collaborate with multiple members of the accounting department | Seamlessly collaborate with accounting teams spread across multiple locations |

| No remote access to accounting and billing details | Instant remote access to all billing and accounting details |

| Auditors must be paid to visit on-site to review account information | Hire remote auditing services for quick and hassle-free auditing |

| Sharing invoices with customers involves multiple steps | One-click sharing of all digital invoices |

| Heavy IT resource investment requirement | No capital expense is necessary |

Benefits of Online GST Billing Software

With different types of GST bills, invoices, and debit and credit notes to be generated, online billing software allows you to scale up your business effectively. Direct integration with the GST portal and e-invoicing portal ensures all-time GST compliance. Some of the benefits of using online billing software are:

- Accurate billing with auto calculation

- Easy audit trails

- Improved budgeting with real-time account access

- Effective cash flow management with bank reconciliation

- Better planning for finances

- Enhanced collaboration with all accounting teams

- Efficient compliance tracking

- Built-in customer management

- One-click data analytics

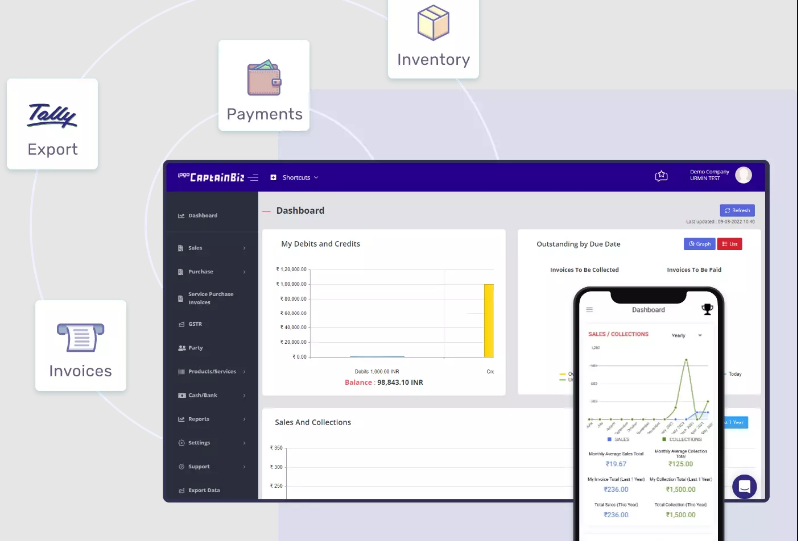

- Easy data import and export for integration with other accounting tools

- Automated GST filing and reporting

- Built-in inventory management

- Mobile Accessibility

Choosing the Right Online Billing Software

While online billing software is ideal for businesses of all sizes, choosing the right GST billing software is crucial. Some of the features that you must look for in an online solution are:

- Easy to navigate, user-friendly interface

- Accurate and real-time GST calculations

- Top-notch data security and protection

- Unlimited cloud access

- Data integration capabilities

- Integration with GST and e-invoicing portals

- Easy import and export of bills and invoices

- Regular software updates with the latest GST regulations

- Efficient customer support

- Ideal pricing with unlimited access to all the features

- Mobile access support

- Easy bank reconciliation

- Integration with payment systems

- Automated inventory management

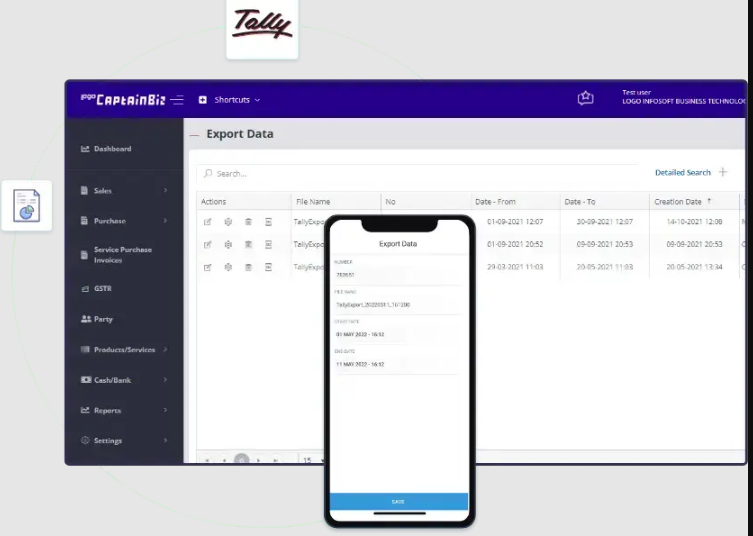

CaptainBiz is India’s leading automated GST billing software that automates billing and invoicing transactions. You can organise your business finances quickly and effortlessly with a few simple clicks. Trusted by more than 46,000 SMBs in India, CaptainBiz is your ideal solution for hassle-free GST compliance. It is recommended by the GST network with easy integration and import/export of GST reports.

Whether running your small business as a solo entrepreneur or with a large team, CaptainBiz controls your finances and inventory completely. Track payments and get paid directly using the software. Instantly share your invoices using email or WhatsApp to get paid quickly. Real-time inventory visibility helps with stock management. Integrate accounting with Tally with easy download of accounting statements. Manage your business from anywhere at any time safely and securely using CaptainBiz. Try the software solution risk-free with a 14-day free trial with full access to all the features.

Also Read: Why There Is a Need to Select GST Software?

Conclusion

As digital business operations expand, relying on offline software solutions is no longer viable. You need online software solutions that enable you to access all your bills and invoices at any time quickly. Also, data integrity and security are guaranteed by online solutions. Instant payment and payment tracking options enable you to get paid faster. Such a solution automates and streamlines GST compliance.

Also Read: Know Everything about GST Billing Software

FAQs

1. What is the prime benefit of using online GST billing software?

Instant and real-time accessibility is the primary benefit of GST billing software. CaptainBiz supports mobile devices, ensuring your business accounting information is available at your fingertips. All the changes in business accounts are made in real time with instant bank reconciliation support. It provides an accurate audit trail.

2. Is an online solution better than an offline solution for my small business?

Yes, even if you run your business independently as a solo entrepreneur, the online GST billing solution is a better option. You don’t have to worry about secure storage for your bills and invoices, as they are always accessible on the cloud. With a few simple clicks, you can generate GST reports and submit them on your own. You can also create e-invoices automatically.

3. What are the drawbacks of using offline GST software?

The offline software doesn’t provide real-time accessibility. You must manually store and retrieve invoices at the time of need. There is also an increased risk of errors in validating invoice data. There is no mobility with offline software, and it cannot scale up rapidly when you must generate bulk invoices.

4. Is online software cheaper than offline GST software?

Yes, offline software is more expensive due to licencing requirements. As GST regulations change, these solutions are often incompatible. Online software is cheaper because no capital expense is needed. You do not need office space or storage servers to store your data. You can choose monthly or yearly subscription plans and pay as long you use the software.

5. Can I switch from offline GST software to online GST software?

You can easily switch to online GST software if you have used an offline billing solution. These solutions provide easy data migration to move all your accounting information from the old to the new cloud-based system. You can also get support from the online GST software team to make this migration easier.

6. Do I need technical knowledge to use online GST software?

No, anyone with basic computer skills who can access the web browser can use the online GST software. There is no training needed to start using the online software. There are no installation requirements. Once you pay for the subscription, you can use your login credentials for the online GST billing software.

7. Where will my bills and invoices be stored with online GST software?

Unlike offline solutions, you don’t have to worry about servers for storing bills and invoices with online GST software. All your business account details are stored safely and securely on the cloud. Cloud security protocols and data recovery systems will be in place to ensure data security and integrity and avoid data loss.

8. Is online GST billing software compliant with GST?

Yes, the online GST billing software ensures continuous GST compliance. Such tools are automatically updated based on the latest GST regulations. The GST calculations and validations are done automatically in real-time, especially if you choose CaptainBiz, which is approved by the GST network.

9. Can I integrate online software with my account software, Tally?

Yes, you can easily integrate online GST billing software with Tally. CaptainBiz provides easy integration with compatible account statements. You can synchronise your invoices and account details between the two systems seamlessly.

10. How can I get started with online GST software?

To start using CaptainBiz, choose your subscription plan and pay for it. Your 14-day trial period will begin after the payment. Get your login credentials and start using the online software right away. You will get full access to all the features during your trial period. If you don’t like it, you can cancel the subscription anytime. Flexible subscription plans allow you to manage your business finances more effectively.